Summary:

- Google’s dominance in search remains strong despite the success of Microsoft’s ChatGPT in the AI space.

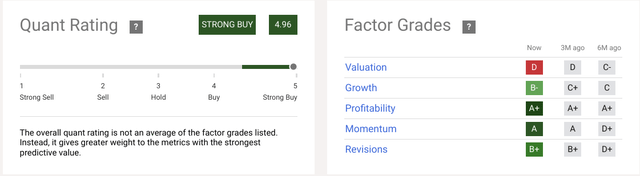

- GOOG is undervalued on both a relative and intrinsic basis, and the company’s proven strengths make this valuation even more compelling.

- The company’s undervalued stock, strong cash flow, and improving antitrust situation make it an attractive investment option.

Alex Wong

What now seems like a lifetime ago, Google (NASDAQ:GOOGL) fumbled a public demonstration of its Bard AI after Microsoft (MSFT) had a slam-dunk introduction of ChatGPT to the public. Some analysts began speculating that Microsoft’s amazing achievement may supplant the search giant. Artificial intelligence has a history of being hard to understand and even sometimes seemingly deceptive. While ChatGPT is a great achievement, Google’s dominance in search isn’t threatened for the time being.

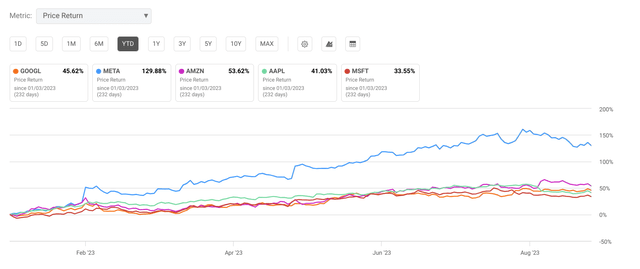

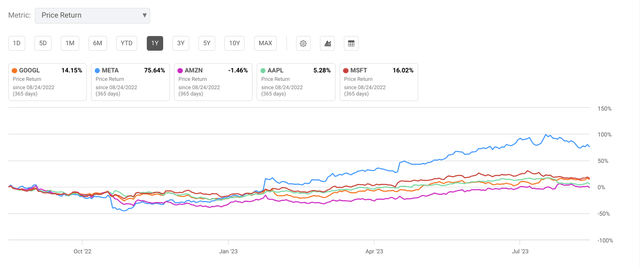

It’s also important to remember that the “Fab Five” have done well this year, but Meta (META) has outpaced them all. Of course, Meta also has the most similar business to Google, given the overlap in digital advertising. When you stretch out the performance a year, Meta’s outperformance is still evident.

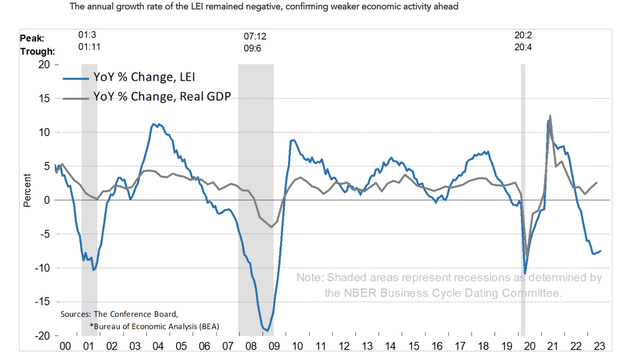

But the picture becomes a bit different if you look at a three-year time horizon. You can see that Google outperformed the other members of the Fab Five, and there was dramatic outperformance during the post-COVID bull market. One exciting thing I think this suggests about Google, compared to the other Tech Generals, is that it has more cyclicality because of the heavy dependence on digital ads.

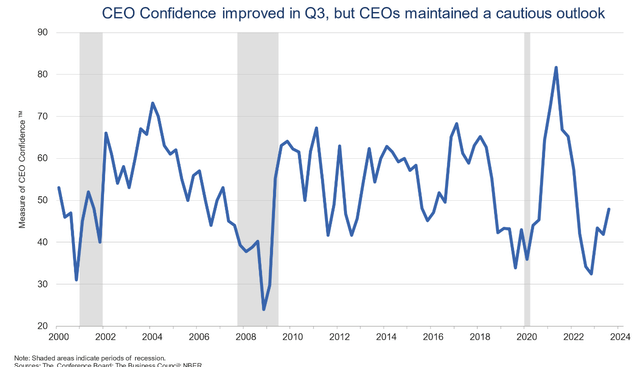

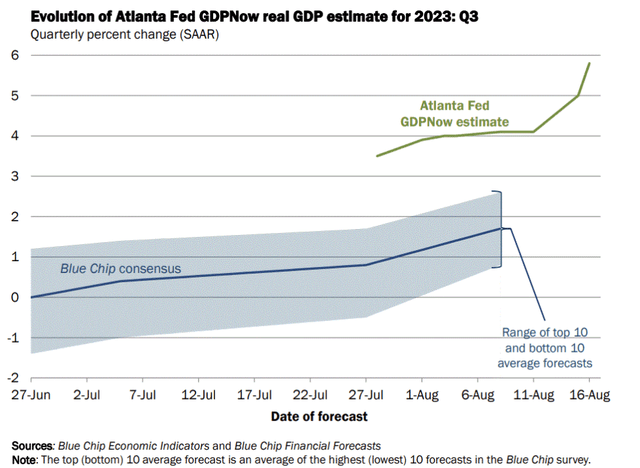

Atlanta Fed

This makes it particularly interesting in an environment where the economy is not only not slowing down; growth is clearly accelerating. This company is well positioned to do well from additional economic strength. Furthermore, business confidence and spending both appear to be accelerating. Business spending hit the highest level in the last GDP report in six quarters, and confidence is increasing across several measurement methodologies.

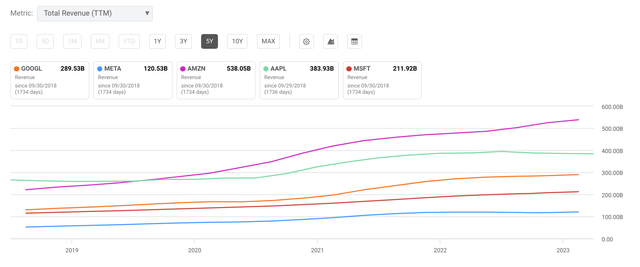

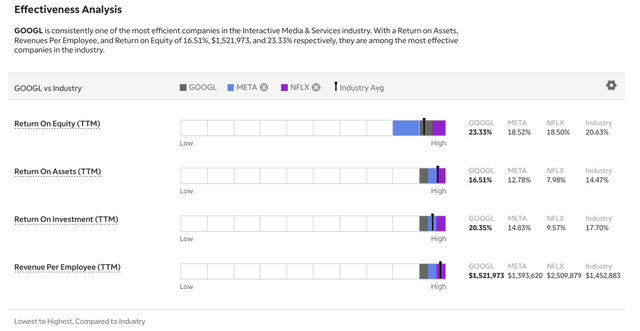

When you consider companies that benefit from economic strength, it’s important to remember that revenue is a major factor. Market cap in the stock market may be a poor indicator of how much the real economy will affect a company, but revenue is not. The firm has also made tough, aggressive cost cuts but also improved the financial profile of an already efficient company by many measures. Margins should improve in the coming quarters.

So, if margins are improving and economic strength with Google, one of the most cyclical of the FAAMG, I might even buy the stock if it was fairly valued or slightly overvalued. However, recent trends in business spending suggest that momentum is just getting started and not ebbing. The US consumer is stretched, but they aren’t done yet. I think Google has had some fortuitous developments on the antitrust front, and most of all, I like that it is undervalued. It may be facing headwinds in ads, but it’s still dominant.

Many people missed the run-up in the FAAMG this year, and the aforementioned characteristics make it the most attractive of the cadre given the economic strength since Meta has had a prolific run that leaves a lot more valuation risk.

Many institutional investors had a horrible year in 2022 and missed the main winners in 1H23. So, when some of them inevitably come back to FAAMG and chase the outperformance that could continue in 2H23, I think Google is likely a prime beneficiary because of its valuation.

Valuation

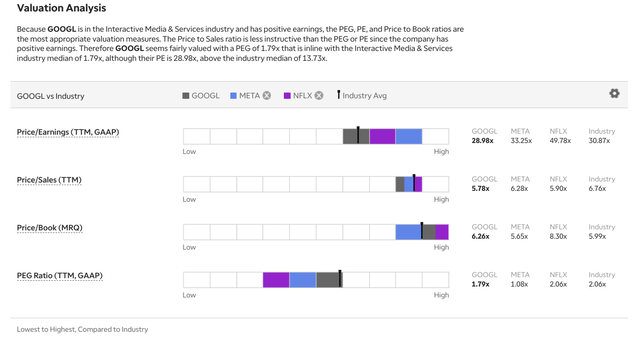

Google is undervalued right now despite the incredible run that technology has had this year. There is much to like about the company long-term based on its achievements and continuing investments in artificial intelligence. However, that is just icing on the cake. And while Microsoft and ChatGPT have shaken Google’s confidence, the firm still reigns supreme in search.

Aside from the AI hype and the coming contest between Titans, there is still likely some upside for Google because of what is happening in the economy. Digital advertising is a highly cyclical part of business spending, and when economic activity contracts, it is one of the first areas to feel the pain. However, when economic activity consistently outperforms expectations, it can be a boon to the company’s bottom and top lines.

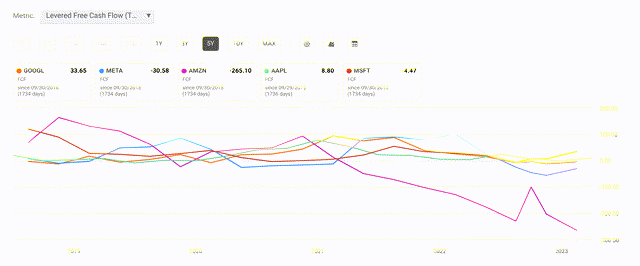

Furthermore, the company has shown that it delivers to shareholders in a manner that exceeds more richly valued peers, which makes its valuation all the more compelling. Another point of comparison against its peers that is very appealing is when you look at Google’s leveraged free cash flow compared to other FAAMG members.

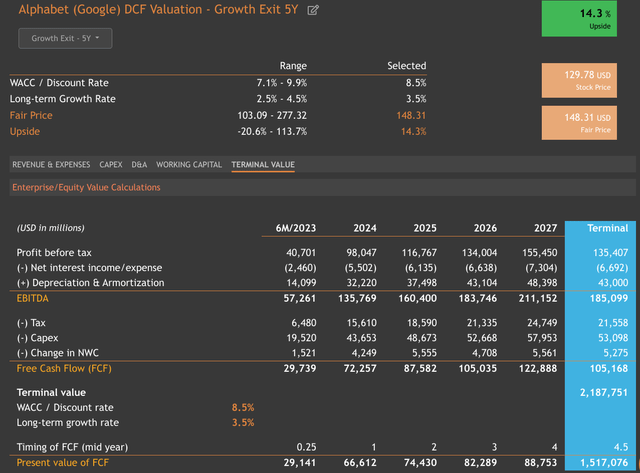

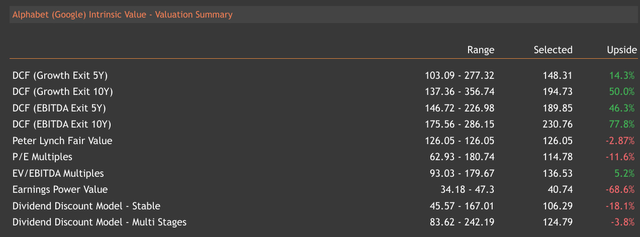

So, while several points of relative valuation are appealing for Google, I think the picture of intrinsic valuation is even more compelling. As you can see below, the 5-Year Growth Exit DCF suggests some upside for the stock with reasonable assumptions. Google has great cash flow and a strong balance sheet.

But, when you look at several other methodologies and time periods of DCF, you can see that they all indicate Google is undervalued. The 5-Year Growth Exit DCF suggests a much lower fair price for Google’s stock than the other methods, as shown below.

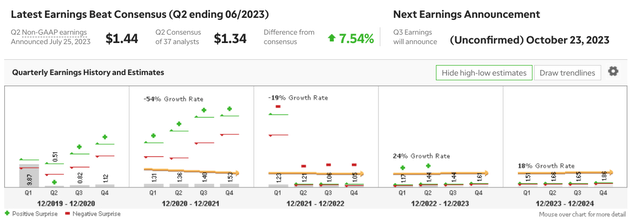

This is pretty compelling for a stock of Google’s size and with the upside exposure to economic strength that I have described. Furthermore, I think that Google’s expectations partially assume economic weakness, and the firm has an opportunity to outperform expectations.

So, I think the valuation picture is advantageous, and this is converging with what looks like building economic strength and other advantages for the firm, like an improving anti-trust picture. You might not expect a company like Google to be undervalued after the prolific run that mega-cap Technology has had in the first half. Still, there’s a very compelling argument to be made that Google is intrinsically undervalued.

Risks and Where I Could Be Wrong

One of Google’s biggest risks is its significant concentration in the exact advertising revenue. I expect to be a favorable catalyst for the stock because of economic strength. If I am wrong, and there is, in fact, economic weakness or there is a major pullback in stocks, then Google will suffer from this concentration. The instantaneous nature of digital ad spending means it can be pulled quite suddenly when economic conditions become adverse.

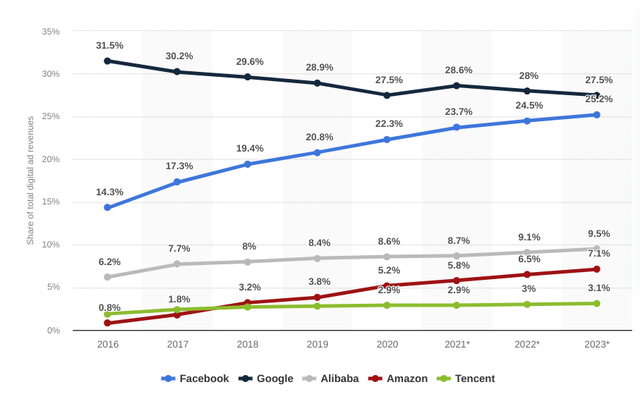

Aside from the potential deterioration of economic conditions, one of the most significant risks to Google is the potential erosion of ad revenue from completion. The main competition here is not Meta but from TikTok. The Chinese social media firm is consistently eroding the market share of the once imperturbable duopoly of digital advertising.

Of course, Google is always an antitrust target. While there has been some recent progress in this area, the monopolistic characteristics of some of its business lines will always draw regulators’ ire. The coast looks clear for now, but an upcoming trial could prove problematic if it goes against the firm. Other matters are pending. This risk could play gruesomely with the aforementioned concentration, but that’s a low-probability outcome.

Conclusion

Google is one of the most substantial companies in the world. It has excellent management and some of the most compelling AI chops on the planet. Perhaps most importantly, if data is the new oil, then Google is metaphorically Saudi Arabia. This important advantage will make it a player in the artificial intelligence race regardless of anything else. Data is paramount in the new world of AI, and Google knows the US consumer better than anyone else.

Of course, this is all just the cherry on top of a firm with a solid core business. There is also exciting stuff going on in Google Cloud, and of course, Other Bets is always exciting. However, I think this firm will prove an enticing target for many investors on the heels of building economic strength. Google is more cyclical than many of its FAAMG peers, and while this can be a disadvantage in a slowdown, the firm is particularly well-positioned to exceed expectations if the good news keeps coming.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.