Summary:

- Despite regulatory risks and reduced EPS estimates, Google remains undervalued among the Mag 7, warranting a “Buy” rating.

- Google’s Q2 2024 performance showed strong revenue growth, particularly in Google Services and Google Cloud, with solid profitability and cash flow.

- Regulatory concerns seem exaggerated; Google’s investments in AI and cloud technologies are expected to drive future growth and offset risks.

- I think Google is well-positioned to exceed conservative Q3 2024 forecasts, with the potential for significant EPS growth and undervaluation compared to peers.

- The stock is a “Buy” before the Q3 Fy2024 results release.

Boy Wirat

My Thesis Update

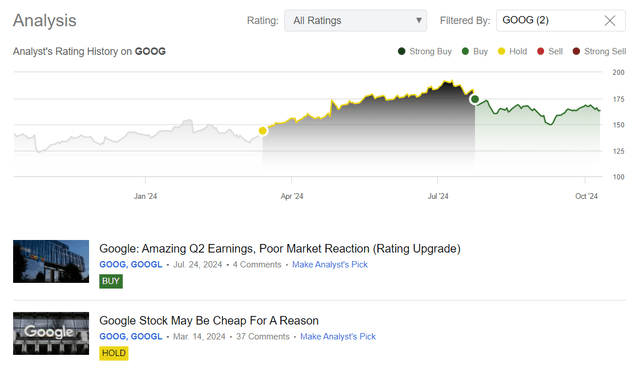

In March 2024, I initiated my coverage of Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) stock here on Seeking Alpha with a “Hold” rating. However, I upgraded my rating to buy at the end of July 2024. Unfortunately, the stock entered a correction, and since then, Google has significantly lagged behind the broader market, contrary to my expectations (I anticipated that the company’s EPS growth rate would likely surpass that of its competitors in the FAANGMAN group, and the market would likely reprice the stock higher).

Seeking Alpha, Oakoff’s GOOG coverage

Despite facing significant regulatory risks and some reductions in EPS/revenue consensus estimates for upcoming quarters, I believe Google remains one of the most undervalued companies among the Mag 7 group. I think the fears surrounding GOOG are largely exaggerated. In two weeks from now, when Google reports its Q3 2024 fiscal year results, I believe we might hear positive comments from management, and given the current lowered consensus estimates, Google could more easily surpass expectations, potentially boosting its stock performance both relative to the index and in absolute terms. Hence, my “Buy” rating confirmation today.

My Reasoning

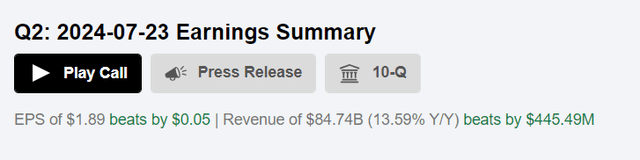

For its second quarter of the fiscal year 2024, Google delivered a strong financial performance with combined revenues totaling $84.7 billion, representing an increase of 14% year-on-year, or 15% in constant currency. This was largely helped by Google Services’ strong performance, with $73.9 billion in revenue (up 12% YoY). Of note, Google Search and other advertising income jumped to $48.5 billion (an increase of 14%), with a significant share coming from retail and financial services. Revenues on YouTube advertising also increased 13% to $8.7 billion, from both brand and direct response ads. Google Cloud also continued to climb and hit ~$10 billion in quarterly revenue, first-ever (+29% year-over-year), driven by major progress on Google Cloud Platform (GCP) and Google Workspace (the AI solutions played a crucial role in helping to drive it, as the press release noted). The Cloud unit was profitable with an operating profit of $1.2 billion and an operating margin of 11% – the company’s long-term strategy to grow its AI infrastructure and generative AI solutions in a profitable way seems to be working. On a consolidated basis, GOOG’s EBIT amounted to ~$27.4 billion (up 26% YoY), with a 32% operating margin, which looks solid to me. Google’s net income amounted to $23.6 billion, which corresponds to $1.89 in EPS – $0.05/share higher than was expected by the consensus:

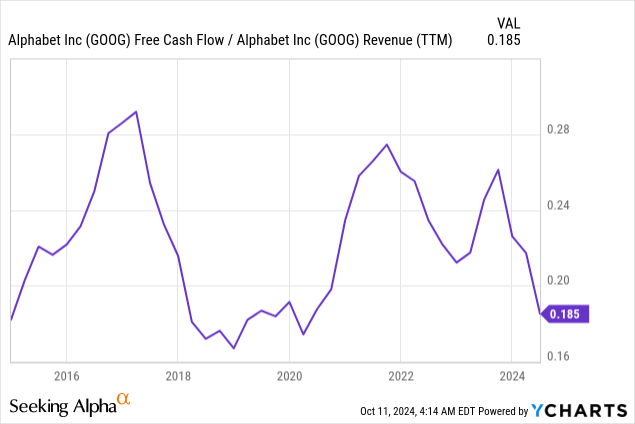

Google’s free cash flow for the quarter came in at $13.5 billion, bringing the 12-month trailing-quarter figure to $60.8 billion. The FCF margin of 18.5% seems to be reaching the low point of cyclicality in a 10-year time frame, but the absolute amount of cash generated continues to look solid in my opinion.

The company’s balance sheet at the end of the quarter also looked strong, with $101 billion in cash and convertible securities. This demonstrates Google’s continued ability to effectively control costs while increasing investment in new projects and generating revenue from its existing core businesses. For the future, Google expects to invest in AI and cloud technologies, focusing specifically on building out its enterprise AI platform, Vertex, and broadening third-party models. The company is also geared to increase the number of AI-based applications portfolios for new customers and upsells.

The market’s perception of the management’s statement is somewhat ambiguous, as the firm plans to continue making substantial investments in the development of artificial intelligence, despite the fact that competition in this area is already intensifying. So there’s uncertainty about whether these current investments will yield a sufficiently high return on investment (ROI) to offset potential risks and opportunity costs for investors. However, I believe that, given its significant market share in Search, Google has all the necessary levers to transform its heavy investments into increased value for investors.

On the other hand, Alphabet is under multiple threats in many respects, but chief among these is its overpowering presence in the internet search space, which accounts for more than 90% of search queries across many countries. Such hegemony triggered countless antitrust investigations, investigations, and lawsuits in the US and Europe. One of the most significant was the decision on 5 August this year by a US federal judge to label Google a monopolist in a lawsuit filed by the DOJ and 37 states.

Google’s monopoly on both general search and text ads was highlighted in the judgment due to exclusive distribution arrangements, which the judge found anticompetitive. The deals, which collectively cost Google $26.3 billion in 2021, made it the preferred search engine on all major browsers and mobile phones, with the ability to stay in business by collecting large amounts of data.

In September this year, the company lost an appeal of a 2017 ruling fining it 2.4 billion euros for “favoring its own price-compare shopping service.” Yet Alphabet did win, partly, when the General Court of the European Union overturned a 1.49 billion euro fine (Reuters source), while still maintaining anticompetitive agreements.

However, despite these lawsuits, Argus Research’s analysts think (proprietary source, October 2024) that these risks to Alphabet are now overblown. They contend that, even as regulations tighten, Alphabet’s business looks healthy: They’re still a big player in digital advertising, particularly with YouTube and Google Cloud. Alphabet too is going after the AI and computing infrastructure to stay ahead of competition from Microsoft (MSFT), OpenAI, and Meta Platforms (META). The current investments of the firm should generate future growth and importance, reducing the effect of regulatory intervention. Meanwhile, Alphabet’s cost optimization strategy is proving successful, with higher margins still growing. In fact, while the business has been heavily criticized for its overuse of digital advertising, the rapid expansion of Google Cloud is making it open up new revenue sources. And Alphabet’s autonomous car subsidiary Waymo continues to expand its commercial offerings to boost the company’s growth prospects. So I consider Google as the leader of the tech world, along with Meta, Apple (AAPL), Amazon (AMZN), and Microsoft – the company’s position as the global leader in artificial intelligence, virtual/augmented reality, and quantum computing puts it on a path for future growth.

The accumulation of risks surrounding the company has resulted in its quarterly EPS forecasts remaining largely unchanged over the past 3 to 6 months as I see it. While there have been fluctuations, with some quarters showing increases and other decreases, the overall impact has been negligible – it appears to me that the market has stopped factoring in the increasing likelihood that Google will start generating more profit from its new business initiatives.

Seeking Alpha, Oakoff’s notes added

I believe this positions the company well to exceed the current conservative consensus for Q3 2024 guidance – and likely beyond if they’re not changed to the upside.

During the latest earnings call, we did hear from the management team that they anticipate that Q3 operating margins “will be impacted by increased depreciation and expenses related to higher levels of investment in technical infrastructure”, as well as the pull-forward of hardware launches. Google also plans a slight increase in headcount in Q3 as it brings on new graduates, (especially in cloud and technical infrastructure). But anyway, they still see operating margin expansion for the full year of 2024 compared to 2023.

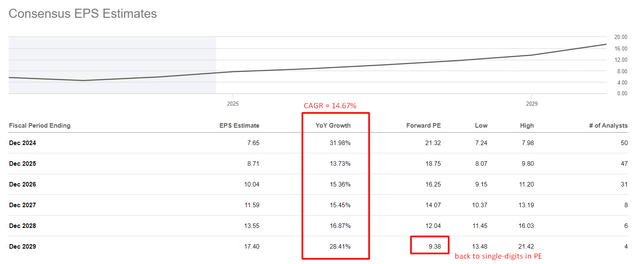

Let me remind you that the company still plans to invest substantial amounts in developing its new business ventures. I believe this will ultimately translate into continued growth in net income per share. Currently, the consensus indicates that over the next 6 years, Google’s EPS will grow at a CAGR of ~14.67%. So by FY2029, Google is projected to achieve a P/E ratio of approximately 9.4x, a level it hasn’t reached in many years:

Seeking Alpha, Google, Oakoff’s notes

For comparison, Meta is forecasted to have a P/E ratio of 15.8x by 2029, while Microsoft’s is expected to be around 18x for the same period, according to Seeking Alpha Premium data. Apple’s P/E ratio is projected to be approximately 19x by 2028. So in any case, Google appears to be one of the cheapest stocks among the “Magnificent 7”, considering not just the TTM ratio, but also taking into account its prospective growth rates.

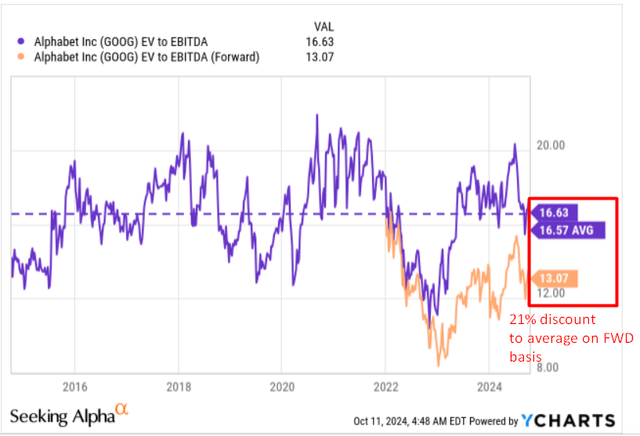

From a historical perspective, Google appears to be quite undervalued, too. Despite the excitement surrounding AI and Google’s chance of capitalizing on it, Google’s forward EV/EBITDA ratio is trading at a 21% discount compared to its average over the past decade, according to YCharts data:

Based on the above, I believe Google deserves a “Buy” rating – still.

Risks To My Thesis

I partially outlined regulatory risks above, but in addition to them, I should also mention other things that every reader should pay attention to.

In my previous article, I noted that investors would probably rather see even more buybacks and dividends than investments in projects that many consider questionable and outside the company’s core business. The risk is that if costs for this business segment continue to grow, we may face a situation similar to Meta’s (META) experience with the metaverse, which led to a significant decline in its shareholders’ value at some point.

On the other hand, Google risks losing part of its market share in various end-markets because competition has been growing rapidly in recent months, driven by innovations in generative artificial intelligence.

And of course, I must acknowledge that regulatory risks, particularly the potential for the company to be broken up or recognized as a monopolist in certain regions, have significantly increased. Such developments could lead to the business being disrupted at some point, which would likely have a very negative impact on its market capitalization.

Your Takeaway

Despite the above risks, I believe Google is approaching its Q3 2024 financial report release date in a strong position

First off, regulatory risks appear to be overdone, contributing to the undervaluation I mentioned earlier. In addition, the declining and stagnant growth estimates (consensus forecasts for the coming quarters) provide a solid foundation for Google to more easily beat these expectations by leveraging the strength of its core business.

Google stock is still a “Buy”.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.