Summary:

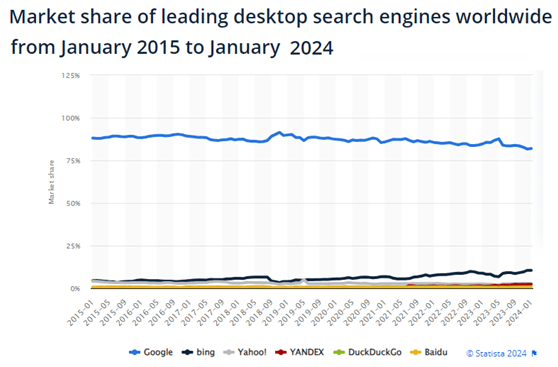

- Alphabet’s core Search business faces increasing competition from Microsoft but has so far managed to reach an 80%+ market share.

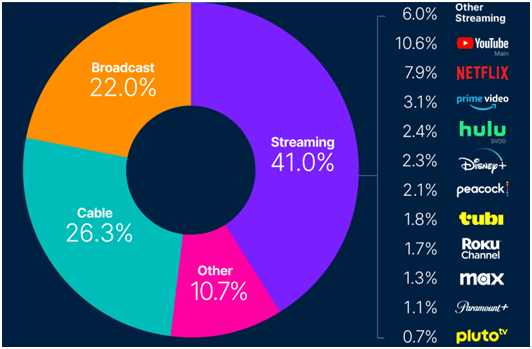

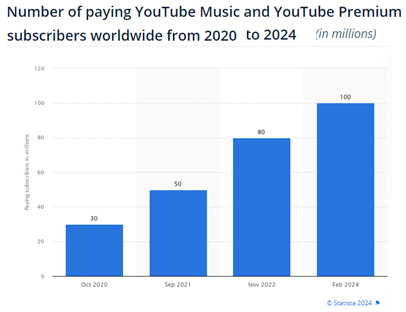

- YouTube is maintaining its NR1 position in terms of streaming time in the US, while new paying account subscriptions reach new records.

- Google Cloud just crossed 10% EBIT margin and could become a new earning engine.

- The firm is limiting OPEX growth, which enables it to reach operating leverage.

- My DCF indicates a 30% upside, and recent results highlighted a solid margin expansion based on cost optimization. The recent stock correction offers an appealing buying opportunity.

Eoneren

My thesis

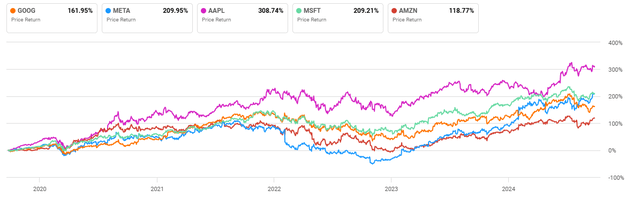

Alphabet (NASDAQ:GOOG) has failed to impress the market for an extended period and lagged Apple (AAPL) and Microsoft’s (MSFT) stock performance over the past five years. However, recent quarters brought us some elements to be excited about. First, the Cloud segment is gaining scale and reaching breakeven margins. Second, a firm-wide cost-cutting plan reduces operating expenses and fuels profitability. Finally, the latest developments of Waymo autonomous driving units are promising and could unlock hidden value in the stock. My DCF model indicates upside potential without taking into account aggressive assumptions. I rate the stock as a BUY.

Investment overview

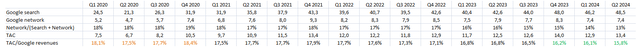

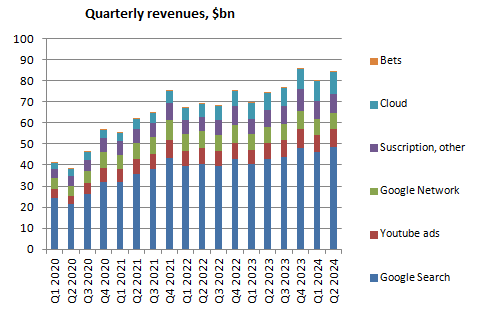

Google Search and Networks (shared traffic) are still two-thirds of Alphabet’s revenues, despite the growth of other segments. This high exposure to advertising makes Google revenues more cyclical than those of other tech companies such as Microsoft or Apple. Despite the integration of Open-IA in Microsoft Bing results, Google Search has maintained a solid market share (above 80% of queries).

company data Statista

While Alphabet expects “TAC (traffic acquisition cost) paid to our distribution partners and Google Network partners to increase,” we can observe that TAC gradually declines as a percentage of revenues, along with Network revenues. This is good news as less profit is shared in relative terms, which should gradually boost Alphabet’s margin.

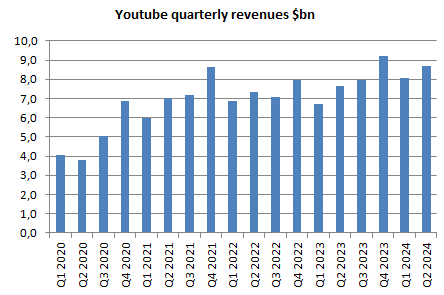

YouTube evolution has been impressive, growing a quarterly revenue of $4bn in early FY2020 to $8bn recently.

company data

According to Nielsen research, Streaming represented 40% of time spent on screen during August. This was ahead of traditional channels such as Cable and Broadcast. Within Streaming, YouTube ranked number one. Alphabet constantly improves the channel by adding AI features, helping creators in their work, and advertising to target their audience more efficiently. YouTube short videos have also gained popularity and helped to be competitive versus TikTok.

Nielsen

In terms of revenues, while Netflix is expected by the consensus of analysts to reach $38bn of revenues this FY24, YouTube could reach $36bn in advertising standalone, assuming 15% growth over FY23, and close to $50bn adding subscription fees (assuming $14/month on 100m users). YouTube has become a clear winner in the streaming space. A long road has been traveled for an asset purchased by Google in 2006 for $1.65 bn.

statista

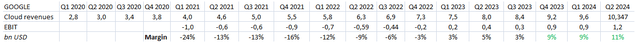

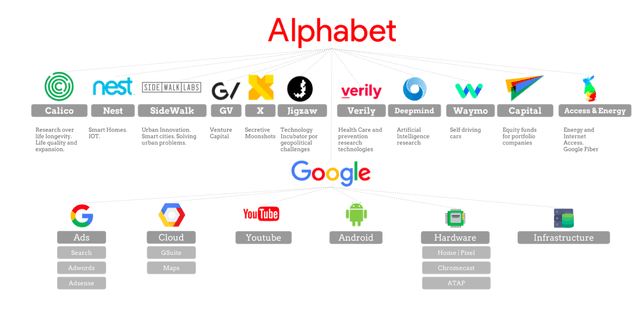

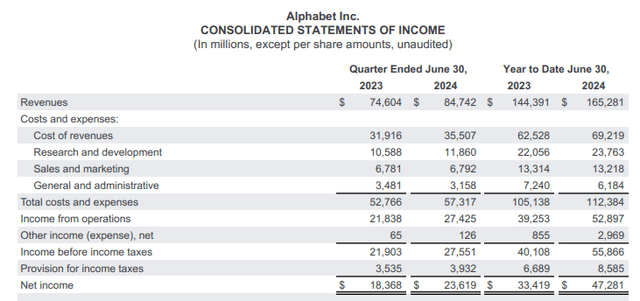

Let’s examine the Cloud segment. It became EBIT positive starting in Q1 FY2023 and reached an 11% EBIT margin on $10.3bn in sales during the last quarter.

While this is encouraging and adds to Google’s profitability in the future (J-curve), we can note that Amazon (AMZN) AWS was more profitable when reaching $10bn sales (see below, 30% margin). I could argue that current AI-related investments are much more capital-intensive and, therefore, are likely to require more Depreciation expenses than in 2020. Also, the competitive landscape in the Cloud business is more intense (pricing) as Microsoft Azure, Amazon AWS, Google, and Oracle (ORCL) are fierce competitors.

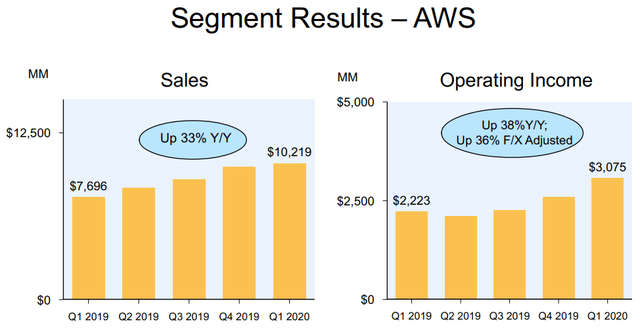

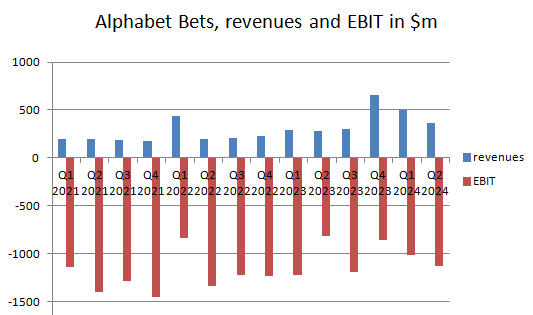

Let’s finish with Alphabet’s Bets segment. As the image below shows, it is a galaxy of entities focused on long-term market trends.

This segment has been a source of cash burn for quite a while. Two recent quarters have shown some signs of relief, with a revenue pickup and a stabilized level of losses. Remember that an annualized EBIT loss of $4bn would represent less than 5% of FY2024’s expected operating income. These investments are, therefore, manageable.

company data

Among these Bets, the autonomous driving unit Waymo is the most promising. It was founded in 2009 by Sebastian Thrun, head of Standford’s IA department. Since then, it has recorded over 20 billion real-world and simulated miles driven since its inception. Waymo offers its services in California, San Francisco, Los Angeles, Phoenix, and most recently Austin. In the meantime, its main competitor, GM Cruise, is having real trouble and has seen its license blocked in San Francisco over accidents. Other competitors have faced difficulties in the past, with the most prominent example being Ford Argo AI, which shut down definitively in 2022.

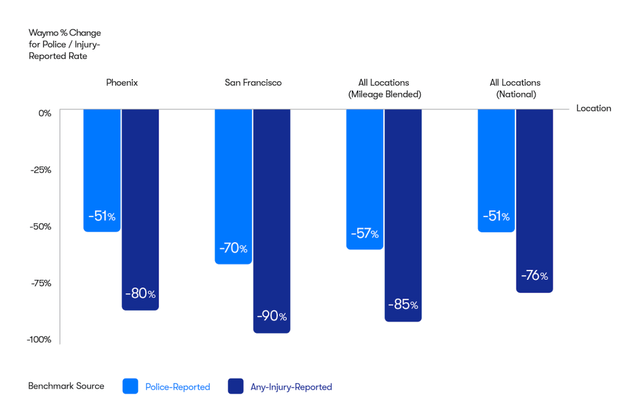

Waymo has started to be more transparent with its statistics, indicating an improvement in accident rates compared to human-driven cars. While self-driving cars are driving in considered safe areas, human intervention is often needed to take control of the vehicle fleet (when the algorithm can’t solve complex situations by itself).

Since August 2023, the state of California has authorized the monetization of Waymo and Cruise for autonomous rides anytime of the day in San Francisco. Potential expansion to other cities and fleet expansion would start to bring material results to Alphabet’s Other Bet segment.

In September 2024, Waymo and Uber extended their partnership. Under new terms, Uber will provide its mobile application to users and take care of car maintenance, while Waymo will make available its autonomous technology. This deal will cover Atlanta and Austin. At the moment, the only relevant competitor to Waymo seems to be Tesla, which plans to announce its robo-taxi by October.

Let’s now have a focus on the cost structure of Alphabet.

After years of over hiring, Alphabet decided in 2023 to cut 12k jobs, representing 6% of its workforce. In June 2024, the firm announced the recruitment of the former CFO from Eli Lilly, to tighten cost discipline. We can see in the following table that the number of employees started to decline in the Q2 of 2023.

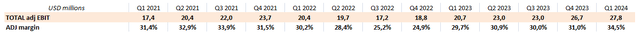

This spending cut, combined with improving margins in the Cloud segment helped a powerful margin expansion, with non-GAAP EBITDA margins to record highs.

Recent quarterly trends

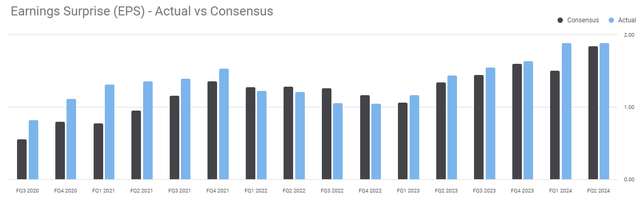

After a period of underperformance in 2022, Alphabet managed to beat EPS expectations in Q1 and Q2 FY24 thanks to reaccelerating growth in conjunction with a severe cost-cutting plan.

On the margin side, expansions came from all lines: gross margins increased from 56.7% to 58.2% in the first semester FY2024, R&D/sales decreased from 15.3% to 14.4% and SG&A from 14.2% to 11.7%. Overall, EBIT margins (GAAP: stock options expensed in the income statement) grew from 27.2% to 32% YoY. In the Q2 result, Alphabet said hiring could restart soon while at a controlled pace: “Looking ahead, we expect a slight increase in headcount in the third quarter, as we bring on new graduates.”

Let’s now focus on qualitative aspects of recent conference calls.

During the Q1 FY2024, published in May, the firm emphasized several interesting points on AI developments:

It said it used its self-developed processor TPU to train its generative IA algorithm: “Gemini was trained on and is served using TPUs.” It is incorporating its new capabilities within the Search Engine: “focusing on areas where gen AI can improve the Search experience, while also prioritizing traffic to websites and merchants. We have already served billions of queries with our generative AI features.” To enhance efficiencies, Alphabet decided to centralize its developer teams under Google DeepMind.

In the Q2 FY2024, I noted interesting points:

Gemini is said to be used by more than 1.5m developers and integrated into several verticals such as Search, Workspace and Google messages. Google continues to roll out AI Overviews features that help the quality of the web engine and translates into a better customer engagement, especially within younger populations. Other positive points came from YouTube enjoying a “strong growth” in subscription accounts. Also, Shorts are gaining momentum while the monetization of these short videos continues to improve.

What valuation can we expect?

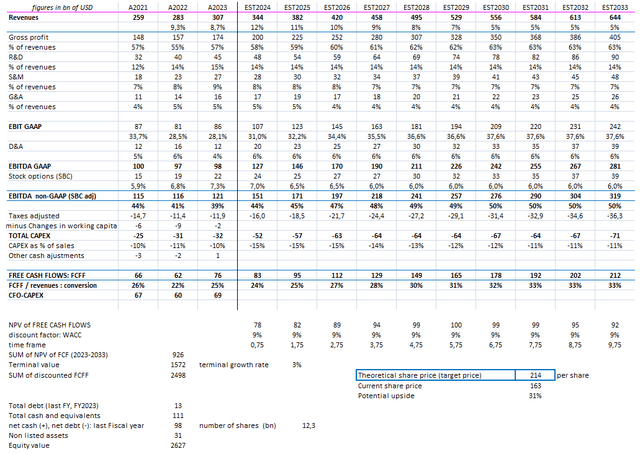

I modeled a revenue stream growing at a CAGR of 11% in the next three years, close to recent trends and benefiting from a growing contribution of YouTube and Google Cloud in the mix.

Margin expansion should be driven by two factors: OPEX leverage (hiring slow down, after the recent cut) and improving profitability of the Cloud segment.

CAPEX is expected to increase significantly this year, close to $50bn, driven by genAI investments. In the Q2 conference call, Google confirmed this by saying: “Looking ahead, we continue to expect quarterly CapEx throughout the year to be roughly at or above the Q1 CapEx of $12 billion“.

Using a terminal growth of 3% and requiring 9% discount on FCFFs, I obtain a value per share of $214, presenting an upside potential close to 30%.

The balance sheet is healthy: Google enjoys a cash and equivalent position of $110bn for a total debt of $13bn. In April, the firm announced a new $70bn stock buyback program and a first dividend payment. The firm has repurchased for $200bn of its own stock since 2020.

Risks

Regulation could limit Alphabet’s expansion, as it controls over 80% of internet search queries. The European Union has been intensifying pressures on firms with monopoly charges. Nevertheless, Google has only been fined eight billion over the last decade, which is not that much compared to its cash generation. Moreover, it recently won a legal battle against the commission and won’t have to pay its most recent EUR1.7bn fine.

Competition is everywhere as Microsoft Bing powered by AI seeks to challenge Google’s core business dominance, Meta and Amazon are grabbing more digital advertising budgets, and Google Cloud remains NR3 in the Cloud infrastructure business. Bears could say it is not diversifying fast enough its revenues away from Search, which deserves a valuation discount against other big techs.

Alphabet’s stock performance over the last five years has been good, but still lags behind most of its US tech peers.

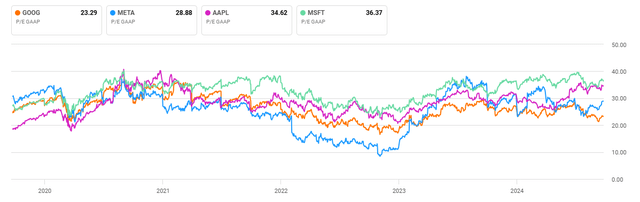

This, despite the fact it is the cheapest in its peer group.

Conclusion

Alphabet should see its profitability keep progressing in the coming years as major business lines gain scale and a strict cost management is finally in place. While competitive risks remain, the company valuation metrics (P/E close to 20X, upside in my DCF) are attractive and can offer sufficient margin of safety. I rate the stock as a BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.