Summary:

- Alphabet Inc. had an impressive second quarter, beating analyst estimates with revenue growth of 13.6% and EPS growth of 30.5%.

- Google Cloud saw significant growth, crossing $10 billion in revenue for the first time, with a 29% increase in revenues and 197% increase in operating income.

- Despite regulatory challenges and market concerns over AI spending, Alphabet stock remains undervalued compared to its peers, with a projected price target of $248.

Marat Musabirov

Investment Thesis

Alphabet Inc. (NASDAQ:GOOGL)(NASDAQ:GOOG) released its second-quarter results last week. In this article, I am initiating coverage of the company by analyzing its second-quarter earnings report and by analyzing some of the major developments announced by the company, especially on the AI front.

A Snapshot of Second Quarter Results

Alphabet delivered an impressive second quarter, in my opinion. Q2 revenues came in at $84.7 billion, up 13.6% y/y and beating analyst estimates by $452.5 million. Diluted EPS came in at $1.44, registering a y/y growth of 30.5% and beating analyst estimates by $0.04. Operating margins came in at 32%, expanding by 300 bps y/y, and free cash flows came in at $13.5 billion, taking the trailing 12-month FCF to $60.8 billion. The company ended the quarter with $101 billion in cash and marketable securities and announced a quarterly dividend of $0.20.

While the company doesn’t give quantitative guidance, the outlook provided during the earnings call offered some insights into what to expect during the second half of the year. While management expects operating margins to expand y/y for the full year, Q3 operating margins are expected to face headwinds from increases in depreciation and expenses related to higher levels of capex spend as well as from higher cost of revenues because of “pull-forward of hardware launches into Q3.” Quarterly capex spend for the rest of the year is expected to be at or above $12 billion, and the company has also committed to a new multi-year investment of $5 billion.

Q2 Shows Strength Across All Segments but Cloud Stands Out

All segments of the company delivered a strong performance during the quarter. Google Services revenues, which includes the likes of Search and YouTube, saw a y/y growth of 11.5%, coming in at $73.93 billion. The segment also saw its operating income jump 26.5% y/y, reaching $29.67 billion. Within the segment, revenues from Search and advertising grew 14% y/y, coming in at $48.5 billion, driven primarily by the retail and the financial services verticals. YouTube revenues came in at $8.7 billion, up 13% y/y, and while these fell short of analyst expectations of $8.93 billion by 2.6%, the fact that the segment returned to double-digit growth after a period of declines last year is a positive takeaway in my opinion. At the same time, it became the most-watched streaming platform on TV screens for the 17th consecutive month, according to Nielsen, which continues to demonstrate its strength. Finally, the monetization rate of Shorts relative to in-stream viewing continues to show significant improvement, further contributing to the revenue growth of the segment. Overall, in my opinion, Google’s core operations delivered a strong quarter and the negative market reaction to YouTube’s revenues is unwarranted, in my opinion.

Having said that, for me, this quarter belonged to Google Cloud, as the segment saw a 29% jump (y/y) in revenues, crossing the $10 billion mark for the first time and a 197% jump in operating income, coming in at $1.2 billion, crossing the $1 billion for the first time. Management also offered some insights into how the company’s AI investments have helped the Cloud segment achieve this milestone. According to CEO Sundar Pichai, “Year-to-date, our AI infrastructure and generative AI solutions for Cloud customers have generated billions in revenues and are being used by more than 2 million developers.”

Furthermore, management also announced, during the earnings call, that a majority of the company’s top 100 customers are already using their gen AI solutions. Based on these comments, it is clear that the company’s AI investments are starting to pay off for the Cloud segment, and while it is nowhere close to Azure and AWS, the progress made by the segment is impressive, and the AI revolution should continue to drive momentum in this segment.

The role that AI has played in driving growth for Google Cloud brings me to yet another contentious point, which is that I believe that the negative market reaction to the company’s AI spend was overdone. More specifically, I am talking about the management’s announcement that the company would be spending at least $12 billion a quarter on AI-related capital expenditures. This would take the company’s total capex spend for FY24 to $50 billion. It is this news that investors reacted negatively to, driving the company’s stock post its earnings release.

I have major issues with this market reaction. First, it is clear that we are in the very early stages of the AI revolution, and the technology has a long way to before it becomes mainstream. While generative AI is already transforming a multitude of industries such as healthcare, agriculture, and manufacturing, its macroeconomic impact has still not been felt. According to the World Economic Forum, this is perfectly normal. The report states that the impact of past technological breakthroughs on macro variables has taken years to materialize, not quarters. As such, the report goes on to state that the impact of gen AI “will not be immediately measurable through common indicators such as GDP growth, inflation, and factor productivity.” At the same time, the fact that the AI technology can be rolled out quickly compared to past breakthroughs suggests that the macroeconomic impact may be felt quicker than in the past. In short, patience is warranted when it comes to the AI revolution and the investments in this space are not for the faint-hearted.

Second, one of the reasons why investors punished the stock was because they were unsure whether AI investments would translate to higher profits. While the company didn’t break out the revenues and profits generated from AI adoption, the performance of the cloud and Search segment clearly showed that AI has had a positive impact on the top and bottom lines of the company. As mentioned earlier, Cloud has seen its revenues jump 29% and operating profits jump 197%. Management, during the earnings call, has seen AI deliver better responses on search queries and is seeing “positive trends,” from the company’s testing of AI Overviews, with higher engagement seen from users in the 18-24 age category through AI Overviews. At the same time, Overviews are also helping the company’s ads business, with positive engagement seen with ads that appear either above or below the Overviews. The result was that revenues from Search jumped 14% y/y. With more AI-driven features set to be incorporated into Search in the coming months, such as video search queries, and with Gemini set to be launched in Gmail and Google Photos, I would expect AI to continue to drive the growth of this segment.

Finally, it is not just Google that’s spending on AI. Amazon, Meta, and Microsoft, all of them are spending big on AI. According to analysts, the total capex spent by Big Tech firms, driven by AI, is likely to exceed $1 trillion in the next 4-5 years. So, it’s not as if Alphabet has a choice. I fully agree with CEO Sundar Pichai’s statement that “the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing.” Simply put, Alphabet cannot afford to stand still. Competitors are continuing to spend, and some of them have even ventured into Google’s territory of AI-powered search. So, staying still is not an option, especially when it comes to a technology that is not a passing façade but is transformative in every sense. Investors expecting quick returns from this, in my opinion, are simply in the wrong place.

Failure to Acquire Wiz Shows the “Regulatory Stench” Surrounding the Company

One of the other takeaways from the quarter was that the company’s $23 billion planned acquisition of cybersecurity player Wiz, fell apart. The acquisition would have been the largest ever in the company’s history, but according to reports, the fact that the deal would have invited regulatory scrutiny was one of the major reasons why Wiz walked away from the deal and is now planning an IPO instead.

While there was no mention of the Wiz deal during Google’s earnings call, management did talk about its decision to reverse its decision of eliminating tracking cookies in its Chrome browser. The company now plans to introduce a prompt that would ask users whether they want to opt in or out of cookies in Chrome, essentially leaving the choice to the consumer. This reversal came after pushback from both advertisers and regulators. The UK regulator, the Competition and Markets Authority (CMA), in this instance, had intervened when Google initially announced its plans as it feared that removing cookies could have pushed advertisers to use the company’s own systems, thereby harming competition.

The battle with regulators is not Google’s headache alone, although it could be facing a massive one, if a ruling in the federal government’s antitrust case against the company results in a breakup of its $250 billion a year advertising business. However, when it comes to acquisitions, each of the ‘Sensational Six’ (Apple, Amazon, Alphabet, Meta, Nvidia, and Microsoft), with the possible exception of Nvidia, have been targets of regulators. They have all become so big that any acquisition announcement invites automatic scrutiny related to whether these tech giants are attempting to kill off competition. So, the fact that the Wiz acquisition fell apart should not come as a surprise. However, the performance of Google Cloud does suggest that the failure of the deal may not have any lasting impact on the company.

The inability to make meaningful acquisitions anymore without inviting regulatory scrutiny is yet another reason why Alphabet has to spend massively on building out its AI infrastructure. Organic growth seems to be the only option available to the company, in my opinion, which lends further support to the company’s plans to increase its AI spend.

Valuation

|

Forward P/E Multiple Approach |

|

|

Price Target |

$248.00 |

|

Projected Forward P/E Multiple |

22.5x |

|

Projected FY24 EPS |

$7.99 |

|

Projected Earnings Growth |

38% |

|

Projected FY25 EPS |

$11.02 |

Source: LSEG Data (formerly Refinitiv), Author’s Calculations, and Seeking Alpha

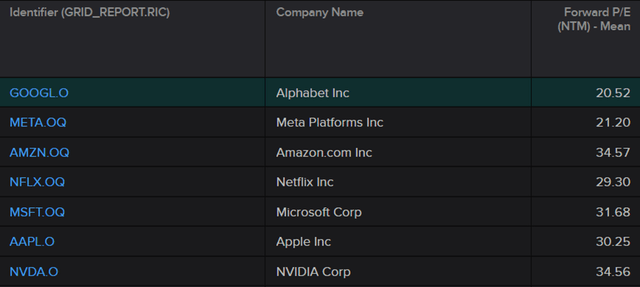

The company currently trades at a forward P/E of 20.5x, making it the cheapest amongst the Sensational Six (Meta, Amazon, Microsoft, Apple, Alphabet, and Nvidia). It is also trading cheaply to its historical multiple of 22.5x. The median P/E multiple of the aforementioned Big Tech stocks stands at 31x. If we drop Nvidia, which belongs to a different category altogether, the median forward P/E stands at 30.2x. In my opinion, this is the multiple that Alphabet should be trading at, given that it, along with its peers, all stand to benefit from the AI revolution. However, given that the benefits from AI will take time to fully translate to profitability, I have assumed the company’s forward P/E to be its historical multiple of 22.5x.

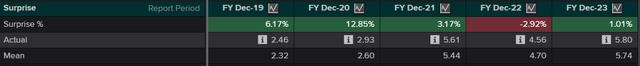

LSEG Data (formerly Refinitiv)

The consensus EPS estimate for FY24, according to LSEG data, stands at $7.65. On average, the company has beaten its full-year EPS consensus estimates by 4.05%, with FY22 being the only time that it missed estimates. I have assumed that the company would beat analyst estimates by 4.05%, so my FY24 EPS estimate stands at $7.99, which would represent a y/y growth of 38%. Assuming the company maintains the same growth rate for FY25, this would result in a projected FY25 EPS of $11.02.

LSEG Data (formerly Refinitiv)

A forward P/E of 22.5x and a projected FY25 EPS of $11.02 results in a price target of $248, which suggests an upside of about 46% from current levels.

Risk Factors

The main risk factor to my thesis is the company’s regulatory issues, especially the antitrust judgment that seeks a breakup of its advertising business. This is a company that has had a history of issues with regulators, both in the US and in the EU. But if the company loses the latest legal battle, then it could be seismic for its business.

The other risk factor, in my opinion, is that competitors, thanks to AI, are entering Search, the company’s core business. The latest entrant is OpenAI, which last week, began testing AI-powered search. In addition, Microsoft also revealed that it added gen-AI capabilities to Bing. Gen-AI-powered search engines are expanding, and while Google continues to dominate the area for now, this is an area that investors have to keep a close watch.

Concluding Thoughts

Alphabet had an excellent quarter in my opinion. It beat both the top and bottom-line estimates, with diluted EPS showing a growth of over 30%. Despite this, the market was not happy with the company on account of its intention to spend more than $12 billion a quarter towards AI infrastructure. This spending is necessary, in my opinion, as this is a technology that is sure to transform every industry out there. At the same time, competitors are also spending heavily, and this is one area where Alphabet simply cannot afford to lag. This is simply not a repeat of 2022, when tech companies, especially Alphabet, had become bloated on account of excessive spending.

Furthermore, due to intensive regulatory scrutiny, companies like Alphabet cannot buy their way toward AI growth. Inorganic growth through M&A is no longer easy for Big Tech, as regulators question whether their acquisitions kill off competition.

Finally, from a valuation perspective, the company remains the cheapest amongst its peers. And there is substantial upside from current levels based on my valuation. However, should the likes of Microsoft, Amazon, Meta, and Apple fail to deliver ‘perfect quarters,’ then I would expect more downside in the name on account of a broader selloff. However, in my opinion, any further pullback only makes the search giant even more attractive.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOGL, AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a beneficial Long position in the shares of MSFT, NVDA either through stock ownership, options, or other derivatives.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.