Summary:

- Alphabet stock is trading at a discount compared to other “Magnificent 7” stocks. Should you buy it right away? Not so fast.

- Excessive investments planned for this year and possibly 2025 may keep the current discount and not result in meaningful returns for investors.

- GOOG stock price seems to be still high compared to where it should be following its correlation with marginality levels.

- Influencers like Elon Musk criticizing Gemini for alleged racism further tarnishes the user perception of Google’s product, undermining the significant investment the company has made in it.

- Despite the relatively low multiples, I don’t think it’s time to buy Google yet – perhaps we should actually wait and see what the company delivers in the first quarter of 2024.

Michael M. Santiago

My Thesis

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) stock is trading at a discount to the rest of the “Magnificent 7” stocks, but I think there’s a reason for that – and I don’t mean Gemini’s recent missteps. I guess that the company’s excessive investments planned for this year (and possibly for 2025) may keep the current discount untouched and not result in any meaningful returns for investors.

My Reasoning

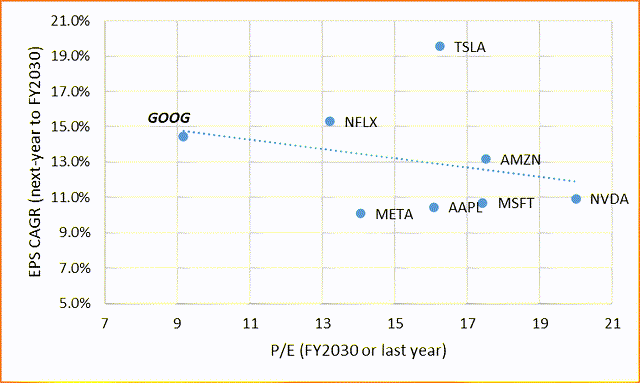

In my last article on Amazon (AMZN), I created a rather interesting chart comparing the growth potential of all the “Magnificent 7” companies based on market expectations for long-term EPS figures and the P/E ratios the companies will receive in a few years based on that growth. I argued that AMZN may be the cheapest of the mega-caps, but one couldn’t help but notice GOOG, which sits on the far left of the chart and whose projected EPS growth is roughly in line with Netflix (NFLX):

Seeking Alpha data, Oakoff’s notes

In fact, the market expects Google to grow at a rate that far surpasses even Nvidia (NVDA) and Microsoft (MSFT). GOOG stands out particularly strongly against MSFT – both companies should theoretically have similar AI-related growth drivers, but for some reason, Microsoft’s valuation premium is much larger than Google’s.

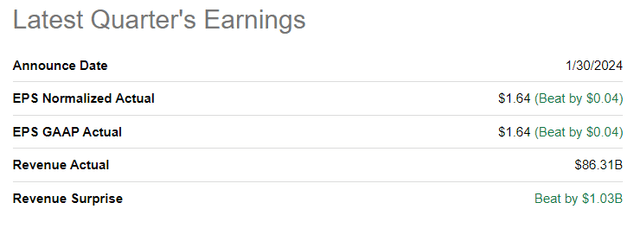

As you may know, Google generates revenue through online advertising, cloud services, and hardware. Typically, at least 2 of these segments are quite cyclical and depend heavily on the global economy, which fluctuates from year to year. But the company’s 4Q and full-year 2023 results (published 2 weeks ago) clearly showed that the economy is now in very good shape. Google’s Q4 revenue of $86.3 billion (+13.5% YoY) and EPS of $1.64 (+56% YoY) beat the consensus estimates by 1.2% and 2.53%, respectively, according to Seeking Alpha’s data:

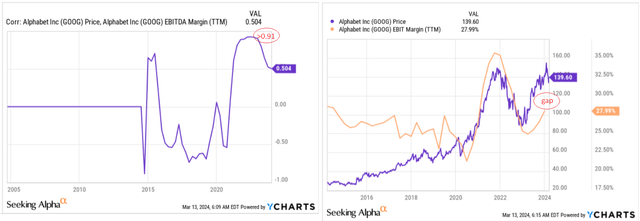

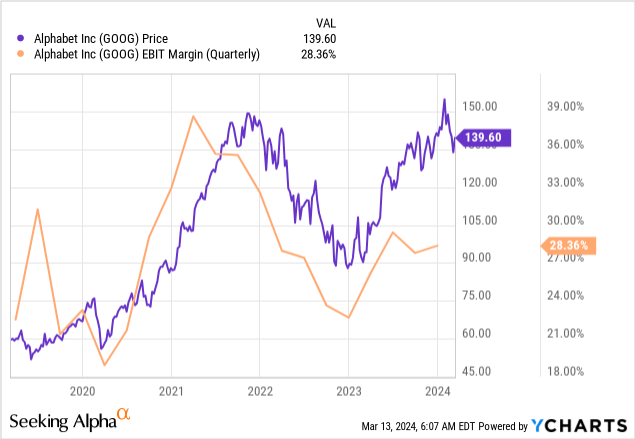

Google’s cost of revenues increased by 6% YoY while the OPEX was up 11% YoY, so thanks to the operating leverage the company’s EBIT margin increased by 89 basis points QoQ and 497 b.p. YoY, which looks exceptionally good, in my view. Google is definitely slowly but surely regaining lost 2021 margins:

As Google became a cash cow rather than a growth company, its stock price became increasingly dependent on how the company’s profit margins behaved. In 2021-2022, this correlation was over 0.91, which is considered very high. This worked both against the backdrop of the upswing and the fall in margins. Now the correlation has fallen again, as the GOOG stock price seems to be still very high compared to where it should be following this correlation.

I think this is one of the reasons why GOOG stock has the valuation discount I discussed above – the market may have already started to perceive the company as a cash cow, and the mere fact that the price hasn’t followed the margin (due to AI hopes) already looks like a win.

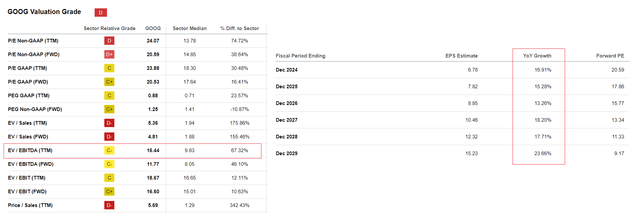

But that is only one possible explanation for why GOOG is as cheap as it seems compared to the MAG 7 peers. In fact, with a TTM EV/EBITDA of over 16x and a long-term EPS growth rate of over 14%, Google can hardly be described as a classic value stock.

Then what else could explain Google’s current cheapness?

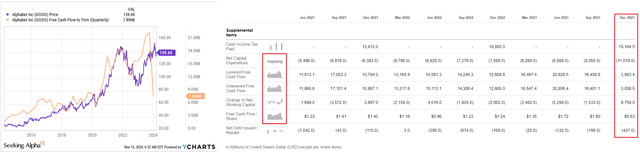

FinFluential, an X-account, recently put forward the thesis that Google’s stock price is likely to remain under pressure until at least the Q1 2024 report sees light. It’s all about declining free cash flows.

I decided to look into this thesis and was surprised: Google’s unlevered free cash flow has actually fallen to 2020 levels. If you pay attention to additional data, you’ll understand why – the company has sharply increased its capital expenditures and at the same time its net working capital (NWC) has increased by $8.76 billion, according to Seeking Alpha:

GOOG’s FCFF fell primarily due to lease exit charges of $1.2 billion, severance charges amounting to $2.1 billion (part of full-year costs), workspace optimization costs totaling $983 million, and accelerated D&A. During the recent earnings call, Ruth Porat explained that the enormous CAPEX totaling $11 billion in Q4 alone was “directed towards technical infrastructure to leverage AI applications for various stakeholders”. She also stated that looking ahead to FY2024, the company anticipates even larger investments as it continues to prioritize innovation and expansion across its diverse portfolio. And this is where the key to GOOG’s discount lies. It’s important that we look to the future and not the past, so this 2024 spending outlook creates an unfavorable setup for the company’s valuation, in my opinion.

Google’s Gemini does not exist in a vacuum – competition for the attention of users is squeezing the company from all sides, and it is anything but certain that the multi-billion dollar investment will be justified. In any case, investors see uncertainty, which in turn leads to an undervaluation.

Criticism from influencers such as Elon Musk, who openly accuses Gemini of racism, adds fuel to the fire – this clearly does not benefit the user perception of the Google product on which the company spends so much.

Elon Musk criticizes Google Gemini’s ‘woke’ AI chatbot for its ‘insane’ response on misgendering Caitlyn Jenner to prevent a nuclear apocalypse.

Source: The Times of India

Google’s current situation reminds me a little of the situation of Meta (META) when the latter tried to become a pioneer in the world of metaverses and wasted billions of dollars it had received from the stable income streams (Instagram and WhatsApp) on innovative and unprofitable projects that were not destined to be monetized.

Your Takeaway

I should say right away that I don’t think the current negativity around Gemini will translate into anything meaningful for Google. The company is still one of the market leaders in the tech industry with a huge moat in the search engine and still holds over 83% of the global market. But this market share is shrinking fast, which may lead to a reinforcement of this trend against the backdrop of what I consider to be very risky AI investments.

The issue here is not so much how justified Google’s investments are – of course, the firm should invest heavily in infrastructure to keep up with the general trend. The only question is, why in such large quantities as in Q4 2023?

I agree with the thesis that FCFF plays an important role in determining likely market sentiment and stock price performance going forward. In addition, investors should not lose sight of margins. I suggest looking at all that closely and also reading what management says about future investments to determine their risk appetite. Despite the relatively low multiples, I don’t think it’s time to buy Google yet – perhaps we should actually wait and see what the company delivers in the first quarter of 2024.

So Google stock is a “Hold” for me now.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.