Summary:

- We’re hold-rated on Alphabet Inc. aka Google after the better-than-expected 2Q23 earning results.

- We’re more constructive on Google Cloud revenue growth, up 28% Y/Y to $8.03B, but continue to see softer cloud/enterprise spending in H2 2023 due to macro headwinds.

- We think Google ad revenue, accounting for around 78% of total revenue, will continue to experience single-digit growth in 2H23 due to softer ad spending amid higher interest rates.

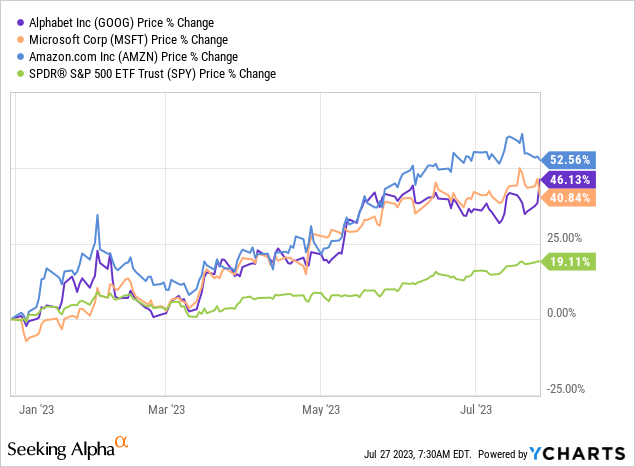

- The stock is up roughly 46% YTD, outperforming the S&P 500 by around 27%.

- We recommend investors stay patient and wait for the macro weakness of softer ad and cloud spending to play out before exploring favorable entry points into the stock.

Dzmitry Dzemidovich

Alphabet Inc. (NASDAQ:GOOG) aka Google stock shot up roughly 6% after reporting better-than-expect Q2 2023 earnings results; we remain hold-rated on the stock. We think there are two factors to track to understand Alphabet’s revenue growth trajectory in 2H23: Google Cloud and Google Ads. The latter makes up the bulk of the company’s total revenues, 77.9% this quarter, while the former is the company’s growth driver in the mid-to-long run and the fastest-growing segment, up 28% Y/Y.

Our bearish sentiment is driven by our belief that ad revenue will not escape single-digit growth percentages in 2H23 due to higher inflationary pressures and spiking interest rates pinching ad firms’ spending budgets. While we’re constructive on the latter’s position within the broader cloud computing market, we expect revenue to be pressured in the near term by softer cloud/enterprise spending due to macro weakness.

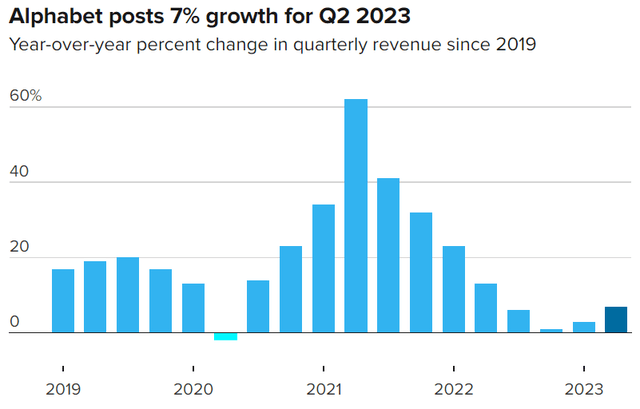

The following chart outlines Alphabet’s revenue growth as of 2Q23.

In 1H23, we think the market spiraled into what was thought to be a bull market triggered by A.I. hype, causing Alphabet, Microsoft (MSFT), and Amazon (AMZN), among others, to break their 52-week highs. Now, earnings are under more investor scrutiny as the A.I. hype fails to materialize into meaningful revenue growth in 2023. Consistent with our post-earnings note on Microsoft, we don’t think investors will see A.I. revenue ahead of expense, and we see near-term macro headwinds pressuring revenue growth in 2023.

The stock is up 46% YTD, outperforming the S&P 500 (SP500) by around 27%. We do expect the stock to outperform in the mid-to-long run, but we don’t think Alphabet provides a favorable risk-reward profile at current levels as ad revenue and cloud growth remain under the weight of near-term headwinds. We recommend investors stay on the sidelines for the near term until macro weakness plays out.

The following graph outlines Alphabet’s stock against Microsoft, Amazon, and the S&P 500.

YCharts

Q2 2023 Review & Preview: Near-Term Grunt Is Not Over

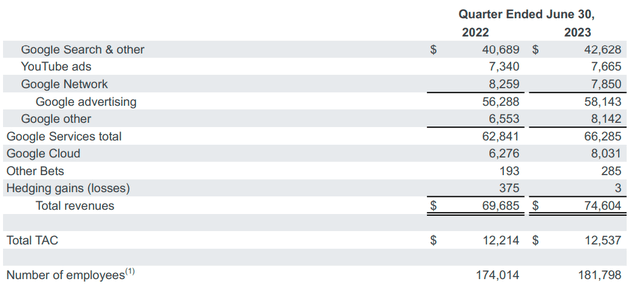

Alphabet beat both top and bottom line estimates in 2Q23; revenue came in at $74.6B, up 7% Y/Y and 6.4% sequentially from $69.79B in 1Q23. We’re constructive on the company’s upward revenue growth trend in FY23; revenue is up 7% this quarter compared to 2.6% last quarter. Still, we expect revenue growth to remain in the single-digit percentage range in 2H23. The company reported Google Ads revenue of $58.14B this quarter, up low single digits at 3.3% Y/Y and 6% sequentially. The Google Search and Other division reported revenue of $42.6B, while YouTube Ads revenue was $7.6B. We’re constructive on the better-than-expected ad revenue, but we don’t think the higher interest rate environment will support double-digit revenue growth this year for ads.

The following table outlines Alphabet’s 2Q23 earning results.

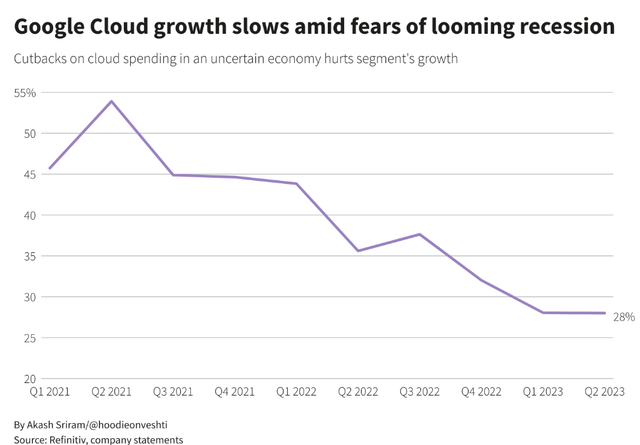

Shifting to Google Cloud, the company’s Google Cloud revenue was much better than we had forecasted at $8.03B this quarter, up from $7.4B in 1Q23; the company’s cloud division turned profitable on operating income in Q1 and has continued to produce profitability on operating income this quarter reporting $395M. We expect Google Cloud to be a growth driver for the company in the mid-to-long run but don’t expect the company to see significant returns from Cloud growth due to the near-term macro backdrop.

We’ve seen signs of slower data center/cloud spending this year from Seagate Technology Holdings plc (STX) earnings reported yesterday; we think the cloud growth slowdown we saw with Azure, AWS, and Google Cloud earlier this year has not washed out yet.

The following chart outlines the Google Cloud growth slowdown between 1Q23-2Q23.

Alphabet’s earnings call and active rollout of A.I. products at its annual I/O developer conference (including developments in SGE and Bard) illustrate that the company can catch up in the A.I. race. We believe Alphabet is well-positioned to compete in the expanding generative A.I. total addressable market (“TAM”) with Google TPUs, Nvidia (NVDA) GPUs, and integrating generative A.I. into ads and its search engine.

Still, we think A.I. revenue will take time to materialize and see spending ahead of revenues; management noted,

“As it relates to CapEx, in Q2, the largest component was for servers, which included a meaningful increase in our investments in AI compute.”

We’re constructive on Alphabet’s position in the A.I. boom but are cautious about getting too excited too early.

Valuation

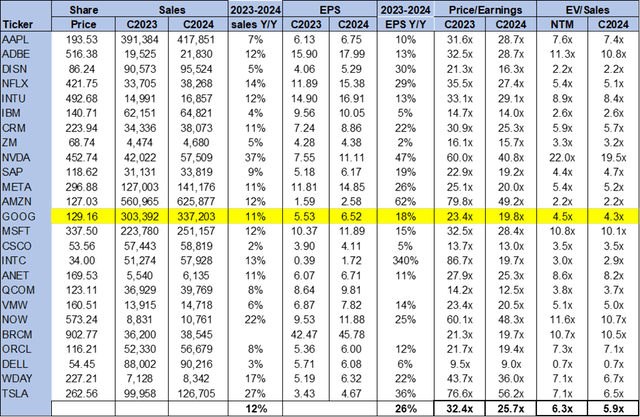

Google stock is relatively cheap, trading below the large-cap peer group average. On a P/E basis, the stock is trading at 19.8x C2024 EPS $6.52 compared to the peer group average of 25.7x. The stock is trading at 4.3x EV/C2024 sales versus the peer group average of 5.9x. We still don’t believe Alphabet provides a favorable risk-reward profile in 2H23 in spite of the attractive valuation.

The following chart outlines Alphabet’s valuation against the peer group.

Word On Wall Street

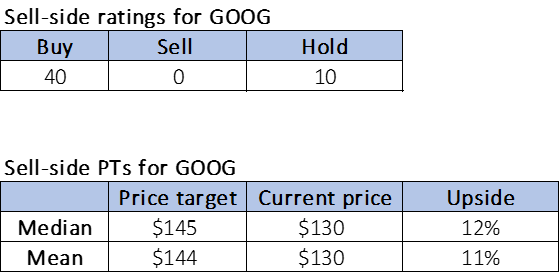

Wall Street is leaning toward a buy rating on Google stock. Of the 50 analysts covering the stock, 40 are buy-rated, and the remaining are hold-rated. We attribute Wall Street’s bullish sentiment to the long-term outlook of the company’s leading position in the search engine market, growth in Google Cloud, and new A.I. capabilities.

The stock is priced at $130 per share. The median sell-side price target is $145, while the mean is $144, with a potential 11-12% upside.

The following charts outline Alphabet’s sell-side ratings and price targets.

TSP

What To Do With Google Stock

We continue to be hold-rated on Alphabet stock; the company is making a comeback from 2022 lows, and our bearish sentiment is not based on our belief that Alphabet won’t experience revenue growth; instead, it’s because we expect this recovery to be slower due to macro headwinds. We believe a significant part of the stock’s surge post-earnings is because expectations were so low in the aftermath of 2022. Also, consistent with our last note on the stock, we continue to believe the company’s monopoly over the search engine market may be contested by Microsoft and legal pressures from the Justice Department.

The company reported acceleration in revenue growth in both Search and YouTube Ads and momentum in Cloud; our bearish sentiment is based on our belief that macro headwinds will cap revenue growth in 2H23. We continue to recommend investors wait on the sidelines to explore favorable entry points into Google stock once macro weakness pressuring ad and cloud/enterprise spending bottoms.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.