Summary:

- Google is going to report results for its first-quarter later this month.

- Google is likely to see only single-digit top line growth due to persistent ad market weakness, but the technology firm should report solid free cash flows.

- Google is likely going to upsize its stock buyback and the stock is one of the cheapest FAANG stocks.

400tmax

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is about to submit its first-quarter earnings sheet later this month (estimated earnings date: 4/27/2023), and in this article I am going to take a look at what investors can reasonably expect from the technology company regarding operating performance. Google has been performing moderately well in the fourth-quarter, given the difficult circumstances in the digital advertising market, but operating conditions in the first-quarter likely remained weak. However, Google’s core advertising business still generates a ton of free cash flow and the Cloud business is likely going to see strong, but decelerating growth in the first-quarter as well. Although challenges exist and the company may not have seen the bottom in the digital advertising market yet, I think shares are a bargain ahead of the Q1’23 earnings release!

What investors can expect from Google’s Q1’23

Investors probably shouldn’t expect a whole lot from the technology company considering that a deep slowdown in the digital advertising market in FY 2022 affected Google, but also social media companies such as Meta Platforms (META) and Snap (SNAP). A weak ad market and overall slowing top line growth has forced Google to cut operating costs: the company announced earlier this year that it was laying off about 6% of its workforce in January which at the time translated to about 12 thousand job cuts. Other tech companies also laid off thousands of people, a sign that the U.S. economy is cooling and that companies are looking for cost cuts.

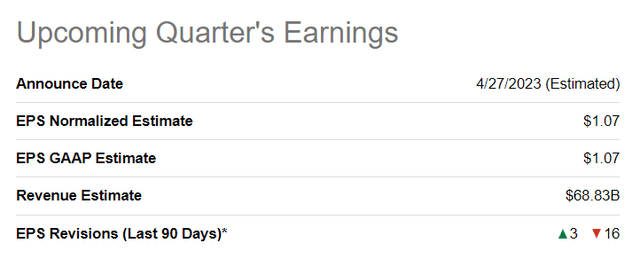

The slowdown in the ad market has been well covered and most investors will be aware of Google’s slowing growth. EPS estimates for the upcoming quarter reflect these expectations: the average prediction calls for $1.07 per-share in earnings in Q1’23, implying a 13% EPS decline year over year. However, Google is still expected to squeeze out a 1.2% top line gain in the first-quarter and report revenues of approximately $68.83B.

Google’s earnings revision trend heading into Q1’23 is also rather negative. Analysts have down-graded Google’s EPS expectations 16 times in the last 90 days and there were only 3 EPS upward revisions, suggesting that analysts as a whole continue to expect persistent earnings headwinds resulting from a slowing advertising market.

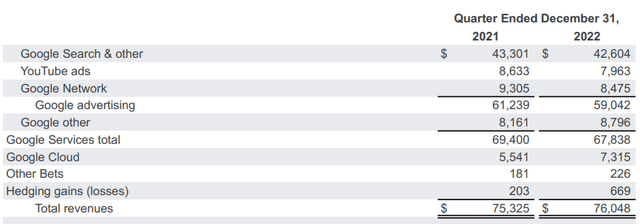

Google’s advertising business remains challenged due to large corporations cutting back on ad spending in an increasingly uncertain market. As a result, Google’s advertising performance suffered in the fourth-quarter and will likely disappoint in Q1’23 also: the technology company reported a revenue decline of 3.6% in its core ad business in Q4’22. For the first-quarter, I expect 1.5-2.5% core advertising segment growth as the ad market remained weak and a string of bank failures possibly hurt spending attitudes during the quarter.

Whether or not Google will report positive top line growth in Q1’23 largely depends on execution in Google’s Cloud business. Cloud business growth chiefly depends on large corporate clients investing in digital infrastructure to drive efficiency. Google Cloud is the fastest-growing business for Alphabet and the business generated $7.3B in revenues in Q4’22, showing 32% year over year growth. For the first-quarter, I expect 28-30% top line growth and it should be Cloud that once again pushes Google’s consolidated revenue growth into the green.

Free cash flow and stock buybacks

Google is on track to complete its stock buyback authorization of $70B, which was announced a year ago, in the very near term. Google repurchased $15.4B of its shares in the fourth-quarter and considering that the company generates approximately $16B in free cash flow quarterly, I believe Google is set to announce a major buyback, perhaps around the $100B mark, later this month.

Assuming that the ad market remained in similar constitution as in the fourth-quarter, I would not expect a material change in Google’s free cash flow prowess: my prediction for Google’s Q1’23 FCF is about $13.8B-$14.2B as first-quarter free cash flow typically falls off after the holiday season. In last year’s first-quarter, Google generated $15.3B in free cash flow and persistent weakness in the ad market makes it unlikely that Google will be able to generate the same level of FCF this year. However, even $13-14B in free cash flow is a handsome sum to spend on buybacks, especially now that the stock is so cheap.

Google’s valuation relative to FAANG rivals

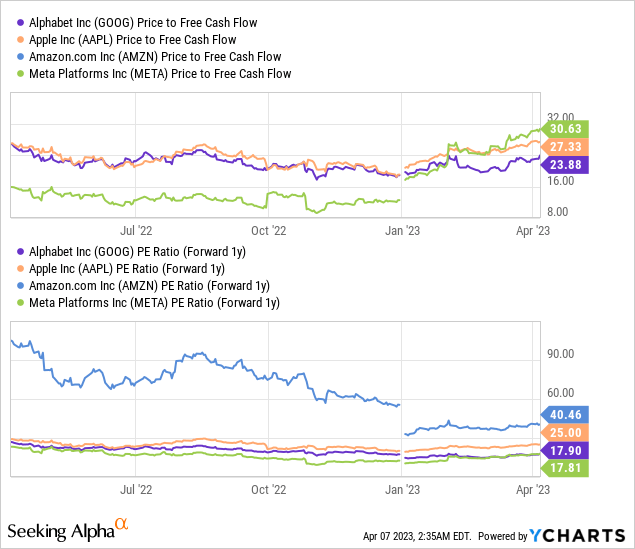

Google continues to have an attractive valuation considering that the company runs a quasi-monopoly search business, Cloud continues to grow at double-digits and Google generates a ton of free cash flow from advertising sales. Google is also quite competitively valued, based off of free cash flow and earnings, when compared against other FAANG stocks… which is why I believe Google should throw as much money as it can afford to buy back shares at a discounted valuation.

Google currently has the lowest P/FCF ratio (23.9 X) in the comparison group and the second-lowest forward P/E ratio (17.9 X), after Meta Platforms. I like Meta Platforms, chiefly because of its $40B stock buyback.

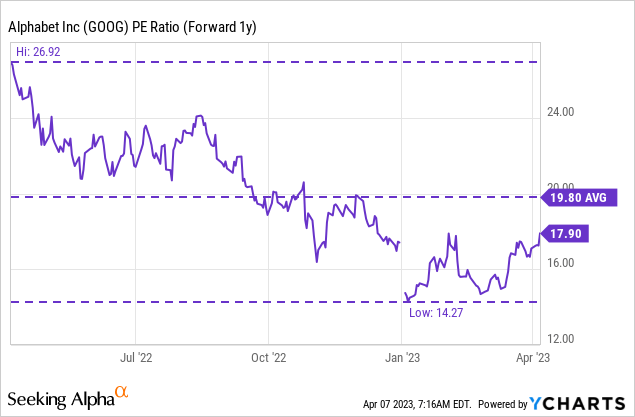

Compared to its own historical valuation range, Google can still be bought below its 1-year average P/E ratio. Considering that the company is likely to make a new buyback announcement at the end of the month, I believe the stock represents deep value for investors before the Q1’23 earnings date. A major stock buyback announcement could result in a re-rating of Google’s stock which is why I am upgrading Google’s rating from buy to strong buy as well.

Risks with Google

The biggest risk for Google is an accelerating slowdown in the digital advertising market which could lead to a deterioration of Google’s core operating performance… and therefore falling free cash flow. The technology company squeezed out a 1% top line gain in the last quarter due to a strong performance of Cloud. Additionally, high inflation has weighed on advertising budgets, but these dollars could quickly return if overall economic conditions improve.

Final thoughts

I don’t expect too much from Google for the first-quarter to be honest, but I nonetheless believe that the technology company is going to put up a solid earnings sheet that will show positive top line growth as well as solid free cash flows. Earnings estimates are very low and a strong Cloud performance could make a difference for Google’s Q1’23 results.

A key catalyst for Google could be the announcement of a major stock buyback which I believe will significantly exceed the $70B buyback announced a year ago. Since the current stock buyback program is set to be completed in the near term and Google’s stock is quite cheap based off of earnings and free cash flow, I believe Google presently represents the best value in the group of FAANG stocks!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.