Summary:

- Google faces antitrust pressure from the DOJ, which last week proposed a break-up of its Search, Chrome, and Android businesses, causing shares to slide 5% lower.

- Despite legal challenges, I remain optimistic about Google’s continued dominance in digital advertising and Cloud, recommending investors buy the dip.

- Search remains absolutely essential to Google’s data-driven business, and a forced sale seems unlikely.

- Google’s valuation is attractive at a P/E ratio of 18.6X, making it one of the cheapest big tech stocks available.

- The most likely outcome, in my view, is a negotiated settlement, not a forced break-up, with negative sentiment potentially persisting until a final decision next year.

da-kuk/E+ via Getty Images

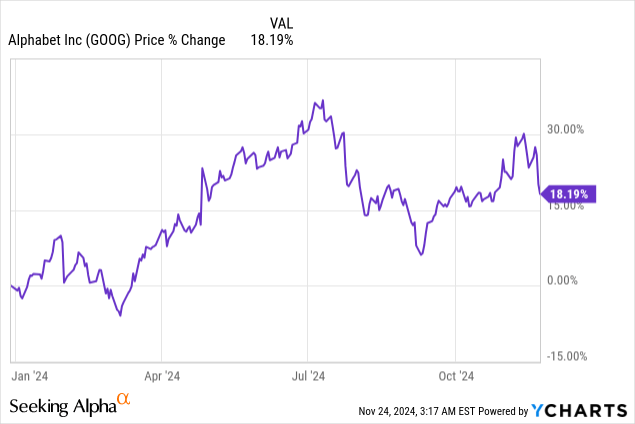

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) is under increasing pressure to split off its Search business which has been the target of an antitrust investigation by the Department of Justice. The legal confrontation between Google and the Department of Justice went into the next round last week, causing Google’s share price to fall 5% on Thursday. However, I don’t believe that Google will ultimately have to sell off its Chrome business and will remain a fully intact Search and Cloud company. Because of the Department of Justice’s attempt to push for a break-up of Google, shares have seen the creation of new negative investor sentiment that I believe investors can take advantage of. I see no reason to sell Google here and remain optimistic that the tech company will be able to continue to outperform in the digital advertising market.

Previous rating

I rated shares of Google a strong buy after the tech company reported better than expected third-quarter results that were driven by exceptional performance in the rapidly-expanding Cloud business as well as Search. As a result, Google benefited from a surge in operating income as well as strong free cash flow, including higher FCF margins. In my opinion, the legal battle surrounding Google’s Search engine is a distraction only, and it will likely get resolved at some point in the form of a settlement.

Google vs. DOJ: the battle is heating up

Google pays Apple Inc. (AAPL) an estimated $18-20B annually to be Apple’s default search engine which obviously benefits Google greatly. By ensuring default search status, Google can maximize the treasure trove of data on the back end and dominate the market for digital advertising. This practice has drawn the ire of the Department of Justice which brought an antitrust case against Google in order to make the digital marketing industry more competitive.

In a major new development, the Department of Justice last week proposed that Google will have to be broken up and sell its Chrome browser. As per the DOJ’s proposed final judgment:

Google’s ownership and control of Chrome and Android—key methods for the distribution of search engines to consumers—poses a significant challenge to effectuate a remedy that aims to

“unfetter [these] market[s] from anticompetitive conduct ”and“ ensure that there remain no practices likely to result in monopolization

in the future.” To address these challenges, Google must divest Chrome,

which has “fortified [Google’s] dominance,” Op. at 33, so that rivals may pursue distribution partnerships that this “realit[y] of control,” id. at 159 (citations omitted), today prevents.

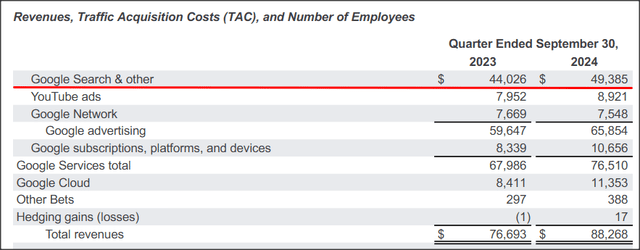

A forced sale of Chrome would obviously be highly detrimental to Google’s business model, which relies to a large extent on data collection and its subsequent monetization. Losing Chrome would obviously be the worst-case outcome for Google, not only because Google Search is generating the majority of the company’s revenue and operating income, but also because this revenue stream is growing reliably. In the September quarter, Google Search generated $49.4B in revenue for Google and represented a total revenue share of 56%.

Further, digital advertising, which is the foundation of Search, is a significant growth driver for Google. In the most recent quarter, Search generated 12% year-over-year growth, and it has by far the largest incremental revenue impact on the company’s consolidated top line. The fastest-growing segment in Q3 was Cloud, which achieved revenue of $11.4B and the highest growth rate of any business of 35%. But because Google Search is generating the highest amount of revenue within Google’s operating portfolio, Search is the most important revenue driver on an absolute dollar basis: of the $11.6B top-line increase, 46% came exclusively from Search.

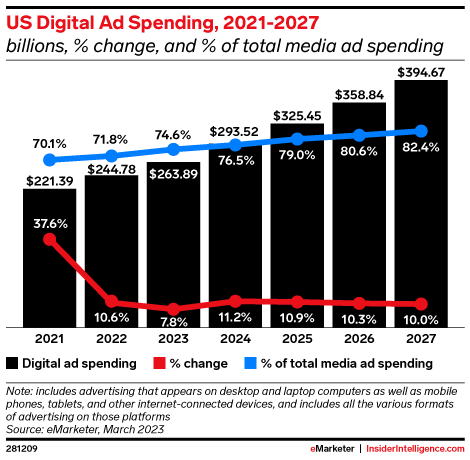

Digital advertising is only going to become more important for Google going forward, in part because companies like Google are learning to use their data better, in part through the application of AI tools. The digital advertising market is set to expand, according to eMarketer, to $394.7B by the end of FY 2027 and more advertising spending is going to be allocated to digital advertising channels.

eMarketer

What is the most likely outcome of the antitrust case?

It is likely that Google investors will have to live with a negative sentiment overhang as it relates to the antitrust case for a while. The final decision will likely be only made next year in August, which is when a final decision is expected. However, I consider it unlikely that Google will lose its Search engine business, which is still Google’s core operation. A negotiated settlement, in my opinion, is the most likely outcome. Even Microsoft Corporation (MSFT), which faced a similarly aggressive antitrust probe in the 1990s was eventually not split up and agreed to modify its business practices; allowing PC manufacturers to include non-Microsoft software in its products. Given that Google is on track to earn ~$70B in the next year in free cash flow (and therefore has sufficient resources), I believe the tech company may ultimately settle its antitrust case with the DOJ.

Google’s valuation

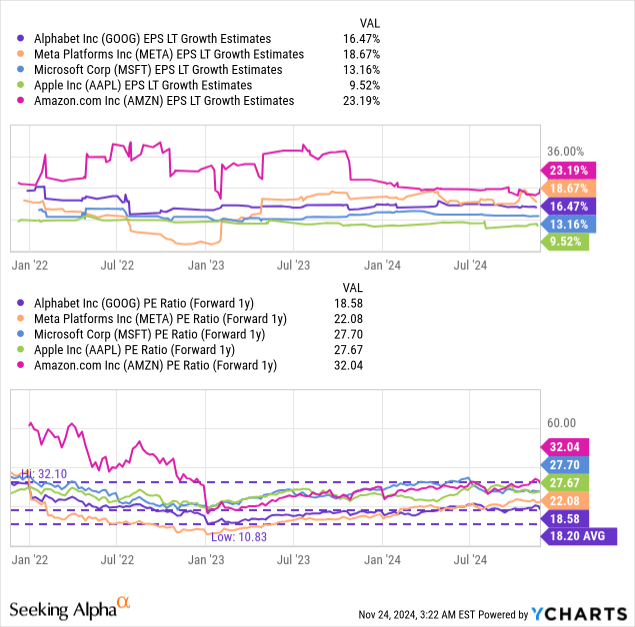

Google’s ‘DOJ’ dip made shares of the tech company cheaper last week. Google is currently valued at a price-to-earnings ratio of 18.6X which makes the tech company the cheapest big tech stock that investors can buy. Google is even cheaper than Meta Platforms, Inc. (META) which has been one of the cheapest big tech firms in the large-cap category for a while. I like Meta Platforms a lot due to its strong free cash flow, low valuation, and consistent user growth across its platforms. The valuation, in my opinion, is still one of the most alluring features of an investment in Meta Platforms: The Valuation Makes No Sense.

The industry group average P/E ratio is 25.6X which implies that Google is priced at a 27% discount to the average big tech company here. The industry group includes Apple, Meta Platforms, Amazon.com, Inc. (AMZN), and Microsoft Corporation (MSFT). Given that Google generates a serious amount of free cash flow each quarter — $17.6B in Q3’24 — I don’t believe the discount to the industry group average P/E ratio is warranted, even under consideration of the DOJ’s attempt to sever Google from one of its businesses. If Google revalued to the industry group P/E ratio of 25.6X, which, I believe, is a reasonable long-term assumption, then shares could have a fair value in the neighborhood of $227 per share, implying 38% upside revaluation potential.

Risks with Google

The biggest risk with Google is, in my opinion, a slowdown in the Cloud and Search businesses because investors’ expectations for super-charged growth are chiefly related to the company executing well in these two specific segments. The worst outcome for Google in terms of the antitrust case would be for the company to be forced to divest its Search business… which I believe is a highly unlikely outcome, especially with the unsuccessful Microsoft case in the 1990s providing a precedent. What would change my mind about Google is if the tech company were to see a decline in its top line growth rate or its free cash flow margins.

Final thoughts

Google’s shares sold off last week after the Department of Justice proposed to break up Google and sell, at the very least, Google Chrome, due to the dominant nature of Google’s Search business. Potentially, even a sale of Android could be on the table. However, I believe that a break-up is highly unlikely, and I would recommend investors buy the ‘DOJ’ dip. No major American company has been forced to sell the core part of its business in the last several decades and even Microsoft in the 1990s ultimately avoided being broken up. I expect, however, Google’s shares to remain subject to negative investor sentiment and my overall strategy here would be to buy the dips along the way.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, AMZN, AAPL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.