Summary:

- Alphabet’s stock price weakness after quarterly earnings presents an opportunity for long-term investors to buy or increase their holdings in Google’s stock.

- The slowdown in Google’s cloud growth is being exaggerated, as the total advertising business is experiencing strong growth.

- Google’s search-related ad sales are growing in double-digits, and the stock is selling at a lower earnings multiple, making it an attractive investment.

Alena Kravchenko

The stock price weakness of Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) after the technology company reported quarterly earnings is an opportunity for investors with a long-term investment horizon to start or double down on Google’s stock, in my view.

Google’s stock price dropped precipitously after 3Q-23 earnings, but investors probably exaggerated the importance of slowing cloud growth. It is true that Google is seeing a slowdown in the cloud, but the total advertising business is experiencing strong tailwinds right now.

With search-related ad sales growing in the double-digits and Google’s stock selling for a lower earnings multiple, I think that the risk/reward relationship is extraordinarily compelling right now.

My Rating History

Back in May, strong cloud growth was one reason I mentioned that helped make the case for buying Google’s stock and culminated in a Buy stock classification on my part. About half a year later, new stock price weakness represents a new opportunity for investors to double down on Google.

Google experiences a substantial recovery in its advertising-related revenue streams and concerns over Google’s cloud performance, a driver of recent stock price weakness, are probably exaggerated.

Google Gets Punished For Slowing Cloud Sales Growth

Slowing sales growth in Google’s cloud segment explains the 10% drop in Google’s stock price immediately after the technology company reported its quarterly results for 3Q-23 in the last week of October.

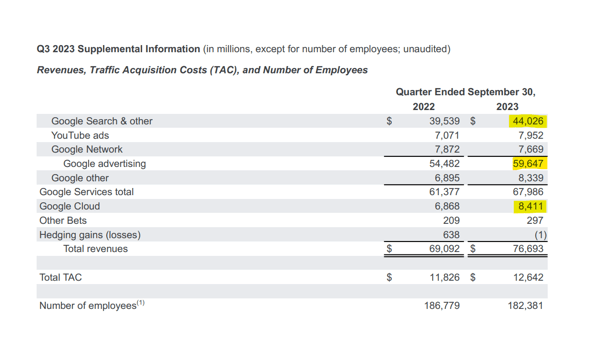

Though it is true that growth in cloud slowed to 22.5% in the third quarter (Google’s cloud growth was 28.0% in the second quarter), the search segment excelled and showed its best performance in more than a year.

Google Cloud Sales (Alphabet Inc)

Search produced $44.0 billion in sales in the third quarter, reflecting a YoY growth rate of 11.3%. Search-related sales growth was at its highest since the second quarter of 2022 which is when sales grew 13.5% YoY.

Here is the trajectory of Google search unit’s sales growth:

3Q-23: 11.3%

2Q-23: 4.8%

1Q-23: 1.9%

4Q-22: -1.6%

3Q-22: 4.3%

2Q-22: 13.5%

Here is Google’s total ad sales growth trajectory in the last year:

3Q-23: 9.5%

2Q-23: 3.3%

1Q-23: 0.0%

4Q-22: -3.6%

3Q-22: 2.5%

2Q-22: 11.6%

The 10% price slump primarily happened because the Google parent missed estimates for the cloud segment. Cloud-related sales were $8.41 billion which missed estimates of $8.64 billion, which implied the expectation of a YoY growth rate of 25.8%. In short, Google’s realized cloud-related sales growth was 3.3 percentage points lower in the third quarter than Street expectations indicated which in turn triggered a selloff that I think wasn’t justified.

While moderating growth in cloud is not great, obviously, it raises the question as to why investors are judging Google’s results fairly, particularly because the technology company reported much stronger sales growth in its advertising business.

By sales volume and on a run-rate 3Q-23 basis, search sales were 5.2x larger than Google’s cloud operations. The totality of Google’s various ad sales streams was 7.1x larger than Google’s cloud sales.

What probably made things worse was that Google’s cloud results for 3Q-23 stood in stark contrast to Microsoft’s results. Microsoft cloud revenue soared 24% YoY to $31.8 billion, suggesting that Google lost ground to its cloud competitor in the third calendar quarter. Be that as it may, the significance of Google’s advertising rebound seems to be greatly underappreciated.

I think that investors are going to realize that the business performed rather well, creating a re-rating opportunity.

Technical Analysis

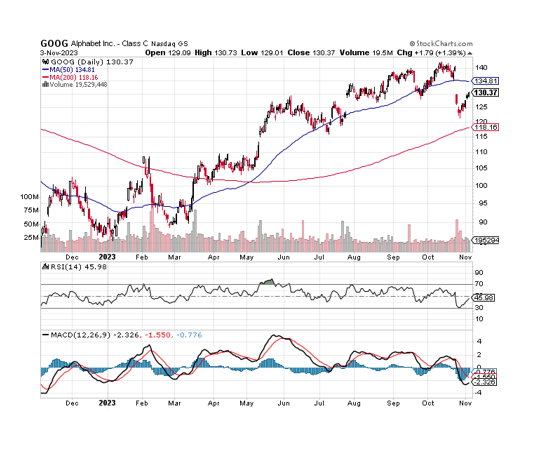

The earnings release and investors’ reaction to Google’s missing cloud growth estimates resulted in a 10% stock price dip which was the worst fall since the pandemic.

With that being said, Google beat profit and sales estimates and the ad recovery, in my view, more than compensated for the rather small QoQ decline in the cloud growth rate.

The selloff caused Google to slump through its 50-day moving average line, but the stock quickly got a hold of itself and went back up, a strong sign that investors have started to realize that a price overreaction has taken place.

The 200-day moving average line was not broken and Google stock, according to the Relative Strength Index, is not oversold. I think the setup is attractive and I would expect Google stock to continue its recovery path in the near term.

Moving Averages (Stockcharts.com)

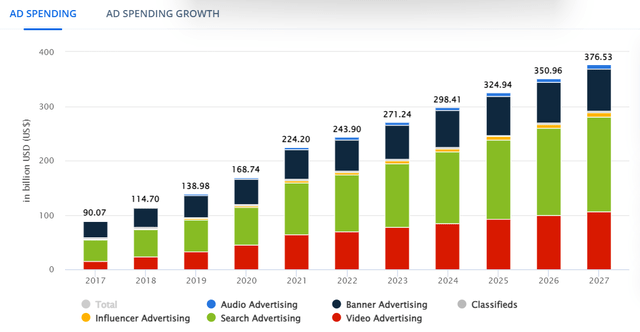

Ad Spending Growth

Ad spending, across ad categories, is in a long-term uptrend with search advertising being (and projected to remain) the largest spending category in the future.

Total search advertising, which covers Google’s core business, is expected to grow to $175.0 billion by 2027, up from an estimated $118.2 billion in 2023.

However, search advertising spending, like all forms of advertising spending, goes up in a growing economy when demand for products and services increases. A strong economy, as we have seen in the third quarter, leads to higher confidence on the part of companies which in turn results in higher spending.

Strong Re-Rating Opportunity After Misguided Selloff

The market presently models $6.29 per share in profits for 2024 which translates into an earnings multiple of 20.7x. The average estimate implies 19% profit growth for Google next year whereas the current estimate reflects a YoY profit growth rate of 16%.

I think that if the advertising market, buoyed by strong economic growth, continues to perform next year as well as it is today, estimates may re-rate higher in 2024 and Google might see even stronger profit growth.

With profit growth converging on 20% next year, I think Google’s valuation multiple of 20.7x is a steal. I got a slightly better valuation multiple on my last buy, 19.0x, but I think the present valuation still leaves considerable room for a re-rating and implies a robust risk/reward relationship.

Earnings Estimate (Yahoo Finance)

Why Google Might See A Higher/Lower Valuation Multiple

Last year investors were freaked out about Google’s search business which, in fact, cratered due to wide-spread dial-back in advertising spending. Now, when the business is surging back and investors should be elated, investors find a new reason for concern and freak out about a rather small miss in cloud growth estimates.

Be that as it may, Google is dependent on advertising spending more than anything else. Slowing growth in search, or advertising in general, might be a much bigger issue for Google than softening cloud growth as the ad business in its totality is about 7x larger than cloud.

My Conclusion

All this drama following Google’s 3Q-23 earnings release was due to Google’s underperforming cloud sales growth estimates by 3.3 percentage points while investors completely dismissed the stellar performance (and rebound) in the ad business.

To me, this made no sense and since investors obviously overreacted to Google’s quarterly earnings, I doubled down on the stock and also doubled my position in the tech company.

First, Google profited profoundly from a rebound in total advertising sales, but particularly search. Second, Google’s miss of cloud-related growth estimates is not a big deal, in my view. Third, Google’s stock is cheap, selling for 20.7x next year’s profits and earnings per share are still expected to grow at double-digits.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.