Summary:

- The DoJ’s allegations against Alphabet’s Chrome monopoly are weak; users prefer Google services by choice, not compulsion, and Alphabet’s legal team is well-prepared.

- Alphabet’s growth remains strong, with Q3 revenues up 15% and Cloud revenues up 35%, showing significant potential for future profitability.

- Subscriptions like YouTube Music and Premium are growing, providing stable, high-quality revenue streams that enhance Alphabet’s financial stability.

- At $165 per share, Alphabet is a reasonable buy; at $150, it becomes a highly attractive investment opportunity.

Ariel Skelley

I had been regretting not increasing my position in Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) for weeks when it was trading at $150, but I think the DoJ wants to give me a second chance. Recent allegations regarding Google Chrome’s monopoly are creating panic among Alphabet investors, but I am not worried about any of that and in this article I explain why.

Analysis of the allegation

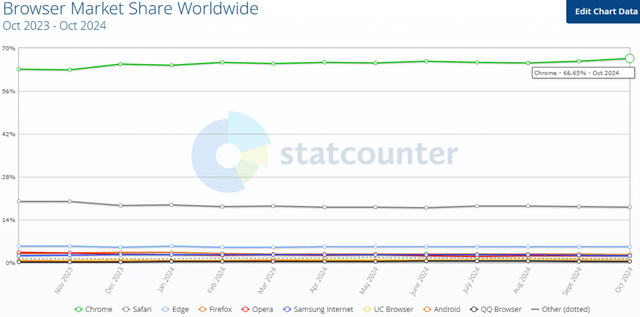

The U.S. Department of Justice has recommended that Alphabet required to divest Chrome, which is by far the world’s most popular web browser. Its market share is about 66%, so its dominance is undoubted.

statcounter

Restoring competition to the markets for general search and search text advertising as they exist today will require reactivating the competitive process that Google has long stifled.

The basis of the accusation is just that Chrome has too great an advantage over peers, and together with the Android operating system, it has “forced” users to use only one search engine, namely Google.

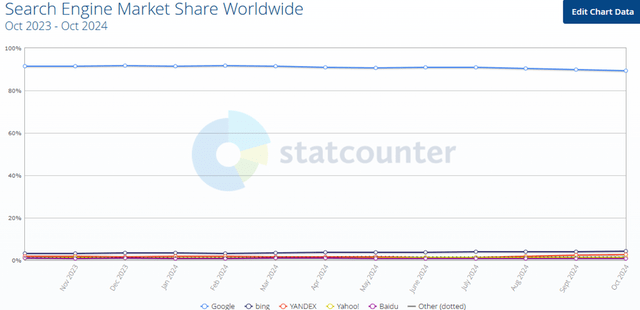

statcounter

This is not the first time Alphabet has faced these problems, but it is inevitable to create a few enemies when your product is used by everyone and no one can replace it.

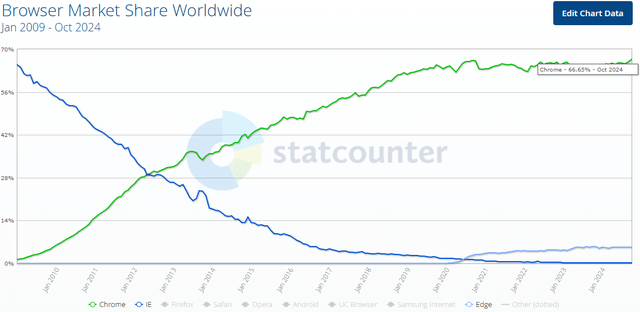

It’s even easier to create a few enemies when your web browser within a few years wipes out the most widely used one at the time (Internet Explorer) and not even a new version with a new name (Edge) can turn the tide.

statcounter

The same is true for Google, which continues to dominate Bing despite the fact that Microsoft has invested billions to integrate new features related to artificial intelligence. ChatGPT was supposed to destroy Google, but in reality nothing has changed.

This is not the first time Alphabet’s dominance has been challenged, but in the end the Mountain View giant has always come out on top. The DoJ has been trying to get in its way for years, and the CEO of rival Microsoft has also been outspoken.

In October 2023 Nadella was questioned by DoJ lawyers about Alphabet’s dominant position in the general search market. You can read what was discussed in the link above, but in summary, he seemed very concerned about the competitive advantage Alphabet could gain in training its AI language models from the huge amount of data from user searches and YouTube. AI is the next new chapter, and having a distinct advantage over competitors can make all the difference, which is why Microsoft is trying to close this gap. In any case, even with ChatGPT, the results have not been as hoped, and users continue to snub Edge and Bing.

In my opinion, the point of the matter is to understand why users prefer Alphabet’s services in the first place, and not to focus only on market share. It is obvious that if we looked exclusively at Google’s 90% market share we can think of it as a monopoly, but it is simply the result of a general preference. No one is forced to set Google as the default search engine on their browser, it is simply a choice due to personal preference.

If most people avoid Edge (including me), it is not because we are forced to, but simply because we believe that Chrome is better. Users have been using it for decades, are comfortable with it, and have no reason to change. If things have not changed in such a long time it is because Alphabet has been able to provide high-quality services, always.

Nadella’s concern about the future of AI seems reasonable to me, but Alphabet cannot be blamed. It was simply the company that played its cards better, and Microsoft should have been more astute in keeping Internet Explorer’s market share high when at the time Chrome did not yet exist. Instead, Internet Explorer has become a meme for its slowness and constant bugs.

To be honest, I find it more annoying dealing with Edge when I click on any external link having a Microsoft operating system. I do everything to stay in the Alphabet ecosystem, simply because it is more functional, and I am more familiar with it. Like me, I suppose there are millions and millions of people.

Overall, I think the DoJ’s allegations do not have a solid basis and are bound to fail. A true monopoly does not involve user choice; in Alphabet’s case, no one is forced to use Chrome or Google.

Everyone knows this aspect, especially the 900 lawyers that Alphabet has at its disposal. Since this company is huge and operates in markets where it is easy to be accused of something, it is already well organized legally. It is virtually impossible to catch it off guard, and they have already been working on this for years. By the way, there is a rather ironic aspect to take into account, which is that Alphabet is almost itself the DoJ.

Alphabet has at least five former DoJ members on its legal team and works with outside law firms that include about 20 former DoJ members, many of whom worked in antitrust. This strategic move is critical, as these lawyers ready to defend Alphabet are very familiar with their former colleagues, their strengths and weaknesses.

There are lots of lawyers out there. But only alumni of an office really understand how that office works. That means its strengths and weaknesses, that means the tendencies of people in that office. And they can therefore give much more concrete intelligence and better-informed advice to their client.

Jeff Hauser, executive director of the Revolving Door Project.

Most of the hires were made in 2022, so I am confident that Alphabet is already prepared to defend itself against this weak allegation. Basically, in federal court there will be a clash of colleagues, DoJ vs. former DoJ.

An opportunity to be taken advantage of

This news shook the market and Alphabet plummeted nearly 5%. Among the big tech companies it is currently the one in the most trouble, and since I consider these problems to be temporary, I see a buying opportunity.

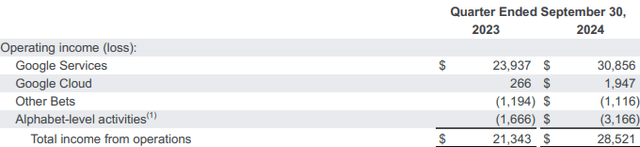

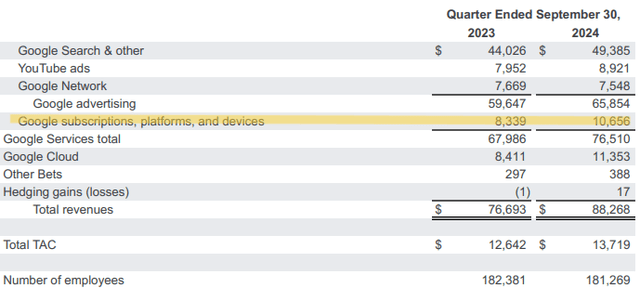

Alphabet is already a huge company, but it is showing that it can continue to grow in double digits. In the last quarter, revenues increased by 15% and operating margin by 32%. The Google Services segment remains the main driver of Alphabet’s growth, but the Cloud is back to impress as it has in the past with the help of AI.

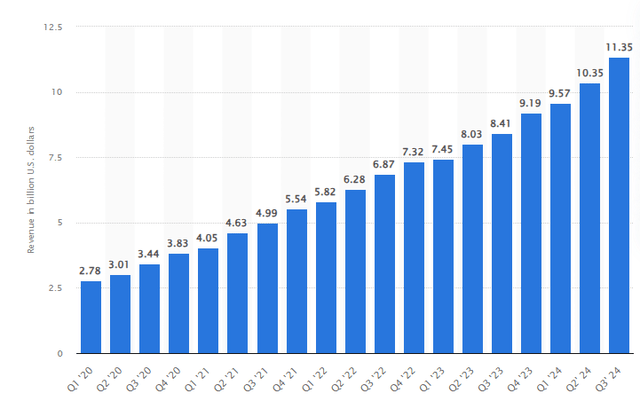

Statista

Compared to Q3 2023, revenues increased by 35% and reached $11.35 billion. Since Cloud is a scalable business with predominance of fixed costs, Alphabet can use operating leverage to greatly improve its profitability in the coming quarters. The increase in Cloud revenue will result in a more than proportional increase in operating income.

Alphabet Q3 2024

This trend is already visible; in fact, Cloud revenues were up 35%, while operating income was more than 6x higher. This was what everyone wanted, but the DoJ allegation prevailed in defining market sentiment toward Alphabet.

Alphabet Q3 2024

Alphabet’s operating margin is currently 32%, but assuming continued improvement in the Cloud, it is very likely that it can increase a lot. In Q3 2024, Cloud operating margin was 17%, basically less than half of AWS (38%).

If for the next 10 years Cloud revenues record a 20% CAGR (which I think is doable), it would mean having a business generating $250 billion in annual revenues in 2034. Assuming an operating margin of 38% like AWS in 2024, the operating income from this segment alone would be $95 billion, which is about $7 billion more than the total operating income for the whole of 2023. But Alphabet is not only Cloud, but also Google, YouTube, AI, Waymo and more.

In sum, there is the foundation for a new cycle of double-digit growth, and having the opportunity to buy this company at a discount, I consider it my early Christmas present. Of course, there is nothing certain about any of this, mine are just assumptions, and Alphabet may continue to plummet. The support at $150 per share is very interesting and in part I hope that negative market sentiment can take it to those levels. Anyway, from a long-term perspective, my confidence in Alphabet remains total, and it is one of the few companies that has a crucial weight in my portfolio.

Finally, one last aspect that perhaps fell by the wayside in the last quarterly report is the changing nature of revenues. We tend to view Alphabet as a company dependent on advertising revenues, and therefore partially cyclical since ads are the first thing to be cut in a recession. Yet, something is gradually changing and Alphabet’s revenues are becoming more solid and predictable.

Alphabet Q3 2024

Google subscriptions got revenues of $10.65 billion in the last quarter, a 28% increase over last year: more and more people are subscribing to services such as YouTube Music and YouTube Premium. People who spend a lot of time on these platforms do not want to see ads, therefore they are willing to pay for a subscription. Paying users are more than you probably think, in fact, they are estimated to have exceeded 100 million. About 47% of people with internet access at least once a month use YouTube: I would say there is a lot of room for improvement.

Revenues from subscriptions are of higher quality than revenues from advertisements, because they give stability to the business and consequently the valuation multiples increase. We may not be that far away from the day when subscriptions will have a very important weight in total revenues: in Q3 2023 they accounted for 11%, today 12%. This may seem like marginal growth, but until a few years ago this category did not even exist.

In all this, I would like to point out one last aspect. All these positive results have occurred even though personnel has decreased: from 182,381 employees to 181,269 in one year. The company’s efficiency is improving, and the increase in operating income in the future may also come from better cost management, not only from increased revenues.

Conclusion

Alphabet is in my opinion one of the best companies in the world, and even though it is already a giant, its growth margins are promising. Google Services remains the certainty, and I personally don’t think the DoJ can really challenge its dominance. Users choose Alphabet’s services on purpose because they are the best around, not because they are forced to. Moreover, Alphabet has an extremely knowledgeable legal department and some of these professionals are former members of the DoJ itself. They know these dynamics well and are the best possible defense against the recent allegations. Overall, I am optimistic, but I cannot be certain that everything will work out in the right way.

On the other side we have YouTube and the Cloud, both highly interesting business segments. The former is in the homes of every household and is getting more and more subscriptions, and the latter is back to growth as in the past and will give a strong boost to operating income.

At the current price I think Alphabet is slightly at a discount, so I maintain my buy rating.

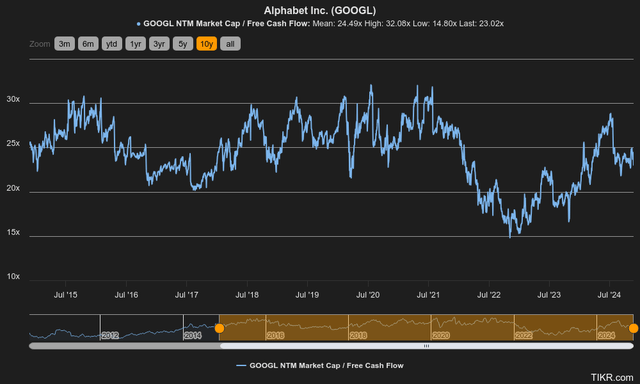

TIKR

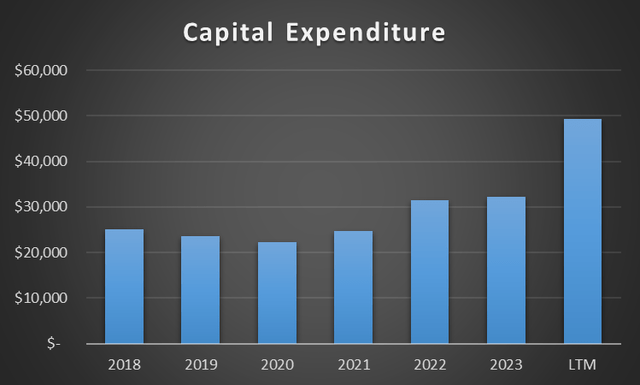

The NTM Market Cap/ Free Cash Flow is 23.02x, slightly lower than the 10-year average of 24.49x. In any case, keep in mind that this years’ free cash flow is negatively affected by abnormal CapEx.

Chart based on SA data

As you well know, in the last 12 months, AI has become increasingly popular and has become the main trend to be exploited. Those who want to grow must invest in AI, and Alphabet is among the companies most involved, so it has significantly increased its CapEx to blow away the competition. In the past 12 months, CapEx has been $50 billion, a figure far higher than in previous years and likely to remain high. Assuming a normalized investment environment, the free cash flow would be higher and the multiple lower.

Overall, I think Alphabet at $165 per share is a reasonable price to build a position or increase it. At $150 it starts to become more than interesting, and I will not pass up the opportunity once again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.