Summary:

- Several factors come together that could cause the results to be worse than expected.

- The company has already underperformed expectations in the past few quarters. Earnings revisions are not looking so good either.

- I think a multi-percent post-earnings loss is more likely than a post-earnings rise in the share price.

anyaberkut/iStock via Getty Images

Investment thesis

There’s no question that Google (NASDAQ:GOOG, NASDAQ:GOOGL) is a strong company with a strong brand, and it’s not priced overly expensive at the moment. The money printing machine of the ad business is in danger, but this would be a gradual process over several years. However, there is a risk that several factors could come together to result in Q1 results that are worse than expected. Therefore, a multi-percent post-earnings loss is more likely than a post-earnings rise in the share price. Those who want to buy, or re-buy should wait until after earnings.

Why Q1 results could be worse than expected

What factors come together? Here is an overview before I go into the details:

- Layoffs do not yet save money but cause costs in this quarter

- Google’s ad business reflects the overall economy

- Google´s market share is under pressure

-

Some parts of the company are close to stagnating

1. Layoffs do not yet save money but cause costs in this quarter

In January, the company announced that it would be laying off about 12,000 employees. The reason can be interpreted as “tougher times are ahead, and we are already starting to save.”

Over the past two years we’ve seen periods of dramatic growth. To match and fuel that growth, we hired for a different economic reality than the one we face today.

CEO Sundar Pichai

This will, of course, lead to savings in the long term, but a few days ago, it was announced that in Q1 2023, this would initially result in considerable costs. In addition, further costs will arise from exit costs relating to office space reductions.

Following our January 2023 announcement that we had made the decision to reduce our workforce, we announced our expectation that, as a result, we would incur employee severance and related charges of $1.9 billion to $2.3 billion, the majority of which will be recognized in the first quarter of 2023.(…)We also announced actions to optimize our global office space and our expectation that we would incur exit costs relating to office space reductions of approximately $0.5 billion in the first quarter of 2023. We may incur additional charges in the future as we further evaluate our real estate needs.

Of course, these are one-time effects likely to be reflected in non-GAAP earnings accordingly. However, as an investor today, you must remember that algorithms do most trading. This means that no matter what the reason is that earnings are worse than expected, the algos react within fractions of a second. However, a change in depreciation accounting has the opposite effect and results in savings of about $800M per quarter. Overall, both effects (layoff costs and depreciation) still weigh on Q1 results.

In January 2023 we completed an assessment of the useful lives of our servers and network equipment, resulting in a change in the estimated useful life of our servers and certain network equipment to six years. For assets in service as of December 31, 2022, we expect that the effect of this change will be a reduction of depreciation expense of approximately $3.4 billion for the full fiscal year 2023.

2. Google’s ad business reflects the overall economy

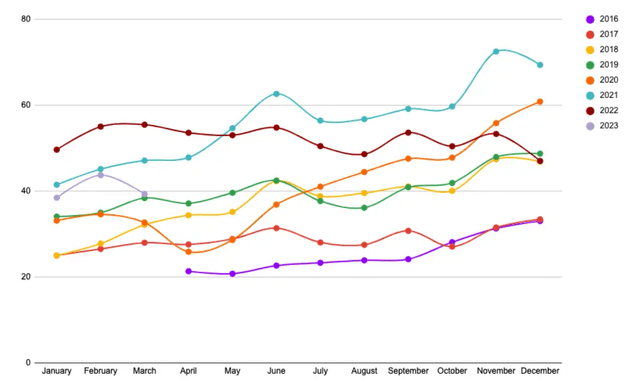

As Google wants to cut costs and lay people off, so do many other companies. One of the most obvious ways to save money is to cut back on advertising. From this point of view, Google is closely linked to the entire economy and therefore suffers more from a recession than, for example, Microsoft. Advertising on Google is like an auction house where you bid money on specific keywords. The website Ezoic created the “Ad Revenue Index”, which is supposed to show how expensive advertising is in relation to previous years.

This graph shows ad rates day over day since Ezoic first published the Ad Revenue Index in April 2016. They have since come down as businesses prepare for a possible coming recession and are more on par with ad rates from 2019, before the pandemic. While inflation means ad rates are still lower than what the average “should be,” they are only drastically low when compared to 2021 and 2022.

Simply put, this means there was more competition in the Google advertising auction house during the pandemic because more companies wanted to advertise. This has increased advertising revenue for Google even more than it would have under normal circumstances. However, now demand is declining as companies are already trying to get ahead of a possible recession. Therefore, the advertising price is decreasing, which should reduce Google’s advertising revenue.

3. Google’s market share is under pressure

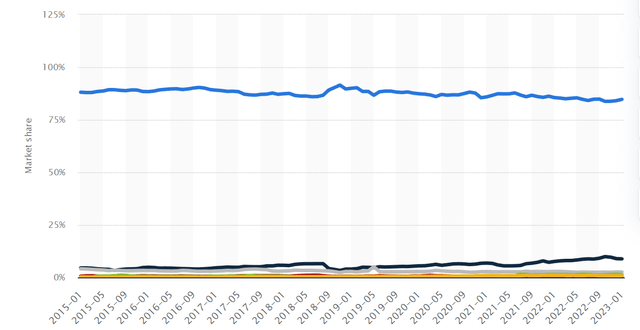

At the outset, I would like to mention that it is difficult to get exact figures here. The exact market shares differ depending on the source, so all results should be taken carefully. Relatively irrelevant are also monthly changes; more interesting are long-term trends. A few months ago, I wrote an article about Google’s market share titled “Has Google Reached Its Peak? Analysis Of the Market Share”, where you can find more details about Google and YouTube.

At the time of the article (Nov 22), the overall market share of desktop and mobile combined was 92%, according to statcounter.com. Depending on the source, the current market share is between 90% and 93%, mainly driven by mobile dominance (approx. 96%). The market share on the desktop has been continuously decreasing for years and is now at 85% vs. 90% in 2016 (according to Statista).

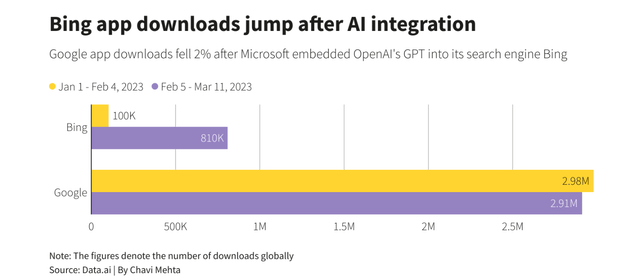

A few days ago, Microsoft announced that Bing recently had 100M Daily Active Users, a new high. Of course, this is still tiny compared to Google’s several billion daily active users. Still, looking at the last few years, one can see that Bing has made progress in capturing market share, especially on the desktop, where it recently stood at almost 9%.

There is more to say about that. Data shows that Bing indeed gained popularity after its AI integration. Certainly, many users just wanted to try it out, but also these are searches that Bing then handles and no longer Google. Some users may continue to use Bing, even if it’s only occasionally. The same is partly true for ChatGPT. At least some of the traffic is traffic that would otherwise have been handled by Google.

Page visits on Bing have risen 15.8% since Microsoft Corp unveiled its artificial intelligence-powered version on Feb. 7, compared with a near 1% decline for the Alphabet Inc-owned search engine, data till March 20 showed. (…)And over the last 28 days, bing.com was up 13.6% and google.com was down 2.8%. (…)Meanwhile, those traffic gains to Bing paled compared to traffic growth to ChatGPT which was up 21.3% weekly.

searchengineland.com (March 23, 2023 article)

I noticed in my research that Google’s market share is falling in high-value countries: e.g., USA, Germany, UK. However, on the other hand, Google has a remarkably high market share in some developing countries like India or the African continent. This, in turn, means an excellent opportunity for Google as the costs for advertisers are still low and will probably increase.

I don’t want to talk the market share being worse than it is because it is still very high. But I would also like to point out that it is not a law of nature that this will remain so high forever. Currently, Google is paying to be pre-installed on Samsung phones, and the news recently made headlines that Samsung is considering switching to Bing. This could save Google a lot of money per year but would likely lead to a loss of market share.

“The idea that anyone would use Bing five months ago was a joke,” Jaluria said. “But now you’re having serious conversations about using Bing instead of Google. And so if Microsoft has that opportunity they should absolutely take it.” The fact that Samsung is even considering changing its default search engine presents a rare moment of weakness for Google, especially on smartphones.

This news shows how much is moving in this area. And given Google’s years of dominance as the only real search engine, it’s not in Google’s interest to see anything change in this market. When you already have over 90% market share, you can almost only lose, so I think it’s certainly the case that Google would have preferred the status quo, and now they are suddenly faced with a series of new challenges. See also my article “Google seems to be outdated.”

4. Some parts of the company are close to stagnating

In my article about Google’s market share linked above, I put forward the thesis that YouTube is losing market share, but no one has noticed yet because the actual numbers are not accurately reported: The number of “monthly active users” is meaningless. When I talk about losing market share, I mean the total amount of monthly hours spent on the platform.

The combination of all these points suggests that YouTube’s user numbers (or at least the time spent by them) are likely declining. There are some indications for this:

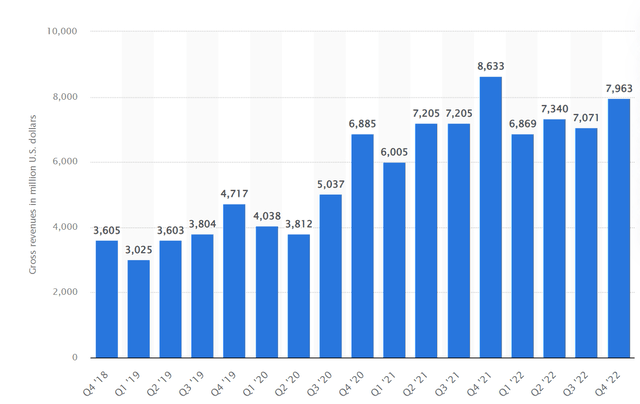

- premium users on YouTube are increasing, but revenue is stagnating

- competitors like Rumble, Odysee, and TikTok are gaining popularity

- I notice many more bots in the comments on YouTube than I used to. This makes it even more challenging to understand how exactly the user numbers are.

Another argument for this is that every YouTube non-premium user knows how annoying the advertising has become and can hardly be increased further. So, if the number of users is increasing, and the number of ads and the number of premium users, why does the revenue development not look so impressive? For me, this can only be explained by the average user spending less time on YouTube than, for example, in 2021.

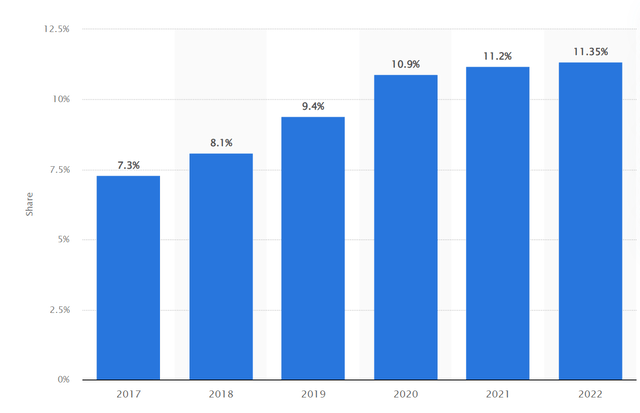

Revenues are still on a slight upward trend and have not stagnated yet, but the momentum from previous times is definitely not there anymore. Here’s another interesting take on YouTube’s flattening growth: YouTube’s advertising revenues as a percentage of Google’s global revenues.

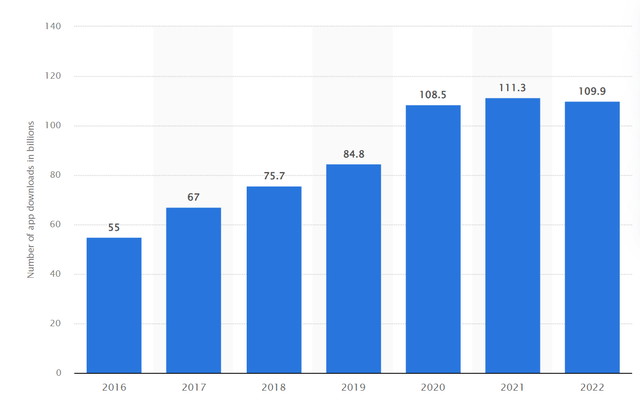

Another area that is stagnating is the App Store, as seen here.

Long-term outlook

Overall, it is simply a matter of time before saturation occurs in all areas. For several reasons: the world’s population is no longer growing as fast as it was a few decades ago, and most of it now has internet access. The biggest remaining upside potential is in Africa. However, if you look at internet access and social media usage statistics, you can’t assume this will reach 100% in all continents. I also know many people who spend less time on the internet today than they did ten years ago. It’s just not new and exciting anymore. It turns out to be a time-eater, and real contacts in the real world are more important.

I expect how we search for information online will change entirely in the long run. The most likely scenario is that we will have real AI assistants. Be it in the form of smart devices to whom we can ask questions or, eventually, in the form of physical robots. Why sit in front of a device and type text with your fingers when you can use your voice? This will turn out to be the superior form of information acquisition. But well, enough philosophizing now; let’s get to the valuation.

Valuation

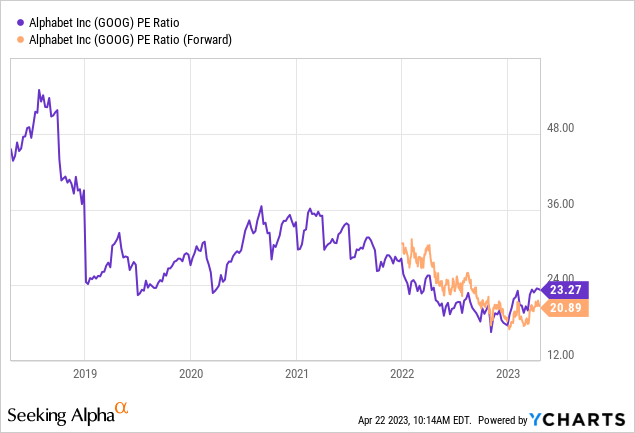

The valuation is currently relatively low for a company as dominant as Google. Even in its historical comparison, the stock is currently cheaper than at almost any time in the last five years. If the estimates are correct, the future P/E ratio is around 21.

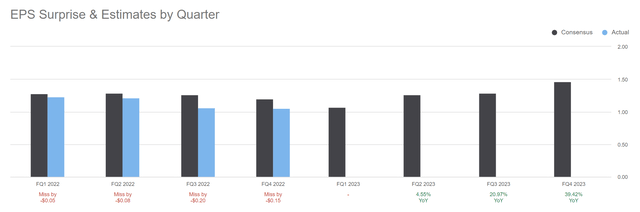

However, the company has already underperformed expectations in the past few quarters, as can be seen here.

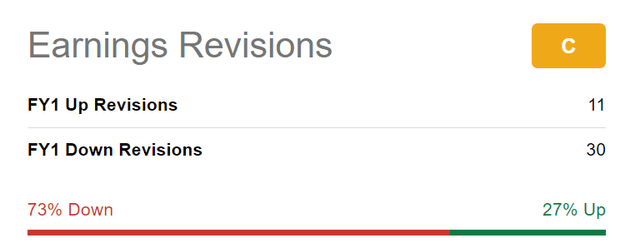

Earnings revisions are not looking so good, either. This interesting section of Seeking Alpha is worth looking at when analyzing a company. Sometimes the earnings estimates indicate an undervaluation, but if there are frequent downward earnings revisions, this could mean that one should not rely so much on the estimates.

This is exactly what the entire article is about. There is a risk that expectations will not be met again, and the market will react negatively. Or, to put it another way, the probability of a negative surprise is greater than that of a positive one.

Conclusion

Overall, I hope this article did not sound too pessimistic; I just want to draw attention to the current dangers. However, that does not mean I am bearish for the future. As we all know, the company is still a cash cow, known worldwide, and used by billions of people daily. In addition, they have the potential of the “other bets” and are better positioned in AI than almost any other company. See also my article “A Deep Dive Into DeepMind.”

Overall, I think it is very good for the users that the monopolistic position in the search engine, which has lasted for years, is getting competition. If the company makes the right decisions, it will, in the end, be stronger than ever.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.