Summary:

- Alphabet’s strong position in web search and YouTube, along with opportunities in cloud and AI, make it a buy at current prices.

- Advertising is expected to rebound and accelerate, benefiting Alphabet’s revenues.

- YouTube has significant potential for advertising growth and could become a substantial revenue generator for Alphabet.

Justin Sullivan

Investment Thesis

I wanted to take a closer look at Alphabet’s (NASDAQ:GOOG) financial position over the last couple of years to see how it has evolved and to see what kind of revenue catalysts the company has in store, and whether it is a buy at these prices. Given the strong position in web search and growing popularity of YouTube, coupled with exciting avenues in the cloud and AI space, I rate the company a buy at these prices.

Outlook

Advertising

The signs of advertising winter seem to beginning to thaw now and according to Business Insider, the second half of the year will begin to rebound and accelerate with many advertisers looking to increase their spending in the upcoming months. Alphabet is still predominantly an advertising business. Not as much as Meta Platforms (META) but still 80% of FY22 revenues came from advertising. Advertisers are beginning to pay more, which will play a huge role in company revenues for the next few years until we see another winter of advertising slowdowns but for now, we may have seen the worst of it, now that inflation is coming down as well.

YouTube

Speaking of ads, the streaming platform has been performing extraordinarily recently. The numbers sit at around 150m screens reached on TV screens alone with over 80m paying subscribers. The potential for advertising is huge. My go-to streaming platform that I use daily is YouTube. I was also not surprised to see that YouTube Shorts is achieving fantastic reach, with over 2 billion logged-in users every month compared to 1.5B the same time last year. Whenever I have some downtime, I gravitate towards short-from content of YouTube shorts on my phone or if I have a little bit more time, I will consume content on standard YouTube content also.

The premium service is great overall; however, I believe YouTube music isn’t as good as Spotify (SPOT). Good thing I got YouTube Premium for free (on a family plan), so I don’t feel guilty using Spotify for my daily music needs.

Even though YouTube has been around for many years now, I believe that in the next 5-10 years this platform will be much bigger than it currently is and will become a very substantial revenue generator for Alphabet.

Cloud, AI, and Other Bets

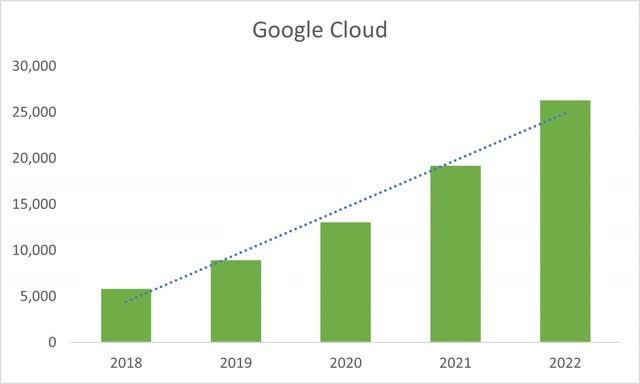

I will keep these segments short because there is a lot of potential in these to contribute to revenues in the near future, especially the Cloud and AI side of things, however, right now are not contributing too much to the company. Cloud is the most promising, which will go in tandem with AI. Google Cloud, just like Microsoft’s (MSFT) Azure and Amazon’s (AMZN) AWS has been growing rapidly over the last couple of years and I don’t believe this will stop anytime soon. The company is facing stiff competition from the mentioned 2 companies that control number 1 and 2 spots in the cloud segment, while Google Cloud is taking the number 3 spot currently and is gaining market share slowly from the juggernaut AWS. According to Statista, AWS is maintaining a strong lead against Azure and G Cloud, however, Azure and G Cloud managed to take away around 1% each from AWS in Q2 ’23. G Cloud has been performing tremendously and is showing no signs of stopping. Would it be a stretch to think that in the next decade, the segment’s revenues will 10x? I wouldn’t be too surprised as it has averaged 46% growth in the last 5 years.

In terms of Other Bets, I will include these potential catalysts in the far future mainly because these ventures are still at very early stages and are still burning through cash, however, the potential that Waymo or Verily holds could be massive. YouTube was once thought of as a long shot in the beginning, and so were Chrome and Android, which the company refers to as “Moonshots”. The company is looking for the next moonshot, which could be coming from Waymo or Verily, but the most likely case is AI and ML initiatives in my opinion.

Risks

Advertising may slow down again, which will massively affect the company’s revenues, especially if it keeps depending on it to make all of its net income. Alphabet is doing a great job trying to diversify away from the dependency of ads business to adding subscription business in the form of YouTube premium and hardware sales like smartphones, smart devices, and Cloud.

Google Cloud may not be able to achieve such impressive growth going forward due to the competition offering a much better product than Alphabet and beginning to lose market share. So far it looks like it is gaining share, however, if we see future reports show a decline here, this will mean the company has dropped the ball and will need to rethink its strategy fast. G Cloud just turned positive in the last 2 quarters. It looks like the company is starting to manage expenses; however, this may turn back to a losing segment once again and start burning around $5B a year just like it did in the past.

YouTube ads are a big part of revenues for the company. The platform is not free of controversies. The debacle of “adpocolypse” may return once again and advertisers may stop advertising on the platform because they deem the platform not “family-friendly” once again, which will materially affect the company’s revenues when they start to withdraw from the platform in droves.

Financials

The below graphs will be as of FY22 because I like to see the big picture of where the company is headed, however, I will include the most recent numbers for extra color if necessary.

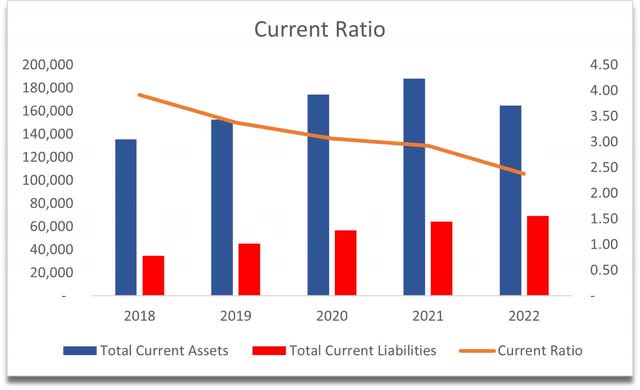

As of Q2 ’23, the company had over $118B in liquidity, against around $78B in long-term debt. For any company that is not Alphabet, Meta, Apple (AAPL), Microsoft, or Amazon this debt would be a deal-breaker. Seeing that GOOG is a $1.6T company, the debt figure is minuscule. The company makes much more from its marketable securities than it pays in annual interest expense on debt. I don’t think there is any bank that wouldn’t lend money to a company that is able to generate around $100B in operating cash flows and over $70B in EBIT. Safe to say, GOOG is at no risk of insolvency.

The company’s current ratio is also sitting at around my preferred number, which is 2. At the end of FY22, that number stood at 2.38 which tells me the company is very efficient with its assets and is not hoarding cash even if it looks like it is. The company has no problem paying off its short-term obligations if it has to all at once, which is unlikely.

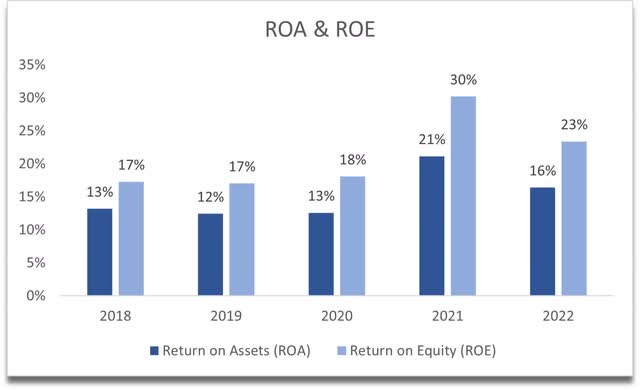

In terms of efficiency and profitability, the company is shining here also. ROA and ROE are well above my minimums of 5% for ROA and 10% for ROE, which tells me the company is able to utilize its assets efficiently and is creating value for shareholders.

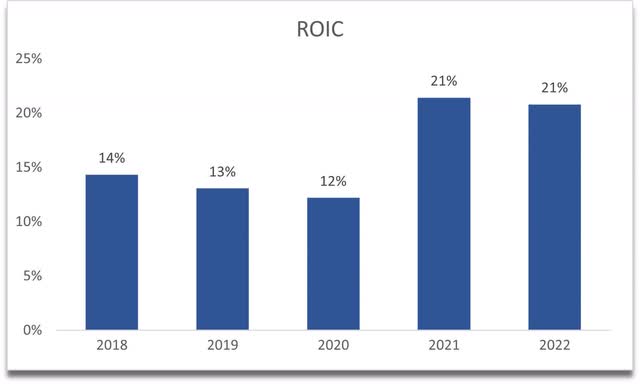

The same can be said about the company’s return on invested capital. It is double what I would consider to be good, which tells me that GOOG has a very strong moat and strong competitive advantage and that alone deserves a premium in my opinion.

Overall, GOOG is in a very strong financial position, one of the best I’ve seen, and for that reason, I also wouldn’t mind paying a premium. The mountain of liquidity the company has makes it very flexible in how it wants to keep growing or how it wants to reward its shareholders in the future.

Valuation

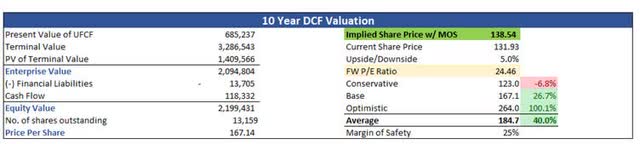

I separated the main revenue segments for my DCF because I believe the growth in the Cloud segment will be much higher than the rest of the segments which are the Google Services that include the Google Other segment also.

For the base case, I went with revenue growth of around 11.5% on the Google Services segment and 19.5% CAGR revenue growth for G Cloud which I think is on the conservative side since it grew around 46% CAGR in the last 5 years. For the Other Bets segment, I decided to be conservative and assume they will not make money in the next 10 years and will lose $5B a year.

For the optimistic case, I went with 15.5% CAGR on Google Services and 23.5% CAGR on G Cloud, while for the conservative case, I went with 9.5% and 17.5%, respectively.

In terms of margins, I went with around 300bps improvements in gross margins over the next decade and 200bps in operating margins. This will bring net margins from around 21% in FY22 to around 28% by FY32.

On top of these estimates, I will add a 25% margin of safety, which is the lowest I assign to any company that has a very strong balance sheet. With that said, Alphabet’s intrinsic value is $138.54 a share, implying a 5% upside or the company is valued fairly right now and is a good buy for the long term.

Closing Comments

I think GOOG should be in everyone’s long-term portfolios and to see that the company is still a buy when a lot of other companies soared this year to new highs is a blessing. The future potential outweighs the risks and I believe that risk/reward right here is very appealing.

I believe my valuation is on the conservative side and if Waymo or Verily becomes profitable in the future, it will just be a positive for GOOG.

At current prices, the company is a buy and if we are not out of the woods yet in terms of macroeconomic headwinds, which may bring down many great companies like GOOG, you should take that as an opportunity to add to a very solid business that will reward its shareholders in the long run.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.