Summary:

- Google faces significant antitrust challenges, but investors are overestimating the impact on its growth and margins, making the stock undervalued.

- Despite legal headwinds, Google’s management has effectively maintained robust margin expansions and operating leverage, showcasing strong financial resilience.

- Google’s stock is trading at one of the lowest valuation multiples in a decade, presenting a compelling buying opportunity.

- The risk of a breakup is low; fines and operational adjustments are more likely, similar to the Microsoft antitrust case.

alengo

Investment Thesis

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) has become DoJ’s favorite punching bag. There is no sugar-coating this.

The search giant already lost one major antitrust case this year, calling into question the scope of splitting up the Mountain View, CA-based company. This was after the EU hit Google with antitrust charges, last year. A second legal challenge by the DoJ began last week, casting further shadows over Google’s eponymous search business and digital ad empire.

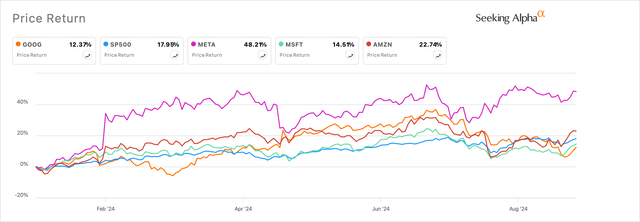

The antitrust cases have pushed Google’s stock lower, now returning just 8% for the year per Exhibit A below, underperforming many of its peers.

Exhibit A: Google is the worst performing stock of Big Tech this year. (Seeking Alpha)

What the broader fears have also done is bring Google’s valuation multiple to one of the lowest levels in the last decade.

I believe investors are overestimating the headwinds from the legal challenges I stated earlier, given how the company is managing its growth and margins despite these headwinds.

While I had initiated a Buy rating on Google in May due to its strong ad distribution network, the litigation fears have created a deeper discount to my valuation of Google. I still recommend a Buy on Google.

All Legal Roads Lead To a Big Fat Fine

Let’s tackle the most recent challenge of the two. I write this as Google’s second DoJ lawsuit, maybe in progress in Virginia.

The DoJ is expected to continue its antitrust imperative of challenging Google on its suspected monopolistic practices of dominating the digital advertising industry. Unlike the first DoJ case, DoJ is expected to push harder to break up Google’s ad empire. This has created an overhang on Google’s stock, but investors should also remember that there are several remediations that the judge is willing to offer before potentially deciding on the breakup.

Google has already laid out its plan to address these accusations on several points, which include fostering competition, freedom of choice, and low barriers to entry. A breakup seems the least likely of the lot for now, in my perspective, given the sheer scale and complexity of Google’s business. The EU had warned last year it would take a similar course of action to break up Google, but recent reports suggest it’s not likely “because of the complexity involved.”

My conviction comes from a similar case in 1998 where Microsoft was accused of anti-competitive practices in installing software such as its IE browser, and the remediation course set was to break up Microsoft into two entities. Microsoft successfully appealed the ruling and won. The company settled with the DoJ by having to pay penalties and alter its software distribution to appeal the competitive levels that adjudicators deemed fit.

I believe this could be the eventual result for Google as well, with the internet titan having to pay a fine and alter its distribution network to make it more competitor-friendly. Part of the remediation would be to stop paying TACs (traffic acquisition cost) to push its eponymous search engine as the trusted search solution. Google reportedly paid Apple (AAPL) $20 billion TAC to be the preferred search engine.

The takeaway here is that breaking up Google will be hard, given the sheer size and complexity of its business. Moreover, Google’s antitrust trial judge is not expected to issue any decision before August of next year.

This still means it will be business as usual for Google despite these headwinds swirling.

Google’s Operating Leverage Grows Despite Antitrust Headwinds

The case above is just one of the several cases that Google has had to face since the start of this decade, causing an uptrend in Google’s legal expenses.

While Google does not explicitly state its legal expenses incurred, an analysis of their statements provides strong hints of how much Google may have incurred and the company’s accrued litigation expenses it sets aside.

Per Google’s filings, the company states that “expenses relating to legal matters, including certain fines and settlements,” are one of the three core cost components of the G&A line item under Operating Expenses. Further, the company also states that when Google loses cases, such as last year’s EU case I cited at the start of this note, management includes “the fines in accrued expenses” item of the balance sheet. Note that Google may also challenge rulings, and if the company wins, management removes the related expenses, returning cash back to the company.

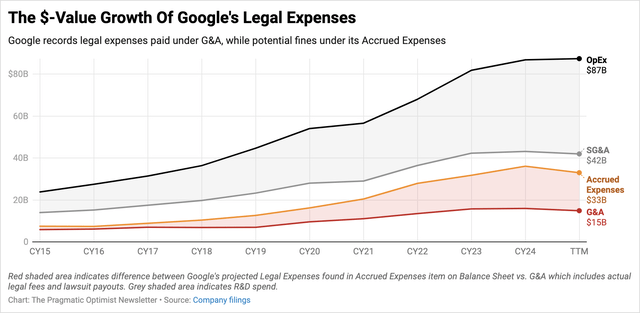

In Exhibit B below, I have added trends of Accrued Expenses versus the company’s G&A line item and compared it with the operating expense growth.

Exhibit B: Google’s expense profile over time which includes accrued expenses from the balance sheet (Company filings)

This definitely shows the rise in Accrued Expenses, indicating Google has been recording a higher share of its cash as reserves for potential legal settlements and fines that it may incur over the next 12 months due to the rapid rise of antitrust cases against the company.

However, that has not translated directly into its G&A growing at the same rate, implying that the company does not necessarily end up paying fines for many reasons, which could also be that the company challenges the decision and may win the case eventually. Also, Exhibit B also shows Google’s operating expenses have actually risen over time due to higher R&D, which seems perfectly reasonable in my opinion.

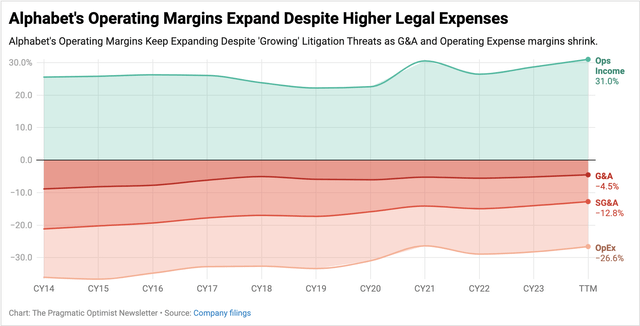

Another way to look at its expenses and fines is to compare & contrast the impact of G&A and other expenses on Google’s revenue. In Exhibit C below, I have added the margins of operating expenses, S&M, and G&A and compared them to the operating income margins. Note that these are all GAAP numbers.

Exhibit C: Despite, the rise in litigation settlements, fees, and fines along with higher operating expenses, Google’s margins are actually expanding (Company filings)

It’s easy to spot the trend above, where management has been delivering robust margin expansions despite the litigation headwinds that investors perceive will impact the company’s operating leverage. Per Google’s Q2 report, GAAP operating margins have actually expanded by 233 bp since 2023 on a TTM basis, while Google’s expense profile has been shrinking, which is contributing to the lift in operating margins.

These robust margin expansions occur in the backdrop of the company growing its revenues by 18% CAGR, operating expenses at 14.6% CAGR, SG&A at 12.2% CAGR, and G&A, which records paid litigation expenses, growing at 10% CAGR since 2014. These growth rates pale in comparison to the company’s 20% CAGR in operating income.

While the spotlight is on the volume of antitrust cases against Google or on how competition and GenAI might put pressure on Google, the company’s management still fends off these challenges and has secretly become a well-oiled machine at managing its legal headwinds.

Pessimism Puts Google’s Stock At a Discount

I noted earlier how Google’s GAAP operating income is growing at a 20% CAGR over the last decade. Consensus estimates project this growth rate to slow down to the ~15% range through CY26, while revenue growth is expected to slow down to the 11-12% range over the same time period.

This should actually imply a forward earnings multiple of in excess of 23x, but markets are pricing Google’s stock at just 20.7x forward earnings. Even the S&P 500 is being valued higher at 21x forward earnings, which are expected to grow 12-15% through 2026.

Exhibit D: Google is sitting at one of the cheapest valuations in over a decade (YCharts)

This brings Google to one of the cheapest levels seen in a decade, as noted in Exhibit D below from the PE values and PEG ratios.

Risks & Other Factors To Know

The uncertainty in the antitrust cases I highlighted usually means there can be potentially damaging scenarios as well for Google. The judge could even rule on the side of DoJ and seek a divestiture of Google’s business as a remediation. In that case, expect Google to file an appeal similar to the USA vs. Microsoft case, 1998.

The other scenario of direct impact would be a much larger fine than anticipated, which could cause headwinds to Google’s margin profile by increasing its G&A due to higher litigation expenses. The key will be to track Google’s accrued expenses, compare that to its revenue growth, and watch for the commentary from management to understand the implications of the G&A line.

Takeaways

Google sits at one of the lowest levels of valuation in a decade, diverging from its Mag 7 rivals due to the headwinds from the antitrust headwinds. The rise in legal headwinds impacts the growth outlook of Google in theory, but as demonstrated above, Google’s management is effectively handling the headwinds with ease in concert with a strong legal team fortifying the company from most legal headwinds.

This makes Google’s valuation compelling for investors, and I reiterate a Buy in Google here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.