Summary:

- My estimates suggest that we should see a decline in Google stock price before it can be considered undervalued.

- Google is a fully-fledged dividend stock now, whose dividend yield should amount to 0.26% this year. In addition to that, the firm’s innovation is moving at full speed.

- I’m concerned about the current price, which I don’t consider cheap.

- My DCF model indicates an overvaluation of 9%, and that’s only if we factor in an initial premium to the sales growth rate that the market has not yet recognized.

- Investors should trim or protect their existing long positions through call options selling, waiting for a better price, in my opinion.

igoriss

Intro & Thesis

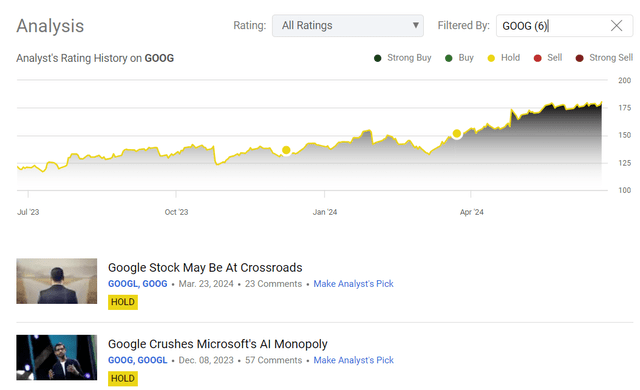

My coverage of Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) (NEOE:GOOG:CA) stock was initiated here on Seeking Alpha back in November 2022. For the past 4 articles, I maintained a “Hold” rating, pointing out that Google’s launch of Gemini, a large language model for AI applications, should challenge Microsoft’s (MSFT) “AI monopoly” and could boost Google’s projected EPS figures in the medium term. However, my “Hold” rating was influenced by the underwhelming GCP performance and the stock’s relatively high valuation at the time.

Seeking Alpha, my coverage of Alphabet

In my very last article (dated March 2024) I noted that if I add up all the positive and negative aspects of the company’s development, I find more positives, but Google seemed to be already fairly valued. Today I think about Google the same way – the time to buy this tech giant cheap last year has gone. Now investors should trim or protect their existing long positions through call options selling as the growth upside potential seems to be limited at this point, in my opinion.

Why Do I Think So?

First off, I should say that looking at the most recent financials (Q1 FY2024), it’s indeed hard to be bearish on Google at this point in time.

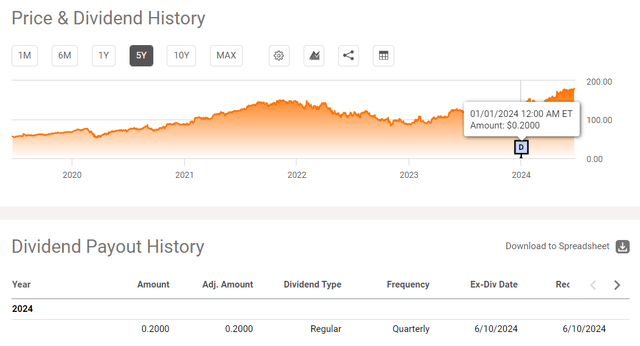

The biggest news coming out of 1Q results may have been the company’s announcement that it’ll initiate a quarterly cash dividend for the 1st time in its history – now Google is a fully-fledged dividend stock, whose dividend yield should amount to 0.26% this year, according to Seeking Alpha data. So far, GOOGL has only paid out once, and the yield itself seems too low to pay attention to, but this move by the company definitely expands the target group of institutional investors, on whose list of criteria dividends are a “must have”.

Now let’s get to the Q1 numbers.

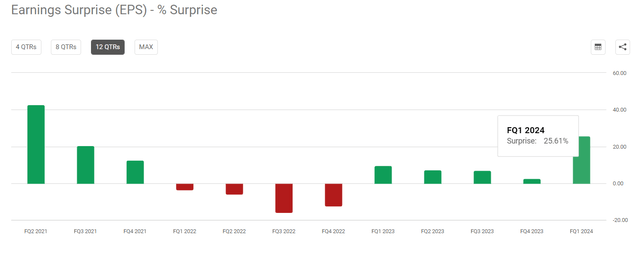

Google’s consolidated sales of $80.5 billion, which is 15.4% YoY, beat the consensus estimate by 2.34%, according to Seeking Alpha Premium data, while the EPS of $1.89 (+61.5% YoY) exceeded expectations by the largest amount since mid-2021:

Search revenue reached $46.2 billion, up 14.4% year-on-year, driven by “broad demand from advertisers, particularly in the retail sector.” YouTube advertising revenue increased by 21% YoY, driven by “increased brand and performance demand”, as well as strong engagement trends in Shorts and Connected TV. Google Cloud – the segment that, I thought, was losing the competition to Amazon’s (AMZN) AWS and Microsoft’s Azure – reported revenue growth of 28% YoY, up from 26% growth in 4Q FY2023 and, therefore, going against my previous hypothesis.

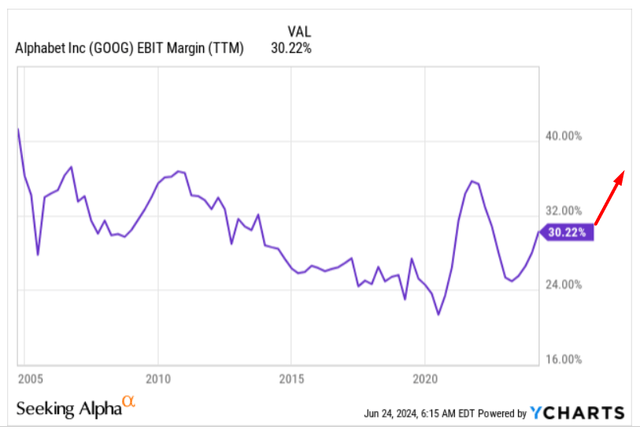

What went in sync with my previous expectations were the positive results of the cost reductions: Q1 EBIT reached $25.5 billion (+46.3% YoY) and the margin increased by 670 basis points to 31.6%. On a TTM basis, the margin is still lagging, as we can see below. There’s still a lot of headroom, so I expect the overall post-COVID AI-driven uptrend in operating margin to continue and reach 35-36% in a few years:

Alphabet has approved a substantial shareholders return package, including an additional $70 billion share buyback authorization and the introduction of a quarterly dividend, as I mentioned above. My calculations suggest that these measures should result in a total shareholder return of ~3%, which should support the company’s high valuation multiples – this commitment to consistent shareholder returns is critical to our long-term forecasts and valuation models, which I’ll discuss a little later.

After reading a dozen research papers from major banks such as Morgan Stanley, UBS, Goldman Sachs, and others (proprietary sources), as well as reading the earnings call transcript and various conferences attended by Google executives, I think we can say that Google has made significant progress in AI and technology optimization in recent months. One of the most notable announcements was the launch of Gemini 1.5 Pro and Gemini 1.5 Flash, which offer “expanded context windows and cost-effective multimodal reasoning capabilities.” In addition, I think updates to the Gemma family of models, including “the new PaliGemma for image-based tasks and the powerful Gemma 2 with a 27 billion parameter model”, should give Google a competitive edge in improving AI performance. Project Astra, which was also unveiled just recently, represents an ambitious vision for a real-time AI agent that can process multimodal input for conversational experiences. I believe the company is on the right track and the rapid progress in different AI offerings and additions suggests a high potential for rapid commercialization, which reinforces my confidence that Google’s margins are likely to increase significantly.

Google’s innovations have also extended to practical applications in the areas of search, workspace, and mobile technology. Improvements such as the new “Questions with video” function and AI overviews in search are intended to improve the search experience for users worldwide. In Workspace, the virtual teammate and Gemini-based side panel aim to increase productivity by integrating advanced features into all Workspace apps. Notable advances in mobile include the launch of the Circle to Search feature on millions of Android devices and the introduction of a revamped mobile assistant based on Gemini Nano. In addition, what I really wanted to see was Google’s in-house chips, and we got this announcement indeed: Trillium TPUs and the AXION processor should provide Google with robust cloud computing solutions in the future.

At this stage, I can draw an interim conclusion that the company is developing exceptionally well and much faster than I had previously expected, especially with the adaptation of AI. I was pleasantly surprised by the improvement in the company’s margins and the general business development of the company. The rapid and qualitative cost reductions in recent quarters were quite impressive. Nevertheless, the question of valuation remains crucial for me: How much are you willing to pay for the stock today? This is perhaps one of the most important questions. I suggest that we create a napkin-like DCF model to come up with a fair price for Google.

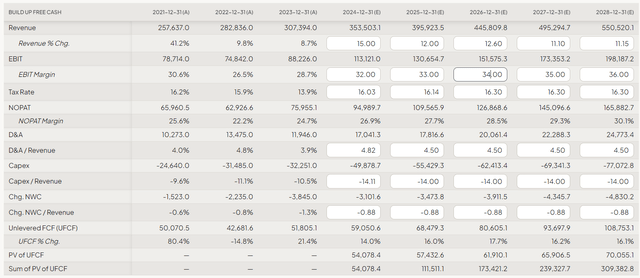

In the last 10 years, the company’s sales and earnings per share have risen by 17% and almost 20%, respectively. Wall Street is now setting a consensus of 7.9% for sales growth and 13.2% for EPS growth over the next 5 years. This slowdown reflects Google’s maturation as a business and the saturation of the markets in which it operates. Anyway, I believe the current revenue growth forecast is close to reality, but let’s assume that the new innovations in AI could increase the revenue growth rate by an additional 2% annually over the next 5 years. In other words, I believe that Google’s revenues could grow by 10% per year instead of the forecast of 7.9%.

I’ve already shared my expectations for EBIT margin, and I stand by them: I anticipate that it’ll to a figure between 35% and 36% in the coming years. Specifically, I project it’ll reach 36% in 2027 and 37% in 2028. Until then, I expect a steady increase from the current levels.

As for most other drivers, in my model, I prefer to look at the averages of recent years and extrapolate them into the future, as about-accurate predictions are challenging. For example, we can’t say exactly what the exact depreciation will be in five years, but we know that investing in artificial intelligence is a costly endeavor. The company has already forecast an increase in CAPEX of ~$4-5 billion for the 2 years at least. I therefore expect Google to spend ~14% of its revenue on capital expenditure over the next few years.

So this is what my model’s outputs look like at this stage:

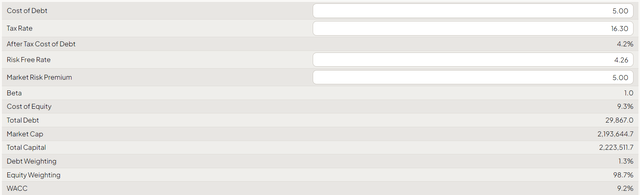

We know that Google’s relatively liquid long-term bonds are currently trading at a yield to maturity of around 5%. The company’s capital structure is not heavily weighted towards debt: In fact, if we look at total debt to market capitalization, it’s less than 2%. Anyway, with a market risk premium of 5% and a risk-free rate of 4.2%, this results in a WACC of 9.2%.

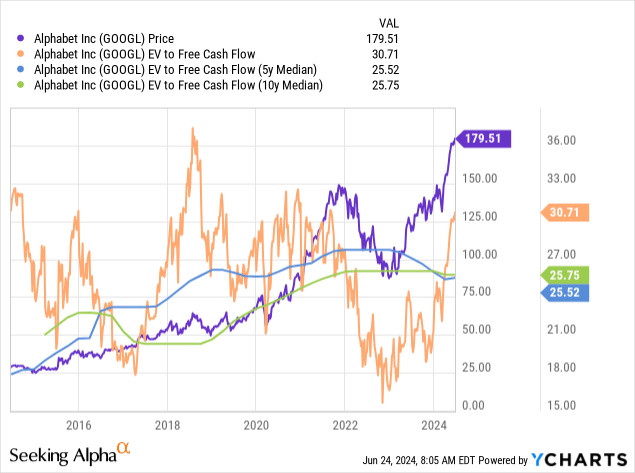

To calculate the terminal value, I use the EV/Free Cash Flow multiple. Given the long-term metrics, I’ll use a multiple of 25x – this is likely to be appropriate in 5 years as the pace of business growth stabilizes, and the company increasingly resembles a “cash cow”.

Thus, we get an overvaluation of Google stock of about 9% to date:

The Bottom Line

As the saying goes, “Beauty is in the eye of the beholder“, so I fully understand those who are willing to pay a considerable premium for Google today. The company is indeed growing and developing faster than I previously expected. I’m particularly impressed by the speed at which new innovations are being introduced, their potential for future commercialization, and the company’s still strong position in its key markets. However, I’m concerned about the current price, which I don’t consider cheap. While there should certainly be a premium to GOOGL’s valuation, even using the EV/FCF multiple, we see that the company is overvalued by ~20%. My DCF model indicates an overvaluation of 9%, and that’s only if we factor in an initial premium to the sales growth rate that the market has not yet recognized.

Therefore, my analysis suggests that we’re likely to see a decline in the stock price from current levels before Google can be considered undervalued. My technical view on the matter suggests that GOOGL could drop 14% shortly to its strong support level that previously acted as a resistance zone. From this point, I’d consider a potential buying opportunity.

TrendSpider Software, the author’s notes

Before Google stock corrects to at least that level, I’ll keep my “Hold” rating unchanged.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!