Summary:

- YouTube subscription business is rapidly growing which could make it one of the key drivers of future revenue growth.

- In the recent quarter, Google Other segment reported YoY revenue growth of 24.3% with an annualized revenue base of over $30 billion.

- Most analysts have highlighted the 28% YoY growth of Google Cloud, however, YouTube subscription has better growth potential with lower competition.

- At the current growth trajectory, YouTube Premium subscriptions should cross 250 million by the end of 2025 which would make it a market leader in the streaming business.

- YouTube subscription provides a good anchor service for Google to add future subscription-based options making it very important for the long-term potential of Google stock.

jetcityimage

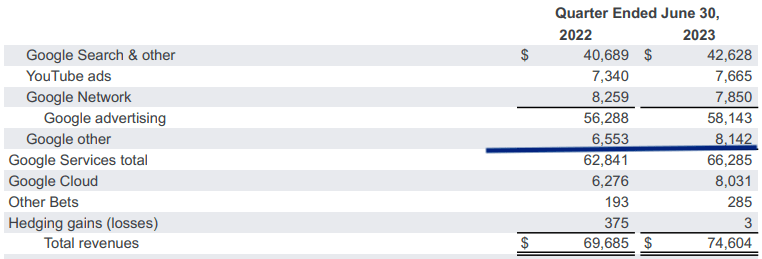

Google’s (NASDAQ:GOOG) recent earnings result has shown some good progress in key metrics. One of the fastest year-on-year growth segments was Google Other. This segment consists of Google Play, hardware, YouTube subscription, and a few other services. The revenue for this segment increased from $6.5 billion in the year-ago quarter to $8.1 billion which is equal to 24.3% YoY revenue growth. Within this segment, most of the incremental revenue is likely coming from YouTube subscriptions. In the previous article, it was mentioned that the company will deliver good earnings despite getting downgrades from a few major analysts covering the stock.

Google has recently increased the price of YouTube subscriptions by $20 a year in the U.S. which shows the demand for this service. The management reported 80 million subscribers on YouTube in the latest announcement which was a massive 60% growth from year-ago subscriber numbers.

Most of the analysts have focused on Google Cloud which reported 28% YoY revenue growth. However, Google will be facing competition from Goliaths like Amazon (AMZN), Microsoft (MSFT), Oracle (ORCL), and others in this segment. On the other hand, YouTube subscription offers a unique streaming service that does not have significant competition and the future growth runway is also quite long. At the current growth rate, YouTube subscriber base could hit the 250 million mark by the end of 2025 which would make the company a market leader in streaming services. Google stock is still trading at a modest valuation when we look at the number of high-growth segments available with the company making it a good buy-and-hold option.

Google Other segment is outperforming

The overall revenue growth of Google was 7% as the company continues to face macroeconomic headwinds in its search business. However, there are a few segments that have performed really well in recent quarters. One of them is Google Other which reported 24.3% YoY revenue growth. There are a number of products and services combined within this segment including Google Play, hardware, YouTube subscription, and more.

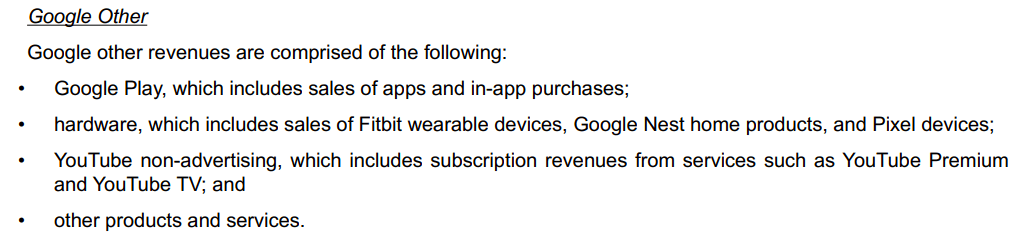

Company Filings

Figure 1: Products and services included within the Google Other segment

In the post-pandemic period, Google Play business growth has likely slowed a lot. Apple’s (AAPL) App Store is also showing signs of a significant slowdown. Most of the incremental growth in the Google Other segment is due to the massive increase in subscriber base for YouTube. The revenue share of this business is also growing which increases its significance for the overall metrics.

Long-term growth runway

In the year-ago quarter, Google Other contributed 9.5% of the total revenue for the company. In the recent quarter, this has increased to 11%. Google reported 7% revenue growth on YoY basis or an incremental revenue of $5 billion compared to year-ago quarter. Google Other segment reported $1.6 billion in incremental revenue compared to year-ago quarter. Hence, over 30% of the incremental revenue growth in the company is due to Google Other segment.

Company Filings

Figure 2: Google Other segment is becoming more important for the overall growth trajectory

There is a significant focus given to AI and its impact on Google Cloud. In the recent quarter, Google Cloud reported 28% YoY growth and positive margins for the second consecutive quarter. However, Google is facing stiff competition from other players who have massive resources. The unique offering of Google Cloud is not very significant. This could limit the long-term growth trajectory and margins of Google Cloud even if the overall cloud industry continues to expand. On the other hand, music streaming and YouTube subscription are not hyped up by Wall Street but this segment could be a major contributor to future growth trajectory of the company.

Race to be a market leader

The management announced 80 million subscribers on YouTube by September 2022 which was 60% YoY growth. Even at a more modest average annual growth rate of 35%, the total subscriber base should cross 250 million by end of 2025. This will likely make the company a market leader in this segment. Google has a significant unique selling point in this service which cannot be replicated by other competitors. The combination of premium YouTube streaming and music streaming makes the subscription more attractive for users who spend a higher amount of time on YouTube.

YouTube has over 2 billion active users which gives the company a long growth runway as it tries to give greater features for Premium subscribers. It has recently launched a higher bitrate option for Premium subscribers which gives better viewing experience. The YouTube subscription also creates a halo effect for other products and services sold by the company by acting as an anchor service. We have seen how Amazon used Prime membership as an anchor service to add more options for members.

Google’s Pixel Pass subscription gives access to YouTube Premium service along with other features. A bigger YouTube subscription base could help Google in increasing the attraction of hardware like Pixel phones for Android users.

Impact on Google stock

Google is trying to diversify its revenue base away from advertising which still brings 78% of the total revenue for the company. A stable subscription revenue base would improve the growth rate for the company and could also improve the valuation multiple for the stock. Spotify (SPOT) reported $13 billion in revenue in trailing twelve months from a paying subscriber base of 220 million. This equates to an average revenue per user of $60 per year. For Netflix (NFLX), the annual average revenue per subscriber is $130. YouTube subscription is priced at a higher level compared to Spotify due to ad-free premium YouTube service. We could also see higher pricing leverage in YouTube compared to Spotify as more features are added for Premium users.

If Google reaches a 250 million subscriber base by 2025 with annual average revenue per subscriber of $120, the revenue base of YouTube subscription would be $30 billion. This would make YouTube subscriptions a key incremental revenue growth driver. YouTube has not spent a massive amount like Netflix in building original content. However, Google has the resources to ramp up its original content creation budget on YouTube which would be another tailwind for subscriber growth.

Spotify’s PS ratio is close to 2 while Netflix’s PS ratio is 6. The standalone PS ratio for YouTube subscription could be higher than both these streaming players due to the higher subscriber growth rate and the halo effect subscription gives to other business segments of Google. At a PS ratio of 10, the YouTube subscription business could be valued at $300 billion by 2025.

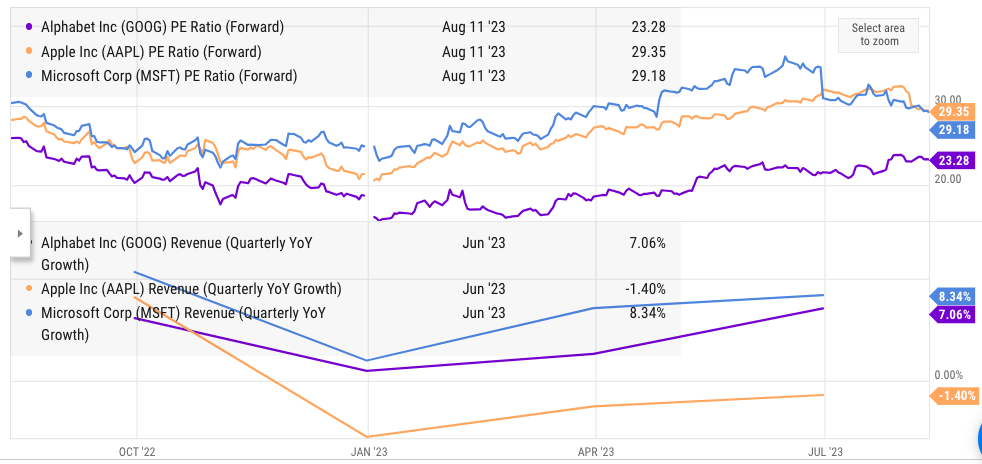

Ycharts

Figure 3: Comparison of forward PE ratio and revenue growth between Google, Microsoft, and Apple

Google’s revenue growth has been higher than Apple’s and a few percentage points less than Microsoft’s (MSFT) in the last few quarters. However, the stock is trading at more than 20% discount when we look at forward P/E. The future revenue growth estimate of Google is also quite strong compared to other Big Tech peers. As the percentage share of subscription, hardware sales, and Google Cloud increases, we could see a better valuation multiple for the stock. This should help the company deliver good long-term returns and also have a better moat against downturns.

Investor Takeaway

Google Other segment reported one of the highest YoY revenue growth for the company at 24.3%. This segment alone contributed 30% of the total incremental revenue growth compared to the year-ago quarter. YouTube subscription is playing a major role in improving the growth trajectory of this segment. The management had earlier announced 60% YoY growth in subscriptions and has recently increased the subscription pricing by 20% which shows good demand.

YouTube subscriber base could cross 250 million by end of 2025 making it a market leader. The revenue from this segment could reach $30 billion by end of 2025 which should improve the standalone valuation of this segment. There is a massive halo effect for subscriptions as new products and services can be sold to subscribers with a better value proposition. Apart from Google Cloud, YouTube subscriptions will be a key growth driver for the company which will help to diversify the revenue base. Google stock is still modestly valued when we look at other peers and the future growth potential making the stock a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.