Summary:

- Alphabet Inc. aka Google reported better-than-expected profits for Q4, driven by strong growth in its advertising business.

- The market reacted negatively to the earnings, causing a 6% drop in stock price, but I see this as a buying opportunity.

- Google’s search and cloud units showed robust growth, and the outlook for the advertising industry in 2024 is promising.

Ole_CNX

Alphabet Inc. (NASDAQ:GOOG) aka Google reported much-awaited results for its fourth quarter on Tuesday January 30th which beat the Street’s profit estimate.

Google again profited from growing strength in its underlying advertising business and produced 13% sales growth in the search unit in the fourth quarter. Ad sales came in below the Street’s expectations, however, which triggered a 6% stock plunge after Q4 2023 earnings.

Because Google is seeing robust growth in ad sales and strength in cloud, I don’t really understand why the market responded the way that it did.

Though I am happy to admit that Google stock is not a complete steal, I think robust growth in advertising and cloud both make Google’s stock interesting.

Taking into account that Google’s stock price plunged 6% after earnings, I think that a potential correction is a buying opportunity here.

My Rating History

Stock price weakness following Google’s Q3 2023 results justified a Buy stock classification for Google stock, in my view. In the fourth quarter, Google showed accelerating growth momentum in search particularly, suggesting that both the corporate sector and the consumer are in great shape right now.

Google is also pulling in a boatload of free cash flow, or FCF, which underpins the value proposition here.

Google Delivered A Decent Profit Beat, Market Overreacted To Results

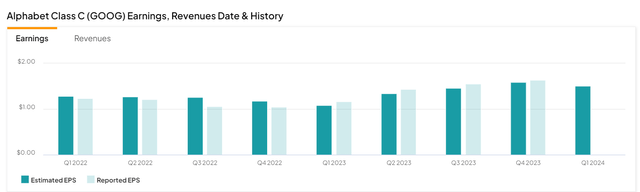

Google exceeded the Street’s profit estimates for the fourth quarter as the advertising giant reported $1.64 per share in profits compared to $1.59 anticipated by the Street. Google produced a profit beat every single quarter in 2023 in terms of EPS.

Even though Google disappointed the market with respect to its ad sales, the company is looking back on an impressive year overall.

Strong Advertising Setup, Solid Growth In Cloud

Google was hit badly by an advertising market downturn in 2022, but these times are clearly behind the company.

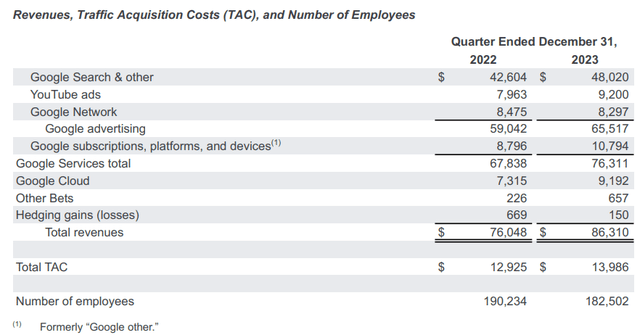

The search unit produced $48.0 billion in sales in the fourth quarter which represented a YoY growth rate of 12.7%. This was also the fourth consecutive quarter of a growing sales in search. In Q3 2023, search sales were up 11.3%, so Google is seeing some strengthening fundamentals here. In terms of search sales growth, Google had its best quarter since Q2 2022. What explains such strength is probably that we are dealing with softening inflation which was a key reason why advertisers pulled back from spending on digital ads, particularly in the second half of 2022. Google’s total ad sales, including YouTube, hit $65.5 billion, up 11.0% YoY, but fell short of the Street’s estimate of $65.9 billion.

Cloud-related sales hit $9.2 billion, reflecting a YoY growth rate of 25.7% compared against a growth rate of 22.5% in Q3 2023. Both search and cloud did, therefore, quite well even though the very weak market response to Google’s earnings release painted a different picture.

The 6% price plunge in extended trading is not justified, in my view, because Google’s double-digit growth momentum involved all of its major key business lines, including search, YouTube, and cloud.

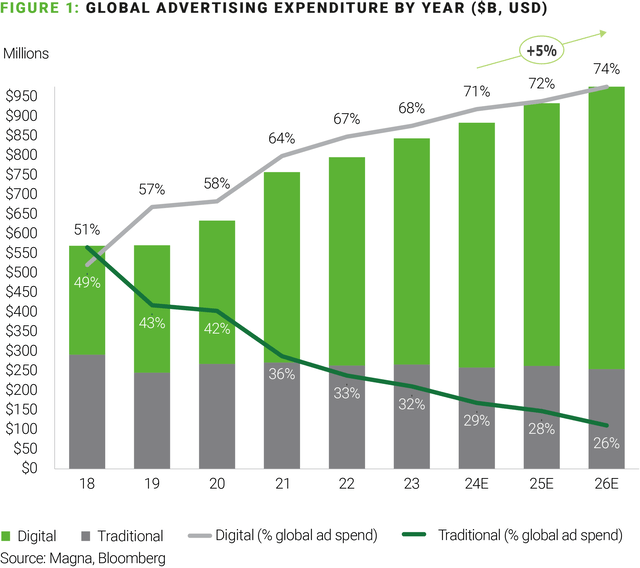

Furthermore, the outlook for the advertising industry is actually quite promising in 2024, suggesting that Google’s upside momentum in sales has legs to stand on.

Global advertising expenditures are set to grow and as a major destination for advertising dollars given Alphabet’s huge scale, I think the company could profit from sustained operating tailwinds in this market.

Based on estimates made by private equity company AlixPartners, global advertising spending is anticipated to recover in 2024. Importantly, the share of spending going to the digital advertising industry, of which Google is a part, is anticipated to grow 2 percentage points on average each year over the next three years. In short, the pie for the digital advertising industry is getting bigger, which is set to benefit Google.

Global Advertising Expenditure By Year (Magna, Bloomberg)

Technical Situation

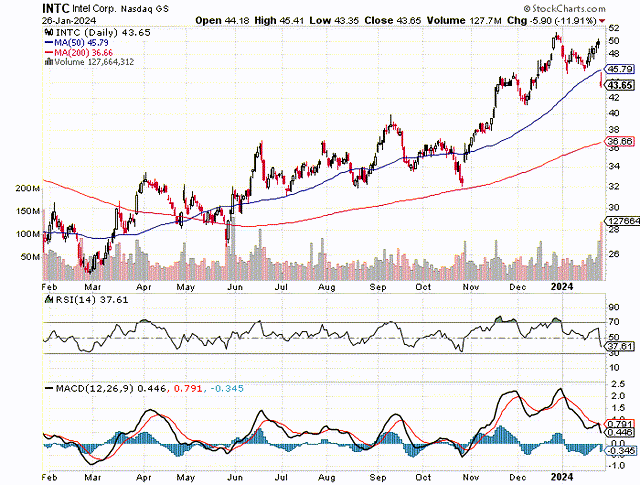

The GOOG technical setup is quite positive, and the 6% price plunge on Monday doesn’t change this. The market has been willing to recognize and reward Google’s gradually recovering strength in the advertising business and, most recently, Google stock has surged above the 50-day moving average line. This makes Google vulnerable to a correction in the short term, but given the robust performance of Google across its businesses in the fourth quarter, I like to view the healthy correction as a buying opportunity. I would expect Google to find strong support at the 50-day moving average line, which presently sits at $140.55.

Relative Strength Index (Stockcharts.com)

Why Investors Should Consider Buying The Drop: A Discount Deal After Q4

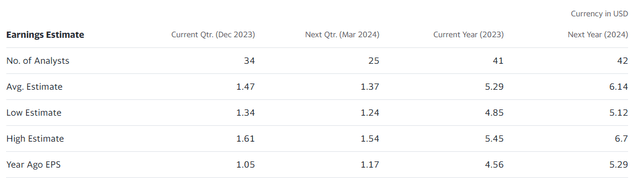

Besides growth momentum in Google’s two fast growing units, search and cloud, Google is selling at an attractive earnings multiple of 23.5x. Yesterday, the earnings multiple was 25.0x. The Street models $6.14 per share in profits this year, which reflects only 6% YoY profit growth. The implied profit growth estimate may turn out to be a bit low and I see, when taking into account the recovery trends in Google’s search business, 10-15% YoY profit growth as more sensible growth assumption. With estimated profits of $6.38-6.67 per share in 2024, the “real” earnings multiple may be only 22.0x.

This multiple gives you access to a fast-growing technology company with earnings upside as well as tremendous underlying free cash flow. Google produced $7.9 billion in free cash flow in Q3 2023, and the company was highly profitable on an earnings basis as well: Google had $20.7 billion in total Q4 2023 profits.

If Google continues on its present growth curve, and I don’t see any reasons why it wouldn’t, Google has a lot of potential to deliver pleasant earnings surprises to shareholders in 2024.

Earnings Estimate (Yahoo Finance)

Why I Might Be Wrong – And Not The Market

Google’s risks primarily relate to its big advertising business. Google depends on advertising sales more than anything, though the company has taken steps to diversify away from it and push into other markets such as cloud.

With that being said, a cutback in corporate and consumer spending would probably deal a double-whammy to Google, as its ad sales are sensitive to changes in consumer spending and cloud is driven primarily by corporate spending.

My Conclusion

The market ignored Google’s big recovery and growing momentum in search and cloud, primarily because Google’s ad sales didn’t quite stack up to the Street’s estimate.

The fourth quarter was quite strong for Google and demonstrated ongoing growth in the very important advertising business. The search segment in particular did well, enjoying 13% YoY sales growth. The outlook for digital advertising spending in 2024 in particular is pointing towards sales growth and the market’s implication of only 6% YoY growth in EPS may be easy to beat.

While the market whiffed on Google’s Q4, I think earnings were quite strong and any weakness in the next few days presents a golden buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.