Summary:

- Google stock has been getting downgraded due to “AI transition risks.”

- In particular, some analysts think that the company’s new AI Overviews will reduce Search revenue.

- Google Cloud is one of the most obvious businesses for monetizing AI, as it creates an opportunity to “rent” AI servers to clients.

- Google has moats in search, long-form video and smartphone operating systems.

- The stock is worth the investment in a discounted cash flow model, assuming only moderate levels of growth.

igoriss

Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) has been getting bearish coverage from analysts due to its perceived weakness in generative artificial intelligence (“AI”). Most recently, Rosenblatt analyst Bruce Crockett downgraded the stock due to the “transitionally negative” revenue impact of AI overviews. Shortly before that, downgrades were observed at Wedbush, Seeking Alpha Quant, and elsewhere. In addition to the “transitionally negative revenue impact,” Crockett also touched on search share loss to Microsoft’s (MSFT) Bing, and advertising share loss to retail media networks.

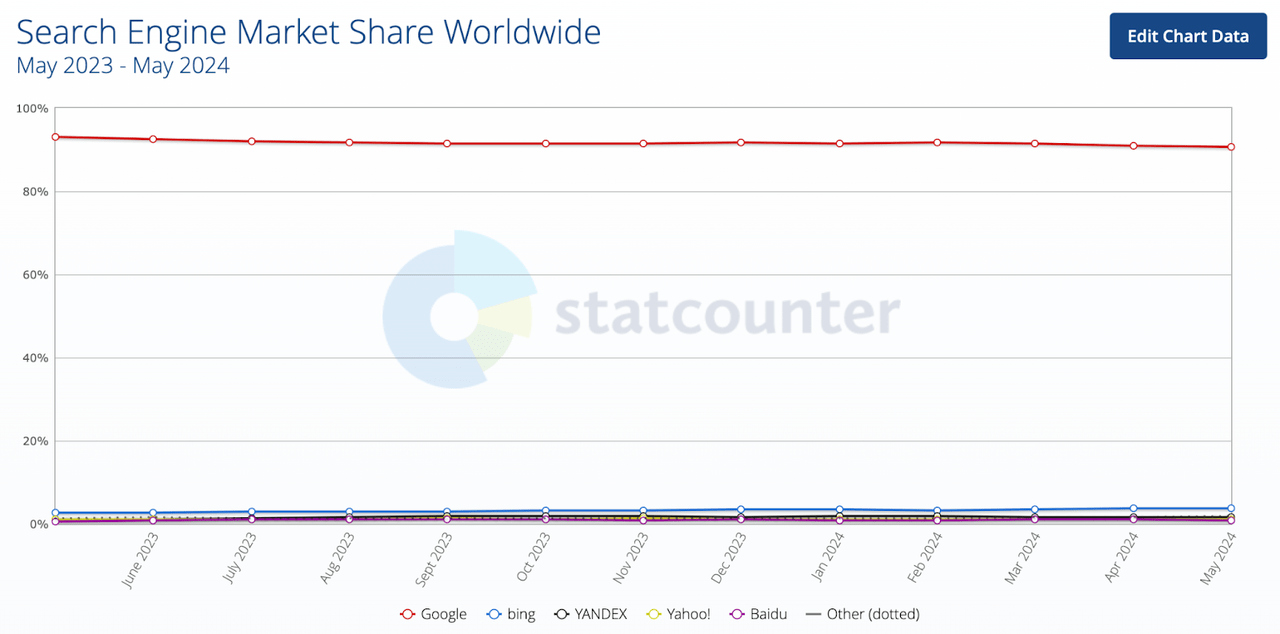

Although most analysts are presently bullish on Google, the views expressed in Crockett’s note are not uncommon. Namely, that the stock is good going by historical financials, but that its competitive position is deteriorating in a way that will prevent such numbers from being repeated in the future. Such views have some merit to them; for example, Google’s Search Market share has, in fact, been declining over time (albeit at a very slow pace).

Google Search Market Share (Statista)

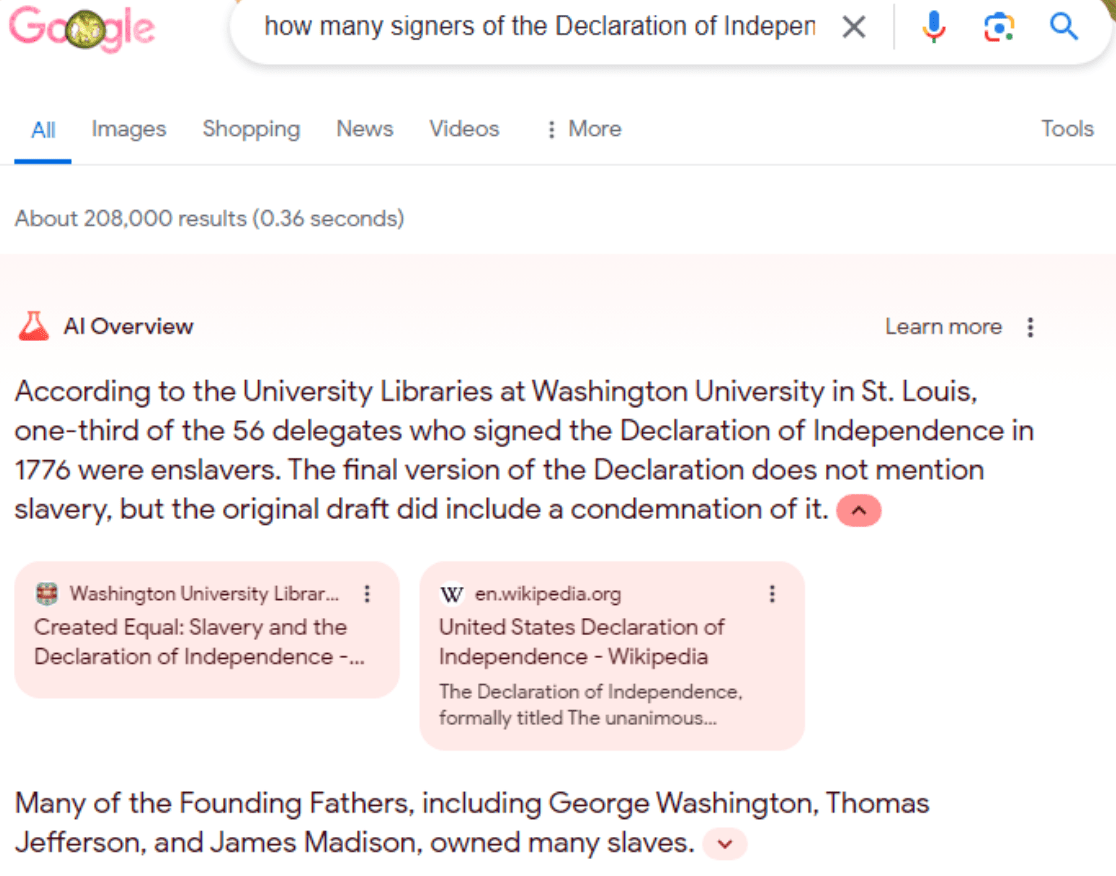

Also, concerns about a negative revenue impact from AI aren’t unwarranted. If you consider Crockett’s claim that AI overviews will cost Alphabet some revenue temporarily, you’ll see that it has some merit. The way Google’s AI overviews work now is these overviews are displayed where ads traditionally were (right beneath the search bar), which means that they compete with ads for screen real estate. So the overviews might, in fact, result in fewer ads being clicked, and lesser revenue.

Google AI overview (Google)

The above are valid reasons to think that Alphabet stock is due for a correction. The stock’s valuation is historically high, scoring an ‘F’ in Seeking Alpha Quant. Furthermore, the company faces competitive threats that it didn’t face in years past. All of these factors suggest that Google’s core search business could suffer shrinking margins in the years ahead.

However, there are other reasons to think that Google will thrive in the years ahead. The company is an AI leader, it owns YouTube and the Play store, and its cloud services business is one of the world’s fastest growing. Although the majority of the company’s revenue has historically come from search, that needn’t be the case forever. Other segments are growing more rapidly; some of them are growing as rapidly as true growth companies. These segments could provide the fuel needed for more gains going forward. Accordingly, I consider Google stock a great value today, despite all of the risks it faces.

When I last covered Google, I rated the stock a buy for reasons similar to those outlined above: it was relatively cheap for a big tech company, had a strong competitive position as well as high growth. Those reasons still stand. However, having used some of Google’s newer AI tools myself, I now believe that Google is more an opportunity for Google than a risk in the long run. Accordingly, I am upgrading my rating to ‘strong buy.’

Google’s AI Opportunity

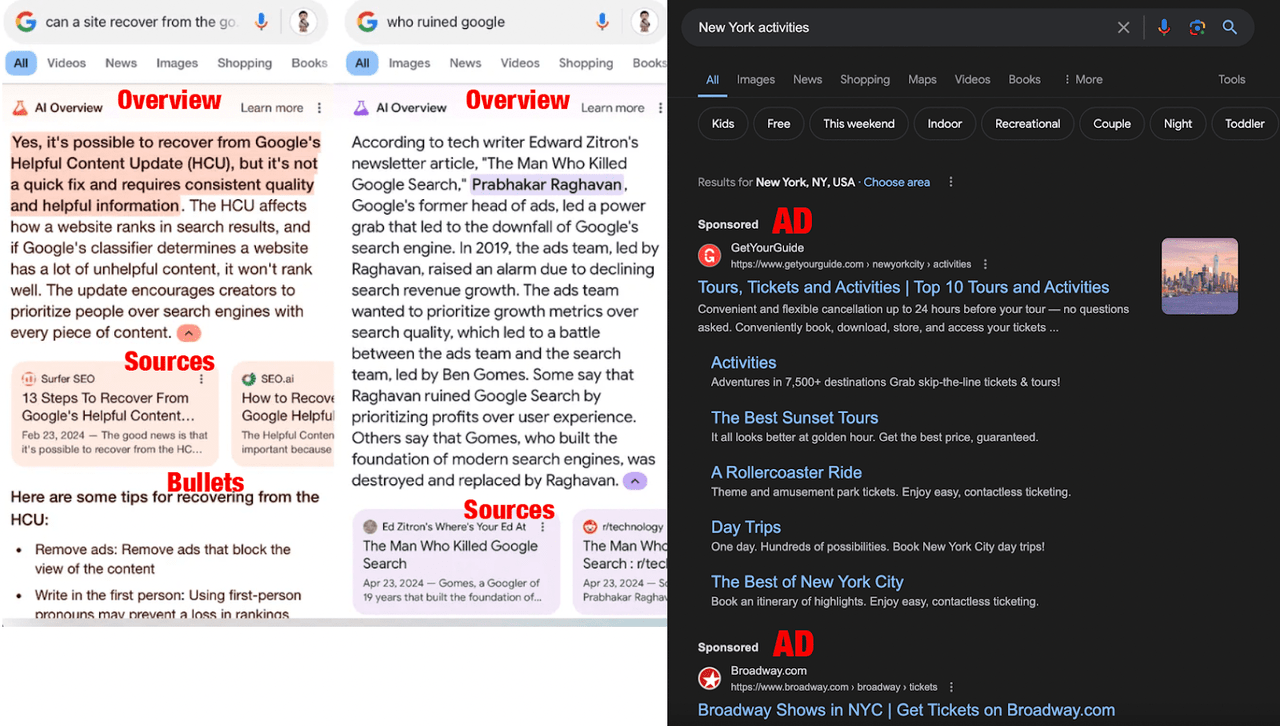

One of the main criticisms of Google in the Rosenblatt note mentioned at the beginning of this article is the fact that AI overviews will reduce Search revenue in the near term. This is probably correct, as the image below illustrates. On the left are two of the new AI-powered search results, and on the right are traditional results. In the AI-powered search results, the AI overviews crowd out screen real estate that would normally be reserved for showing ads. As you can see, the “traditional” search results have ads immediately below the search bar and “above the fold.” The AI-powered search, on the other hand, features AI overviews and their sources, with no ads visible “above the fold.”

AI Google vs Old Google (Google, with annotations by the author)

Despite the fact that AI search overviews are crowding out ads presently, it appears likely that such overviews will be a positive rather than a negative for shareholders in the long run.

First, as Microsoft showed with Bing, it is possible to embed ads within AI-written content.

Second, Google is more than just search. Although Search is 57% of Google’s revenue mix, the percentage has been trending downward over time. YouTube ads grew at 60% and the Cloud grew at 28% last quarter, while Search grew at 15% year-over-year. These facts imply that YouTube and the Cloud are going to be a bigger percentage of Google in the future than they are today.

Third, a “temporary headwind to revenue” is not the same thing as an existential threat. If stocks are valued as the discounted value of their cash flows over their entire lifetimes, then temporary revenue headwinds are not fatal. A single quarter of $0 profit does not much change the value of a multi decades-lasting cash flow starting at a billion dollars per year, compared to if the profit track record were uninterrupted.

Fourth and finally, AI is overall more of a tailwind for Google than a headwind. Google is one of the world’ leading artificial intelligence (“AI”) companies. Having invented the transformer method that made ChatGPT such a smash hit, it was pivotal in the development of modern AI. This heritage means that AI has deep roots at Google.

To be sure, Google has attracted some criticism for how it has handled consumer-facing AI. This year, some of Gemini’s output featured egregiously incorrect depictions of people and things. When examples of such output were posted to social media, they generated a firestorm of controversy, ultimately culminating in Google apologizing for Gemini’s errors.

Such concerns have been with us for a while. When ChatGPT first launched, commenters speculated that it would “kill” Google Search. Later, when it turned out that ChatGPT didn’t kill Google search, the company again found itself embroiled in controversy when its own chatbot delivered inaccurate results.

It all looked pretty grim for Google for a while. More recently, things turned around. First, the company announced AI enhancements for search, which included AI-powered search summaries. These were well received–much better than Gemini was. Second, the company put out a series of good earnings releases, such as its first quarter 2024 release, which easily surpassed analyst expectations. These two factors came together to massively improve sentiment toward Google, which has outperformed the S&P 500 year-to-date.

Despite Gemini’s lukewarm reception, Google is one of the best positioned companies in the AI arms race. It has seven products with over a billion users each; a massive captive audience to push its AI offerings to. It has many capable AI engineers. It has a number of AI patents that can be used to protect its moat. So, Google has many cards up its sleeve.

How Google will Make Money With AI

There are several ways for Google to make money with AI, including:

-

Continuance of what it’s already been doing. Google is already realizing efficiency gains by incorporating AI into YouTube. One way YouTube uses AI is in content moderation. Google’s AI can identify violating content with surprisingly high accuracy and take it down. In 2023, Google cut costs aggressively, largely in YouTube content moderation teams. There was no apparent hit to revenue. In fact, revenue increased in the first quarter of 2024. The fact that efficiency improved after the spending cut is a testament to the efficiency boosting power of AI. Similar gains may be seen in other areas of Google’s business after AI is better integrated into them.

-

Selling AI servers. Google is already offering access to NVIDIA-based servers as a selling point to Google Cloud users. Google Cloud is a revenue generating, EBIT-profitable business unit, and a powerful use case like this one could drive revenue growth, possibly even acceleration.

-

Better integrating AI into search. Although Rosenblatt called AI overviews a “temporary headwind” to Google Search, the same feature could also drive revenue in the future, namely through embedded ads. They could also help retain users if implemented well. So, a good implementation of Search AI could help shore up Google’s competitive position.

Valuation

Using the following assumptions, I built a simple discounted cash flow model for Google:

- The next five year’s revenue growth rate will be 10% CAGR, as Google’s scale will probably bring some deceleration from the previous 10-year rate (18.56%).

-

COGs will increase at the same pace as revenue.

-

Operating expenses, which grew at 13.6% CAGR over the last 10 years, will decelerate to 10% growth in the next five years thanks to AI efficiency gains.

-

Net interest expense will remain near $3.8 billion, as the company does not have a pressing need to borrow money.

-

The share count will continue declining at 0.85% per year, which is the historical rate.

-

Taxes will be 15% of EBT.

These assumptions yielded the model below:

|

TTM |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

REV |

318146 |

349960.6 |

384956.6 |

423452.3 |

465797.5 |

512377.3 |

|

COGS |

135319 |

148850.9 |

163735.9 |

180109.5 |

198120.5 |

217932.6 |

|

OPERATING COSTS |

85828 |

94410.8 |

103851.8 |

114237 |

125660.7 |

138226.8 |

|

INTEREST |

3807 |

3807 |

3807 |

3807 |

3807 |

3807 |

|

EBT |

93192 |

102891.9 |

113561.7 |

125298.7 |

138209.2 |

152410.8 |

|

NET INCOME |

13979 |

15433.7 |

17034.2 |

18794.8 |

20731.3 |

22861.6 |

|

TAX |

79213 |

87458.1 |

96527.5 |

106503.8 |

117477.8 |

129549.2 |

|

SHARES OUTSTANDING |

12648 |

12540.5 |

12433.8 |

12328.2 |

12223.0 |

12119.5 |

|

EPS |

$6.26 |

$6.9 |

$7.7 |

$8.6 |

$9.6 |

$10.6 |

Note that the TTM figures differ from the actuals because this model ignores currency fluctuations, to keep everything understandable.

Basically, what we’ve got here is EPS growing from $6.25 to $10.69 in five years. This is an 11.3% CAGR growth rate. The cash flows, discounted at 8%, are worth $34.31. If the cash flows grow for one more year at 11.3% before levelling off to a 5% steady state growth rate, then we get a “terminal year cash flow” of $11.89. The value of that cash flow in year 5 is $396. The present value of the terminal value is $223. Adding the discrete forecast plus the terminal value together gives an approximate $258 fair value estimate. That’s 41% upside to today’s price. So, Google appears to be worth the investment.

Conclusion

Is Google’s AI implementation going to cause the company to experience near-term revenue weakness? It’s possible, but not a foregone conclusion. AI overviews taking up valuable screen real estate certainly reduces search ad load, but Google has so many businesses that slight weakness in search could be made up for elsewhere in the business. If we assume only moderate top line growth and reasonable cost discipline, then GOOG stock is worth the investment. So, I plan to continue holding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.