Summary:

- Both Alphabet and Meta currently have an attractive Valuation: while Meta’s P/E [FWD] Ratio stands at 20.74, Alphabet’s is 22.75.

- However, I consider one to be superior in terms of Profitability and Growth while also coming with less risks attached.

- In this comparative analysis, I will show you which of the two companies I believe is the better pick in terms of risk and reward.

400tmax

Investment Thesis

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) and Meta (NASDAQ:META) currently have a Valuation that appears to be appealing for investors. Alphabet’s P/E [FWD] Ratio stands at 22.75 while Meta’s is even lower (20.74).

However, I believe that Alphabet is clearly the more attractive choice for investors in comparison to Meta when investing over the long term.

In the following, I will summarize why I believe Alphabet is superior to Meta in terms of risk and reward:

- Alphabet has stronger financial health than Meta: while Alphabet has a Total Cash Position of $115.10B, Meta’s stands at $37.44B.

- I see Alphabet as being ahead of Meta when it comes to Profitability: the company has a higher Return on Equity (22.76% when compared to 17.29%) and a higher Net Income Margin (20.58% compared to 18.27%).

- I think Alphabet is superior to Meta when it comes to Growth: Alphabet’s Revenue Growth Rate [FWD] is 9.00% while Meta’s is 5.82%.

- At the companies’ current price levels, my DCF Model indicates an Internal Rate of Return of 9% for Alphabet and 8% for Meta, thus indicating that the reward should be higher for Alphabet investors.

- In addition to that, I consider the risk factors for Alphabet investors to be lower than for those who invest in Meta. This is also reflected in Alphabet’s 24M Beta Factor of 1.22, which is below Meta’s (1.32).

- I believe that Alphabet has a higher economic moat when compared to Meta, to which Alphabet’s higher brand value and stronger financial health have contributed.

- While Alphabet receives my strong buy rating, Meta only receives my hold rating at its current price level.

- Furthermore, I recommend overweighting the Alphabet stock in a long-term investment portfolio while I recommend underweighting the Meta stock.

The Companies’ Competitive Position within their Industry

Both Alphabet and Meta have a strong competitive position within the Interactive Media and Services Industry, which is reflected in their high EBIT Margins: while Alphabet’s is 25.35%, Meta’s is 28.46%.

However, I believe that Alphabet has even stronger competitive advantages than Meta, which I will now discuss in more detail.

While Alphabet maintained the third position in the ranking of the most valuable brands in the world according to Brand Finance (with an estimated brand value of $281,382M), Meta is listed 14th (it was ranked 7th in 2022). In my opinion, Alphabet’s higher brand value reflects the company’s stronger competitive position when compared to its rival.

In addition, I see Alphabet as being financially stronger than Meta: the reason for that is Alphabet’s current Total Cash Position of $115.10B when compared to Meta’s ($37.44B). Furthermore, it can be highlighted that Alphabet has a slightly better credit rating than its competitor: while Alphabet has an Aa2 credit rating from Moody’s, Meta’s is A1, once again confirming Alphabet’s financial superiority.

I believe that Alphabet and Meta have collected an enormous amount of data within the past decade, which will help them to maintain a strong competitive position within their industry.

However, I believe that Alphabet’s economic moat is even stronger than Meta’s. This opinion is particularly based on the fact that Alphabet has a higher brand value and possesses even stronger financial health than Meta.

Alphabet’s stronger competitive position is one of the reasons why I suggest overweighting its stock in an investment portfolio while I suggest to underweight the Meta stock.

The Companies’ Valuation

Alphabet currently has the higher P/E [FWD] Ratio when compared to Meta: while Alphabet’s P/E [FWD] Ratio stands at 22.75, Meta’s is at 20.74. In addition to that, it can be highlighted that Alphabet’s Price / Sales [TTM] Ratio lies slightly above the one of Meta: Alphabet’s Price / Sales [TTM] Ratio is 5.50 while Meta’s is 5.48.

Discounted Cash Flow Model for Alphabet

My DCF Model indicates an intrinsic value of $115.18 for Alphabet. At the company’s current stock price of $121, this implies a downside of 4.8%.

Internal Rate of Return for Alphabet

Below you can find the calculations of the Internal Rate of Return for Alphabet when assuming different purchase prices for the company’s stock. At Alphabet’s current stock price of $121, my DCF Model indicates an Internal Rate of Return of 9% for the company.

|

Purchase Price of the Alphabet Stock |

Internal Rate of Return as according to my DCF Model |

|

$100.00 |

15% |

|

$105.00 |

13% |

|

$110.00 |

12% |

|

$115.00 |

11% |

|

$120.00 |

10% |

|

$121.00 |

9% |

|

$125.00 |

9% |

|

$130.00 |

8% |

|

$135.00 |

7% |

|

$140.00 |

6% |

|

$145.00 |

5% |

Source: The Author

Discounted Cash Flow Model for Meta

My DCF Model currently shows an intrinsic value of $220.24 for Meta. At the company’s current stock price of $247, this implies a downside of 10.8%.

Internal Rate of Return for Meta

Below you can find the Internal Rate of Return for Meta when assuming different purchase prices for the company’s stock. At Meta’s current price level of $247, my DCF Model indicates an Internal Rate of Return of 8%.

|

Purchase Price of the Meta Stock |

Internal Rate of Return as according to my DCF Model |

|

$225.00 |

11% |

|

$230.00 |

10% |

|

$235.00 |

10% |

|

$240.00 |

9% |

|

$245.00 |

9% |

|

$247.00 |

8% |

|

$250.00 |

8% |

|

$255.00 |

8% |

|

$260.00 |

7% |

|

$265.00 |

7% |

|

$270.00 |

6% |

Source: The Author

At the companies’ current stock prices of $121 (Alphabet) and $247 (Meta), my DCF Models indicate an Internal Rate of Return of 9% for Alphabet and 8% for Meta, thus strengthening my confidence in selecting Alphabet over its competitor.

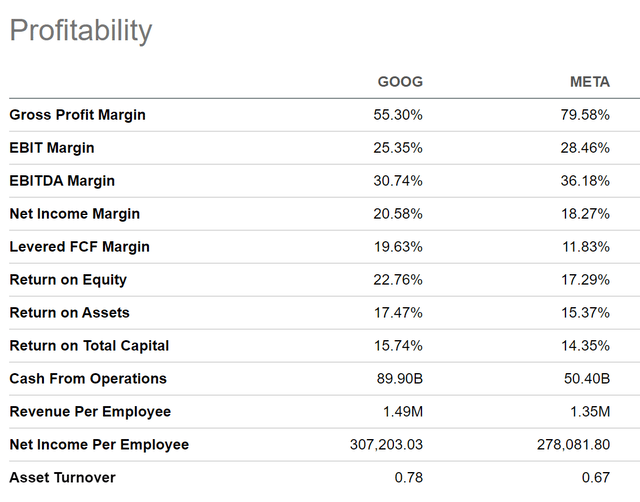

The Companies’ Profitability

In terms of Profitability, I believe that Alphabet is ahead of Meta. There are a variety of metrics that support this theory. Alphabet has a higher Return on Equity when compared to Meta: while Alphabet’s Return on Equity stands at 22.76%, Meta’s is 17.29%.

The same is confirmed when taking a look at the companies’ Return on Assets: while Alphabet’s is 17.47%, Meta’s is 15.37%. In addition to that, Alphabet’s Net Income Margin of 20.58% stands above the one of Meta (18.27%).

All of these metrics support my theory that Alphabet is superior to Meta when it comes to Profitability and has contributed to my decision to select the company over its competitor.

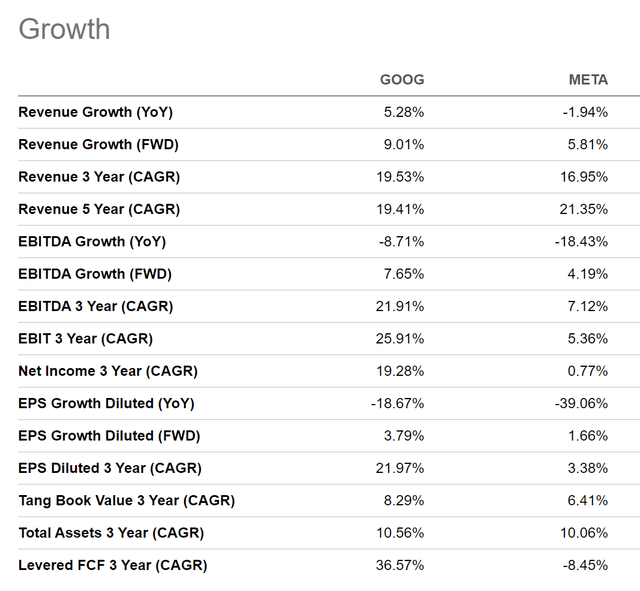

The Companies’ Growth Perspectives

In terms of Growth, I also believe that Alphabet is in front of Meta: Alphabet’s Revenue Growth Rate [CAGR] over the past 3 years is at 19.53% while Meta’s is at 16.95%.

In addition to that, it can be highlighted that both Alphabet’s Revenue Growth Rate [FWD] (9.00% when compared to Meta’s of 5.81%) and its Revenue Growth Rate [YoY] (5.28% compared to -1.94%) are higher than Meta’s.

Furthermore, Alphabet’s EBIT Growth Rate [CAGR] over the past 3 years is clearly above the one of Meta. This indicates that Alphabet has increased its profits at higher growth rates than its rival: while Alphabet’s 3 Year EBIT Growth Rate [CAGR] is 25.91%, Meta’s is significantly lower (5.36%).

Alphabet’s superiority in terms of Growth is further confirmed when taking into consideration the EPS Diluted Growth Rate [CAGR] of both companies over the past 3 years: while Alphabet’s is 21.97%, Meta’s is 3.38%.

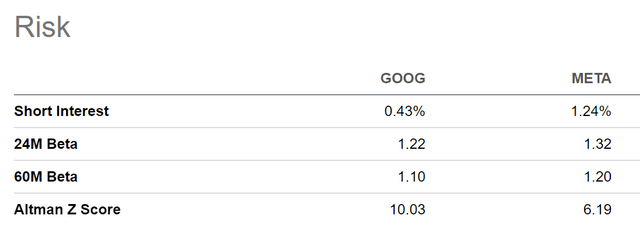

Risk Factors

In terms of risks, I believe that Alphabet is the company that comes with less risks attached.

Alphabet has a higher Total Cash Position (115.10B compared to Meta’s, which is 37.44B) and a lower Total Debt to Equity Ratio (11.30% compared to 22.65%). Both of these factors indicate that Alphabet is the lower risk investment between the two picks.

This is further confirmed when looking at the companies’ Beta Factors: while Alphabet’s 24M and 60M Beta Factor are 1.22 and 1.10, Meta’s are 1.32 and 1.20 respectively. This once again confirms my theory that Alphabet is the company with the lower risk factors attached.

Alphabet’s higher brand value further contributes to the fact that I believe it’s the lower risk investment when compared to Meta.

In addition to that, it can be highlighted that Alphabet has a Free Cash Flow Yield [TTM] of 3.95% while Meta’s is 2.68%. This serves as an additional indicator that an investment in Alphabet comes with less risks attached compared to an investment in Meta.

Furthermore, I would like to add that Alphabet’s Current Ratio (2.35 compared to 2.07) and its Quick Ratio (2.20 compared to 1.91) are superior to Meta’s, once again confirming my investment thesis.

My opinion to consider Alphabet as the lower risk investment has contributed significantly to the fact that I suggest overweighting Alphabet in a long-term investment portfolio while I would only underweight the Meta stock.

Conclusion

There are a variety of reasons why I believe that Alphabet is currently the more attractive pick for investors when compared to its competitor Meta.

First, Alphabet is ahead of Meta when it comes to Profitability, which is underlined by the company’s higher Return on Equity (22.76% when compared to 17.29%).

Second, I believe that Alphabet is superior to Meta when it comes to Growth: Alphabet’s Revenue Growth Rate [FWD] stands at 9.00% while Meta’s is 5.82%.

Third, I believe that Alphabet has a higher economic moat than its rival (to which its higher brand value and stronger financials have contributed).

Fourth, Alphabet has a significantly higher Total Cash Position when compared to Meta: Alphabet’s Total Cash Position stands at $115.10B while Meta’s is $37.44B.

Fifth, I believe that the risk factors are lower for Alphabet investors than for Meta investors: while Alphabet’s 24M Beta Factor is 1.22, Meta’s is 1.32.

Sixth, my DCF Models indicate an Internal Rate of Return of 9% for Alphabet and 8% for Meta. Thus demonstrating that the reward for Alphabet investors should be superior in comparison to Meta investors.

Summarizing, I believe that Alphabet is the better pick when compared to Meta in terms of risk and reward, which has contributed to the fact that Alphabet receives my strong buy rating while Meta receives my hold rating.

In addition to that, it has led me to recommend overweighting the Alphabet stock in an investment portfolio while underweighting the Meta stock.

Author’s Note: Thank you for reading! I would appreciate hearing your opinion on this comparative analysis on Alphabet and Meta. Do you own any of these companies or plan to acquire them?

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.