Summary:

- Google’s stock price jumped over 10% and surpassed a $2 trillion valuation mark after reporting strong first-quarter results.

- GOOG’s advertising business showed robust growth, with total sales rising 15% YoY and ad sales increasing 13% YoY.

- The introduction of a dividend and a $70 billion share repurchase plan were well-received by investors.

Prykhodov

Alphabet Inc. (NASDAQ:GOOG) reported first quarter results on Thursday last week, which caused a big jump in Google’s stock price amid robust momentum in the marketing business. Marketing strength in Google’s core business, advertising, was a major catalyst for growth in the first quarter.

Google also announced that it would start to pay a modest dividend, which has been well-received by investors, too.

As a consequence of Google’s very strong 1Q24 earnings, the company’s stock price jumped more than 10% and Google surpassed the $2 trillion valuation mark on Friday for the first time. Yet, Google is still very reasonably valued, based on earnings, and I think the risk/reward relationship remains compelling.

My Rating History

A rebound in advertising, particularly in search, robust free cash flow and a favorable macro backdrop underpinned my Buy recommendation in February 2024.

In addition, in the first quarter, Google handed investors a real surprise by announcing that it will pay a dividend of $0.20 per share per quarter moving forward, which comes in addition to a $70 billion share repurchase plan.

The advertising business is on fire and Google is seeing substantial tailwinds to operating income growth. I think that Google’s value proposition has gotten even better since January, and my stock classification for GOOG remains a Buy.

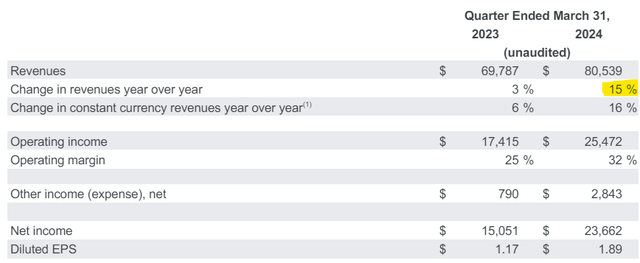

Google Reported A Double-Beat

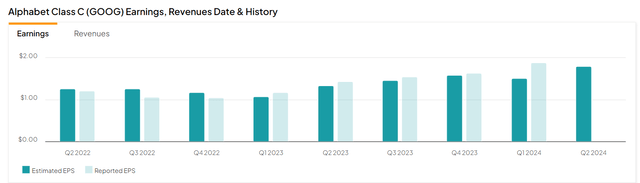

Google easily smashed consensus profit estimates on Thursday with profits for 1Q24 coming in at $1.89 per share vs. 1.51 per share expected. Sales hit $80.5 billion, vs. $78.6 billion expected. The profit beat was the fifth straight time that Google exceeded the Street’s profit estimates.

Earnings And Revenues (Yahoo Finance)

Google’s advertising business is on fire and the technology company’s first quarter earnings brought the receipts as well: Google’s total sales rose 15% YoY to $80.5 billion due to strength across the portfolio, but especially in marketing. Compared to the year ago period, Google grew its sales five times faster.

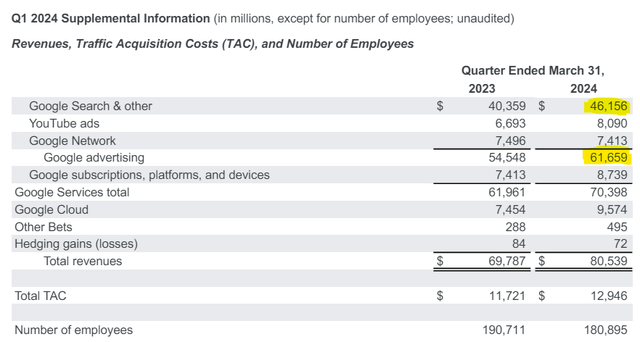

Google’s ad business delivered very good results in 1Q24, with marketers still seeking out the company’s various advertising platforms (Search, YouTube, Network) as ad delivery vehicles. Search did well, seeing 14% YoY growth, while YouTube hit it out of the park with a YoY sales growth rate of 21%.

Total ad sales hit $61.7 billion in 1Q24, up 13% YoY. In 4Q23, total ad sales rose 11%, so Google has seen a bit of a boost here in the first quarter as well.

The outlook, as far as I am concerned, in light of these results, is very favorable, in particular because search continued to contribute the lion share to Google’s sales growth.

Google Advertising (Alphabet Inc)

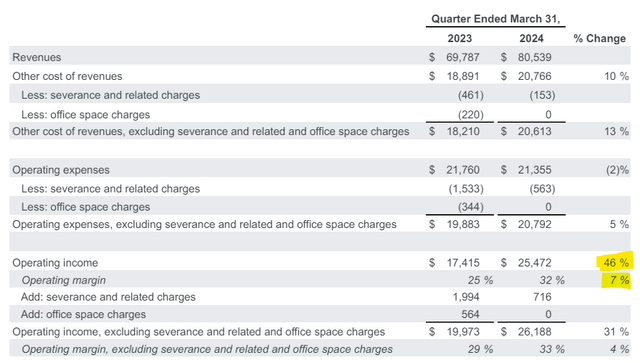

Furthermore, Google surpassed $25 billion in quarterly operating income in the first quarter, reflecting a stunning 46% YoY growth rate. This growth was driven primarily by Google Services (in particular search) and a substantial decrease in operating expenditures due to lay-offs that are now paying off for Google.

Based on the current run-rate, I would not be surprised to see Google grow to $100 billion in annual operating income in 2024. Furthermore, Google has posted respectable operating income margin gains and retained 32% of its sales as operating income in 1Q24, up 7 percentage points YoY.

Operating Income (Alphabet Inc)

Google’s Technical Setup

Investors have responded very favorably to Google’s quarterly earnings last week. As I said, Google reached, for the first time, a market valuation exceeding $2 trillion last week which makes this a good time to look at the company’s technical foundation.

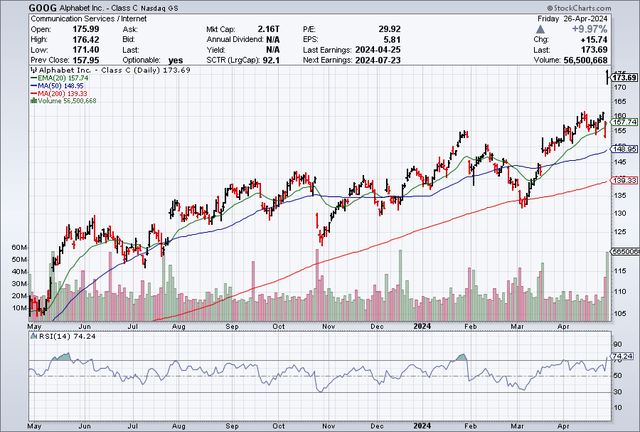

The 10% stock pop on Friday drove Google’s stock substantially above the 20-day moving average line, which is a bullish signal in the short term. Technically, Google stock is now slightly overbought, based on the Relative Strength Index, but as I will discuss further below, Google has considerable potential to grow its valuation multiple in 2024. I would get concerned about Google only if the 50-day moving average line broke and a new down channel would be established in the short term.

Moving Averages (Stockcharts.com)

Google Is Still A Steal

Double-digit sales growth, a reboot of the marketing business, substantial operating income growth and the dividend introduction are reasons why I am calling Google a steal, even though the technology company is selling for a 21.5x leading earnings multiple.

I see 15-20% profit growth potential for 2024 and 2025 taking into account Google’s search and advertising sales growth boost in 1Q24, which implies somewhere around $6.80 per share in earnings this year (which is near the Street’s estimate of $6.81 per share) and $8.00 per share next year. I am thus slightly more optimistic than the market. Google’s annualized 1Q24 profits would equate to $6.56 per share, so I think my calculations are quite reasonable.

Earnings Estimate (Yahoo Finance)

Amazon Inc. (AMZN), another growth stock with considerable operating income and double-digit sales growth, is selling for 33x leading earnings. My intrinsic value calculation (15-20% annual profit growth) and using an earnings multiple of 30x (given that Google increased its operating income by almost 50% in 1Q24) translates into an intrinsic value of $240 for Google, a target that, I think, could be achieved within the next year IF Google’s marketing business keeps growing at the present rate.

Why The Investment Thesis May Prove To Be Faulty

I like Google a lot better than Meta Platforms, Inc. (META) because Google has a collection of businesses in its portfolio, some of which are uncorrelated with the marketing business (cloud).

Google is thus a more diversified technology company with a considerable cloud presence that is much less reliant on the health of the marketing industry.

As I said last time, I think that a downturn in the U.S. economy and resurging inflation are risk factors that could negatively affect consumer and business spending and therefore also negatively impact Google’s marketing business.

My Conclusion

The more Google’s stock rises, the more I’ll buy, not less because Google is just doing everything right at the moment.

Google’s marketing business is on fire and with total sales growing five times faster than a year ago, the company has clearly moved on from the market correction in advertising last year.

Furthermore, the dividend introduction and the $70 billion buyback are good news for investors as well.

Though Google has seen a substantial increase in its valuation (multiple) in 2024, Google is not going to stop growing. The risk/reward relationship remains therefore promising, even though GOOG is presently slightly overbought and the company’s market valuation exceeds $2 trillion for the first time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.