Summary:

- Samsung is reportedly considering making Microsoft’s search engine default on its devices, potentially ending a 12-year partnership with Google.

- Samsung’s deal value with Google is much less significant than Google’s deal with Apple. However, it suggests that Microsoft could gain a foothold against Google’s dominance.

- GOOGL’s valuation is still discounted against its mega tech peers. However, its recent price action suggests caution is warranted.

- Apple will likely keep a close eye on Samsung’s negotiations with Google, which could potentially allow Apple to strengthen its bargaining power with both Microsoft and Google.

Alena Kravchenko

The New York Times, or NYT (NYT), reported that Google’s (NASDAQ:GOOGL) (NASDAQ:GOOG) long-time Android partner Samsung (OTCPK:SSNLF) is considering Microsoft’s (MSFT) search engine as default on its smartphones.

That took some Google employees by “surprise,” as Samsung’s close partnership with Google stretches back over 12 years. While the $3B annual revenue contribution isn’t as massive as Apple’s (AAPL) estimated $20B it receives from Google annually, it marked a significant development, given Samsung’s position as the premium Android leader.

Google has reportedly pushed the “panic” button as executives scrambled to counter-propose to Samsung in a bid to prevent Microsoft from having its “first potential crack in Google’s seemingly impregnable search business.”

While Samsung could be using Microsoft as a bargaining chip to negotiate a better deal with Google, it does highlight the uncertainties of Google’s advertising-heavy business model.

Accordingly, advertising accounted for nearly 80% of Google’s FY22 revenue base. In addition, search advertising accounted for more than 72% of its advertising revenue.

Therefore, it’s justified that Google executives are concerned, as search ads are projected to be the second-most lucrative segment margin at 55%, just below Play Store’s 60%.

While we don’t think investors need to panic now, it brings into focus how Google’s contract renewal discussions with Apple over Chrome could pan out this year, as the contract is expected to be up for renewal.

As such, we believe Apple CEO Tim Cook & his team will likely watch the Samsung developments carefully as the Cupertino company navigates a highly pivotal product launch sequence at its WWDC in June.

Investors must note that Google’s search advertising dominance is the primary source of its wide economic moat. It proliferates the network effect on its other advertising properties, driving user and advertiser growth.

As such, if Microsoft can gain a foothold through Samsung, Google’s moat could be weakened, and therefore its valuation assessment could be affected.

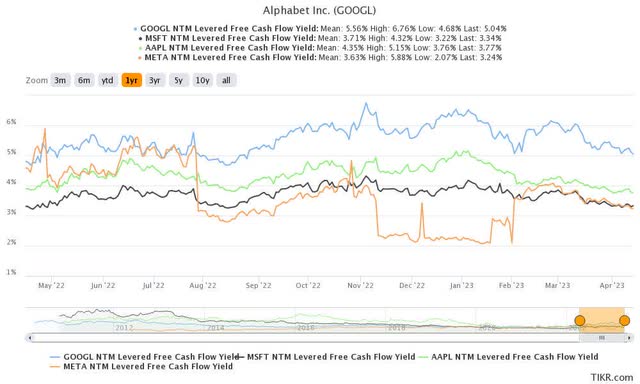

GOOGL & peers NTM FCF yield % valuation trend (TIKR)

We believe it possibly explains why the market has priced in a more significant discount against GOOGL’s valuation, as seen above.

Accordingly, GOOGL last traded at a next twelve months or NTM free cash flow or FCF yield of 5.04%, well above its 10Y average of 4.2%.

It’s also significantly above its mega tech peers, MSFT, AAPL, and Meta (META) stock, requiring investors to assess whether the market is overly pessimistic on GOOGL.

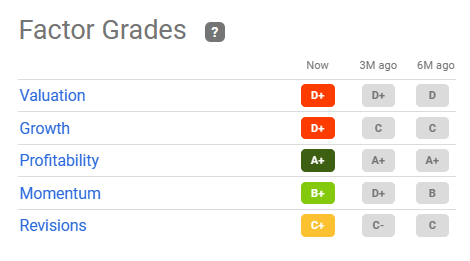

Quant factor ratings (Seeking Alpha)

Seeking Alpha’s quant ratings of GOOGL’s valuation (D+) suggests potential upside could be limited, as it trades at a significant premium against its industry peers.

Trefis’ sum-of-the-parts or SOTP valuation attributes more than 70% of GOOGL’s valuation to its advertising business (and thus the concomitant uncertainties).

As such, we believe the higher FCF yields demanded by the market are justified, as GOOGL’s reliance on its advertising dominance could be struck down in an adverse scenario.

Moreover, Morningstar reminded investors that its fair value uncertainty over GOOGL is “high” due to Google’s “high dependency on continuing online advertising growth.”

As such, we believe investors will need to consider a more considerable discount relative to its fair value, considering Microsoft’s increasing ability to engineer a raid against Chrome’s dominance in the Android and iOS ecosystem.

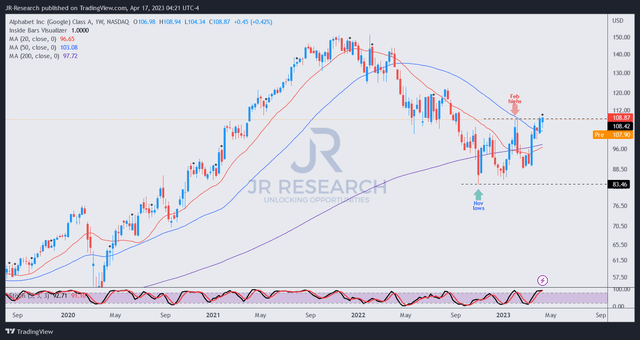

GOOGL price chart (weekly) (TradingView)

GOOGL’s price action re-tested its February highs, which was previously a bull trap or false upside breakout.

That bull trap has been resolved as GOOGL fell toward its March lows.

However, GOOGL’s recent price action still suggests caution, as buyers lifted it back toward its February highs. In addition, it could attract dip buyers to cut exposure, worsened by negative sentiments over the Samsung revelations.

We assessed that GOOGL’s November lows should remain robust but still see an increased risk of a pullback.

As such, investors should avoid chasing the potential breakout and wait patiently for a deeper pullback to improve risk/reward.

Rating: Hold (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!