Summary:

- Both Bill Ackman and Seth Klarman have a 10%+ allocation of their portfolio in Alphabet.

- Google’s AI power has been underestimated and investors could’ve profited from a drawback in the latest quarter.

- Google I/O event was a massive hit with a ton of new AI features that will decrease the friction to get started with AI.

- Valuation is looking less attractive right now to add shares, but I do think Alphabet is going to do fine in AI and integrating it properly in their core products.

400tmax

Every quarter we have 13-F filings of institutional investment managers with at least $100 million in assets under management. This gives us a way to look into the portfolio’s and strategies of arguably the best investors in the world. In the latest quarter, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) was the most bought stock by superinvestors. Two investors in particular are interesting to watch: Bill Ackman and Seth Klarman.

Bill Ackman

Bill Ackman is a billionaire hedge fund manager and founder of Pershing Square Capital Management. He is one of those investors, who loves a good crisis and manages to take large stakes in businesses that everyone is scared of owning. For example in 2020, the Covid-19 crisis, he bought hotels and restaurants that had to close their doors, but those that were still fundamentally really strong. That played out really well as most of those stocks have doubled since then.

Right now, Bill has acquired a large 10.43% stake in GOOG and GOOGL. The average reported price is $103-104 per share, which is still rather high knowing Alphabet traded below $100 for quite some time.

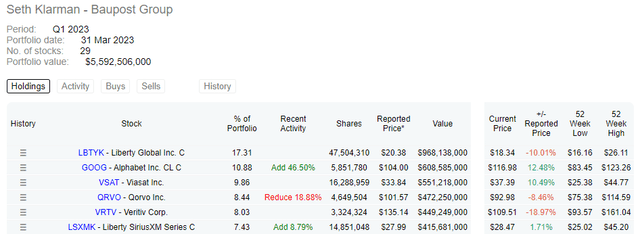

Seth Klarman

Seth Klarman is another billionaire hedge fund manager and founder of Baupost Group. He is a well-known value investor and has written his own book called ‘Margin of Safety’. In the book, he explains how value is found in his hedge fund, with an investment at a discount to its intrinsic value to protect against downside risk.

Seth has increased his stake by 46.5%, making Alphabet a 10%+ stake in his hedge fund. Similar to Bill, the reported average price is around $104 a share, which is not the best one could get in the latest quarter.

Underestimated and AI showcase

So far, I have covered Alphabet twice before. Back in October I called investors at $101 a share: ‘If You Are Not Buying Now, When Will You‘. Some were buying, some wanted to wait for lower prices. Anyways, the stock outperformed the S&P 500 with a 15% return.

A little later, I wrote a new article in March: Alphabet Vs. Meta: Easy Choice, after Alphabet saw another pullback because of AI worries.

I mentioned:

Next to that Investors seem to forget the investments Alphabet has done over the past years. Alphabet was one of the first companies to invest in AI. Back in 2014, the company spent $10 million on Dark Blue Labs & Vision Factory, which is now integrated in DeepMind. Further, Alphabet has its own conversational AI bot named LaMDA, which is built on the Transformer neural network architecture. Transformer was invented by Google Research and has also helped building ChatGPT. Google gains more data than any other company and should easily replicate ChatGPT with Bard (based on LaMDA).

At this moment, Alphabet is 26% higher compared to a modest 3.9% gain of the S&P 500.

On the 10th of May, Google launched its Google I/O event, about all their new products, with AI being one of the main themes. And ooh boy did they deliver… The stock jumped 10% in a span of 2 days.

Some of new AI features:

– Magic Editor: Adjusting pictures has never been easier with AI features that can erase, add and replace objects.

– Google Maps: Some cities will now have a 3D map with AI replication of local weather and traffic. You can even scroll to a later hour and check the estimated conditions for specific locations.

– PaLM 2: Google’s next generation language model got launched with reasoning, multilingual translation and coding.

– Bard: Pictures are no longer an exception for Bard, upload one and ask about it. Bard is now available in more than 180 countries. PaLM 2 helps Bard with coding. Additionally, Google tools and extensions with partners like Spotify, Gmail, Maps, Adobe Firefly will be integrated in Bard and will create less friction and more synergies.

– Workspace: AI will soon be included in Google Slides and documents, upgrading Google’s Workspace.

– Google Search: Of course, Google Search cannot be left behind. There will be a new integrated AI response for what you are looking for, with possible follow up questions you might have.

Takeaway

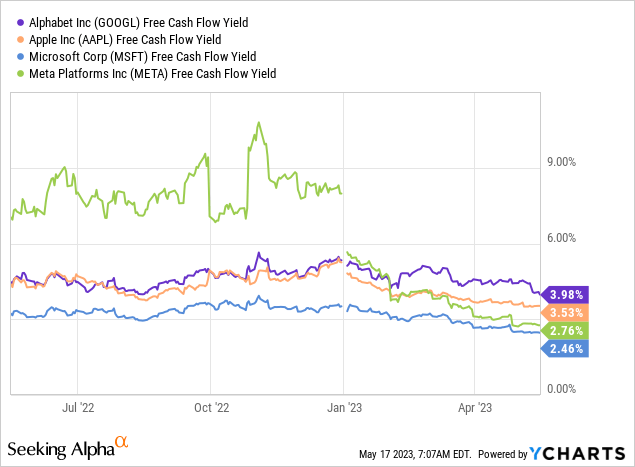

Alphabet is up 40% from the bottom in November 2022. The free cash flow yield has gone back down and is now closer to the other big tech companies. Therefore, I am downgrading the stock from ‘Strong Buy’ to ‘Hold’. While I do think Alphabet is going to do fine in both AI and integrating it properly in their core products. Valuation is something you will always have to keep in mind. In my latest article, you could buy Alphabet for a 5%+ free cash flow yield, which is obviously better than the 3.98% you are getting now. I am happy with the 11% allocation I have now and would only add more shares, when we see prices below $100 a share.

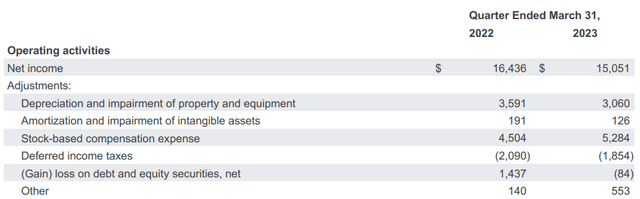

Nonetheless, in my opinion, Alphabet is still a solid investment, as the company did not show its full cost-efficiency yet. Stock-based compensation did still grow year-over-year, which is 30% of free cash flow. This has to go down so that investors can be properly rewarded by share buybacks. Once we see the impact of AI on top-line revenue combined with more cost-efficiency, then Alphabet will have more upside going forward. Obviously, looking for a pullback to jump in, seems better than joining the hype train now.

Be careful with replicating superinvestors, because they have done their purchases in the previous quarter at (most of the time) lower prices. Starting a position now can definitely have an impact on your performance.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG,GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.