Summary:

- Google reported stellar earnings results for Q1 last week.

- In addition to the great performance, it’s likely that Google will remain one of the dominant players in the digital advertising industry and won’t lose its leadership spot anytime soon.

- Even though the rise of various AI solutions of its competitors along with a stricter regulatory environment could disrupt its operations, it’s unlikely to happen in the following quarters.

- As such, Google’s great performance in recent months makes me believe that its stock is still one of the best investments on the market right now.

stockcam

Despite all the chatter about how Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL) aka Google is about to lose its dominant position in the digital advertising market due to the rise of competitors with functioning AI solutions such as Microsoft-funded (MSFT) ChatGPT, the company’s recent stellar Q1 earnings report showed that’s not going to be the case anytime soon. The latest reported numbers indicate that Google will likely remain one of the leaders of the digital advertising industry thanks to its various effective tools that help it to attract advertisers en masse into its platform, while its cloud solutions should continue to be in high demand even in these challenging times full of uncertainty.

At the same time, it would be foolish to think that Google would be a dominant force in the advertising and cloud industries forever. There’s even a reasonable case to be made that the growth of AI solutions of its competitors along with a stricter regulatory environment could disrupt its business operations in the future. However, it’s safe to assume that we’re unlikely to witness that happening anytime soon. Therefore, Google management’s positive outlook for the following months, coupled with the fact that the company’s business likely trades at a discount to its fair value, make me believe that Google is still one of the best investments on the market right now.

Growth Is Back

Google’s latest earnings report showed that the company managed to generate $69.79 billion in revenues for the March quarter which is up 2.6% Y/Y and above the street estimates by $950 million. At the same time, the company’s GAAP EPS of $1.17 was also above the estimates by $0.10, which indicates that the business is able to mitigate most of the risks and keep growing despite all the challenges in the current turbulent macroeconomic environment. Add to this the fact that Google’s Board of Directors recently authorized an additional $70 billion for the repurchases of the company’s stock and it becomes obvious that the business’s shares have more room for growth from the current levels.

On top of that, the forecasted growth of the digital advertising market is also likely to help Google improve its performance in the following years thanks to its dominant position in the market. The latest data shows that the digital advertising market is expected to grow at an annual rate of over 10% and the ad spent is expected to surpass $700 billion in 2025, which is a positive development for Google as it’ll likely be able to benefit the most from such a growth due to its edge in the business.

At the same time, despite all the worries about how AI solutions of other competitors are about to dethrone Google from its leadership spot in the digital advertising market, the latest earnings report showed that’s unlikely to happen anytime soon. In Q1, Google managed to increase its search-specific revenues by 1.9% Y/Y to $40.36 billion, which is a sign that Bing – or any other search engine – is unlikely to pose an existential threat to the business in the foreseeable future.

In addition to that, Google has also been actively integrating various AI solutions such as the Multitask Unified Model into its core search business to ensure that ads are more relevant to users so that advertisers continue to use its services to promote their businesses within Google’s ecosystem. On top of that, there are reports that Google is also working to create a new search engine that currently goes under the project name of Magi to ensure that users are being offered more personalized experiences when using search functions so that they don’t go to competitors as well.

Considering all of this and the fact that Google was also able to retain its 10% share in the cloud services market while its cloud business increased its revenues by 28.1% Y/Y to $7.45 billion in Q1, it would be safe to assume that the company’s growth story is far from being over.

Is It Time To Buy?

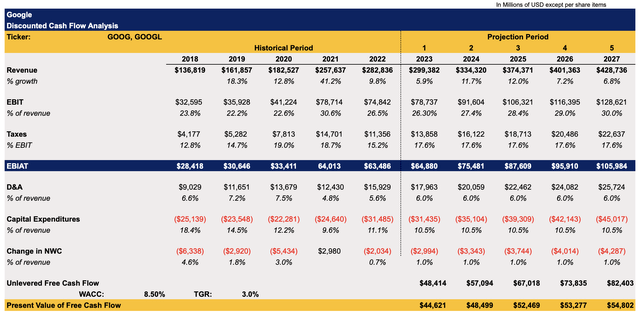

With all of that in mind, it makes sense to update my discounted cash flow (“DCF”) model, which at the beginning of February showed Google’s fair value to be $110.11 per share. In the updated model below, the revenue growth rate along with the EBIT rate are mostly in-line with the new street expectations for the years ahead while the tax rate remains unchanged and is the average of the previous few years. All the other metrics in the model are mostly unchanged except for the WACC rate, which was bumped by 0.5% to 8.5% to better reflect the higher interest-rate environment along with the increase of the risk-free rate.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

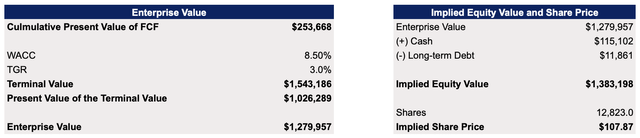

The new model shows Google’s enterprise value to be $1.28 trillion, while its fair value is $107.87 per share, which is close to the current market price.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, while at first it seems that the upside in Google’s stock is limited at the current levels, I nevertheless think that other factors outweigh pure fundamental calculations. First of all, if the WACC rate stood at 8% as it was the case in the previous model, then Google’s fair value would’ve been around ~$120 per share. If the Fed decides to pivot later this year or at the beginning of next year and begins to decrease interest rates while Google remains resilient to the turbulent macroeconomic environment, then a justification for a lower WACC along with a potential bigger upside would be greater.

On top of that, there are all the chances that the digital advertising market would continue to grow while the demand for cloud solutions would likely increase over the long run, which could make it possible for Google to beat its estimates and for the street to revise its growth expectations upward. In such a scenario, a greater upside is guaranteed and it’s one of the main reasons why I continue holding Google’s stock in my portfolio without any plans to unwind the long position anytime soon.

Some Risks To Consider

Despite all the positive developments, it would nevertheless be foolish to think that other AI solutions don’t pose a threat to Google’s monopoly in search in the long run. Back in December, Google’s own management panicked over the rise in popularity of ChatGPT while there were also talks about Samsung thinking about replacing Google Search with Microsoft Bing on its phones. On top of that, there were also reports which described how Google’s employees were skeptical about their own AI chatbot Bard. However, the latest numbers for Q1 showed that it’s unlikely that Google could lose its dominant position in the search business anytime soon despite all the challenges that it faces.

In addition to that, one of the bigger risks for Google is the implementation of new regulations that could inflict major material damage to its business or force the company to break up. In the past, I’ve already highlighted how new regulations could pose an existential threat to Google in the long term. However, as it’s the case with AI-related risks, the regulatory risks are also unlikely to materialize anytime soon.

The Bottom Line

Considering all of this, it would be foolish to think that Google would remain a dominant force in the digital advertising and cloud industries forever if it fails to improve its own AI solutions or it doesn’t adequately react to the changing regulatory environment. However, it’s also safe to assume that even despite some of the challenges, the company’s stellar performance in Q1 along with the fact that its growth story is far from over indicate that it’s too soon to say that Google already faces an existential threat. At the same time, since the company trades below its fair value in some scenarios while the street remains bullish about its performance in the foreseeable future, then there are reasons to believe that Google remains one of the best investments at this stage as it has a window of opportunity to create additional shareholder value in the following quarters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!