Summary:

- Google has a 90%+ market share in its core search franchise, driving user engagement across its other franchises like YouTube, Chrome, Gmail, and Google Cloud.

- Despite market concerns over Google’s AI strategy, Silver Beech has invested in the company, believing it to be a high-quality company with strong returns on capital and growth prospects.

- Google is trading at a valuation cheaper than its peers and the broader S&P 500.

Sean Gallup

The following segment was excerpted from this fund letter.

Alphabet Inc. (NASDAQ:GOOG,NASDAQ:GOOGL)

Alphabet Inc. (“Alphabet” or “Google”) is a high-quality, asset-light global monopoly business in digital advertising. Google has maintained 90%+ market share in its core search franchise for decades; search dominance drives user engagement across the company’s other market-leading franchises including YouTube, Chrome, Gmail, and Google Cloud, among many others. In the global digital advertising market, Google search and YouTube capture ~50% of total spend. Google’s lead in search is so pronounced that three of the top four search terms on Bing, Google’s “closest” search competitor, are “Google”, “YouTube”, and “Gmail”!

We have long admired Google. Silver Beech invested in the company during the second quarter at an attractive valuation as market concern over the company’s AI strategy eclipsed the reality that Google is a high-quality company with years of growth ahead. In short, we believe that Google is a high-quality company with strong returns on capital and growth prospects, trading at a valuation substantially cheaper than peers, and in fact, cheaper than the broader S&P 500. We believe Google’s intrinsic value is more than 30% greater than its June 30 share price.

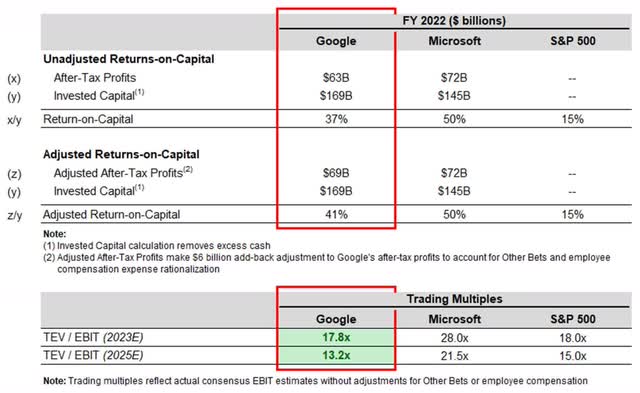

In the tables below, we illustrate Google’s high quality by calculating its after-tax returns on capital (ROC). When evaluating business quality, we think of a business like a capital machine: you put capital in (as capital investment) and get capital out (as cash flow). ROC captures this idea. Generally speaking, the higher a company’s ROC, the higher its quality. We think Google’s true ROC requires a few adjustments because the company funds unprofitable business lines that are secondary to its core franchise and excessive employee compensation that has been widely criticized and even noted by management.

Comparing Google to Microsoft (MSFT, one of the best capital machines in history) and the broader S&P 500 (comprised of 500 of the largest capital machines in the United States) is striking alongside the valuation multiple comparison below.

As depicted in the above tables, Google’s returns on capital are much higher than the broader S&P 500, yet Google trades at a lower valuation. There are multiple reasons why investors would be willing to pay a higher price for Microsoft than Google–and we do not assert that Microsoft and Google should trade at similar multiples even if their returns on capital are similar–but we strongly believe that Google deserves a higher multiple than the S&P 500.

Our investment thesis is based on Google’s existing dominant market position(s) and the discrepancy between the company’s intrinsic value and share price. We do not believe our Google investment is predicated on the company “winning” AI; however, we note that Google is a formidable AI competitor due to some key advantages:

- Ability to distribute AI services across existing search, video, and productivity tools and users.

- Rich dataset of search queries and consumer preferences data that can be used to train AI models.

- Access to capital to fund research and development. Well-endowed technology companies are best positioned to fund AI innovation and reap its benefits due to the huge amounts of capital expense required to train AI’s models.

- Deep history in AI innovation. In 2014, Google acquired DeepMind, whose technology is now at the forefront of AI research. In 2015, the company released TensorFlow, a powerful open-source machine learning framework that has become industry standard. Other notable AI developments include Google Brain, a deep learning program that has greatly contributed to the medical field, and Google Assistant, an AI-powered virtual assistant that incorporates natural language processing, and Bard, its generative AI chatbot, which, like OpenAI’s ChatGPT, is built on large language models.

We think our investment in Google represents an opportunity to own a high-quality business at an attractive price.

IMPORTANT DISCLOSURESSilver Beech Capital Management, LLC (“Silver Beech”) is a New York limited liability company that serves as the investment manager to Silver Beech Capital, LP (the “Fund”), a Delaware limited partnership. The principals of Silver Beech are James Hollier, who serves as the portfolio manager and managing partner of the Fund, and James Kovacs, who serves as the managing partner of the Fund. All performance results presented herein refers to the performance of an unrestricted investor in the Fund since its inception. Net performance is presented net of the highest performance allocation in effect at the time (20%) above a 6% hurdle rate, the highest actual management fees (1.0%) charged at the time, and net of other expenses, and includes the reinvestment of all dividends, interest, and capital gains. Performance for investors who subscribed on different dates, or who pay different fees would necessarily be different from the performance presented herein. The rate of return is calculated on a “time weighted” rate of return basis, which minimizes the effect of cash flows on the investment performance of the Fund. All monthly performance data presented herein reflects unaudited data, unless otherwise specified, and as such its accuracy cannot be guaranteed. Past performance is not necessarily indicative of future results. All securities transactions involve substantial risk of loss. The material presented is compiled from sources thought to be reliable, including in certain instances, from outside sources, but accuracy and completeness cannot be guaranteed. Any opinions expressed herein reflect the judgment of Silver Beech and are subject to change. The information in this letter is for discussion purposes only. Nothing contained herein should be construed as an offer to sell, or a solicitation of an offer to buy or sell any security or investment strategy or a recommendation as to the advisability of investing in, purchasing or selling any security or investment strategy, which may only be made in the Fund’s confidential offering memorandum and operative documents (collectively, the “Offering Documents”). Before making an investment decision with respect to the Fund, prospective investors are advised to read the Offering Documents carefully, which contain important information, including a description of the Fund’s risks, investment program, fees, expenses, redemption and withdrawal limitations, standard of care and exculpation, etc. Prospective investors should also consult with their tax and financial advisors as well as legal counsel. The Offering Documents are the sole documents on which a potential investor is entitled to rely in evaluating an investment in the Fund. The information in this letter does not take into account the particular investment objectives, restrictions, or financial, legal or tax situation of any specific prospective investor, and an investment in the Fund may not be suitable for many prospective investors. This letter is not intended to be, nor should it be construed or used as, investment, tax or legal advice. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.