Summary:

- Google stock has corrected by over 10% over the past month, following a strong rally since the start of this year.

- The latest AI moves from key tech rivals have triggered some selling pressure on Alphabet shares.

- At this current dirt-cheap valuation, the stock is definitely worth buying.

Justin Sullivan/Getty Images News

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) stock has corrected by around 10% over the past month, along with the other mega-cap tech stocks dipping lower as well. OpenAI, a chief rival in the generative AI era, has been making various moves over the past several months to challenge Google’s dominance, including a partnership with Apple and the revelation of SearchGPT. Though the way these competitive threats are evolving, they are ironically proving the fortitude of Google’s moat and early mover advantages in the AI era, making GOOG stock a ’buy’.

In the previous article, we delved deeply into Google’s two main avenues for monetizing generative AI, the ad-based approach through Search and broader platform services (e.g. YouTube, Maps, etc.), and the subscription-based approach via Gemini Advanced, to help investors gain a clearer understanding of the revenue growth opportunities ahead. We discussed these monetization opportunities relative to Meta Platforms’ (META) approach, which is also likely to use a combination of ad-based and subscription-based monetization strategies. Though Google came out as the stronger AI play given the broad and diverse range of digital applications it already offers, buoying consumer reach and distribution efforts.

In this article, we will be focusing on how Google’s solid Search moat can withstand the latest threats from OpenAI. While the stock had been selling off amid these developments, GOOG is actually a steal at its current valuation of 22x forward earnings, making it one of the cheapest Magnificent 7 stocks.

OpenAI reveals SearchGPT to challenge Google Search

It is ironic to think that just over one year ago, the conversation was around Google Search being displaced by increased use of ChatGPT, as well as other rising generative AI-powered chatbots. The market expected dramatic shifts in consumer habits towards increasingly asking automated chatbots for anything they needed, as opposed to going through Google Search.

Fast-forward one year later, and OpenAI itself is now entering the Search engine arena with the introduction of SearchGPT, which is currently in beta testing mode with limited users and publishers.

OpenAI’s entrance into ‘Search’ is testament to the fact that Search engines and ‘Search Engine Results Pages’ [SERP] will remain key avenues for people to navigate the internet and digital world more broadly. At present, Google still firmly dominates this arena.

On the SearchGPT web page, the company says the prototype feature will “give you fast and timely answers with clear and relevant sources”. We don’t yet know whether these source links will direct towards websites listed on Google’s index, similar to how Search start-up Perplexity does, or whether they will be limited to websites listed on Microsoft’s Bing.

Alternatively, given that SearchGPT would also be competing against the Bing Search engine of its biggest investor Microsoft, it’s unclear whether OpenAI will actually be striving to build up an index of websites on its own in the future.

Consider the fact that Google has over 4 billion websites indexed on its search engine, covering numerous verticals, as Gary Illyes, an Analyst for the Google Search team, revealed in an interview:

you can see that we have about 4 billion host names that we check every single day for robots.txt. Now, let’s say that all of those have subdomains, or subdirectories, for example. So the number of sites is probably over four, or very likely over four billion.

So building up an index of websites that is competitive with Google will be a steep uphill battle for OpenAI, or even Perplexity for that matter.

What is certain is that OpenAI will strive to compete against Google on the ‘User Interface’ front, aiming to build a richer user experience for people to search for and find the information they need. But even on this front, encouraging users to use SearchGPT over Google’s extensive platform may be easier said than done.

Keep in mind that Google’s popular Search engine is complemented by various other consumer applications/ services that augment the user experience, including YouTube, Google Maps and even Google Shopping to facilitate e-commerce activities through the platform.

In fact, a survey conducted by Morgan Stanley earlier this year had found that “23% of ChatGPT users” have used it for shopping queries. Hence, realizing the opportunity to serve e-commerce activities, it is unsurprising that OpenAI is expanding into the Search arena in order to be able to optimally capitalize on such forms of user queries through both a chatbot and a Search engine, depending on consumers’ individual preferences. For context, that same survey also found that “36% of Google’s Gemini users are using the chatbot to shop for products”.

Google clearly has the lead when it comes to facilitating shopping activities through its platform. The company had revealed in early 2023 that more than 35 billion products were listed on Google Shopping.

Moreover, Alphabet’s ownership of the largest video-sharing platform on the planet is another key strength that fortifies Google’s moat.

Firstly, YouTube complements Google’s ability to facilitate e-commerce activity through its platform, as Chief Business Officer Philipp Schindler shared on the Q2 2024 Alphabet earnings call:

Last year, viewers watched 30 billion hours of shopping-related videos, and we saw a 25% increase in watch time for videos that help people shop.

In fact, Google has already showcased AI that can help with pinpointing the particular section of a video that is relevant to the user’s query. This can not only aid with product searches, but also with serving informational queries, such as “how to…” questions or educational content searches more broadly.

YouTube is approximated to host over 10 billion videos on the platform, as per a research paper from the University of Massachusetts Amherst in 2023. Therefore, once again, the uphill battle for OpenAI to catch up to Google’s dominance is steep.

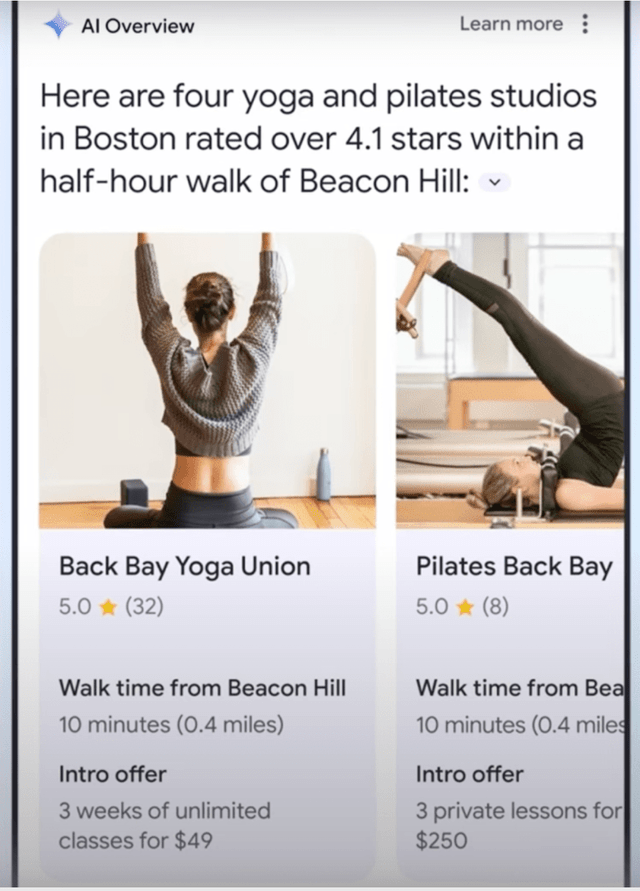

Additionally, don’t forget about the deep integration of Google Maps with Google Search, as well as the millions of businesses listed on the platform. In fact, Google boasted these elements during the I/O event in May 2024, showcasing how AI Overviews can incorporate useful data such as travel distances/ times and business reviews/ ratings in response to users’ commercial queries.

AI Overviews response example, incorporating data from Google Maps and business reviews (Google I/O 2024)

Furthermore, on the last earnings call, CEO Sundar Pichai had shared that:

We are pleased to see the positive trends from our testing continue as we roll out AI overviews, including increases in search usage, and increased user satisfaction with the results.

…

People who are looking for help with complex topics are engaging more and keep coming back for AI overviews. And we see even higher engagement from younger users, aged 18 to 24, when they use search with AI overviews.

The fact that younger users are so engaged is a positive signal that Google is well-positioned to sustain its moat in the Gen AI era.

More importantly, Google is making encouraging progress in monetizing the new form of Search through advertisements, helping alleviate investors’ earlier concerns that the Search giant’s ad-based business model could be disrupted amid the rise of ChatGPT and chatbots more broadly, as Chief Business Officer Philipp Schindler shared on the previous earnings call:

people are finding ads either above or below AI overviews helpful. We have a solid baseline here from which we can innovate and as you have probably noticed at GML, we announced that soon we’ll actually start testing Search and Shopping ads in AI overviews for users in the U.S.

Seeing how Google is efficaciously deploying generative AI into its Search engine and demonstrating viable pathways for sustaining ad revenue, Microsoft is also seeking to do something similar with Bing, and OpenAI indeed also wants a share of this pie through ‘SearchGPT’. This is testament to Google’s ability to maintain a lucrative Search engine business despite the rise of chatbots.

Apple’s AI delays are a boon for Google

Aside from the introduction of SearchGPT, OpenAI’s partnership with Apple (AAPL) to be the first to integrate its ChatGPT chatbot into iOS was also perceived to be a threat to Google.

Apple executives quelled some of these concerns by highlighting that they also plan to incorporate other AI chatbots, like Google’s Gemini, going forward. Although there was still a worry that OpenAI could gain a first-mover advantage here, whereby iPhone users become habitually accustomed to using ChatGPT for “broad world knowledge” questions, making it their default chatbot even when presented with more choices.

However, Apple recently released the preview of Apple Intelligence as part of iOS 18.1. It revealed which features will be available this year, and which features are being delayed for release.

Some of the most key features are being delayed.

Firstly, the integration of ChatGPT into iOS will not be part of iOS 18.1, which is great news for Google. The delay of ChatGPT integration gives more time for Google and Apple to strike a deal together to also incorporate Gemini as an option for iPhone users when asking more complex questions. This would enable Google to stay relevant and avoid the scenario of Apple’s installed base habitually using ChatGPT for broader questions.

Furthermore, the Apple Intelligence preview also revealed that “other Siri improvements, including its ability to use your personal information, and the ability to take actions inside apps”, will also be delayed.

The absence of such a key AI feature from iOS 18.1 raises questions over whether Apple will be able to drive a meaningfully strong iPhone sales cycle amid the launch of Apple Intelligence. This comes as chief rival Samsung is already selling generative AI-enabled smartphones.

Moreover, the Gemini model is already well-integrated into Samsung’s latest smartphone models, which run on Google’s Android operating system. At Samsung’s Galaxy Unpacked event, VP of Gemini User Experience, Jenny Blackburn, showcased how Gemini can be used with applications like YouTube to ask questions about videos, and even with Google Maps to plan trips. Gemini is well-integrated with Gmail and Google Docs to be able to use users’ personal information to complete tasks.

It goes without saying that Google was much better prepared for this AI era than Apple, and this is now manifesting in the form of Android racing past iOS in terms of AI capabilities.

In fact, UBS analyst David Vogt highlighted in a recent research note that:

the iPhone lost market share in June…

Sell-through data for the iPhone was up roughly 1% to 45M units, compared to 4% for the overall smartphone market

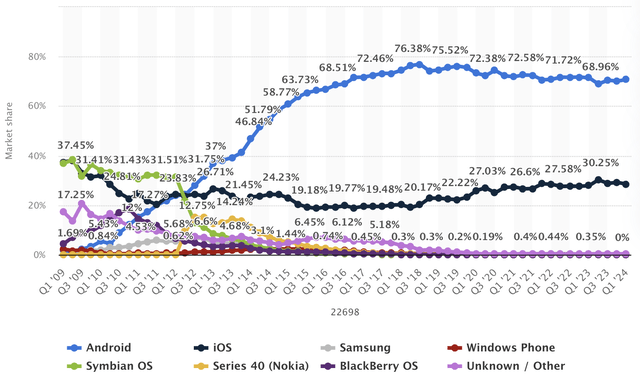

Google continues to dominate the smartphone operating system market, with Android commanding over 70% market share.

Market share of mobile operating systems worldwide (Statista)

And now with iOS lagging Android in AI capabilities, Google is benefitting from more Android-based phones being shipped, giving the Search giant the opportunity to lock consumers into its ecosystem early on in this new AI era, where sticky AI-powered assistants (such as Gemini) strive to serve up increasingly better responses by storing users’ preferences in device memories.

Risks to the bull case for Google

So far, we covered how Google’s well-established Search moat fostered by deep integration with other popular consumer apps (e.g. YouTube, Google Maps) makes for a steep uphill battle for OpenAI to catch up through its new ‘SearchGPT’ product.

Although OpenAI will indeed strive to build a richer user interface and user experience for SearchGPT, to carve out a slice of market share for itself in the Search engine space. Even if OpenAI manages to take just 10% of market share, it would undermine Google’s Search advertising revenue growth prospects going forward.

After all, ChatGPT was the “fastest-growing consumer application in history”, reaching “100 million monthly active users” within just two months after launch. And OpenAI CEO Sam Altman had shared at the company’s developer conference in November 2023 that ChatGPT had 100 million weekly active users, within a year of launch.

Now OpenAI will certainly strive to leverage the popularity of its ChatGPT chatbot to induce fast experimentation with and adoption of SearchGPT.

Furthermore, OpenAI also seems to be moving much faster than Google when it comes to introducing the world to agentic AI capabilities, amid the launch of GPT4o. Shortly after revealing its multimodal capabilities at a company demo in May 2024, OpenAI made GPT4o available to both free users and ChatGPT advanced subscribers, with differing token limits, stating that paid subscribers will “continue to have up to five times the capacity limits of our free users”.

As per a report from The Wall Street Journal:

The company’s [OpenAI’s] recent demo of its voice-powered features led to a 22% one-day jump in mobile subscriptions, according to analytics firm appfigures. This shows the company excels at generating interest and attention

Meanwhile, Google revealed similar agentic capabilities at its I/O event in May, named “Project Astra”, with executives stating that these features will be made available later this year.

Google’s slower rollout risks enabling OpenAI to capture more market share in this space, as it currently is the only firm that offers such advanced, multimodal agentic capabilities. OpenAI could indeed leverage early users’ interest in GPT4o to induce usage of other new services the company introduces, namely SearchGPT, and strive to become a force to be reckoned with against Google.

Google Financial Performance and Valuation

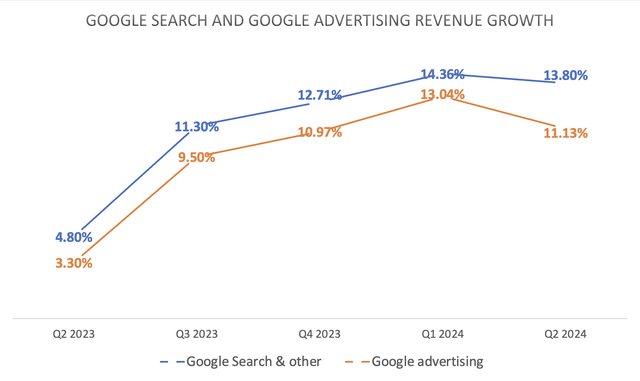

Despite the rise of chatbots, Google once again proved its ability to sustain its Search engine business last quarter, with Google Search revenue growing by almost 14%, while the broader Google Advertising segment (consisting of Search, YouTube and Network) grew by just over 11%.

Nexus, data compiled from company filings

With regards to Alphabet replacing the traditional Google Search with AI Overviews, CEO Sundar Pichai shared:

we are seeing that ads appearing either above or below AI overviews, continue to provide valuable options for people to take action and connect with businesses.

Hence, Google stands to keep the ad dollars flowing even as it deploys generative AI features in its Search Engine business.

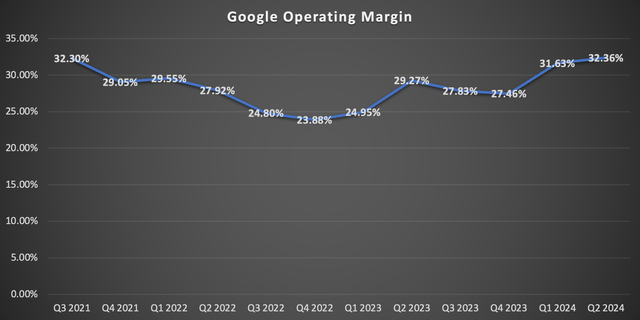

In terms of profitability, Google once again saw its company-wide operating margin expand.

Nexus, data compiled from company filings

And this trend of margin expansion is expected to continue, as CFO Ruth Porat shared on the last earnings call:

overall company-wide, it is important to note that we do expect to continue to deliver full year ’24 Alphabet operating margin expansion relative to 2023

And this comes despite continued growth in CapEx to build out its AI infrastructure, with the CFO guiding that:

Looking ahead, we continue to expect quarterly CapEx throughout the year to be roughly at or above the Q1 CapEx of $12 billion

Investors are certainly becoming impatient to see some meaningful returns on investments from all this heavy CapEx spending.

Though Google certainly has a proven track record of spending each dollar as efficiently as possible, through its long-term strategy of durably re-engineering the cost base. In fact, in a previous article, we had discussed in-depth, and in a simplified manner, how Google uses a new technique called “compute-optimal scaling” when building next-generation AI models, which essentially enables them to build more efficient models that require less resources for both training and inferencing. This not only enables Google to run new generative AI features more cost-efficiently, but also allows them to offer more economical AI models to Google Cloud customers.

And that is just one example of how Google strives to build a sustainably efficient cost-base. On the last earnings call, CEO Sundar Pichai proclaimed:

We are relentlessly driving efficiencies in our AI models. For example, over the past quarter, we have made quality improvements that include doubling the core model size for AI overviews, while at the same time improving latency and keeping cost per AI overviews served flat. And we are focused on matching the right model size to the complexity of the query in order to minimize impact on cost and latency.

This strategy enables Google to serve answers faster while keeping serving costs low, essentially allowing the company to potentially drive top-line revenue growth by augmenting the user experience, while sustaining operating profit margins for shareholders.

Therefore, Google should be able to effectively deliver returns on investments for shareholders, from all this AI-related CapEx.

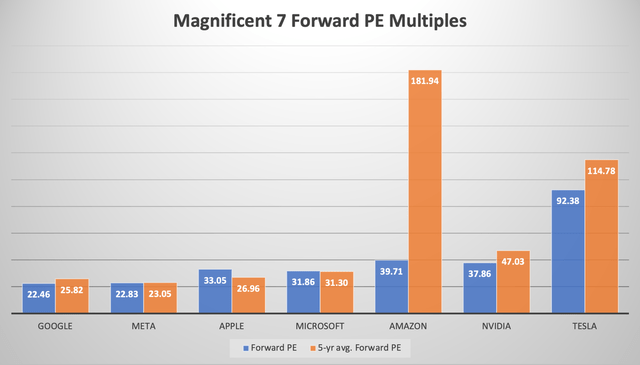

Although despite Google’s continued Search dominance and profitability outlook, the stock continues to trade at a relatively cheap valuation multiple of 22.46x, notably below its 5-year average Forward P/E of 25.82x, making it the cheapest Magnificent 7 stock.

Nexus, data compiled from Seeking Alpha

This valuation suggests that the market is still uncertain about Google’s ability to sustain advertising revenue growth in the era of AI. Although as discussed earlier, Google’s Search business boasts an incredibly strong moat, buoyed by the most extensive knowledge/ information base, and the deep integration with its broader suite of popular consumer applications.

OpenAI’s need to also create its own SearchGPT is testament to the fact that Search engines will remain key avenues for content discovery and engagement in the era of AI.

Therefore, as the sustained leader of the Search engine market, GOOG deserves to trade at a higher valuation multiple, at least in line with its 5-year average of 25-26x forward earnings. This would imply up to 16% stock price upside from here, solely based on valuation rectification back upwards. Additionally, as per Seeking Alpha data, the company’s expected EPS FWD Long-Term Growth (3-5Y CAGR) is 17.42%, which is up from 16.42% last quarter. Sustained EPS growth should also further drive the stock price rally going forward, as the company begins to optimally monetize its rollout of generative AI-powered services, as well as the continued growth of Google Cloud, which is one of the picks and shovels of this AI revolution.

The point is, GOOG stock is a steal at its current valuation, making it a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.