Summary:

- Alphabet’s operating leverage is on the way up, but free cash flow generation looks poised to decrease in the second half of the year.

- While Google’s P/E valuations are no longer cheap, the sturdy nature of its earnings growth through FY25 (19% CAGR) should not be dismissed.

- Bullish momentum appears to have come off and the stock has entered an old congestion zone.

- We are revising our rating from a BUY to a HOLD.

Justin Sullivan

Introduction

At the start of the year, we had presented the case for Alphabet, Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) as a potential long play. Having locked in a solid chunk of returns over the first three quarters of the year, we thought it would be a good time to revisit the stock and review things once again. Here are our big-picture thoughts on Google as we enter the final quarter of the year.

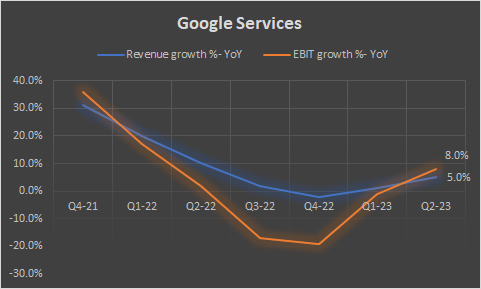

First Signs Of Operating Leverage In A Long Time, But FCF Generation May Ebb

Over the last 12 months or so, Alphabet’s C-Suite has been talking of their desire to bring through superior operating leverage in their core division, and for the first time, in a long time, they were able to facilitate that, with the segment EBIT growth exceeding revenue growth by +300bps. To see the last time, Google Services’ (92% of group revenue, and the only positive contributor to group EBIT) EBIT growth exceeded the segment’s revenue growth, one needs to go back around six quarters to Q4-21.

Earnings Calls

Looking ahead, we think the topline growth should continue to convalesce at an encouraging pace, firstly because the base effect over the next three quarters will be rather low (+2%, -2%, and +1%). But even without the aid of the base effect, there’s still a decent amount of momentum seen in certain verticals which should abet the overall performance.

Take for instance, what’s happening in the retail segment (the biggest contributor of growth for the segment), where a growing cohort of retailers are fast signing up for Google’s expertise. With the crucial holiday season upon us, and consumer conditions not perhaps in the most resilient state, retailers will be very keen to extract maximum ROI on the advertising front.

Regarding this theme, we’d like to mainly highlight the impact of Performance Max, which can help drive tremendous value from a single ad campaign. Basically, the tool leverages various Google AI technologies and helps optimize ad performance across the best combination of inventory on the Google network (encompassing YouTube, Search, Gmail, etc.) to help drive retail conversion and footfalls. Results have shown that clients who tap Performance Max have seen a 13% increase (on average) in incremental conversions. One shouldn’t also underestimate the impact of this tool to drive increased footfalls for retailers when local searches are on the way up.

On the EBIT growth front, we think the company could continue to engender improvements. The pace of hiring has continued to drop, even as the company trims its overall real estate infrastructure. A better pricing landscape with YouTube Premium and YouTube Music (prices were hiked by 17% for the former, and 10% for the latter) should also ensure a better drop-through at the EBIT level. However, on the flip side, investors should also note that the steep appreciation of the dollar all through Q3 (up by 2.5% in the quarter) will likely leave an adverse mark on the company’s expense base, given that the bulk of the company’s R&D is based domestically.

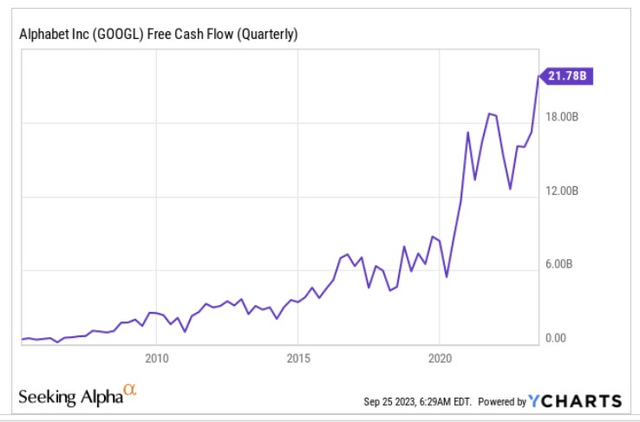

Then, it’s also worth noting that Google’s FCF performance which has been quite stellar of late (the FCF is currently at record highs of close to $22bn) will almost certainly take a hit in H2, due to a few reasons.

Firstly, the company had pushed out certain tax payments which will need to be paid up in Q4, and there will be a marked step-up in the group CAPEX in H2 (which could persist even in H1-24), primarily related to higher technical infrastructure costs.

Just to get a sense of how steep this could be, note that H1 capex came in at just a little over $13bn, whereas last year’s FY CAPEX was $31.4bn. Now, on the earnings call, management confirmed that CAPEX for the whole of FY24 could be higher than what was seen last year, which means you could be looking at sequential growth in the CAPEX of at least 40% between H1 and H2.

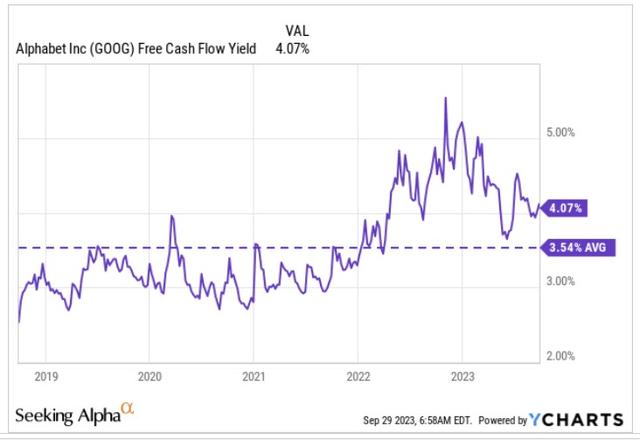

Thus, even though GOOG’s stock may be currently offering an FCF yield that is 50bps higher than its long-term average, there’s a high chance this comes off quite significantly in the quarters ahead.

P/E Valuations Are No Longer Cheap, But The Medium-Term Earnings Growth Runway Is Still Attractive

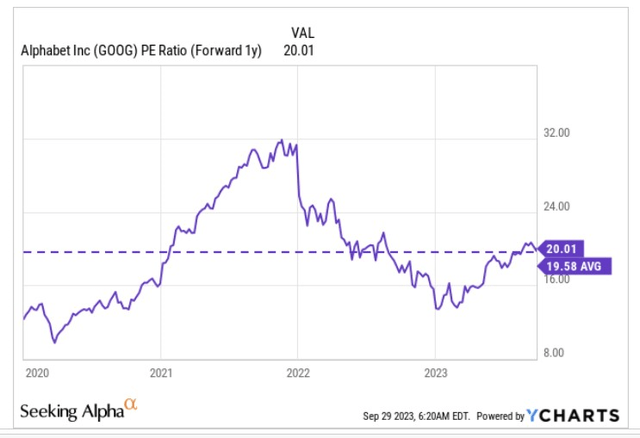

The last time we covered Google, the stock could be picked up at close to a -40% discount relative to its forward P/E 5-year average multiple. That narrative is no longer in play with the stock now trading at a +2% premium over its long-term average.

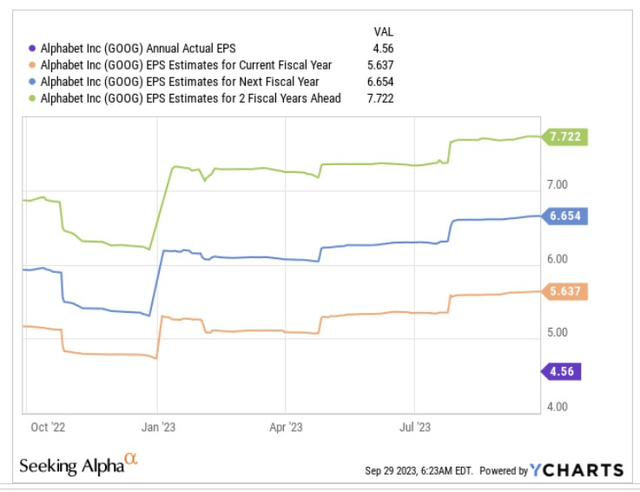

For value-conscious investors, the lack of a sizeable discount may be off-putting, but if you’re looking for silver linings, do also consider that you’ll still be getting some pretty solid earnings growth potential over the next two years. Based on consensus expectations over the next few years, you’re essentially staring at a business that is poised to deliver 19% earnings CAGR through FY25 (FY22-FY25). For context, earnings growth during this period would come in at almost 2x the expected pace of revenue growth (10% CAGR between FY22-FY25)

Bullish Momentum Fizzles Out

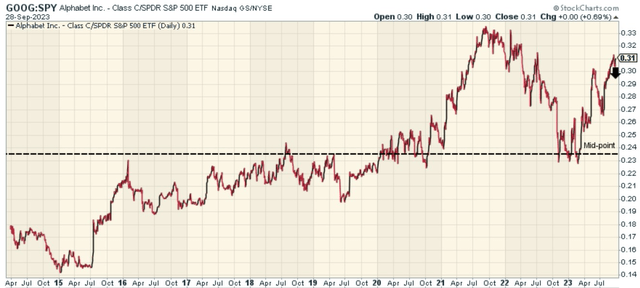

The chart below highlights how GOOG’s stock is positioned relative to the broader markets; the relative strength ratio in regard to its long-term range can help identify suitable rotational opportunities within the S&P 500. At the start of the year, things looked fair with the ratio having mean-reverted to the mid-point of its range, but in recent months, this ratio has spiked once again to rather elevated levels, dampening GOOG’s allure as a long play.

Then on Google’s own chart, there are some interesting developments taking place. After forming a bottom in late 2022/early 2023, the stock had made a smart V-shaped recovery. Bullish interest was also validated in the manner in which it had respected an upward-sloping trendline until last week, where we saw a strong red-bodied candle break through the trendline.

Now, this may very well end up being just a false breakdown, and time will tell. Also note that even though we’ve had a trendline break, the series of higher lows and higher highs still continues to persist. For that to come to an end, GOOG would need to break and close below the $127 mark (red line) on a weekly basis.

Even if this does not come to fruition, and GOOG continues to recoup its old trendline, we still think that the stock may struggle to make decisive one-way moves to the upside, as it is now in the midst of a congestion zone. Note the area highlighted in yellow, in H2-21/early 2022, where the stock just chopped around within the $125-$150 range, and failed to make any headway. Don’t be surprised to find the stock range bound within this terrain.

Closing Thoughts

To conclude, our overall take is that fundamentally, Google is in a better place than where we last found it at the start of the year, but considering the potentially lower cadence of FCF, the premium valuation, and the recent price action, we are revising our rating from a BUY to a HOLD.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.