Summary:

- My previous bearish call on Google has aged well, with the stock losing around 14% of its value since July 10.

- I still believe that Google struggles to compete in the generative AI space, but this does not spell the end for the company.

- The stock appears to be a compelling opportunity ahead of the Q3 earnings release, supported by a strong mix of catalysts.

400tmax/iStock Unreleased via Getty Images

Investment thesis

My previous bearish thesis about Google (NASDAQ:GOOGL) aged well as the stock has lost around 14% of its value since July 10. I still believe that Google significantly lags behind competitors in its generative AI offerings, which I covered in my previous call. I do not want to cover generative AI once again today because I believe that the picture did not change much since then.

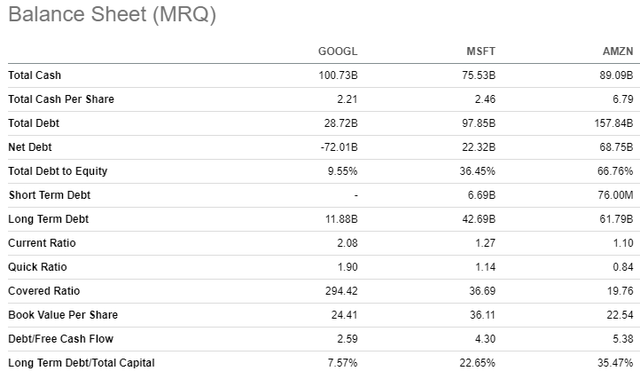

Despite this secular issue, I want to upgrade the stock to ‘Buy’ before the upcoming earnings release. The valuation is quite attractive after the recent dip, and the technical setup is quite bullish. Moreover, the stock’s seasonality trends suggest that investors typically respond positively to Q3 earnings. Let us also not forget the fundamentals. While there are questions about Google’s generative AI offerings ability to compete with OpenAI’s ChatGPT, Google is financially much stronger than Amazon (AMZN) and Microsoft (MSFT), and recent partnerships by Google Cloud look promising for closing the gap in cloud. I am also optimistic about YouTube’s recent expansion into the large Southeast Asian e-commerce market. Therefore, there are solid reasons to be optimistic before Google’s upcoming earnings release.

Recent developments

The latest quarterly earnings were released on July 23 when the company surpassed consensus estimates. Revenue growth accelerated to 15.4% on a YoY basis, and the adjusted EPS expanded from $1.44 to $1.89.

Seeking Alpha

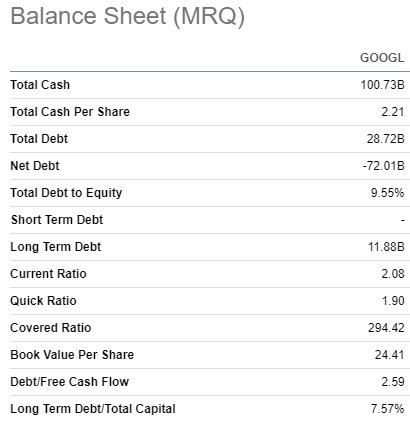

Google’s operating leverage is solid as the company delivered a solid expansion in both gross and operating margins in Q2. The levered free cash flow [FCF] in Q2 was also solid at around $10 billion. As a result, Google’s financial position remains among one of the strongest among technological giants with $100 billion in cash and only $29 billion in total debt. Such a financial position makes Google extremely firmly positioned to aggressively invest in growth.

Seeking Alpha

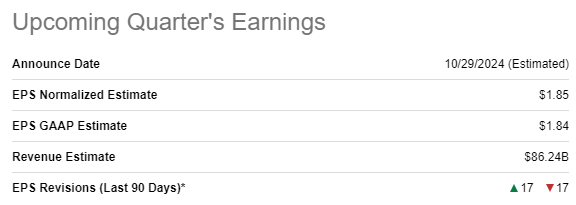

Let me proceed with delving into the upcoming earnings preview. The release of Q3 earnings is scheduled for October 29. Wall Street analysts expect Q3 revenue to be $86.2 billion, which will be around 12.4% higher compared to the same period of 2023. The adjusted EPS is expected to outpace revenue growth in Q3 with a 19% YoY growth. The setup is quite bullish, but the only drawback is that Wall Street’s sentiment appears mixed, with an equal number of downward and upward EPS revisions over the last 90 days.

Seeking Alpha

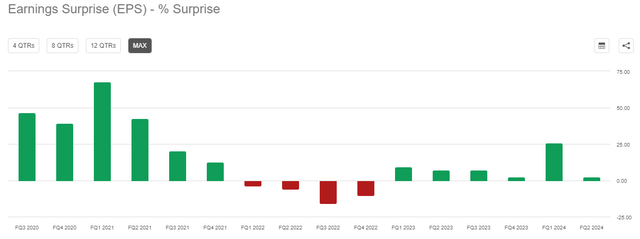

From the perspective of earnings surprise history, Google has been quite strong over the last six quarters with revenue and EPS beats. On the other hand, the last EPS surprise was quite narrow.

Seeking Alpha

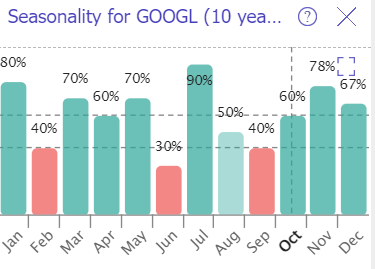

Historical seasonality patterns demonstrated by the stock over the past decade are also a bullish factor. According to the bar chart from TrendSpider below, November is historically one of the most successful months for GOOGL. Since the company typically reports its Q3 earnings in late October, the market usually absorbs this quarter’s earnings release quite optimistically.

TrendSpider

If we speak about the business itself, developments look quite positive. The fierce race involving Google, Microsoft, and Amazon in the cloud business is still going. Google Cloud appears to be in the “pedal-to-the-metal” mode as the company has announced several notable partnerships over the last few days.

For example, one of the partnerships is with Honeywell (HON), one of the world’s largest players in industrial technology and aerospace. The partnership aims to leverage AI capabilities to drive operational productivity, reduce maintenance costs, and upskill employees. The penetration of AI in the industrial sector is quite low, meaning that securing partnership with such a prominent player as Honeywell puts Google in a pole position in this promising niche. According to Market Research Future, the industrial AI market is expected to compound with a strong 46% CAGR by 2032.

Another promising partnership of Google Cloud is with a Norwegian telecom giant Telenor Group (OTCQX:TELNF). The partnership aims to accelerate Telenor’s digital transformation. Telenor is one of the world’s most technologically advanced telecommunications company and selecting Google as its partner to accelerate digital transformation speaks a lot about Google Cloud’s quality.

Seeking Alpha

All three cloud giants continue announcing new large investments in data centers almost every week. From the financial position perspective, Google is much better positioned to win this data center spending battle. The company’s net cash position is $94 billion ahead of Microsoft, and $141 billion stronger compared to Amazon.

Another promising development is YouTube’s expanding presence in e-commerce after it started partnership with Shopee, one of the leading online shopping platforms in Southeast Asia and Taiwan. The initiative will expand into Thailand and Vietnam. The total population of these two counties is around 170 million with the cumulative GDP of above $900 billion. That said, YouTube has expanded into quite a promising market.

Valuation update

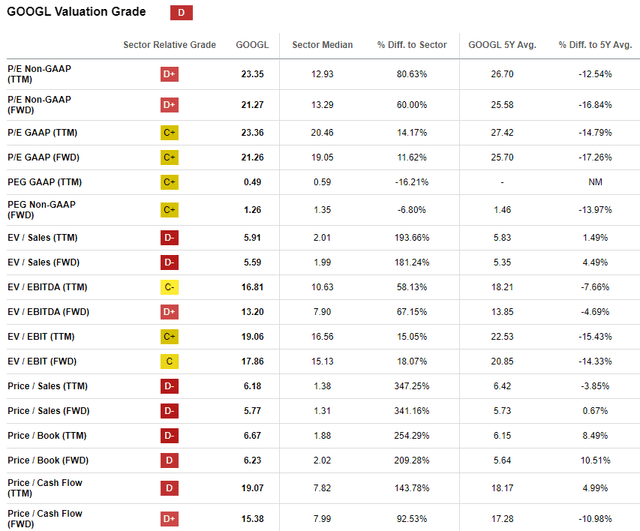

GOOGL has gained approximately 17% over the last 12 months, lagging significantly behind the broader U.S. stock market. Its YTD performance is closer to the broader market, yet still trails, with a 16% increase in share value so far in 2024. Despite receiving a low ‘D’ valuation grade from Seeking Alpha Quant, I cannot say that Google’s multiples are high, particularly when compared to historical averages. The contraction in the forward P/E ratio also appears quite aggressive, which is favorable for investors.

Seeking Alpha

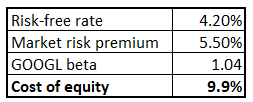

As usual, I proceed with the DCF model. We saw above that Google’s debt is very low compared to the company’s scale. Therefore, I choose cost of equity as a discount rate instead of WACC. The below calculation relying on the CAPM formula suggests that Google’s cost of equity is 9.9%.

Author’s calculations

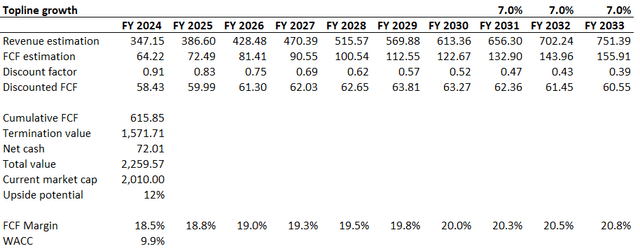

If readers examine GOOGL’s revenue consensus estimates, they will notice that only one analyst covers the company’s revenue projections beyond FY2030. This seems insufficient to me. Therefore, in my DCF model, I combine consensus projections for FY2024-2030 and apply a 7% revenue CAGR for the years beyond FY2030. The latter is my personal judgment, but as long as the combination of consensus and my judgment results in a conservative 9% revenue CAGR for the next decade, I am comfortable. Google’s average levered FCF margin for the last five years was 18.5%. This is higher than the TTM level, but I use it as a base-year assumption. To balance it out, I incorporate a very conservative 25 basis points yearly FCF expansion.

Author’s calculations

My DCF model suggests that GOOGL’s fair value is around $2.3 trillion. This is around 12% higher compared to the current market cap of $2 trillion. Therefore, the stock looks quite attractively valued prior to the upcoming earnings release.

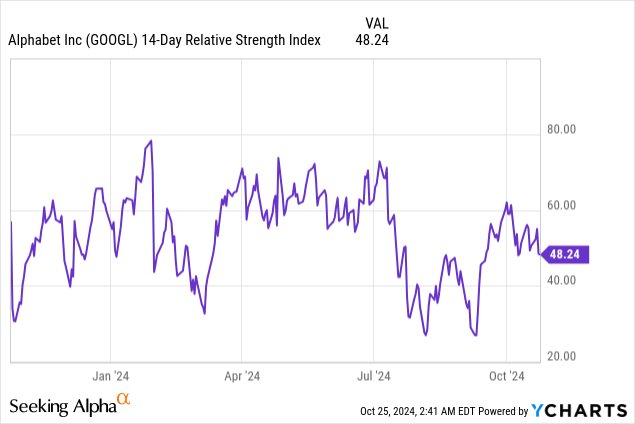

In addition to attractive valuation, GOOGL’s technical setup looks quite bullish with a below-50 RSI indicator.

Risks to my rating upgrade

Assigning ratings to stocks before earnings releases is inherently risky because the market’s reaction is unpredictable. A company might exceed earnings estimates, but the stock could fall if investors anticipated a larger positive surprise. Conversely, a stock might rally even if the company misses a metric, such as revenue or EPS. Consequently, there is always a risk that the stock’s movement post-earnings release may contradict my rating.

Political and geopolitical factors are also crucial, adding another thick layer of uncertainty. The U.S. presidential elections are approaching, and it is difficult to determine which candidate will be more beneficial for the U.S. technology sector. Geopolitical developments involving large oil exporters like Russia and Iran significantly affect market sentiment regarding energy prices. We all saw how crude oil prices skyrocketed in 2022, leading to a spike in U.S. inflation and forcing the Fed to start aggressively increasing interest rates. A new shock in oil markets could prompt the Fed to reconsider its plans to cut rates further, potentially leading to a new selloff in growth stocks, similar to what we saw in 2022.

Bottom line

Google’s fundamentals are solid, despite questions about its ability to compete with OpenAI’s ChatGPT. The mix of factors looks quite bullish before the earnings release, including notable undervaluation, a low RSI indicator, and recent promising partnerships.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.