Summary:

- Google has been vital in getting benefits from the secular shift to digitalization which is evidenced by the company’s strong financials over the last decade.

- Google is investing heavily in R&D to diversify revenue streams, but there is little certainty over the extent of how new products and services will (or will not) boost Google’s financials.

- My valuation suggests the stock is slightly undervalued with mid-single-digit upside potential.

Justin Sullivan/Getty Images News

Investment thesis

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) has delivered stellar topline growth over the last decade. But profitability metrics are not expanding on the scale because the company is striving to diversify its revenue streams which are not cheap. Google invested $200 billion in R&D over the last decade, but digital advertising revenue still represents the lion’s part of Google’s sales. The company recently released its Bard generative AI tool, which some belief can beat ChatGPT. But at the time, I prefer not to invest and wait on the sidelines and watch how the generative AI race will develop as well as the company’s new bets, especially given the little room for upside at the current level of the stock price.

Company information

Alphabet, formerly called Google, is a company representing the Communication Services sector and was founded in 1998 by Sergei Brin and Larry Page. Google is now an operating segment of Alphabet. The company is an undisputed leader in the search engine market, handling over 90% of all search queries worldwide.

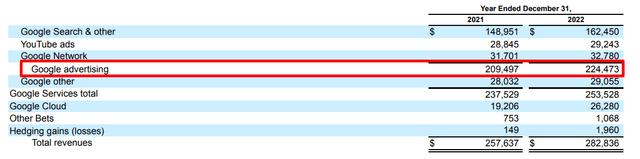

About 80% of the company’s sales come from digital advertising, according to the latest 10-K report.

Financials

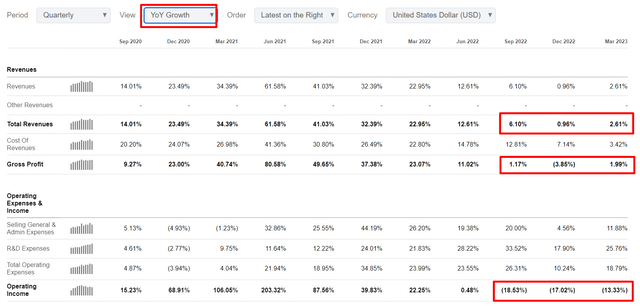

To start with financial analysis, I usually prefer to zoom out to understand the extent to which a company captures favorable secular trends. For technology companies like Google, an evident secular trend is a shift to digitalization, which was significantly boosted by the Covid-19 pandemic.

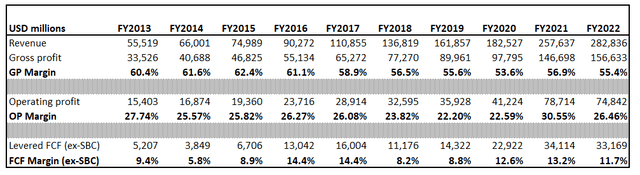

If we zoom out ten years back, we can see that the company delivered a robust financial performance with an almost 20% revenue CAGR throughout the decade. On the other hand, the company did not demonstrate margin expansion with the growing scale, except for the free cash flow [FCF] ex-stock-based compensation [ex-SBC].

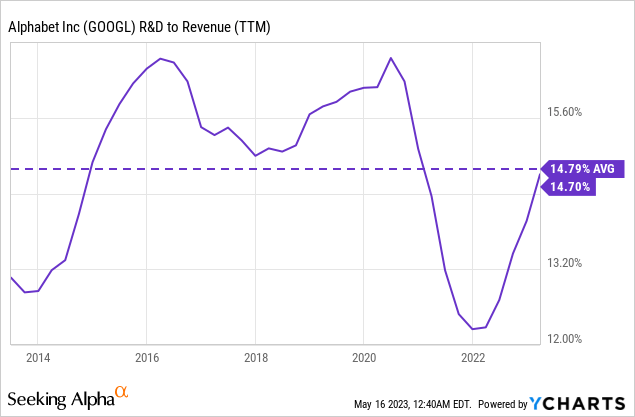

The company did not demonstrate an operating margin expansion over the last decade because of the increased R&D spending, which has been, on average, substantially higher compared to FY 2013.

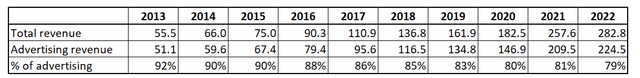

A large portion of sales invested in R&D in recent years looks very reasonable, given that digital advertising represents a vast portion of Google’s revenue. And the company actually succeeded in diversifying its revenue streams, but the pace of revenue mix shift is slow, given the substantial amounts of sales generated from digital ads.

The company decreased its share of advertising out of total sales from 92% in 2013 to 79% in 2022, which is a good sign for me. Relying solely on only one revenue stream is risky for the company and makes it vulnerable to cyclical circumstances. For me, as an investor, it is a good sign that the management is proactive in addressing secular shifts.

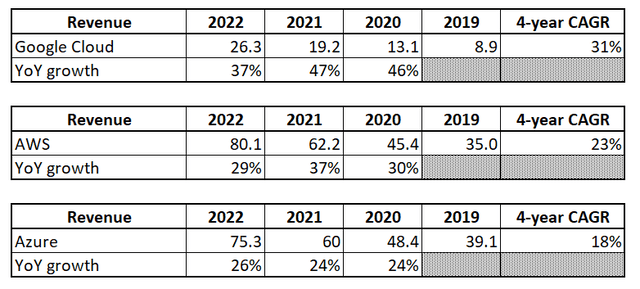

Google has been investing heavily in the Google Cloud business and Other Bets. Other Bets are at an early stage of commercialization, and the extent of uncertainty is high regarding the ability of these “bets” to break even and generate sustainable cash flows so I would ignore them for my analysis at the moment. I would like to look at the cloud business, which has demonstrated a 31% revenue CAGR over the last four years since the company disclosed Google Cloud revenue separately. The growth rate was substantially higher than shown by major cloud rivals: Amazon’s (AMZN) AWS cloud business and Microsoft’s (MSFT) cloud unit, Azure. Though Google’s market share in the cloud industry is far lower than that of its rivals, comps are more challenging for AWS and Azure.

Given the wide gap in market share between Google Cloud and its competitors and signs of cloud industry growth cooling down, I do not see how Google can become a market leader. What is also crucial for me as an investor is that cloud business growth has already been priced in the stock price. Thus, we should wait for a new moonshot from Other Best to explode for the stock price to rally significantly. And the uncertainty about it is high.

I will not pay much attention to the latest earnings because it is apparent that all companies are navigating a challenging environment nowadays, with revenue growth decelerating and margins under significant pressure.

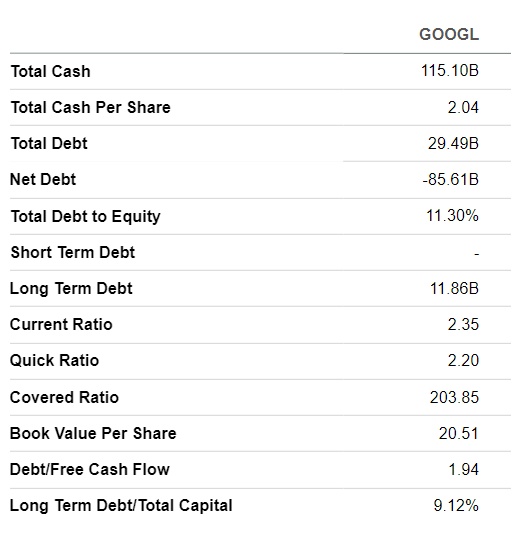

I believe these challenges are temporary and not secular and the company’s balance sheet is strong enough to weather the storm. As of the latest reporting date, the cash balance is substantial, even with debt deducted. Liquidity risk is also shallow, given respective excellent metrics.

Seeking Alpha

I believe Google’s financial performance and capital allocation have been excellent over the long term. Still, we should admit that the company’s major growing star, the cloud business, is entering a maturing stage, and the growth pace will continue decelerating. The company needs to demonstrate at least some of the Other Bets to generate stable cash flows to prove that consolidated revenue growth can be sustained at double-digits.

Valuation

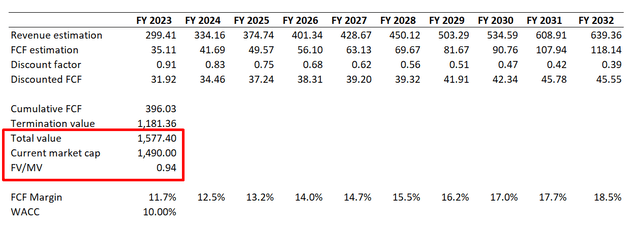

Google has been very generous regarding share repurchases over the last decade, with almost $180 million spent on buybacks, but the company still does not pay dividends. Therefore, I use the Discounted Cash Flow [DCF] approach for valuation.

Selecting underlying assumptions can be tricky, so I prefer to be conservative. I use the estimation provided by valueinvesting.io for WACC and round it to 10%. I have a historical FY2022 margin for future FCF, which I expect to expand by 75 basis points yearly. For the topline, I use earnings consensus estimates which project revenue to grow at about 8% CAGR over the next decade. This is conservative, especially given the close to 20% topline growth over the previous decade.

Incorporating all the assumptions together gives me a fair value-to-market value ratio of 0.94, indicating a modest upside potential for the stock.

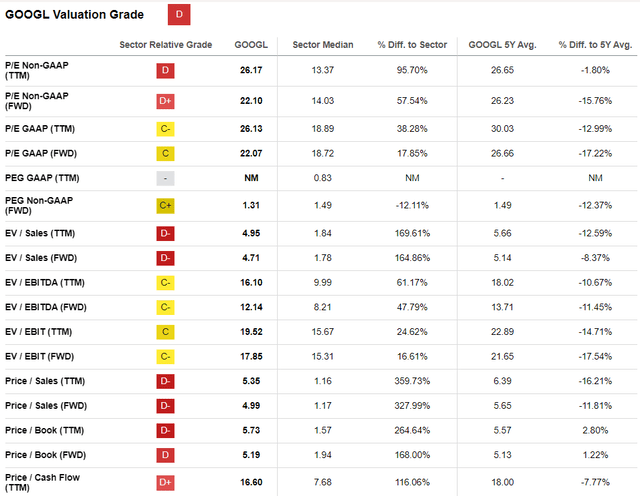

To be on the safe side, I also usually perform valuation multiples analysis. It also helps to cross-check my DCF outcomes. Let’s go to the Seeking Alpha Quant valuation grades page. We can see that current valuation ratios are lower than 5-year averages, which also indicates an undervaluation.

Overall, I believe that the stock is slightly undervalued. It is also important to mention that assumptions are very conservative. In case one of the company’s moonshot bets prove to be sustainably profitable, it will add vast upside potential to the stock price.

Few significant risks to consider

As mentioned earlier, the company significantly depends on the digital advertising revenue stream. This is risky since the company’s overall financial performance becomes highly vulnerable to unfavorable changes in the industry. The competition in digital advertising is also fierce, represented by giants like Amazon and Meta’s (META) family of social media apps.

Another significant risk that I see is antitrust investigations. The company has been investigated both domestically and in Europe. This poses substantial risks to the company’s operating and financial performance. Google suffers from fines and penalties, and there is always the risk that regulators might force the company to split the business or disrupt operations and synergies in other ways.

Last but not least, as we have seen in the “Financials” section of the article, Google invests vast amounts in R&D. Any signs that these investments are not paying back will highly likely disappoint investors and can cause sell-offs, which will put pressure on the stock price.

Bottom line

Overall, I believe that Google is a company with predictable growth prospects, and the stock is still slightly undervalued. However, the growth pace is expected to decelerate until one of the company’s new products demonstrates a path to scaling and profitability. I have GOOGL in my portfolio, but I prefer not to increase my position until more certainty comes regarding new products.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.