Summary:

- Alphabet Inc./Google’s Waymo is leading the U.S. robotaxi race, with over 100,000 trips per week.

- Waymo’s safety record is remarkable, with fewer crashes than human drivers.

- Hardware costs are decreasing for Waymo such that their complete and redundant architecture is becoming less of an economic challenge.

JasonDoiy/iStock Unreleased via Getty Images

Introduction

Per my August article, Google (NASDAQ:GOOG, NASDAQ:GOOGL) has a great business, but there is a high level of regulatory risk. Since then, it has been revealed that Waymo has doubled from 50 thousand rides per week to 100 thousand.

My thesis is that Waymo is leading the race to capture significant ride-share miles in the U.S. with robotaxis.

The Race

Per an April 2023 article from The Verge, Cruise (GM) was doing 1,000 driverless trips per day or 7,000 per week before their fleet was pulled off the roads. A July 2023 post by @kvogt talks about Cruise being in areas like San Francisco, Phoenix, Austin, Houston, Dallas, and Nashville. Their fleet was suspended because of an incident between one of their vehicles and a pedestrian about a year ago on October 2, 2023. CBS News says Cruise vehicles will be back on the roads in a partnership with Uber (UBER) in 2025, but they are extremely far behind Waymo now.

A July 2024 Fortune article by Jessica Mathews says Amazon Zoox (AMZN) hasn’t yet launched their commercial passenger service.

Per a May 2024 Fortune article, both Uber and Apple (AAPL) were directly in this race at one point, but the former quit in 2020 and the latter in 2024. Uber is still indirectly involved through their partnerships with Waymo and Cruise.

Mobileye (MBLY) and Volkswagen (OTCPK:VWAGY) made a robo-shuttle announcement in March 2024, but I think it will take them a considerable amount of time to reach a substantial number of miles driven in the U.S.

Tesla (TSLA) is having a robotaxi event on October 10th, but they have zero robotaxi trips up to this point. Currently, their full self-driving (“FSD”) software requires a licensed driver to sit in the driver’s seat while keeping eyes on the road.

Per a September 2024 Reuters article, the Biden administration has raised the possibility of banning Chinese connected car tech from U.S. roads. Given this uncertainty, the scope of competitors in this article is limited; Chinese companies like Baidu (BIDU) are excluded.

Waymo is leading the race, and I believe they will continue to be successful. Tesla doesn’t yet have any robotaxi miles, but unlike Waymo, their software works just about everywhere in the United States. One reason we take Tesla seriously despite them not yet having robotaxi miles is because they are not as reliant on mapping as Waymo, Cruise and Zoox. The July 2024 Fortune article above points out issues for map-reliant companies like Waymo, Cruise and Zoox:

Zoox’s autonomous driving technology operates via mapping, Evans explained, and differences in the way snow is plowed or falls may alter the roads from those maps. In an interview after her on-stage talk, Evans told Fortune that all robotaxi companies are doing additional research to be able to operate in the snow, but they haven’t figured it out just yet. “I don’t want to mislead people that it’s just an extension of what we’re currently doing,” she said. “It requires some additional innovation.”

Both Waymo and Tesla use cameras for production self-driving software but their use of LiDAR differs. Waymo uses LiDAR for production whereas Tesla only uses LiDAR for training. Tesla announced they were eliminating radar in new cars in May 2021. A Washington Post article by Faiz Siddiqui says some Tesla engineers disagreed with CEO Musk about this decision (emphasis added):

Without radar, Teslas would be susceptible to basic perception errors if the cameras were obscured by raindrops or even bright sunlight.

Tesla’s decision to eliminate radar in May 2021 is puzzling, given what Waymo has said about weather (emphasis added):

Radars are naturally good at seeing long distances and are relatively unaffected by even the toughest weather conditions.

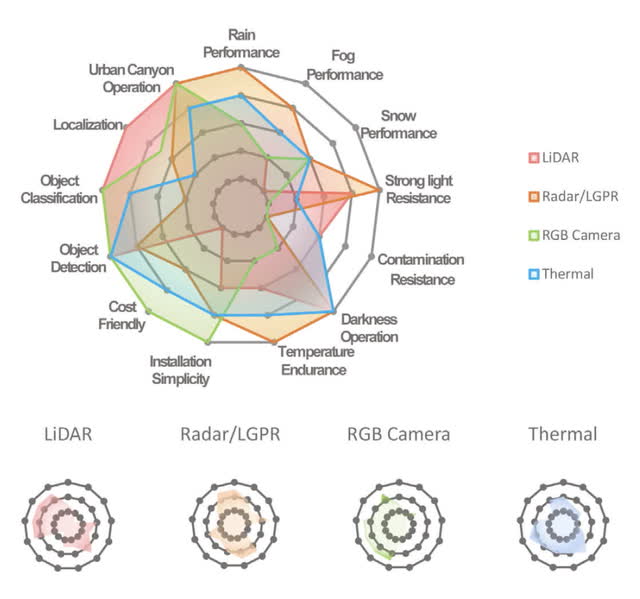

A February 2023 Perception and sensing for autonomous vehicles under adverse weather conditions paper by Yuxiao Zhang et al. breaks down sensor performance in a diagram, and we have to review some terms to appreciate the ramifications for the robotaxi race. Urban canyons are formed when a street is densely populated with tall buildings on the sides. Quoting from a 2018 paper by Fallah Kuutti et al., the Yuxiao Zhang paper defines localization as follows:

The awareness of an ego vehicle’s own location is as important as knowing other elements’ locations in the surrounding environment. In terms of autonomous driving, localization is the sensing of an AV about its ego-position relative to a frame of reference in a given environment.

Object classification occurs when we differentiate between pedestrians, vehicles and other objects. The other terms in the diagram are self-explanatory. Looking at the diagram, LiDAR performs well with localization, urban canyon operation, object classification and object detection. Radar shows strength with rain performance, urban canyon operation, temperature endurance, darkness operation and light resistance. RGB camera scores well with urban canyon operation, object classification, object detection, cost, and installation:

LiDAR, Radar and Cameras (February 2023 Yuxiao Zhang et al paper)

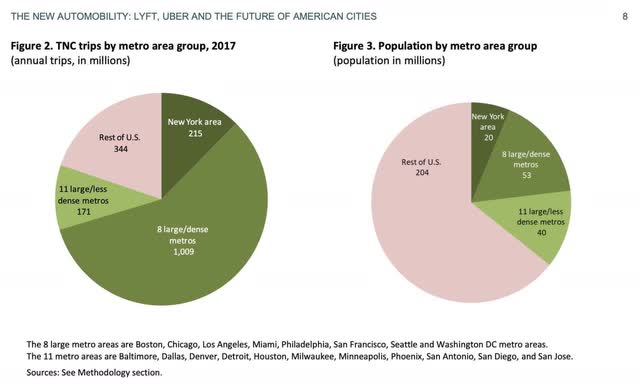

Some say Waymo’s lead isn’t wide because Waymo vehicles rely on mapping such that it may take them a long time to get their technology working in some urban areas with snowfall and in all rural areas. This is opposed to Teslas whose FSD software works anywhere in the U.S. This consideration has limited impact on the rural side because most ride-sharing miles are in urban geographies. Per a July 2018 Schaller Consulting report, Transportation Network Companies (TNCs), otherwise known as Ridesharing companies, are largely concentrated in urban areas. 70% of Uber and Lyft trips in the U.S. in 2017 were in large urban areas such as Boston, Chicago, Los Angeles, Miami, New York, Philadelphia, San Francisco, Seattle, and Washington DC. Combined, there were an estimated 1,224 million TNC trips in these 9 urban areas in 2017 out of an estimated total of 1,739 million trips. Waymo already has a presence in San Francisco and Los Angeles:

Ridesharing geography (July 2018 Schaller Consulting report)

Waymo is currently doing more than 100,000 trips per week, which exceeds 5.2 million trips per year. There is plenty of room for them to increase this immensely by remaining diligent with their focus on urban areas. Per a July SF Chronicle article, Waymo has been growing nicely in California and the numbers give us a sense of how we can extrapolate from trips to miles::

|

Paid driverless trips |

Paid driverless miles |

Avg. miles per trip |

|

|

Jan 2024 |

77,200 |

426,800 |

5.5 |

|

Feb 2024 |

74,200 |

411,300 |

5.5 |

|

Mar 2024 |

83,900 |

450,100 |

5.4 |

|

Apr 2024 |

92,000 |

573,200 |

6.2 |

|

May 2024 |

143,600 |

903,500 |

6.3 |

If other states such as Arizona also work out to about 6 miles for each trip like California, then Waymo is doing over 600 thousand miles per week nationally, seeing as they said they are now doing over 100 thousand rides per week. I think they’re doing about 2.5 million miles per month now, which is about 30 million miles per year, and this should go up substantially as they use the Uber app in new markets like Austin and Atlanta. Forbes says Buffalo, Dallas, Detroit, Houston, Las Vegas, Miami, New York City and Seattle are some 25 cities where Waymo is doing testing. Not only does Waymo have a lead, but they are building on it rapidly. In all of Waymo’s existence over many years, they only had about 22 million cumulative miles through June 2024, and now they are adding substantially more than that every single year.

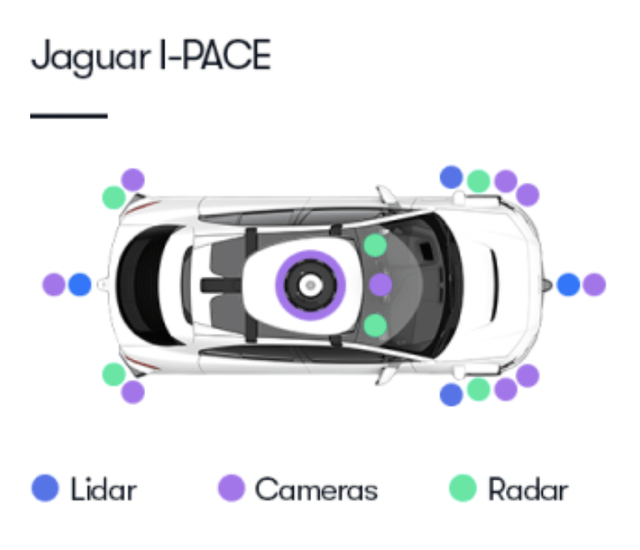

The hardware for Waymo vehicles is getting cheaper. Their 5th generation Jaguar I-PACEs have 29 cameras, and Tangram gives a detailed breakdown. Waymo’s 6th generation vehicles have just 13 cameras. Here is a diagram of the I-PACE hardware:

Historically, LiDAR has been a substantial cost for Waymo. Their 6th generation architecture has 4 units and prices should continue to fall in the years ahead. LiDAR continues to get less expensive over time, per a March 2024 MotorTrend article:

today’s sensors are priced in the hundreds of dollars, and they’ll only get cheaper.

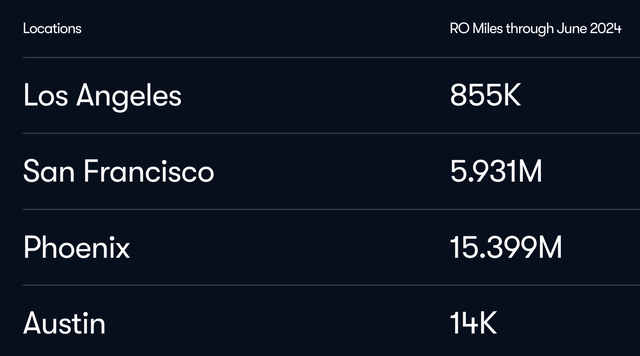

One of the reasons Apple, Uber, and others are no longer working on their robotaxi projects is because they couldn’t demonstrate safety records as strong as Waymo’s. The September 2024 Waymo Safety Impact report is based on approximately 22 million rider-only (RO) miles through June 2024, mostly from Phoenix, Arizona:

Waymo Mileage (Waymo Safety Impact report)

Per the above report, Waymo has fewer crashes than human drivers on average. The Waymo numbers from approximately 22 million miles show 48% fewer police-reported crashes, 73% fewer injury-causing crashes and 84% fewer airbag deployment crashes relative to human drivers:

Waymo Safety (Waymo Safety Impact report)

Given Waymo’s lead with miles, their safety record and the falling costs of their all-purpose/redundant architecture, I believe they are in an excellent position to continue in first place in the U.S. robotaxi race for the foreseeable future.

Valuation

A May 30 Fortune article by David Meyer quotes Ptolemus Automotive Consultant Frederic Bruneteau, saying one of the reasons licensing opportunities exist for Waymo is because many automakers don’t have the resources to build self-driving systems themselves (emphasis added):

According to Bruneteau, this – and the fact that Waymo doesn’t present competition in the automaking field – may provide an opportunity for Alphabet’s operation to license its technology. “There could be an invasion from the robo-taxi segment to the high-end and midrange segments of those [automakers] who haven’t been able to sufficiently invest,” he told me. “And today, that’s most of them.”

Fortune Writer Meyer goes on to quote a Waymo spokesperson who confirms the potential with licensing:

And a Waymo spokesperson indicated that this is indeed an option, noting that the Waymo Driver could be integrated with everything from ride-hailing vehicles and trucks to personal cars: “By building a driver, not a vehicle, we’re building a system of multiple applications and routes to commercial scale, which means we have multiple routes to huge markets without being locked into a single use case, and that our share of the [autonomous vehicle] market can grow without the costs of vehicle manufacturing.”

The licensing potential for personal vehicles should strengthen Waymo’s valuation range considerably. Forward-looking investors need to pay attention as the hardware continues to get less complicated, less weird looking and less expensive.

My valuation thoughts for Google as a whole haven’t changed substantially since my July and August articles because Waymo is a small part of the overall picture at this time. I see Google stock as being somewhere between a hold and a buy, given the current regulatory uncertainties with their larger advertising business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AAPL, AMZN, TSLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.