Summary:

- We continue to be hold-rated on Alphabet (GOOG) toward 2H23 as the company finds itself head-to-head with Microsoft on the AI front and now in the search engine market.

- The stock slid on Monday after reports suggested Samsung is considering replacing Google as its default search engine with Microsoft’s Bing.

- The “panic” around increased competition in the search engine market intensifies as Microsoft launches an AI-powered Bing search engine.

- We believe this adds another layer to the near-term headwinds pressuring the stock alongside concerns of weakening ad spending in 2023.

- We recommend investors wait on the sidelines for the near-term headwinds to be meaningfully factored into the stock price.

400tmax

We remain hold-rated on Alphabet (NASDAQ:GOOG) stock as we see more downside risks ahead. We downgraded Alphabet from a buy to a hold earlier this year, driven by our belief that weaker ad spending and softer cloud demand would pressure the company’s main revenue streams. We’re now adding a new layer to our bearish sentiment on the stock: competition with Microsoft (MSFT) on the AI and search engine fronts.

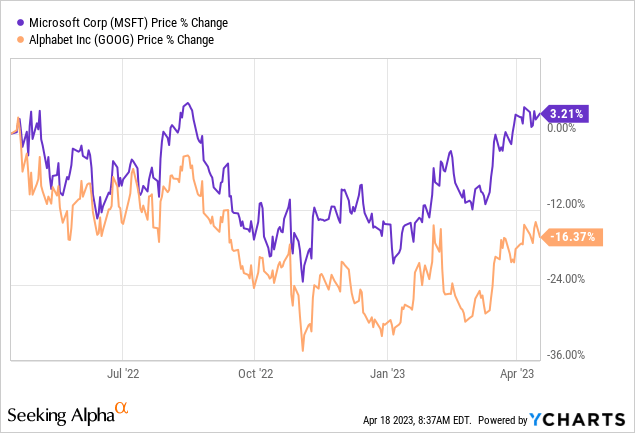

Alphabet is venturing more seriously into the generative AI space as it launches its own version of OpenAI’s ChatGPT, Bard, for testing in the U.S. and UK. The company’s new AI chatbot and dominance over the search engine market look great if you ignore the intensifying competition from Microsoft on both those fronts. We believe the tides are changing for Alphabet in the near term as the company faces competition in its previously uncontested dominance over the search engine market. Samsung is reportedly considering switching its default search engine from Google to Microsoft’s Bing in its smartphone lineup; Alphabet shares fell more than 3% after the news, and Microsoft shares closed up 1%. The stock is down around 16% over the past year, underperforming Microsoft, up 3% during the same period. We see further downside risks for Alphabet toward the 2H23 and continue to recommend investors wait on the sidelines for a better entry point into the stock.

The following graph outlines GOOG stock performance against MSFT over the past year.

YCharts

Changing tides in the search engine market

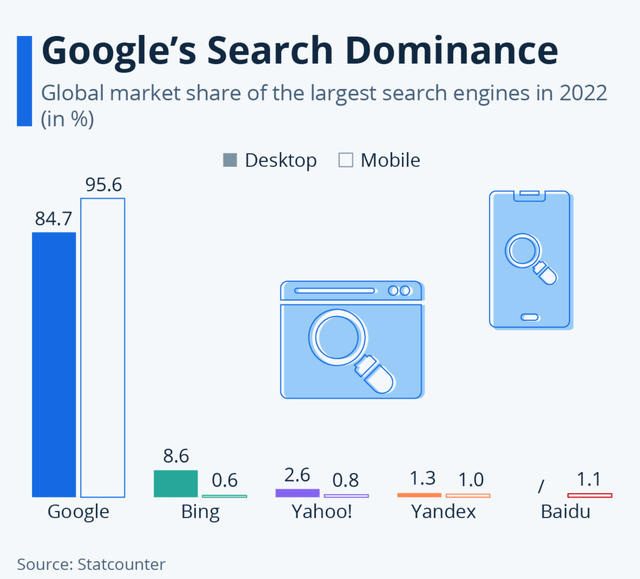

Alphabet enjoyed dominance over the search engine market, with a roughly 96% market share on smartphone search engines in 2022 with minimal competition. The following graph outlines Google’s search dominance in 2022.

Statcounter

Samsung’s re-consideration of its default search engine signals that tides could be changing in favor of Microsoft’s Bing due to its generative AI advantage, launching an AI-powered Bing search engine and Edge browser. The news from the South Korean consumer electronics company sparked “panic” among Google employees, for a good reason; around $3B in annual revenue is at stake with the Samsung contract. Samsung leads the Android space and retains a 19% smartphone shipments market share as of 4Q22, according to Counterpoint data. Our bearish sentiment is not only driven by Samsung’s potential shift away from Google toward Microsoft; instead, we’re concerned over the precedence this sets for Alphabet’s similar contract of roughly $20B tied to Apple (AAPL), which is up for renewal this year.

In analyzing the significance of a crack in Alphabet’s seemingly impenetrable search engine dominance, it’s important to note this shift’s potential impact on the company’s ad revenue. Advertising still accounts for the bulk of Alphabet’s revenue, roughly 80% in FY2022, and the majority of ad revenue is derived from search advertising. Hence, if Alphabet’s search engine dominance tumbles, it could have significant implications for the company’s primary revenue stream: ads.

Alphabet is not standing by and watching the tides change; the company’s racing to enhance Bard and working on “bringing new A.I.-powered features to search,” according to Lara Levin, Google spokeswoman. The company’s efforts to update its existing search engine with AI features are rolled out under Project Magi. Despite Alphabet’s best efforts, we’re still worried that Bard, among other AI projects, won’t save the stock from a near-term pullback as the company simultaneously faces other macroeconomic headwinds from weaker ad spending and sluggish cloud demand in 1H23.

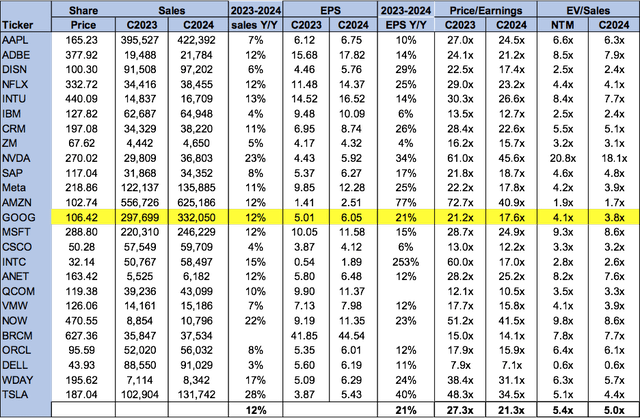

Valuation

Alphabet stock is relatively cheap, trading below the peer group average. On a P/E basis, the stock is trading at 17.6x C2024 EPS $6.05 compared to the peer group average of 21.3x. The stock is trading at 3.8x EV/C2024 Sales versus the peer group average of 5.0x. We recommend investors not buy the stock based on weakness as we see further downside toward 2H23.

The following table outlines Alphabet’s valuation.

TechStockPros

Word on Wall Street

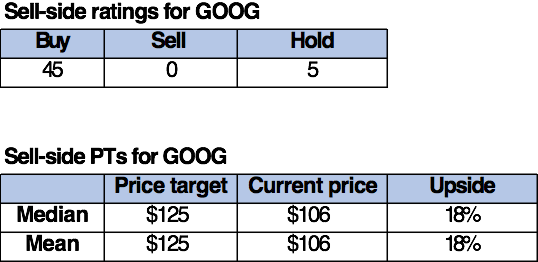

Wall Street is bullish on the stock. Of the 50 analysts covering the stock, 45 are buy-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment on the stock to a long-term outlook on Alphabet’s position within the search engine market and, more importantly, Google Cloud’s leading position alongside Microsoft and Amazon (AMZN) in the rapidly expanding cloud space. We share Wall Street’s bullish outlook on Alphabet in the long run but believe the near-term risks are too severe to ignore. We don’t see favorable entry points for long-term investors into the stock at current levels.

The following table outlines Alphabet’s sell-side ratings.

TechStockPros

What to do with the stock

We maintain our hold-rating on Alphabet stock. We expect more downside ahead as Samsung is reportedly considering switching its default search engine to Microsoft’s Bing, given the company’s recent AI breakthroughs. We believe Microsoft has taken the lead in the AI space and expect Alphabet to struggle in the near term to keep up while retaining its position in the search engine market. We also believe Alphabet’s ad revenue is under significant pressure toward 2H23 as macroeconomic headwinds pressure ad spending. The stock is trading 19% lower than its 52-week-high of $131.40; we don’t see favorable entry points at current levels as near-term headwinds persist and competition with Microsoft intensifies. We recommend investors wait for the near-term risks to be factored into the stock before exploring entry points into the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.