Summary:

- Alphabet faces an avalanche of challenges that already prompted its shares to experience weakness in recent months.

- Our valuation model shows that even under the base scenario the company is overvalued.

- We believe that Google’s downside is more significant than ever and its stock is a SELL for us.

peshkov

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) is currently facing major regulatory risks that could undermine the company’s business model and are likely to limit the stock’s upside in the foreseeable future. The rising competition within the digital advertising and AI sectors now also can create additional headwinds for Google and make it questionable to justify a long position in the company. That is why we believe that Google is a SELL at this moment in time since the downside right now could be more significant than ever.

Growth Is Under Threat

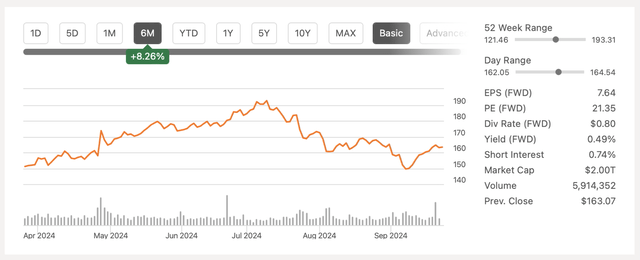

Google had performed well in the first half of the current fiscal year. The latest Q2 earnings report that was released last summer showed that the revenues were up 13.6% Y/Y to $84.74 billion and above the estimates. However, Google’s shares have been mostly depreciating since that time.

Google’s Stock Performance (Seeking Alpha)

At this point, Google faces an avalanche of challenges that already prompted its shares to experience weakness in recent months.

In the United Kingdom, the company hopes to dismiss an over $9 billion lawsuit, which accuses the company of abusing its dominance in the digital search market.

In the European Union, Google earlier this month lost a major appeal in the European Court of Justice and is now forced to pay a€2.42 billion fine for abusing its dominant position in digital shopping. At the same time, the European regulators are planning to issue an order in late 2024 or 2025 that will prompt Google to reform its adtech business or face consequences. In addition to that, a new fine could be imposed in the next month as the EU prepares a formal chargesheet against Google for abusing its dominant position in the search business.

In the United States, Google lost an antitrust suit last month. In it, the Department of Justice accused the company of being an illegal monopoly and violating Section 2 of the Sherman Act by paying Apple (AAPL) $20 billion in 2022 to make its search engine the default search engine of the Safari browser. There’s a risk that the Justice Department would go as far as to break up the company, which will more than likely undermine its business model and its dominant position in the search business.

At the same time, Google also faces another antitrust fight as the Department of Justice also accuses the company of illegally monopolizing the market for advertising technology. The hearing before the judge is expected to last a few weeks.

The Downside Is Significant

All of the developments from different parts of the world show that the downside for Google is likely more significant than ever. Going forward, lower returns hang in the balance. Considering that in Q2, Google’s search business generated $48.5 billion in revenues and accounted for 47% of all revenues, the potential disruption of its business model due to regulatory actions could undermine the growth opportunities. If the Department of Justice succeeds in its efforts to break up the company, then the consequences could be fatal considering that Google generated nearly half of its total revenues in the United States in Q2.

There’s also a risk that under the worst-case scenario, Google could face lawsuits of up to $100 billion from advertisers, which accounts for almost all of its case reserves at the end of Q2.

At the same time, the European Union could force Google to pay up to 10% of its global annual revenues if it doesn’t comply with the upcoming guidelines that the European Commission is expected to present in the foreseeable future. If Google complies with the European Union, then its search business will be at risk of disruption. If it doesn’t comply and the verdict is made before the end of this year, then Google could be forced to pay slightly over $30 billion in damages, which accounts for ~10% of the company’s revenues in 2023.

In addition to regulatory risks, the competition is also rising. Microsoft’s (MSFT) backed OpenAI recently started testing its AI search platform that’s available to a selected group of users. Given the regulatory challenges that Google faces, there’s a possibility that OpenAI will be able to disrupt the search market in the future.

Therefore, it’s safe to say that Google faces an avalanche of challenges that could lead to lower returns under the moderate scenario and the full breakdown of business under the worst-case scenario. That’s why we believe that Google’s downside is more significant than ever.

Risks To Our Bearish Thesis

While the downside is significant, Google still has several ways to avoid the worst-case scenario. Earlier this month, Google won an appeal in another case in the European General Court against the European Commission, which imposed a $1.67 billion fine five years ago. At the same time, even though Google lost another appeal, it also took several years until a final judgment in the court was made. Therefore, even if the European Commission forces Google to pay 10% of its annual global revenues, the company would appeal such a decision and it would take years until the courts make a final ruling.

As for the United States, a federal judge in 2000 ruled that Microsoft also violated the Sherman Act and abused its monopoly power, but the company avoided being forced from breaking up after filing an appeal. Therefore, Google could also have an opportunity to avoid the worst-case scenario.

The company also controls over 90% of the search market and likely has a few years to generate decent returns in the search business before final judgments in courts are made. As such, the short-term picture appears solid.

The American economy also remains resilient as GDP continues to rise thanks to higher consumer spending. As inflation appears to be under control, we could see an increase in advertising spending in the following years, which could help Google grow at a decent rate until the worst-case scenarios start to materialize.

The Real Value Of Google

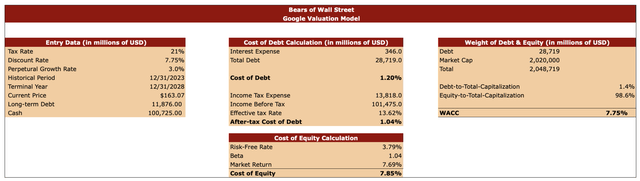

Considering all of those risks and growth opportunities, we decided to create a base-case valuation model to figure out Google’s intrinsic value. The tax rate in our model is 21%, which is the standard tax rate in the United States. We believe that while 21% is higher than Google’s current rate, this is the most appropriate rate to use for a 5-year forecast model considering that there’s a possibility that a corporate tax rate could gradually increase over time. The discount rate in our model is 7.75%. We calculated it by figuring out Google’s cost of debt and cost of equity. For the cost of debt, we used Google’s TTM numbers. To calculate the cost of equity, we used the risk-free rate of 3.79%, a beta of 1.04, and the market return rate of 7.69%.

The perpetual growth rate is 3%, which aligns with the historical GDP rate. Google’s market price at the time of creating the model was $163.07 per share. The long-term debt and cash data is used from the latest earnings report.

Google’s Valuation Model (Bears of Wall Street)

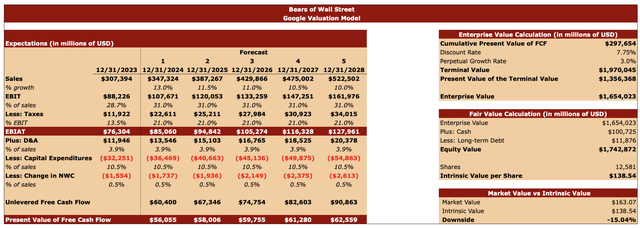

For the sales forecast, we expect Google to grow at 13% this year, which is what the street guides for FY24. After that, the sales growth rate will gradually decline as lower returns hang in the balance and regulatory risks begin to slowly materialize. The company is likely going to continue to grow at a decent rate as the worst-case scenario could be realized only at the end of the decade or later when the final judgment in courts after a series of appeals will be made. The EBIT margin in the forecast is the same as in the previous quarters. The tax rate is 21%, and the assumptions for other metrics are the same as in the previous year.

Those forecasts helped us figure out Google’s present value of future cash flows and the enterprise value, which is $1.65 trillion. Then we added cash reserves to the enterprise value and subtracted long-term debt to figure out Google’s equity value, which is $1.74 trillion. After that, we divided the equity value by the number of shares and figured out that Google’s intrinsic value under a base case scenario is $138.54 per share. This means that Google’s downside is ~15% from the current market price.

Google’s Valuation Model (Bears of Wall Street)

If regulatory actions lead to the disruption of Google’s business model quicker than expected, then the company’s sales growth rate could be lower than in the model and result in lower intrinsic value. At the same time, new fines and lawsuits could lead to major monetary damages, drain Google’s cash reserves, and lead to a lower equity value, which will subsequently result in a lower intrinsic value.

Final Thoughts

Overall, Google is a SELL for us at the current market price. The stock has been mostly depreciating since its highs from July and the price action is signaling a downtrend due to repeating the lower lows and lower highs technical pattern. In addition, the rising regulatory risks and the additional pressure from the competition in the digital advertising and AI sectors have created new headwinds, which are likely going to be hard to overcome in the current environment, which signals that a potential recession is around the corner. Even if the macro situation improves and the recession risks fade, Google would still face major challenges that make it questionable for us to justify a long position since the upside is likely to be non-existent at the current market price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.