Summary:

- Alphabet operates in high-growth sectors like AI, cloud computing, streaming, and autonomous vehicles, creating unparalleled synergies across its divisions.

- Unlike rivals, Alphabet’s ecosystem integrates its technologies deeply, enhancing efficiency and reinforcing its market positions.

- Alphabet’s interconnected system boosts revenue streams, with YouTube’s $8.9 billion ad revenue and Google’s Cloud division’s 35% YOY growth as prime examples.

- Alphabet’s comprehensive ecosystem positions it to capitalize on the world’s largest current and future revenue streams, making it a standout large-cap tech stock.

Jonathan Kitchen

Alphabet (NASDAQ:GOOG) doesn’t just operate in some of the most profitable high-growth sectors, it is deeply embedded in all of them. From the massive search and digital advertising markets to the rapidly emerging trillion-dollar arenas of AI, cloud computing, streaming, and autonomous vehicles, Alphabet sits at the nexus of the most transformative opportunities of our time. While other Big Tech rivals like Microsoft (MSFT) and Amazon (AMZN) also operate in multiple large spaces, none integrate and reinforce their various divisions with the depth and efficiency that Alphabet does.

For investors focused on the future, Alphabet is not just another large-cap tech stock. It is a uniquely comprehensive ecosystem that has unparalleled synergies across all of its major divisions. This ecosystem will allow Alphabet to capitalize on many of the world’s largest current and future revenue streams all under one roof.

True Synergy vs. Partial Overlaps

Most major tech firms claim to have synergies, and are oftentimes correct. Microsoft leverages OpenAI’s foundation models in Azure and many of its productivity markets. Amazon uses AWS, which itself is invested in foundation model maker Anthropic, to bolster its e-commerce and entertainment ventures. Apple famously intertwines its hardware, software, and services so elegantly and thoroughly that they have often been accused of setting up a “walled garden.” Yet while these companies create meaningful overlaps that do have synergies, Alphabet’s integration and synergies are much more thorough, far-reaching, and deep.

Alphabet doesn’t just pair two or three lines of businesses superficially, it connects search AI breakthroughs, cloud computing infrastructure, streaming, and even autonomous driving technologies in one giant interconnected system. Consider that YouTube, for instance, generated $8.9 billion in quarterly ad revenue and feeds off the same AI backbone that enhanced Google Search and Waymo’s self-driving capabilities. Or that Google’s increasingly impressive Cloud division’s 35% YOY revenue surge is driven not only by strong enterprise demand, but also Alphabet’s own AI innovations and data center investments. Alphabet creates a tightly woven ecosystem of technologies that reinforce each other continuously.

Search: The Bedrock of Innovation and Cash Flow

Search isn’t just Alphabet’s legacy strength, it’s the financial and strategic foundation for all of Alphabet’s other major divisions. Alphabet’s dominance in search advertising generates enormous cash flows that support the company’s other major long-term bets like Waymo and quantum computing. In addition, the AI enhancements that improve Google’s search algorithms also enhance the rest of Alphabet’s ecosystem. This interplay ensures that even as new trillion-dollar markets emerge, Alphabet’s core search engine keeps running.

Other major tech companies also have foundational products, like Amazon’s marketplace, Apple’s hardware, and Microsoft’s enterprise software solutions. However, none has a core asset that drives profits and future innovations so directly. This results in a virtuous cycle where search revenues fund moonshots or side projects, whose breakthroughs in turn feed back into improving search and other key products.

AI: Alphabet’s Central Nervous System

AI has become critical to every Big Tech company’s overarching strategy, but Alphabet’s approach stands out. Alphabet’s Gemini models, which are set to rival or even exceed OpenAI’s capabilities, run on custom Tensor Processing Units that the company designs itself and fully controls. Unlike Microsoft, who leans on OpenAI for its AI capabilities, or Amazon, who leans on Anthropic for its AI capabilities, Alphabet’s completely vertically integrated AI stack ensures maximum efficiency and agility within the organization.

Alphabet’s AI advances don’t sit in isolation. Advances in its AI push Google Search’s relevance even further, make YouTube’s content recommendations even more engaging, fine-tune Waymo’s self-driving algorithms even further, and bolster Google Cloud’s enterprise offerings. As AI continues to influence the most promising trillion-dollar markets, Alphabet’s highly integrated approach ensures it captures a large share of gains across these markets.

Google Cloud: Leveraging the Entire Alphabet Toolkit

Cloud computing is already a trillion-dollar opportunity, and Google Cloud’s increasingly impressive performance in this industry is evidence of Alphabet’s synergy at play. With revenue growing 35% YOY and operating margins hitting 17%, Google Cloud is no longer playing catch-up to AWS and Azure. In fact, it is now even differentiating itself through AI-driven solutions like Vertex AI, which helps enterprises build and customize their own foundation models.

Unlike competitors that must forge alliances in order to integrate external AI layers, Google Cloud directly taps into Alphabet’s advanced AI, global data centers, and operational expertise from its thousands of engineers supporting its behemoth Google Search and YouTube divisions. What’s more, Alphabet can keep investing heavily into its cloud R&D as a result of its vast cash war chest. This creates a value proposition that few can rival.

Waymo: Fueled by the Alphabet Machine

Waymo is arguably the most undervalued gem in Alphabet’s entire portfolio, given how astronomically large many expect the self-driving market to be. This self-driving subdivision is transforming from an experimental moonshot bet to a genuine commercial enterprise for Alphabet. In fact, Waymo is exponentially increasing its weekly paid rides and is now offering over 150,000 weekly paid rides and is projected to hit $3 billion in annual revenue by 2025. With the autonomous vehicle market potentially exceeding trillions of dollars in revenue by 2030, Waymo’s cautious, data-driven approach sets it up for significant success.

Waymo’s technical edge does not just emerge from thin air. It draws substantially from Alphabet’s integrated ecosystem, with AI breakthroughs from DeepMind flowing into Waymo’s machine learning algorithms. Waymo’s map data is also enriched by Google Maps, and the company’s computing needs are fulfilled by Google Cloud. While Tesla (TSLA) may excel at certain aspects of autonomy, it does not enjoy the all-encompassing synergy that powers Waymo, making it a far better bet than Tesla’s self-driving technology division.

Waymo

YouTube: Dominating a Multi-Billion-Dollar Streaming Landscape

YouTube, which generates $8.9 billion in quarterly ad revenue, is the standout in the streaming space. In fact, it even rivals Netflix (NFLX) in terms of total viewer hours. Unsurprisingly, YouTube also benefits enormously from Alphabet’s synergy. AI-driven recommendations, enhanced monetization tools, and strategic ventures like NFL Sunday Ticket define its competitive edge over traditional streamers. As the shift from TV to streaming intensifies, YouTube’s integration with the rest of Alphabet, whether it be leveraging AI for better content curation or capitalizing on Google Cloud for cheap and reliable infrastructure, keeps it far ahead of competitors.

While Amazon integrates Prime Video with its retail ecosystem and Apple ties Apple TV+ into its hardware-software “walled garden,” YouTube’s advantage is that it’s powered by the same AI and data analytics backbone that fuels search and many of its other ventures. This ensures that as streaming becomes an even greater part of the entertainment landscape, YouTube will remain at the forefront and likely even increase market share.

Quantum Computing: The Ultimate Moonshot

Alphabet’s Willow quantum computing chip has the potential to be the start of an entirely new computing paradigm. For instance, it could solve problems in minutes that would have taken traditional computers septillions of years. This opens the doors to entirely new and potentially ultra-high-value markets. If quantum computing even partially lives up to its promise, it could put Alphabet far ahead of competitors for the foreseeable future.

Financial Strength

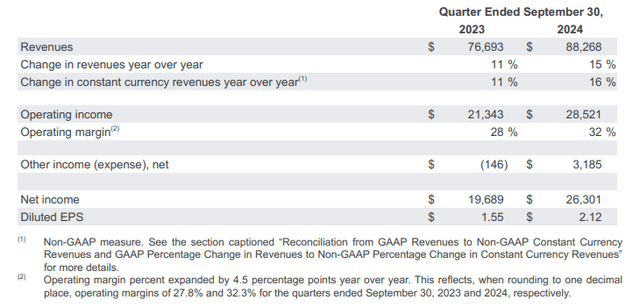

Alphabet’s strong financial metrics reinforce its ecosystem. The company does a good job of balancing heavy R&D investments with cost controls, evident in its $88.3 billion in revenue last quarter, $26.3 billion in net income, and operating margin of 32%. This continuous stream of revenue allows Alphabet to maintain a warchest only rivaled by a few other companies. Alphabet also trades at around 25x earnings, making it cheaper than many of its mega-cap peers. This makes the company an even more attractive investment given its strong growth prospects.

Alphabet’s significant cash reserves and stable profitability give the company an edge in negotiations with suppliers, regulators, and acquisition targets. The liquidity position granted by its cash reserves means that it can take more risks and pivot quicker than competitors if needed. Alphabet’s financial strength becomes a powerful tool that allows the company to remain dynamic and forward-looking without significantly threatening its core businesses.

Significant Risks Remain

Alphabet faces several major risks that could hamper its long-term growth trajectory. The most notable being regulatory roadblocks, particularly with the ongoing antitrust case brought about by the U.S. Department of Justice. The allegations of monopolistic practices in search and advertising will have an incredibly negative impact on Alphabet’s ecosystem, as it would force Alphabet to break up several parts of its company. This could significantly weaken Alphabet, as it reduces the synergistic benefits that subdivisions gain from the greater whole.

Competition in core markets also continues to pose a big threat to Alphabet, despite the strides Alphabet has made recently in Cloud and AI. Currently, Alphabet trails behind AWS and Azure when it comes to cloud computing. Amazon and Microsoft are doing everything possible to maintain their market shares given how profitable cloud computing is, so Alphabet still has an uphill climb if it wants to dethrone AWS and Azure. Similarly, in AI, Microsoft’s OpenAI partnership and Amazon’s Anthropic partnership still poses a major threat to Alphabet’s in-house foundation model Gemini. While Gemini is more deeply integrated into Alphabet, OpenAI and Anthropic still remain incredibly competitive models.

Conclusion

While other tech giants have synergies of their own, the scale, scope, and depth of Alphabet’s integration remain unparalleled. For investors looking to capture the immense value at the intersection of AI, cloud computing, autonomous vehicles, streaming, and beyond, Alphabet is not just a strong bet. It is a rare single platform that strategically unites them all, ensuring that Alphabet will likely be at the center of whatever revolutionary industries explode next. As such, Alphabet is still relatively cheap at its current valuation of $2.3 trillion relative to its big tech peers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.