Summary:

- Google’s revenue growth rates remain strong, with increases in YouTube, Cloud, and Search.

- Google’s Free Cash Flow is strong, but rising SBC costs should be monitored.

- Alphabet’s share buybacks and potential dividend growth rate offer positive prospects for shareholders.

Kenneth Cheung

The Alphabet Investment Thesis

Seeking Alpha

In my last article from January 2024, I wrote about how Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) seemed to be a bit slow in entering the AI era, as it looked like the competition had been able to gain small advantages. And I even thought that Google’s moat might be in danger.

However, the latest results seem to show that Alphabet’s execution was better than the market expected and market participants assumed. Therefore, I think that one should take another look at the updated situation to see if a rating upgrade would be appropriate based on the new situation.

Especially since expectations still seem to be relatively low and sentiment towards Google may be too negative. And at first glance, the disruption of Alphabet’s business model by generative AI that I feared at the time seems to have failed to materialize.

It’s only been a short time, but right now, I think it looks like Alphabet will be able to maintain its moat, so I want to update the thesis accordingly. Alphabet was a very fundamentally strong company at the time, but the threat to its search business led me to issue only a Hold rating at the time, which I now want to raise.

What’s Happened Since I Last Wrote About Google / Alphabet?

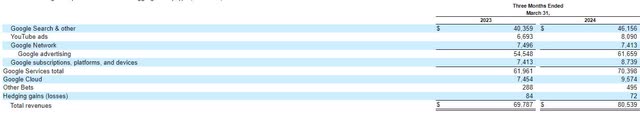

From an annual perspective, the revenue growth rates look fantastic for a company of this size. Year over year, YouTube revenues increased by 20%, Cloud by 28% and Search, which received a lot of criticism, by 14%. But if we compare the figures with those from my last article, the growth rates look somewhat different again. Google Network revenues, for example, were higher in the third quarter of 2022 and 2023 than they are now. At that time, they were already $7.8b and $7.6b.

And YouTube ads were already at $7.9b in the third quarter of last year. Now they are at $8.0b. That means that these two areas are growing a little bit slower if you take a step back from the year-over-year numbers and look at different quarters. But Google subscriptions, platforms and devices, which used to be listed under Google other, has a very strong growth rate, whether on a quarterly or annual basis.

But the growth in search, which is well above my expectations, is more than enough to offset the other areas. Without a continued competitive advantage, Alphabet would never have seen such rapid growth, even though the competitive situation is probably the toughest it has been in years.

And Google Cloud still has a $72.5b revenue backlog according to the latest 10-Q, half of which they expect to recognize in the next 24 months.

Plus the cloud customers can also look forward to many new innovations. Gemini 1.5 is now available for Google cloud customers and also the connection from Google Search to AI workloads from the cloud is possible. In addition, TPU v5p, the AI accelerator, achieves 4 times the computing power of previous generations.

And the AI agents also seem to help many people to work more productively and efficiently. Some of the real world applications are, for example, real time translations, smart chatbots that help with sales, as well as the skipping of repetitive activities that are automated.

The search experience also improved further in 2024. With Circle to search, you can now quickly search for something from images by simply tapping or circling. This, in conjunction with shopping ads, offers enormous potential for future growth.

So the incredible amount of data that Alphabet has, combined with AI, will enable highly personalized ads and search results in the future. Last time, I predicted that generative AI had great potential to change the search engine market, but I overestimated the short-term impact of OpenAI. For now, it looks like Alphabet will maintain its position if you look at the growth rates of Google Search, but there is still a chance that the competition will gain market share in the long run when the impact is really felt.

I continue to believe that generative AI will improve search results and that we will see strong development in the area of multimodal search, and that follow-up questions will become much more important. But Alphabet’s labs are constantly developing new features to make the search experience even more personalized.

And the criticism that the ad-free GPT alternatives would lead to a revenue decline at ad-dependent Google has so far not been borne out, so I have to give Alphabet credit for strong execution in recent months. But of course, the ad-free alternatives could also switch to an ad-based model in the future, since ads are a very lucrative business that they would not want to miss out on with a strong market position. Just look at the success of Alphabet and Meta (META) in recent years and their strong FCF.

Google’s Free Cash Flow

The Free Cash Flow forms the basis for the newly introduced quarterly dividend of $0.2 dollars and the share buybacks.

The levered FCF over the last 12 months is $55b, from which we deduct the SBC of just about $22b, giving us an SBC adjusted FCF of about $33b for the TTM.

If we now take the levered FCF from the 2022 financial year as a comparison and adjust these, we get the following values:

- Levered FCF: $50b

- SBC: $19b

- Adjusted FCF: $31b

This clearly shows that SBC costs have risen more sharply than FCF. Of course, the FCF are still incredibly strong, but the rising SBC costs should be monitored.

But since Alphabet only has LT debt of $13b, with an effective interest rate of 0.57% to 2.33%, and cash reserves of $108b, liquidity should remain very well secured. And the improvement in the operating margin from 25% to 32% is also a positive sign that FCF could continue to rise.

Therefore, I believe that Alphabet’s share buyback program and dividend are safe for the time being, assuming the search business remains in place for the near future.

Alphabet’s ROIC And Capital Allocation

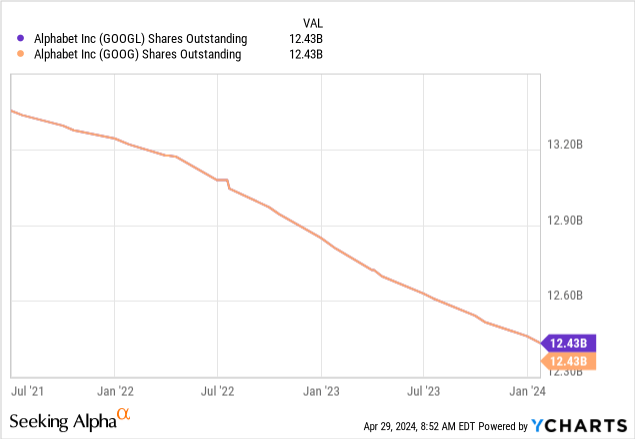

In my last article 3 months ago there were 12.52 billion shares outstanding, now that number has dropped further to 12.43 billion. In Q1 2024, 111 million shares were repurchased for just under $16.1B, leaving $20.4b outstanding from the old buyback program. Furthermore, a new $70b share repurchase program was imposed, which therefore increases the outstanding amount of the buyback programs to $90.4b.

A total of 111m shares were retired and of the $16.057b, $3.35b was used to buy back class A shares and $12.7 to buy back class C shares. And although Alphabet has relatively high SBC costs, the shares outstanding are falling continuously, which means that there is no longer any dilution of shareholders, as was sometimes the case in the past.

The combination of the share buybacks and a potentially strong double-digit dividend growth rate as well as the earnings growth, which will probably be in the range of 10% to 15% over the next few years, could give shareholders a lot to look forward to.

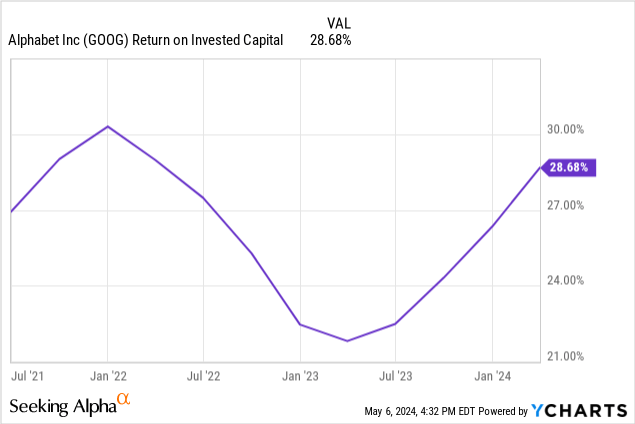

It is also very pleasing to see that ROIC, after the short hiatus in 2023, is almost back to its old peak. I think that is a very positive signal. While ROIC was also strong at just under 21% in early 2023, sometimes different standards apply to an outlier like Google, and a decline in ROIC like that can always be a sign of tough times ahead.

However, as returns on capital start to rise again, it is reasonable to assume that capital allocation has become more efficient again.

Google’s Valuation

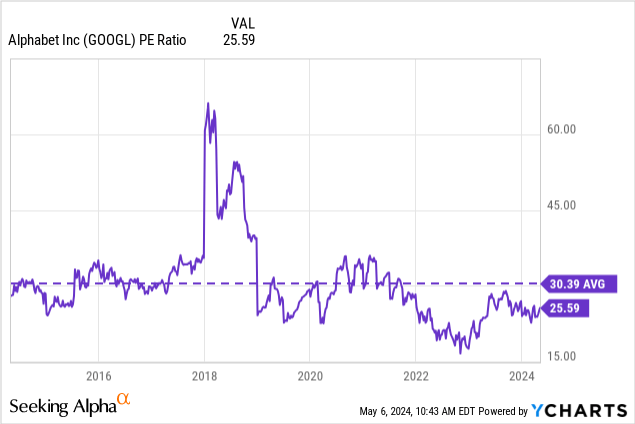

At the moment, Alphabet’s PE multiple is below the average, which could mean an undervaluation, but of course, you have to bear in mind that the outliers in 2018 distort the average.

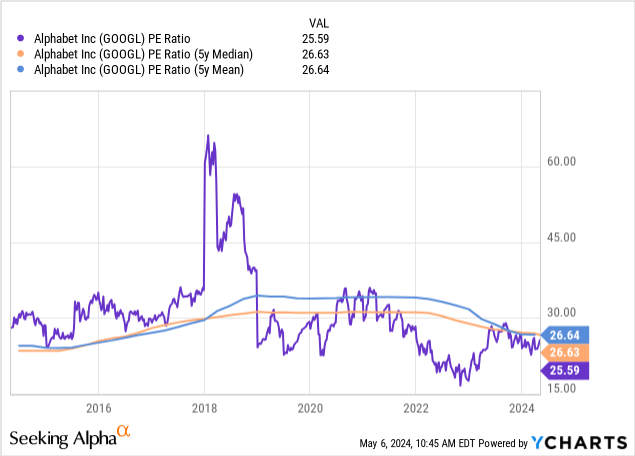

Looking at the mean and median, Alphabet is still slightly below, but the difference is no longer as significant. Therefore, we should also look at a reverse DCF to see what the market is currently pricing in for Google.

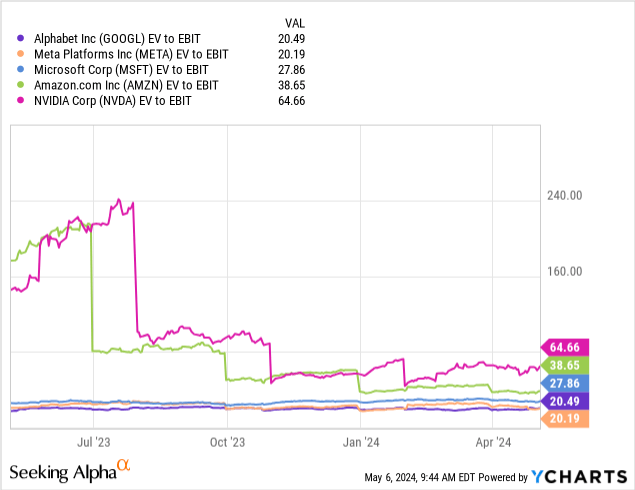

Assuming that the market is mostly correct in its assessment, Alphabet and Meta Platforms Inc have the most uncertainty and the least potential, as the market gives them the smallest multiple of the peer group.

However, I disagree with this assumption because I think Meta Platforms Inc has a lot of potential, but also the negative sentiment towards Alphabet could be exaggerated if we look at the good results of the last quarter. Of course, artificial intelligence will change search behavior, but Alphabet seems well on its way to continuing to play an important role.

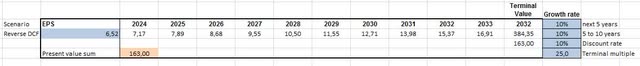

Reverse DCF Google

Basis: diluted EPS TTM of $6.52

Over the next 10 years, the market is currently pricing in a diluted EPS CAGR of only 10%. However, the historical diluted EPS growth rates are as follows:

- 3Y: 20.20%

- 5Y: 26.73%

- 10Y: 21.24%

This means that Alphabet has historically performed much better than the market predicts for the future. So if Alphabet continues to perform well, it may indicate that market sentiment is too negative and that Google may be undervalued. And in my last article, the market was pricing in an 11% growth rate, so the strong results have led to a lower priced in growth rate than a few months ago, even though the stock has become more expensive.

I think the fast-growing, albeit lower-margin, cloud business will continue to drive EPS growth. And if there are any upside surprises as the cloud business delivers better than expected margins, that would make this a slightly conservative EPS growth estimate. And if the search business really does not suffer major market losses and is able to defend its competitive advantage, then growth rates in the 20% range are not entirely unrealistic, historically speaking, because the search business simply has incredibly high margins.

Conclusion

I understand that the market, given the situation with artificial intelligence and the changes in search engines, thinks that a lower multiple than peers is appropriate. Because normally the markets are relatively efficient in terms of valuing large companies because there are so many research firms and banks covering them.

And the fact that the fast-growing cloud business is unlikely to achieve the fantastic margins of the search business should also play a role, but Alphabet is probably a great company at a fair price right now. And a lot of people are looking for that.

After a strong last quarter, I see Alphabet in a more positive light than I did a quarter ago, both in terms of the search business and the innovation that Alphabet has unveiled in that space. Since Alphabet seems to be able to defend its competitive advantage, as we can see from the growth rates, my opinion on its importance has changed. Perhaps I underestimated Alphabet’s capabilities and got caught up in the negative sentiment against Alphabet.

But in my opinion, it will be still crucial to see how cloud margins and search market share perform. I think these two metrics should be watched closely to see if Alphabet maintains its moat or if it comes under attack.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.