Summary:

- Since my last update, Google has generated 13-14% alpha over the S&P500. Q2 FY23’s results make me even more confident of continued outperformance.

- The Google Search’s resiliency thesis is playing out as it is leading the advertising recovery.

- Margin expansion in Google Cloud is also playing out as it has posted genuine margin improvement, even after removing the benefits of lower depreciation recognition. Further margin levers exist.

- I am optimistic on RuthPorat’s appointment into the Chief Investment Officer position as it can reduce the bleeding in Other Bets’ profitability.

- Valuations are attractive as the company trades at a 13.6% discount to the longer-term 1-yr fwd PEs.

CFO Ruth Porat Phillip Faraone/Getty Images Entertainment

Thesis review

My bullish view on Alphabet (NASDAQ:GOOG) has performed quite well, with an alpha of +13.53% over the S&P 500 (SPX) as the company has generated +23.48% against the S&P500’s +9.95%. In a pinned comment, I had indicated a change in my stance to a neutral/hold after an initial run up. Measuring performance based on this update has generated a slightly higher alpha of +14.21%.

Now, after reviewing the Q2 FY23 results, I am even more bullish than before. Hence, I am upgrading my stance to a ‘Strong Buy’ due to these views:

- Google Search is leading the advertising recovery

- Cloud posts genuine margin improvement

- Ruth Porat can reduce the bleeding in Other Bets

Google Search is leading the advertising recovery

It looks like my earlier thesis about Search revenues being more resilient than it looks is playing out as the segment is starting to recover:

Search and other revenue YoY (Company Filings, Author’s Analysis)

This is when other advertising businesses are still undergoing headwinds, suggesting that Google is leading the advertising rebound:

If you step back, you’re seeing real size now of weakness in linear TV, ad agencies, small and digital companies were all slowing, and the macro backdrop is definitely cloudy, yet you guys [Google] have accelerated your growth this quarter.

– Equity Research Analyst from Michael Nathanson in the Q2 FY23 earnings call

In the earnings call, Senior VP and Chief Business Officer Philipp Schindler called out the AI-powered tools and solutions as being a key driver of the ad-spend rebounds.

Here is a snapshot of the broader revenue profile and associated notes for Q2 FY23:

Revenue Split Summary (Company Filings, Author’s Analysis)

One key data point to note in the table above is the green-highlighted piece. This shows that Q2 FY23’s QoQ results posted broad-based outperformance compared to the usual Q2 QoQ growth cadence, indicating a seasonally stronger Q2 than normal.

Altogether, these results give me confidence that Google’s advertising engine remains well-positioned, and is only set to pick up with the eventual sectoral rebound.

Cloud posts genuine margin improvement

In Q1 FY23, Google Cloud posted margin improvement into positive territory for the first time. However, as discussed in my earlier note “The Hidden Truth to Accounting Boosts”, this margin improvement was optical and not real, as it was skewed by accounting assumption changes related to an extension of servers’ useful lives. This had cast some doubt on my earlier thesis about Google Cloud’s margin expansion.

However, this time in Q2 FY23, my calculations reveal that Google Cloud has posted genuine margin improvement:

Google Cloud EBIT (adjusted for like-for-like comparison) margin (Company Filings, Author’s Analysis)

Profitability is still not profitable, but the momentum is clear; the incremental QoQ Cloud EBIT margins was 33.6%. I anticipate the planned slower headcount growth and further real estate optimizations to lead to further margin expansion, both in Google Cloud and in the overall business.

Ruth Porat can reduce the bleeding in Other Bets

CFO Ruth Porat is moving onto a new role as Chief Investment Officer for Google. She will continue to be the CFO until the company finds a successor to the CFO position. I view this as a positive development as I believe she can dramatically reduce the bleeding and bring in more disciplined capital allocation in the Other Bets segment, which has been a big money-loser so far:

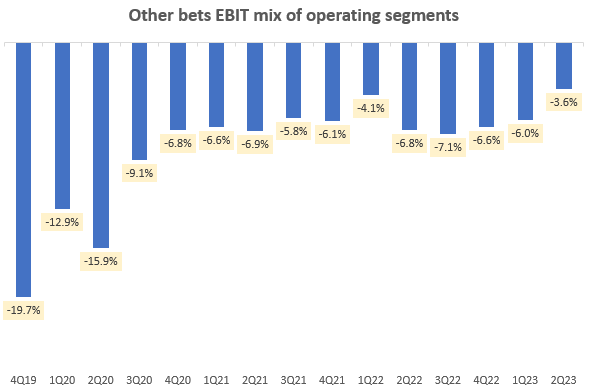

Other Bets EBIT Margin (Company Filings, Author’s Analysis)

Although the drag on overall profitability has reduced, the Other Bets segment still averages around a -6% EBIT margin contribution to the overall company’s margins, reflecting further scope for margin improvements here:

Other Bets EBIT Mix of Operating Segments (Company Filings, Author’s Analysis)

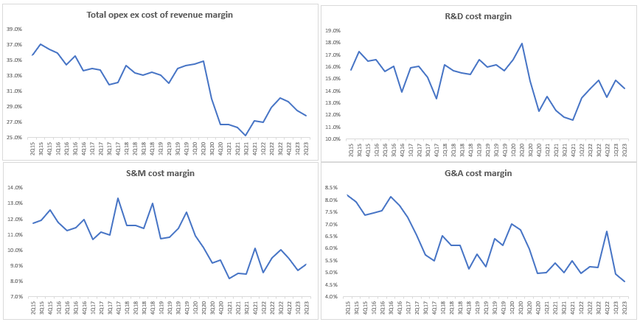

Ruth Porat has been the longest-serving CFO of the company. I believe she has what it takes to improve the capital allocation and margin profile of Alphabet’s investments. This is not only because of her reputation and positive sentiment around her new role, but also because the numbers reflect her track record in cost control:

Evolution of Alphabet’s Cost Profile (Company Filings, Author’s Analysis)

Under Porat’s leadership since she joined the helm as CFO in Q2 FY15, the company has realized broad-based opex cost efficiencies.

Valuation

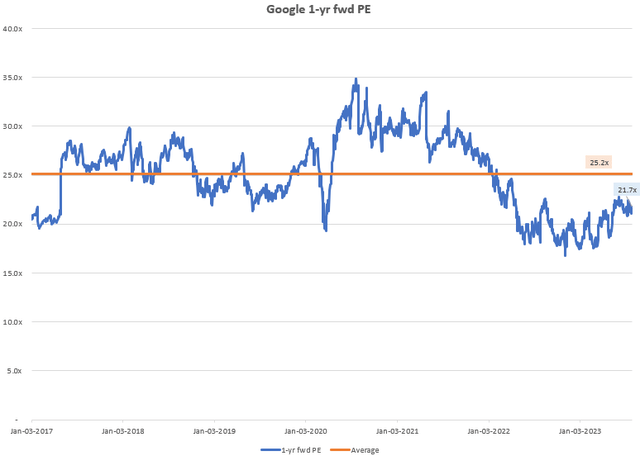

Google/Alphabet 1-yr fwd PE (Capital IQ, Author’s Analysis)

Alphabet is currently trading at a 1-yr fwd PE of 21.7x, corresponding to an attractive 13.6% discount to the longer term 6-year average of 25.2x. Given the business momentum and positive outlook, I believe the valuations are very compelling for buys.

Key Risks and Factors

Although the discount valuations provide some margin of safety, my ‘Strong Buy’ stance relies on a continued, more broad-based rebound in advertising revenues. Naturally, the evolution of Other EBIT margins is also a key factor to evaluate how Alphabet performs with Ruth Porat as Chief Investment Officer.

One risk that may be harder to ascertain would be a tradeoff wherein the Other Bets segment is realigned to profitability improvement too much, too quickly at the expense of asymmentric, low-hit rate but high reward-to-risk ratio investments. I hope we can get to periodically hear from Ruth Porat’s thoughts on her investment philosophy and approach to get a better idea of this risk/monitorable.

Takeaway

My bullish thesis on Google is playing out and after Q2 FY23, I am even more confident than before that the stock is well-positioned to outperform the S&P500. This is because the latest earnings results have affirmed my view that Google Search is more resilient than it looked, as it is leading the advertising recovery. My earlier thesis about margin expansion in Google Cloud is playing out as the company has posted genuine margin improvement in the Cloud segment, even after taking away lower-depreciation boost as a result of accounting policy changes. I anticipate further margin improvements as the company remains focused on cutting costs. I also believe the appointment of CFO Ruth Porat to Chief Investment Officer can lead to better capital allocation and profitability in the Other Bets segment.

Compelling valuations support the rosy outlook as the company trades at a 13.6% discount to the longer-term 1-yr fwd PE. Hence, I upgrade my stance to a ‘Strong Buy’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.