Summary:

- Google has been performing exceptionally well in recent quarters.

- The company has reported impressive earnings results last month and it appears that its growth story is far from over.

- At this stage, Google is an attractive growth play that has the potential to continue to generate excessive returns in the foreseeable future.

georgeclerk

Google (NASDAQ:GOOG)(NASDAQ:GOOGL) has been firing on all cylinders lately. The company has been showing a great performance in recent months, its shares have rallied, and it has everything going for it to continue to exceed expectations in the following quarters. While there are certainly some risks that are associated with Google’s businesses, I believe that the company remains an attractive investment at the current price as its growth story appears to be far from over.

Google Seems To Be Unstoppable

After sitting on the sidelines for a while, I wrote a bullish article on Google in late February, where I stated that the latest pullback of its stock has created a great buying opportunity for investors. Since that time the company’s shares have appreciated by ~24% and significantly outperformed the broader market. While such a performance has certainly been impressive, there are reasons to believe that the company’s growth story is far from over.

If we go through Google’s latest earnings report for Q1, which was released last month, we’ll see that the company managed to beat the revenue expectations by nearly $2 billion as it recorded a 15.4% Y/Y increase in sales to $80.54 billion. At the same time, the operating margin has also increased from 25% a year ago to 32% in Q1, while the GAAP EPS of $1.89 was above the consensus by $0.38.

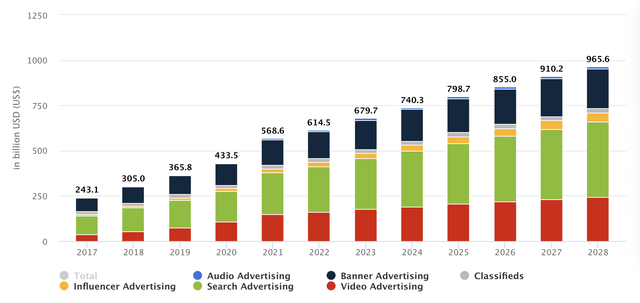

Such an impressive performance in Q1 gives hope that Google will be able to retain its momentum for the rest of the year and end 2024 on a high note. One of the things that should help the company continue to exceed expectations in the following quarters is the expected growth of the overall digital advertising market which is estimated to reach $740.3 billion in 2024. The data also shows that the search segment is expected to have the highest ad spending in 2024 and beyond. Considering that Google continues to control over 80% of the search market, while its search business increased its revenues in Q1 by an impressive 14.4% Y/Y to $46.16 billion, it makes sense to believe that the company will be one of the greatest beneficiaries of the higher ad spending in the foreseeable future.

Digital Advertising Spending (Statista)

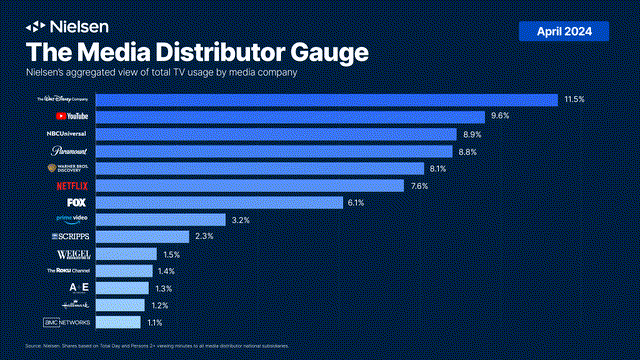

At the same time, while there were doubts about the ability of the company to grow its video business in the past, the latest earnings results and recent developments also proved the doubters wrong. By adopting the model that incentivizes content creators to upload their content to YouTube, Google is able to successfully monetize that content without directly paying for it and not having to deal with unions at the same time. Thanks to this model, the watch hours on Google’s video services continue to grow exponentially, the YouTube business itself increased its revenues in Q1 by 20.9% Y/Y to $8.09 billion, while the video platform also receives greater views in comparison to most media networks.

The Media Distributor Gauge (Nielsen)

In addition to all of that, there’s also a case to be made that Google’s cloud business, which generated $9.57 billion in Q1, up 28.4% Y/Y, could also continue to grow at an aggressive rate in the following quarters. As the ongoing generative AI revolution continues to gain traction, Google has managed to convince the majority of generative AI startups and unicorns to use its cloud solutions to expand their operations. Since the generative AI market is expected to continue to grow at a double-digit rate, it’s safe to assume that a significant portion of firms from the industry will continue to use Google’s cloud offerings and help the company boost its overall sales in the foreseeable future.

Given that Google already expects its YouTube and cloud businesses to reach a combined annual run rate of more than $100 billion this year, it makes sense to believe that the company’s growth story is far from over.

With all of those growth opportunities and a favorable environment, Google has everything going for it to continue to exceed expectations and scale its business at a double-digit rate in the following quarters. In recent months, the company has already received dozens of upward revenue and earnings revisions. The street will likely retain its bullish sentiment for a while since Google has more than enough growth catalysts that should help its business continue to deliver a stellar performance.

Google’s Revisions (Seeking Alpha)

What’s Next For Google’s Shares?

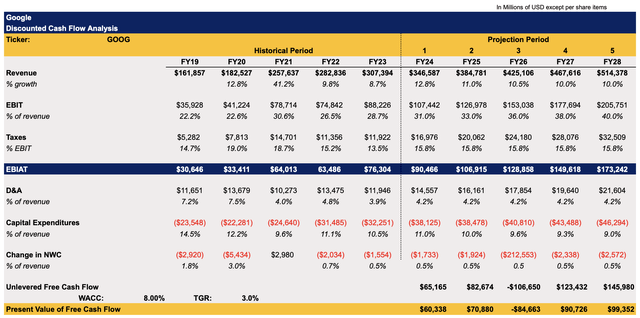

Considering all of the developments described above, I decided to create a DCF model to figure out whether Google’s stock itself remains a great investment after the latest rally. The top-line growth assumptions in the model closely correlate with the street expectations. At the same time, I believe that with the amount of growth opportunities that Google has going for it, it’s more than realistic for the company to continue to grow its revenues at a double-digit rate in the following years.

The EBIT assumptions in the model closely correlate with the company’s historical performance, and I expect the earnings to grow significantly closer to the terminal year. Microsoft’s (MSFT) EBIT currently accounts for over 40% of revenues, so there’s a case to be made that Google’s EBIT could reach 40% of revenues a few years from now as well. The assumptions for all the other metrics in the model closely correlate with Google’s historical performance. The WACC in the model is 8%, while the terminal growth rate is 3%.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

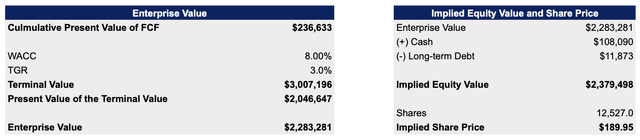

The model shows that Google’s enterprise value is $2.28 trillion, while its fair value is $189.95 per share, which represents an upside of ~7% from the current market price.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

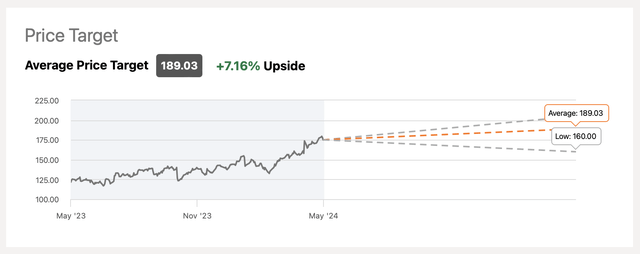

The broader investment community shares a similar sentiment as the consensus price target for Google’s stock at the time of this writing is $189.03 per share. Add to all of this the fact that at a forward P/E of ~23x Google’s shares trade below the market’s average P/E of ~28x, and it becomes obvious that the company indeed could be undervalued at the current price even after the latest rally.

Google’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

Despite all of the growth catalysts that Google has going for it, there are nevertheless several risks that could negatively affect the performance of its business and its shares if those risks materialize.

First of all, the weak retail and investment data from China could have a greater effect on the global economy, and result in a lower growth rate of Google’s overall business. At the same time, the potential announcement of new oil production cuts by OPEC+ next month could once again result in higher oil prices and lead to a period of higher inflation, which could negatively affect the overall stock market. Some might even think that the market is already overheated at this stage, so shares of a company like Google could experience a greater decline than others due to the fact that they significantly appreciated in recent months in comparison to other peers from the industry.

On top of that, the potential regulatory actions against Google not only by the European Union but also by other major non-European countries could disrupt the company’s business model in the future. Last year, I explained in detail how the changing regulatory landscape could lead to the breakdown of Google by the end of the decade. While investors have nothing major to fear in the short to near term, there’s a real risk that the company won’t be able to properly create value later in the decade if regulators force Google to pay extreme fines a few years from now.

Last but not least, as the generative AI revolution continues to gain traction, Google appears to be lagging behind its competitors such as OpenAI. Recently there has been a backlash against Google’s AI system that has been giving misleading information to users. While it’s unlikely that this will undermine the company’s overall growth story, there’s nevertheless a risk that businesses like Microsoft will use more advanced generative AI assistants to gradually undermine Google’s monopoly in the search market. This hasn’t happened yet, but it certainly should be considered a long-term risk if Google continues to play a catch-up game with its more advanced generative AI competitors.

The Bottom Line

At this stage, Google appears to be an attractive growth play that has the potential to continue to generate excessive returns in the foreseeable future. While the company certainly faces risks that are outside of its control and which could affect its performance, I would nevertheless argue that the opportunities continue to outweigh those risks at this stage. Given that Google also appears to be undervalued right now and has more than enough growth catalysts to continue to exceed expectations in the foreseeable future, I decided to stick with my BUY rating for its shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.