Summary:

- The market’s concerns about OpenAI’s SearchGPT and DOJ’s potential push for a breakup are overblown.

- SearchGPT is at a prototype stage and faces a very uncertain path forward with OpenAI’s leadership challenges and looming financial stress.

- The possibility of a breakup is too remote to be part of our investment decision at this point.

- Even if it materializes, I’m not convinced it will be detrimental to shareholder value.

Techa Tungateja/iStock via Getty Images

GOOG stock: Strong buy rating reiterated

I last wrote on Google’s (NASDAQ:GOOG, NASDAQ:GOOGL) stock, aka Alphabet Inc., back in July shortly after the release of its Q2 earnings report. That article, entitled “Google Q2: Price Correction Offers Entry Point,” focused on reviewing its Q2 earnings and the market response afterward. I argued for a strong buy rating based on the following considerations:

Strong Q2 results for GOOG stock were met with a sizable market correction. The price dip, combined with the improving fundamentals, offers an excellent entry point. Key return drivers include growth in its cloud service, margin expansion potential, and integration of AI into its vast product lineup.

Since that writing, there have been two material developments surrounding the stock that have caught many investors’ attention. First, news came out that OpenAI is testing an AI-based search engine code-named SearchGPT that’s expected to compete directly with GOOG’s search engine. Second, the U.S. Justice Department recently ruled that GOOG’s search engines were to be considered a monopoly, and furthermore, the potential of a breakup of the company has surfaced shortly after the ruling.

With the developments, I thought it would be helpful to reevaluate my previous thesis and see if it needs to be changed. In the remainder of this article, I will explain why my answer is no. I think the path for SearchGPT is very uncertain, and the fear of its representing a meaningful threat to GOOG is largely speculative at this stage. As for the breakup potential, my argument is that: A) the possibility is so remote that we should not make investment decisions based on it, and B) even if a breakup happens, I doubt the breakup would be detrimental to shareholder value.

SearchGPT and OpenAI’s issues

Let me start with the news surrounding SearchGPT. First and foremost, it’s only a temporary prototype in the testing stage as you can see from the company’s official website (the emphases were added by me):

We’re testing SearchGPT, a prototype of new search features designed to combine the strength of our AI models with information from the web to give you fast and timely answers with clear and relevant sources. We’re launching to a small group of users and publishers to get feedback. While this prototype is temporary, we plan to integrate the best of these features directly into ChatGPT in the future.

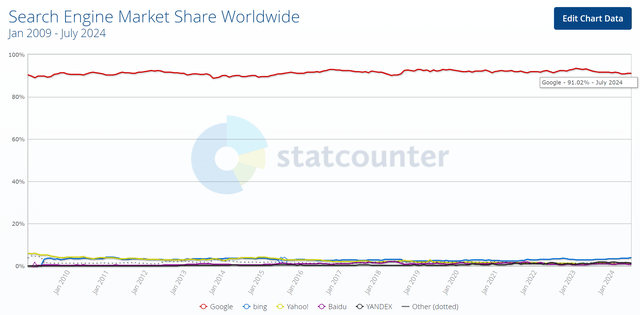

Search engines have always been a contested space from the PC Internet era to the mobile Internet era. And I’m sure competition will extend into the AI era too. However, after more than 20 years of development, the business model of search engines has become quite stable and GOOG has built a relatively mature moat and ecosystem, as reflected in its stable and leading market share shown in the chart below.

There has been no lack of contenders to challenge GOOG’s dominance in the past, many of them with far more resources and technical prowess than today’s OpenAI. Microsoft’s Bing search engine is a handy example. In contrast, OpenAI is currently facing a very tumultuous situation, in my view, with internal unrest and looming financial issues. For example, recent estimates from The Information suggest that OpenAI could suffer losses of up to $5 billion this year and may burn through all its existing cash in one year. The company is losing key talent at an alarming, in my observation. As a recent example (or three examples), three key OpenAI executives have left the company recently, according to this NYPost news. Quote:

Greg Brockman, OpenAI’s President and one of its 11 co-founders, revealed that he is taking an extended leave of absence through the end of the year. Another co-founder, John Schulman, jumped ship to take a position at OpenAI rival Anthropic. Schulman helped lead the OpenAI team responsible for “post-training,” or efforts to hone the large-language models that power ChatGPT. A third product executive, Peter Deng, has also departed recently.

Finally, GOOG is not sitting still – far away from it – on the AI front. Google has been at the forefront of AI integration across its vast product suite, in my view. Specific to search engines, Google’s core search engine already utilizes AI for pretty much everything in my experiences, ranging from understanding search queries to delivering relevant results, including AI summaries, featured snippets, knowledge graphs, image searches, etc.

GOOG stock: What if a breakup happens

Now onto the potential breakup. First, as aforementioned, I consider the possibility of such a breakup so remote that investors should not make their investment decisions on it. If you recall, the last attempt of a similar magnitude was the push to break up Microsoft about two decades ago. Microsoft’s issues at that time were even more extreme than today’s GOOG, in my view, and yet the breakup push failed. In my mind, less dramatic options are way more likely. As an example, DOJ could force Google to share more data with other companies. I hardly think it’s a bad option for GOOG. I see good odds for this option to further enrich and strengthen GOOG’s ecosystem.

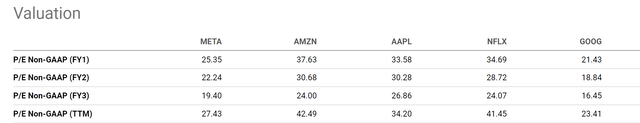

Second, even if a breakup happens, I’m not convinced that it will be detrimental to shareholders. GOOG currently is valued at a discounted P/E compared to many of its peers. As an example, the chart below compares the P/E of GOOG to other FAANG stocks (Meta (META), Amazon (AMZN), Apple (AAPL), and Netflix (NFLX)). As seen, Google’s P/E ratios are generally lower than those of its peers by a sizable margin. Breaking the company up into more independent pieces could add valuation clarity to each part. The individual units could also better focus on their core competencies. Smaller, more focused companies with clear growth trajectories tend to be more appealing to investors, potentially driving up valuation multiples and stock prices. As a result, the combined market value of the individual units could potentially exceed the current valuation of Google as a single entity.

Other risks and final thoughts

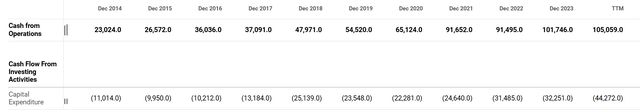

In terms of downside risks, besides the potential competition and regulatory risks analyzed above, the company most likely will have to invest heavily in capital expenditure going forward to stay competitive. The expansion of its AI initiatives and cloud services requires continued investment in technical infrastructure and data centers. As you can see from the chart below, its capital expenditure has grown rapidly in recent quarters. On a TTM basis, its capital expenditure reached $44.2 billion in the past quarter, compared to “only” $32.2 billion in the past year. The good news is that its financial position and organic cash generation capability are very strong. The company exited the last quarter with approximately $100.0 billion in cash assets and only about $13 billion in the long term. Its operating cash flow has consistently increased over the years, as seen in the chart below, reaching a record $105 billion in the most recent TTM period.

To reiterate, the goal of this article is to revisit my previous rating on GOOG given the new development since my last writing. These new developments include OpenAI’s plan to test a prototype AI-based search engine and the recent ruling of the DOJ. And the conclusion is to maintain my early strong buy rating. I do not consider SearchGPT to be a meaningful threat given the uncertainties at OpenAI, GOOG’s competitive moat, and also GOOG’s own AI-related products. As for the breakup potential, I consider it a very remote possibility and suspect it would end up creating shareholder value if it actually happens.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.