Summary:

- Google’s Q1 2024 earnings exceeded analyst expectations, with revenue and operating income up 15% and 46% YoY, respectively.

- The company’s strong performance was driven by commercial acceleration in YouTube ads, Google Search, and Cloud.

- Looking towards the rest of 2024, I am bullish on Google’s ability to deliver on more upside, as the digital advertising market is recovering.

- Meanwhile, Google is seeing healthy momentum in the cloud business, which is growing at an approximately 25% YoY topline rate and increasingly becoming a key profit growth driver for the group.

- I am confident to reiterate my “Buy rating”; and on the backdrop of better-than expected earnings momentum, I raise my base case target price to $201/ share.

Ingus Kruklitis

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) stock intermittently surged as much as 15% in after-market trading, following the company’s release of the Q1 2024 report: In essence, Google pretty much smashed analyst consensus expectations on all metrics, including revenue and profit growth, as well as capital distribution. In the first quarter, Google’s revenue and operating income expanded 15% YoY and 46% YoY, as commercial momentum in Search and YouTube accelerated notably. Reflecting on Google’s Q1 results, I am confident to reiterate my “Buy rating”; and on the backdrop of better-than expected earnings momentum, I raise my base case target price to $201/ share.

For context: Google stock has strongly outperformed the broader U.S. stock market, YTD. Since the start of the year, Google shares are up approximately 23%, compared to a gain of about 7% for the S&P 500 (SP500).

Google Smashes Q1 Earnings

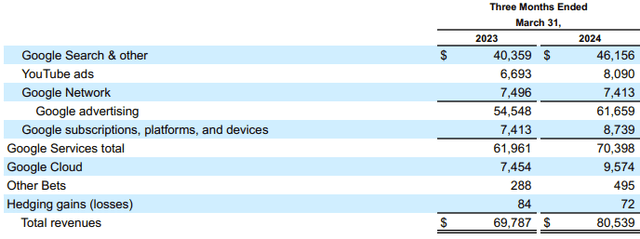

Google reported results for the first quarter of 2024 on Thursday, April 25th, smashing consensus estimates on both topline and earnings: During the period from January to the end of March, the world’s leading Search engine operator generated $80.5 billion in sales, marking a strong 15% YoY increase compared to the same period the previous year. This growth was propelled by a notable commercial acceleration in YouTube ads (up 21% YoY), Google Search (up 15% YOY, as well as Cloud (up 27% YoY). On a group view, Google’s Q1 2024 revenue surpassed analyst consensus estimates by approximately $1 billion, according to data collected by Refinitiv.

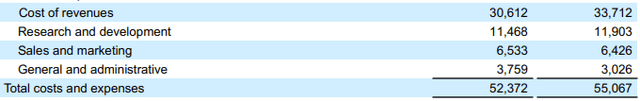

In terms of profitability, Google also delivered: In Q1, Google’s operating margin expanded by about 700 basis points, to 32% (vs. 25% for the same period in 2023). In dollar terms, operating income soared to $25.5 billion, reflecting a nearly 32% increase compared to Q1 2023. On that note, the expansion in profitability can be attributed to operating leverage, as higher topline was met by flattish operating costs: Sales and marketing expenses shrank by about 1-2% and General and administrative expenses dropped by about 19%, while Research and Development expenses increased by 4%.

After factoring in approximately $301 million in interest and tax expenses, Google reported a net income of $23.7 billion, translating to $1.91 per share, compared to $1.18 per share in the same period one year prior (up 62% YoY), and compared to $1.64 per share estimated by analysts to Refinitiv estimates data.

Google finished the quarter with a robust balance sheet, reporting $13.2 billion in financial long-term debt compared to $108 billion in cash and cash equivalents. The company’s quarterly free cash flow from operating activities amounted to $28.8 billion.

Expect More Upside In 2024

Looking ahead towards the rest of 2024, I remain bullish on Google’s commercial momentum. Specifically, I highlight the supportive tailwind of a broader recovery in advertising demand, as a resilient consumer paired with falling production costs (slowing inflation) opens room for richer sales and marketing investments: Based on discussions with seven market participants who hold discretionary spending authority over advertising budgets, primarily representing small and medium-sized enterprises (SMEs), I project that YoY advertising expenditure at a macro level in 2024 could potentially increase by 10-15%. This would likely translate into 15-20% YoY revenue growth for Google, as the Search giant is poised to take an out-sized share of the incremental ad-dollar market (together with Meta Platforms (META).

Moreover, Google has so far proven a good track record to chase opportunities in Cloud and GenAi: In Q1, Google’s Cloud business revenue rose to $9.6 billion, while operating earnings for the segment edged towards $1 billion. On that note, Google’s Cloud business is now of sufficient size to move the needle for Google also on fundamentals/ financials, not just narrative. On GenAi upside, Google CEO Sundar Pichai commented:

We are well under way with Gemini era and there’s great momentum across the company. Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation.

Similarly, Google CFO Ruth Porat commented in the conference call with analysts:

We are really excited about the benefit from AI for our cloud customers. [adding that] We saw an increasing contribution from our AI solutions.”

Zooming In On Google’s Attractive Shareholder Payouts

While Google is growing at a mid-teen YoY rate, the company is also a value play. Specifically, I point out that Google is distributing capital to investors at an increasing rate, supported by ample free cash flow and a centi-billion cash position on the balance sheet. Notably, in Q1 alone Google repurchased about $15.7 billion worth of its common shares, up from $14.6 billion in the same period one year prior (up close to 8% YoY). On an annualized basis, and compared to a $1.9 trillion market capitalization, Google’s pace of capital distribution suggests a greater than 3% yield. And there are highly encouraging signs that Google may step-up capital distributions further: together with Q1 results, management announced the approval of a fresh $70 billion buyback program. Moreover, Google also promised the first-quarter dividend of 20 cents per share amounts to nearly $2.5 billion. The company has announced its intention to continue paying quarterly cash dividends in the future. This move mirrors a similar action taken by Meta earlier this year and underscores a broader willingness among US tech companies to allocate a larger portion of their substantial cash reserves to investors (while still being able and committed to investing aggressively in business growth).

Valuation Update: Raise TP To $201/ Share

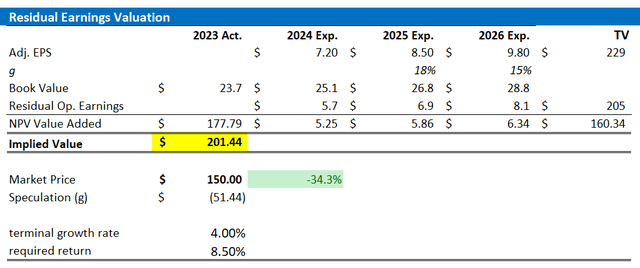

Following a better than expected start into 2024, I update my valuation assumptions for Google stock. Based on analyst consensus estimates collected by Refinitiv (+/- 10%), I now anticipate Google’s earnings per share for FY 2024 to fall within the range of $7.0 to $7.4 (non-GAAP), with projections of reaching $8.5 in FY 2025 and $9.8 in FY 2026. Beyond FY 2026, I maintain a view of approximately 4.0% compound annual growth rate in earnings, about 200 basis points higher than estimated nominal GDP growth and likely conservative. At the same time, I lower my cost of equity assumption by 50 basis points, to 8.5%, mostly as a reflection of a more accommodating interest rate environment. With these updates, I now assess the fair value of Google stock at $201, a significant increase from the previous estimate of $169, and notably higher than Google’s market trading price of approximately $172.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price more fundamental upside compared to my estimates.

Company Financials; Author’s EPS Estimates; Author’s Calculation

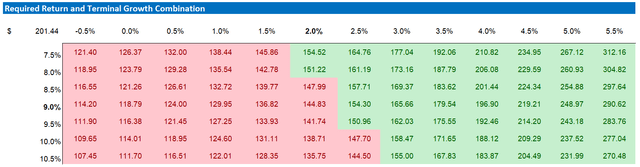

Below also the updated sensitivity table.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

Google’s stock surged above $2 trillion market cap, following the release of the company’s results for the first quarter 2024. The world’s leading Search giant exceeded analysts’ expectations across key performance metrics, with revenue and operating income for the first quarter up 15% YoY and 46% YoY, respectively, driven by strong performance in Search and YouTube. Looking towards the rest of 2024, I am bullish on Google’s ability to deliver on more upside, as the digital advertising market is recovering, and Google is poised to continue its historical strong track-record of taking an outsized share of incremental ad dollars. Meanwhile, Google is seeing healthy momentum in the cloud business, which is growing at an approximately 25% YoY topline rate and increasingly becoming a key profit growth driver for the group. Based on encouraging Q1 results, I am reaffirming my “Buy” rating for Google, and in light of the company’s earnings momentum exceeding expectations, I am raising my target price to $201 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.