Summary:

- I have downgraded Google-Alphabet to Sell due to valuation concerns, rising regulatory risks, and a sharply deteriorating technical momentum pattern.

- Shares have underperformed the S&P 500 and NASDAQ 100 since early July, with net selling evident in indicators like the Ease-of-Movement calculation.

- Required capital expenditures for growth, particularly in AI, have negatively impacted free cash flow and investment attractiveness.

Flashpop

I last mentioned Google-Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) in November here, with my first ever call reducing the stock from a Buy rating. I moved to Hold because of the valuation, relatively high business growth rates becoming more difficult to maintain, and the increasing likelihood of government intervention (fines/regulations) on its wide-ranging online presence.

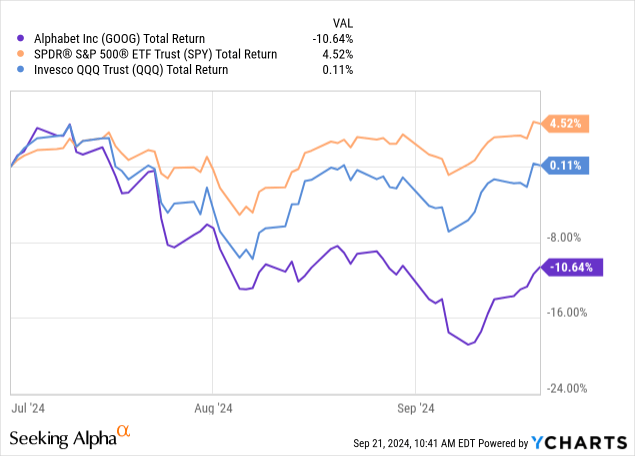

And, the stock has been fading a little in performance terms vs. overall S&P 500 index and NASDAQ 100 Big Tech gains. Over the last 10 months, Google investors have “underperformed” the main U.S. blue-chip index by -7% and the largest technology names by -6%.

The real meat of the investment problems owning Google have only recently appeared. Since early July, Wall Street and shareholders have become quite concerned about European Union and U.S. antitrust interventions in its online advertising business, with the odds of a breakup of the company climbing (not out of the question) over the coming year or two. The EU has imposed anti-competitive fines in the billions of euros (and dollars) on Google over the years, with new warnings this past week over search results that fail to comply with the Digital Markets Act in force after May 2023.

YCharts – Google/Alphabet vs. Index ETFs, Total Returns, Since July 1st, 2024

Shareholders have been net liquidators of the stock for close to three months, and overwhelming sell trends are clearly evident in the momentum indicators I track. Honestly, Google now sports the worst technical pattern of the 10 largest Big Tech names, measured from late June to early July highs. Enough damage is being done, I have decided to downgrade my Google rating again to Sell. A slowing economy and mushrooming antitrust problems could mean the quote is dead in the water over the next few years. I would rather ask readers hunt for better risk-adjusted ideas elsewhere for their investment capital.

Valuation Setup

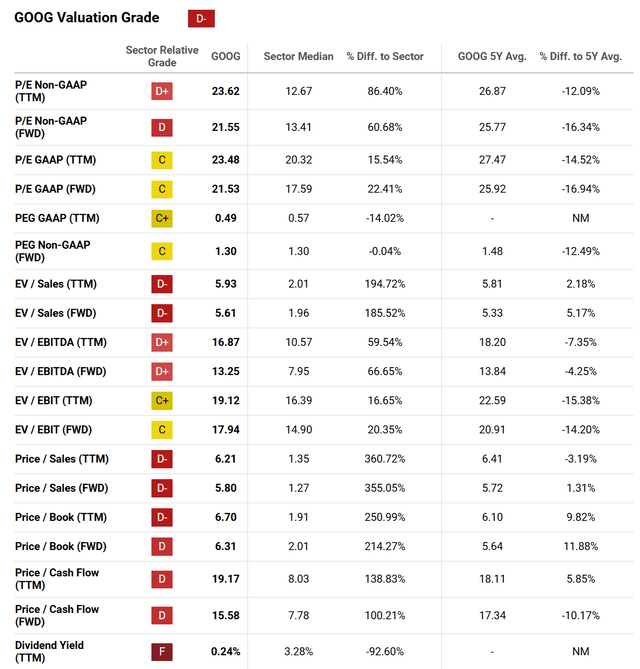

I would not call Google amazingly overvalued, like NVIDIA (NVDA) or Microsoft (MSFT). However, when measured against peers in the online advertising world, the valuation does look quite stretched. You can review this data in Seeking Alpha’s Quant Valuation Grade table below.

Seeking Alpha Table – Google/Alphabet, Quant Valuation Grade, September 20th, 2024

My thinking is an overall rating of “D-” is far from a screaming buy, and could be problematic if government fines on the company rise worldwide, as U.S. regulators/courts move to break up its various digital media units.

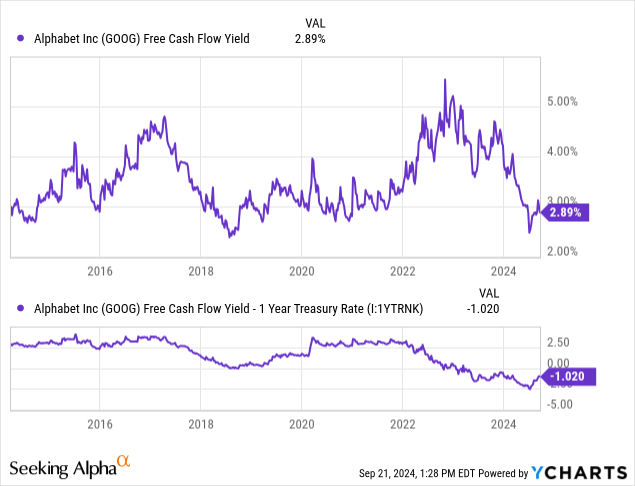

A new problem for Google is it is now required to CAPEX enormous sums to generate growth. Whether its Artificial Intelligence datacenter spending to keep up with Microsoft’s search and browser innovations, or rising capital needs to develop new growth initiatives, free cash flow numbers have suffered since 2023.

Right now, the free cash flow yield on investment for Google stinks. When we compare the 2.9% FCF return on investment (theoretically on the current stock quote) to “risk-free” Treasury rates, investors should be much more cautious owning this name. With all of its regulatory issues and capital spending requirements, why not just take 3.9% in guaranteed return from a 1-year Treasury alongside the 100% guaranteed return of your upfront investment?

YCharts – Google/Alphabet, Free Cash Flow Yield vs. 1-Year Treasury Rate, 10 Years

The relative FCF yield number vs. cash-like investment returns during 2024 is the most “negative” in recent memory. Is the sketchy, elevated-risk story for future profits and free cash flow worth taking on, if a major share price drop is possible?

Rotten Trading Pattern

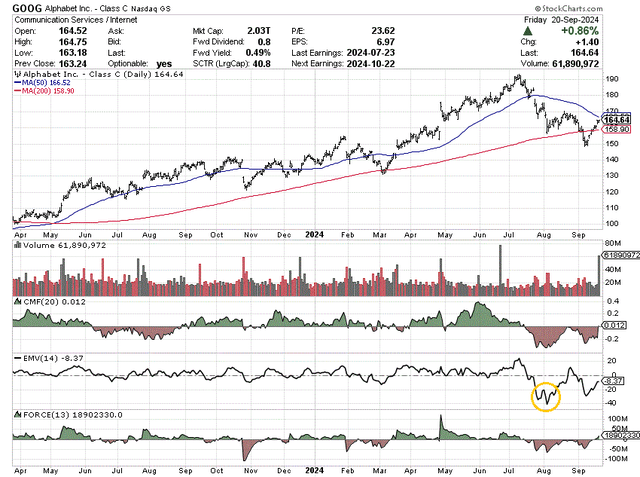

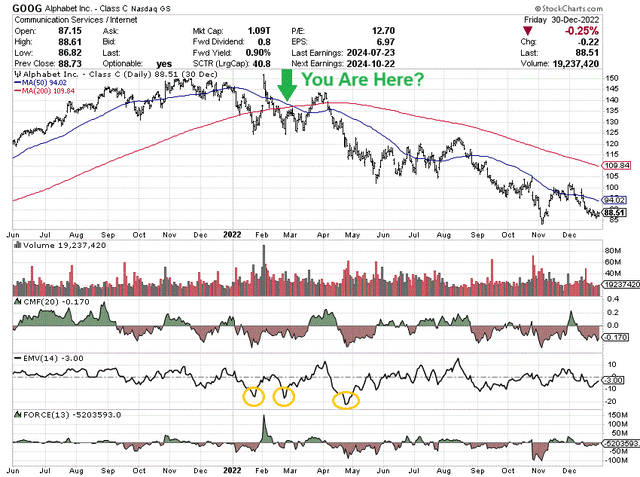

Aggressive selling in Google shares is visible not only in the sinking price during late summer, but a variety of momentum indicators. What bothers me the most is the record-low reading in the 14-day Ease of Movement indicator reached weeks ago (circled in gold below). I have been explaining how similar action in a long list of Big Tech names, starting in April, is projecting extreme caution to AI-focused technology owners. The July-August trading action in this sector is strikingly reminiscent of the November 2021 to January 2022 topping experience.

StockCharts.com – Google/Alphabet, 18 Months of Daily Price & Volume Changes, Author Reference Point

Wild fluctuations in the EMV, particularly to 52-week lows, signals the supply/demand balance of daily trading is being taken over by sellers. Specifically, oversized price declines on light volume can signal serious trouble is brewing. If/when heavy selling appears alongside an absence of buyers, price can only backpedal (usually significantly).

Conversely, when the EMV creation is flatlining after a major selloff, it’s usually a much smarter time to acquire shares. At that juncture, you are trading during a period of weak-hand holders selling their positions to strong-hand ones. The EMV calculation and its trends have worked particularly well anticipating Big Tech moves historically.

When was the last time Google’s EMV reached a record low? That would be the span between January and April 2022 (circled below in gold again). In fact, early 2022 followed 18 months of massive Big Tech gains (into November’s peak from the late March 2020 pandemic bottom), quite similar to the December 2022 to July 2024 trend of late.

In terms of the aftermath, following the ultra-weak EMV scores of January 2022 warning of approaching price risk, heavy volume selling showed up between late February and November 2022 for Google. You can review how the bear market played out, which included a -45% price drawdown over 12 months, peak to trough.

StockCharts.com – Google/Alphabet, Daily Price & Volume Changes, Jun 2021 to Dec 2022, Author References

Final Thoughts

At a stock market peak, investor sentiment gets fixated on the bullish story for a security. Operating issues, changing economic trends, declining margins, etc. are often ignored or tossed out the window as irrelevant.

Technically speaking, one of the first early warning signals for Big Tech investors can be a sizable downturn in the Ease of Movement indicator. Like I have mentioned, Google/Alphabet is not alone in outlining a worrisome and exceptionally weak EMV reading this summer. You can read my bearish takes on NVIDIA in July here, and Microsoft in August here. They represent other examples of probable large-money losers in the months ahead.

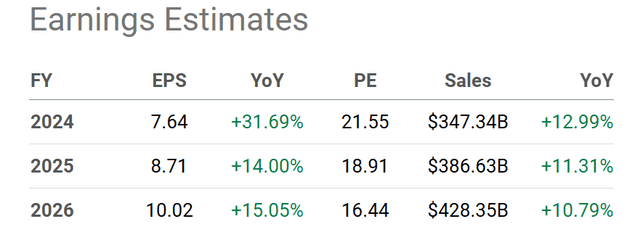

My view is current Wall Street analyst estimates now represent a best-case scenario, where a Goldilocks economy including few new government roadblocks to Google’s operations materialize. Sales and EPS gains of +10% to +15% annually after 2024 are today’s forecast. For sure, not the outstanding +30% to +50% rates of early company development.

Seeking Alpha Table – Google/Alphabet, Analyst Estimates for 2024-26, Made September 20th, 2024

I will also say a rosy/optimistic outcome for this stock is not an impossibility to achieve, just rather unlikely to play out in the real world. A vacuum of buying interest as measured by weak EMV swings is telegraphing the stock is susceptible to disappointment in the near future.

Perhaps an ad recession for online businesses on top of company-specific antitrust problems will keep buyers at bay over the next 3-6 months. Maybe an unexpected rise in crude oil causes interest rates to spike higher and the U.S. equity market to dive into the dumpster. There are plenty of risks to the share price one can identify, if you only ignore conventional wisdom’s one-sided optimism near a major market peak.

I now rate Google/Alphabet a Sell and Avoid, with a 12-month target price range of $125 to $140 (-15% to -25% from current pricing). Once this price area is reached, we can revisit the Google ownership proposition for shareholders. If existing shareholders do not want to part with their shares for capital gains tax reasons, I suggest selling covered calls and/or buying put options to protect some of your gains.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.