Summary:

- Google is undervalued despite boasting the highest ROIC in its history, a net cash balance sheet, and a forecasted $75B in FCF for 2023.

- The DOJ’s anti-trust cases are unlikely to result in catastrophic outcomes, with historical precedents suggesting manageable remedies for Google.

- Google’s AI advancements, particularly the Gemini model and custom TPUs, position it as a leader in AI, creating a significant buying opportunity.

- The recent quantum computing breakthrough offers a free call option on revolutionary technology, enhancing Google’s long-term investment appeal.

Boy Wirat

Introduction

Google (NASDAQ:GOOG), (NASDAQ:GOOGL) is a company that feels as though it’s been through the wars over the past two years or so. The company was delivered a shock awakening in 2022 with the launch of ChatGPT, an event which launched an internal “code red” according to reports. The firm’s initial AI product launches did not inspire confidence, leading investors to wonder if Google was in real trouble.

Additionally, Google has found itself under siege by a two anti-trust cases brought forth by the US Department of Justice, these cases have led to concerns for investors and affected the sentiment surrounding the company. As a result of these concerns, Google trades at a highly attractive valuation both vs the market and its own history.

The cheap valuation is available despite the firm boasting the highest ROIC in company history, having a net cash balance sheet position and a forecast to generate an incredible $75B in FCF this year.

Evidence suggests Google has made substantial progress on AI despite some earlier faltering, with its Gemini model now among the leading frontier models in existence. The change in US politics is likely to lessen the regulatory pressure on the company, and it looks likely that whatever remedy is agreed upon that it is manageable.

Finally, a recent breakthrough in quantum computing provides investors in the stock with essentially a free call option on a technology that could potentially capture hearts and minds in a similar manner to the AI trade. I am recommending Google as a strong buy and naming it as my top pick heading into 2025.

DOJ Case

The Department of Justice has made claims about Google engaging in monopoly behavior in two separate trials. The first trial pertains to Google’s position in the global internet search market, while the second trial is related to Google’s position in the global digital advertising space. I will briefly breakdown the nature of both trials for readers and explain why historical precedent makes me believe these trials are not as much of a threat as investors are pricing at present.

The search trial is probably the more serious of the two. The DOJ contends that Google has created and maintained an illegal monopoly position in search by using incentive payments to the likes of Apple (NASDAQ:AAPL) and android OEMs, to place Google as the default search engine in browsers like Safari. Google has around a 90% market share in the global search market and the prosecution claims this dominance is an unfair monopoly.

The case has historical parallels with a DOJ case brought against Microsoft (NASDAQ:MSFT) which claimed it had an illegal monopoly in PC operating systems and should be broken into two parts. Ultimately, in the Microsoft case, an appeals court ruled in the company’s favor and the Microsoft we see today is still intact and doing just fine. The DOJ has suggested that Google spin off its Chrome browser unit as a potential remedy in the search case, Google has until December 20th to submit a counterproposal.

My expectation is Google will seek a remedy such as users being presented a choice screen when opening a web browser such as Safari to offer a choice between Google and an alternative such as Bing or DuckDuckGo. Google faced similar anti-trust action in Europe where the introduction of a choice screen was enough to satisfy the regulator. From an investor standpoint, the good news is that the impact on Google’s search market share since the intro of a choice screen in Europe has been negligible. Given this prior remedy action take on the European side and the historical precedent where an appeals court ruled in favor of Microsoft. I think the Google search trial will result in some sort of corrective action but it won’t be catastrophic for the firm.

The second case brought by the DOJ is much more of a long-shot and hence I do not expect any action to be required on the part of Google. The DOJ case relates to Google’s role in the ad-tech market. In the digital advertising market the are three sides to the equation. First, the is the advertiser side, these are companies which want to place their ads across the internet to attract eyeballs, an example would be a firm like Coca-Cola (NYSE:KO).

The second side is the ad publisher side. These are websites which host space for advertisements to be seen, think of scrolling through a web page like ESPN for instance. The third leg is the advertising exchange which sits in the middle between advertisers and publishers and allows both sides to dynamically bid for advertising in real time, matching up the two sides.

The DOJ contends that Google is engaged in monopolistic behavior by playing on all three sides of the market. However, this case is difficult for the DOJ to prosecute as there is a lack of historical precedent for a judge to rule off of, which is a key determinant in a common law society. Additionally, Google’s market share in the digital advertising market is only about 40%. Traditionally a legal definition of monopoly has been for firms with greater than 70% market share, so I think the DOJ will have a tough time saying a firm that owns less than half the market is a monopoly.

I believe Google’s share price has been significantly hampered relative to other AI exposed large cap tech for example Meta (NASDAQ:META) which has been unencumbered by the uncertainty of a potential break up of business units at the behest of regulators. With a final ruling in the search case due in April of next year, I believe a likely more positive outcome than the current pricing suggests, will serve as a clearing event for the stock and should provide investors comfort to drive a multiple re-rating in the stock.

Gemini

A key concern for investors in Google over the past two years has been the firm’s ability to adapt to the new AI landscape. Google has long been a pioneer of AI technology but in the absence of competition its efforts were kept in house in a research environment. However the launch of ChatGPT caused a “Code Red” internally and forced Google’s hand to start rolling out competing products.

Early product roll outs were disappointing and included some bizarre hallucinations. However those early missteps look to now be tidied up and the firm’s suite of Gemini models are considered in the upper echelon of AI models on the market. Credit must go to management for a timely restructuring of the AI division to be fully housed under Google DeepMind which is led by Nobel prize winner Demis Hassabis.

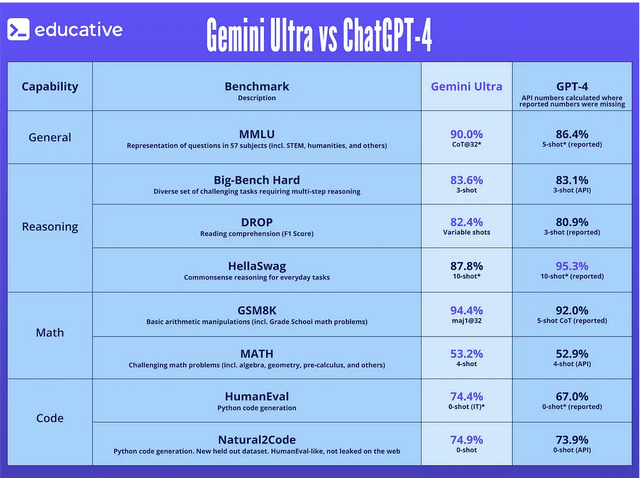

As we can see below, Gemini performs as well or better than GPT-4 on a wide range of tasks. This does not necessarily mean that Google is in the lead in terms of AI development but I think it does serve as comfort that Google has the capabilities and hasn’t been left behind. Unlike large cap tech peers Google is the only firm out there that develops its own AI models, integrates the models into its software suite, develops its own customer chips to run AI and also rents out cloud infrastructure to smaller firms looking to develop their own AI models. Competitors like Microsoft and Amazon rely on the ability of OpenAI and Anthropic to develop the foundation models that power products such as Copilot. Meta does not benefit from the business of renting out cloud infrastructure space to clients looking to develop models.

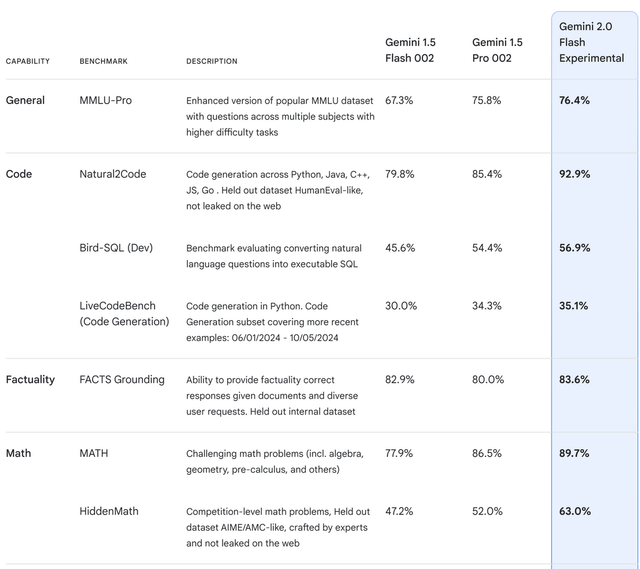

Just last week, Google announced an updated version of Gemini 2.0. The model is yet another step function higher in the continuum of model development. The model continues to show the company’s efforts to optimize size and performance continue to make progress, as the model is both faster and performs better across a host of benchmarks when compared with the prior Gemini 1.5 pro model. Sundar Pichai has been on the record in recent days talking about the new Gemini model as being geared towards the agentic age of AI. Google’s continued progress in AI development gives me confidence the firm will be a net beneficiary of AI and the valuation discount to the firm’s history is unwarranted, creating a great buying opportunity heading into 2025.

Additionally, Google is the further along in terms of developing its own custom silicon, the Google Tensor Processing Units or TPUs. These chips will be a critical element as AI runs into scaling limits at the pre-training level, and we progress onto a new scaling continuum driven by inference or test-time compute. According to Google their latest generation of TPUs provide a 4x performance uplift at only a third of the power consumption vs the prior generation. Hence, I see Google as offering the most comprehensive AI opportunity within the large cap tech space. Regarding Google’s custom silicon, Bank of America analysts Justin Post had the following to say

“Google’s proprietary new TPUs could be a differentiator for Cloud sales and will also help reduce internal compute costs” (Justin Post, BOFA)

Profitability and Balance Sheet

To quickly illustrate for investors the mighty profitability of Google, I compare it to the S&P 500 Information Technology sector. Google is classified as a Communication Service but given that sector houses many legacy media companies it does not make for a fair comparison vs Google in my view, which I think readers will agree is rightly a tech company.

The S&P 500 Information Technology sector trades at a trailing P/E of 34.9x while generating an operating margin of 22.2%. Whereas, Google trades at a trailing P/E of 25.4x while delivering an operating margin of 32%. So to summarize, we are buying into a firm trading at a 27% valuation discount to the broader tech sector while delivering profitability that is 44% higher than the sector. All while boasting $64B in net balance sheet cash. Based on this earnings power differential and war chest balance sheet, I see it as unlikely Google’s valuation discount to the sector will persist at these levels.

Valuation

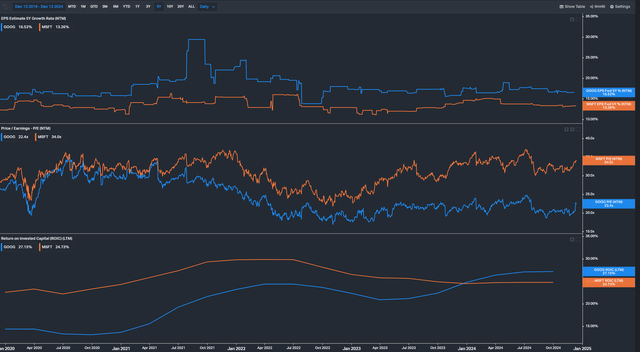

I think the impact of negative sentiment on Google is pretty telling when we do a head-to-head comparison with Microsoft. I wrote about Microsoft previously and I remain bullish on the name, but even more so on Google. To my eyes, there is a clear disconnect between the fundamentals and valuation when comparing the two stocks. They are both market leaders, both have large cash positions on their balance sheets, and both are market leaders in AI.

However, despite Google having a higher EPS growth forecast and a higher ROIC, it trades at a significant discount to Microsoft. I appreciate the markets concern about the DOJ are being discounted in Google’s valuation at present but from a risk-reward standpoint, I see a 35% valuation discount to Microsoft for higher profitability and growth as a very attractive opportunity.

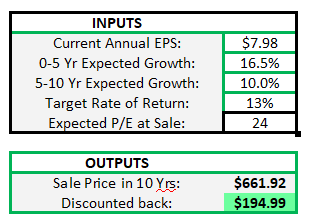

Based on rather conservative DCF modeling, I see Google as priced for at least a 13% total return CAGR over the next decade. I take the analyst consensus growth of 16.5% for the next five years and I use a 10% figure for the remaining period.

I would remind readers that the long term EPS growth of the S&P 500 index is around 10%. I believe it is quite a conservative estimate for Google given the high margin nature of the business and the steady pace of share buybacks, on which Google has spent a cumulative $120B over the past two years and is on track for another $60B+ this year too.

Given the company’s historical capacity to out earn the market, improving profitability and a fortress balance sheet that can boost the bottom line through massive cash deployments to repurchasing shares, I see Google as set up with a floor return for the stock in the low double digits. I see this level of return as very attractive in the large cap equity space and one which investors should look to add to their portfolios.

Author

Quantum Potential

In just the last week, Google has caused quite a stir in both the investing and scientific world with the announcement of a new quantum computing chip known as Willow. The stock price reacted positively to the news, as did a host of other quantum related names. I certainly would not profess to be an expert on quantum technology but the breakthrough certainly sounds intriguing on the surface.

According to reports the chip was able to complete a complex calculation in about five minutes that would have taken a traditional computer 10 septillion years to complete. My personal favorite claim to come out of the chip was from the founder of Google Quantum AI Hartmut Neven, who makes the claim that the scale of computing power willow displayed is evidence of parallel universes as the time it would have taken a traditional computer to complete is larger than the life of the known universe. I have included his full quote below

“Willow’s performance on this benchmark is astonishing: It performed a computation in under five minutes that would take one of today’s fastest supercomputers 1025 or 10 septillion years. If you want to write it out, it’s 10,000,000,000,000,000,000,000,000 years. This mind-boggling number exceeds known timescales in physics and vastly exceeds the age of the universe. It lends credence to the notion that quantum computation occurs in many parallel universes, in line with the idea that we live in a multiverse, a prediction first made by David Deutsch. (Hartmut Neven, Google Quantum)

I have no idea if a quantum breakthrough like this will lead to further economically meaningful thrusts forward, but it’s certainly not inconceivable that a new technology could spearhead rapid stock price appreciation, as we have seen with AI in the recent past. My base case is that quantum will not lead to any material benefit to Google in the next decade at least, but given the stock is trading at a discount to its historical valuation average, it looks like the quantum potential is sitting in the business as essentially a free call option for investors. If the stock was already pricing in material benefits from quantum I would approach it with skepticism, but if it’s a free option, then I am a willing buyer.

Risks

The key risks to the Google thesis include a potentially worse outcome from the DOJ trial or a renewed antitrust assault on big tech more broadly, perhaps at the behest of vice president Vance who has previously made strong anti big tech statements. Another key risk would be a failure of Google to continue making progress on AI, potentially losing ground to competitors like OpenAI. Recent progress by the firm suggests they are innovating in lock-step or even ahead of peers, but technology is always a game of innovation and all the big players face a consistent risk of disruption

Conclusion

I am choosing Google as my top pick for 2025. My thesis encompasses a valuation discount to history being eradicated as the firm and investors move on from legal battles with the DOJ. The firm’s progress on AI has been steady and impressive following some early mishaps, I believe this progress is yet to be fully reflected in the share price when compared with peers like Microsoft. The firm has best-in-class profitability and a clean cut balance sheet which provides it with significant optionality going forward. Finally, a breakthrough in quantum computing creates a ‘freebie’ call option on a potentially revolutionary technology. I am rating Google as my top pick and a strong buy as we head into 2025.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.