Summary:

- Going by its competitive position, Google is the strongest tech company on earth.

- It has high market share in most of its markets and practical advantages that could keep the high share going in several of them.

- Bing is not meaningfully eating into Google’s Search market share.

- Google could lose share in search, long-form video, and smartphone operating systems and still be dominant in those markets.

- In this article, I make the case that GOOG is still a mildly appealing buy despite its increasingly rich valuation.

Sundar Pichai Anna Moneymaker

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) stock, hereafter referred to as “Google,” has been rising lately. Its most recent earnings release was a minor beat, thought it didn’t move the stock much initially. What really got things moving was the company’s efforts in artificial intelligence (“AI”). Google recently put off an AI event that was much better-received than its previous one, which showcased the company’s Bard chatbot making an error. Ever since the second, more successful AI presentation, Google stock has been rallying.

What should shareholders make of all of this?

First things first, I don’t believe that the massive amount of money being piled into companies that mention AI on earnings calls is being spent well. I think that NVIDIA (NASDAQ:NVDA) is way too expensive right now and I think that other tech companies are getting pricey too, albeit to a lesser degree.

However, I actually don’t think the valuation Google has reached is ridiculous, even though recent buyers have been buying for questionable reasons. Going by multiples, GOOG is only slightly more expensive than the S&P 500, which now trades at 22 times earnings. Many other big tech companies trade at far wider premiums to the benchmark. For example, NVIDIA is currently trading at 29 times sales and 95 times earnings.

If you’re going to buy a stock that has been swept up in the AI mania of 2023, then it would help to buy one that at least isn’t at a ridiculous valuation. And I think that logic applies to Google here. The company is being valued fairly richly, but not at a level where the current valuation defies logic. Furthermore, Google still has positive revenue growth, and its earnings did not decline by large percentages last quarter. These signs collectively suggest that it is a stronger company than some of its competitors are. However, it is really Google’s competitive position that argues for it being a good value today, and that’s what I will spend most of this article focusing on.

Competitive Landscape

The biggest reason for thinking that Google is at a reasonable valuation today is the fact that it has a strong competitive position. I wrote about this a few days ago in a Twitter post, which I’ve attached below. I will be expanding on these points in more detail in the paragraphs that follow.

First, let’s talk about Google search. My Tweet was alluding to this in the first point arguing for Google’s strength even in a scenario where Bing defeats Bard.

Bing’s chatbot was seen as a competitive threat to Google until very recently. It is built on ChatGPT, only unlike ChatGPT, it has internet access, and can deal with current events. This was seen as a major competitive threat to Google recently because Google is used to retrieve information, and Bing also retrieves information, with an AI twist. AI is very popular today, and the mere fact that Bing was combining AI and search was enough to get people worrying about Google’s market share.

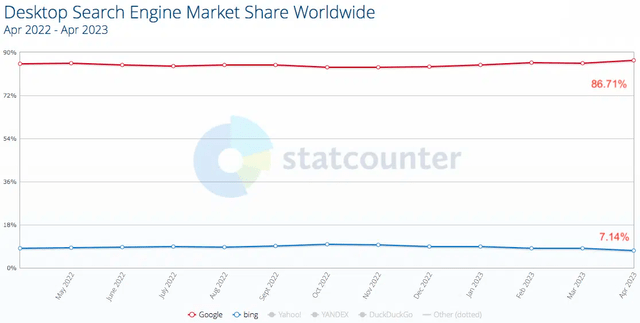

Fortunately, Google has not lost any market share. Bing’s market share peaked in October 2022, Google has made slight gains on it since then. Google still controls a full 86% of the market. As the following chart from Statcounter shows, Google’s search market share has been growing for more than half a year.

Google market share (Statcounter)

The empirical data does not support the idea that Bing is an imminent competitive threat to Google. However, let’s not rush to conclusions. Perhaps Google bears are right and Bing will eventually beat Google Bard in the battle of the chatbots.

That may in fact happen. Bing is getting better early reviews than Bard, but that doesn’t change the fact that Google is holding its search market share. Perhaps these chatbots aren’t as crucial to search as we were led to believe. If so, Google may have an opportunity to quietly push Bard aside, keeping people on the core Google search product without assuming the high costs that come with running chatbots.

It’s a similar story with video. YouTube is currently #1 in online video, with a 75% market share. Frequently, we’ve seen TikTok and Meta Platforms’ (META) Instagram described as competitors to YouTube. And they are in part, but only in short form video. TikTok and Meta both typically feature short videos, with the average Insta reel coming in at seven to 15 seconds. They might take some “eyeballs” away from YouTube here and there, but they just aren’t competing with YouTube’s bread and butter, which is long form video. The average YouTube video is 11.7 minutes long, which is far longer than what you’ll find on Insta and TikTok. So, if you’re looking for interviews, video essays, and full music videos, you’re on YouTube. That portion of the online video market, Google/YouTube has on lock.

Finally, the smartphone operating system market. Google is technically #1 in installs there, although Apple (AAPL) is #1 going by revenue, as the app store generates more sales than the Play Store does. Apple dominates the wealthy U.S. market, where people are more willing to spend money on apps than in the less developed markets that Android dominates.

The point here is that Google has the low-end of the smartphone market locked down and seemingly always will. There are no cheap phones in Apple’s iPhone lineup, iPhone starts at $799. As long as people want smartphones for less than $800, there will be a market for Android phones.

What all this comes down to is the fact that Google’s biggest competitors could make gains on it, and Google would still be strong. Bing could defeat Bard, yet Google Search as a whole would still be the #1 search. Insta and TikTok could dominate the short form video market, yet YouTube would still control the long form video market. iPhone could strengthen its position in premium phones, and Google would still be on top in budget phones. Google has so many advantages that it isn’t hard for it to remain a very profitable company. And that’s not even talking about Google Drive, Gmail, the newly-profitable cloud segment, or any of the company’s “other bets.”

Valuation

Having looked at Google’s competitive position, we can now turn to valuation. At today’s prices, Google stock trades at:

-

27.3 times earnings.

-

5.6 times sales.

-

5.5 times book value.

-

6 times operating cash flow.

-

25.78 times free cash flow.

Even after Google’s big rally, the stock is only a little more richly valued than the NASDAQ-100 as a whole.

Speaking of free cash flow:

According to Seeking Alpha Quant, Google has $4.79 in free cash flow per share. If you discount that at the 10 year treasury yield (3.68%), you get a $130 price target, assuming 0% growth. Of course, this discounted cash flow valuation uses no risk premium, but on the other hand, it assumes 0% growth; is the ‘risk’ to Google growing at just 0% so high? It seems like the company only needs to exercise some cost discipline to achieve such growth. Google’s competitive position is very strong, which means that stable revenue and margins shouldn’t be an issue. So, perhaps discounting at the treasury yield alone is appropriate for such a conservative scenario.

One Risk to Watch Out For

As we’ve seen, Google has an incredibly strong competitive position and is not particularly richly valued. Depending on whether it can get its positive earnings growth back in the next few quarters, its stock may continue rising. However, there is one big risk that investors will want to watch out for here:

Anti-trust risk. Google has a very strong competitive position, and it often gets sued because of that fact. The DOJ is working on a lawsuit against Google as we speak, and the company recently got sued for $4 billion in the EU. Google already lost one appeal against that ruling so there aren’t many appeals left before it is finally forced to pay out. When a company has as many dominant subsidiaries as Google does, it tends to attract the scrutiny of regulators. So, investors will want to watch out for Google’s anti-trust risk.

Nevertheless, GOOG is a great stock overall. The company has a very strong competitive position and the valuation is not that bad compared to most large tech companies these days. I’d say I’ll continue holding Google stock for the foreseeable future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.