Summary:

- Google/Alphabet Inc. stock looks set to continue its prior rally higher after a consolidation/pullback.

- Seasonality is extremely favorable for the next few weeks, and then into year-end.

- Estimates are moving higher and the valuation is still below pre-pandemic levels.

400tmax

Tech stocks, having powered the broader markets to massive gains so far this year, have seen some consolidation recently. Some have consolidated more than others, and in the case of Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) aka Google, that consolidation has been an outright pullback. Alphabet has been relatively weak this year against its mega-cap tech peers, but the chart, valuation, reversion to the mean on revenue and margin growth, and seasonality are all lining up favorably right now for the bulls.

Ready to launch

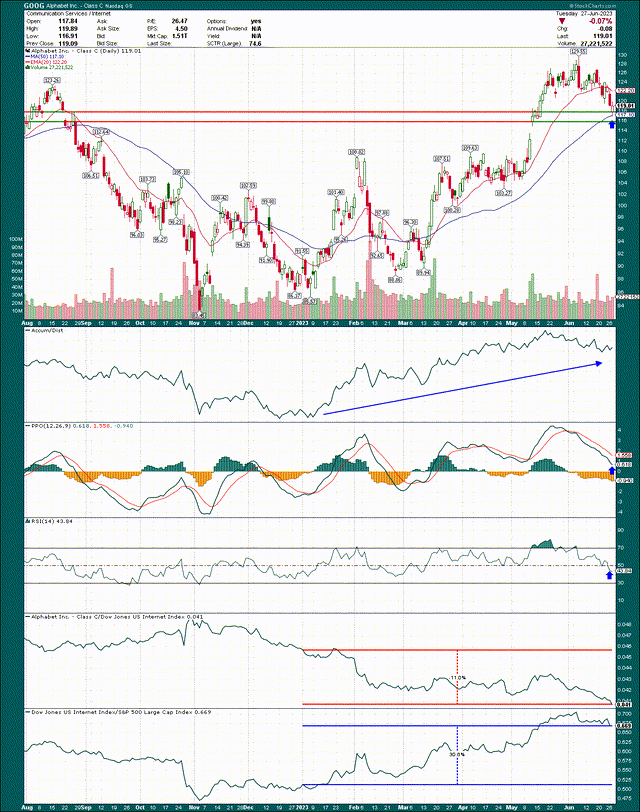

Alphabet shares have been trending lower after the big rally to start the year fizzled out just below $130. The stock closed yesterday about $11 below that, so the pullback has been meaningful. In fact, it’s been meaningful enough to reset momentum, and put the stock into a critical support level that I think has a very high likelihood of holding.

The rising 50-day simple moving average is $117 currently, and the stock bounced very nicely off of it yesterday. That buying means the bulls are still interested, and there’s a zone of support from prior gaps and support/resistance levels that make this area very important. The bottom of the zone is about $116, and the top is about $118, so between $116 and $118 there are three different reasons for the bulls to make a stand. That sort of confluence of support is something I love to trade because the odds are much more in the favor of the bulls with this sort of action.

What makes it even more enticing is that the PPO, which is my favorite trend indicator, is now back right above the centerline. The stock was way overbought at $130, but that’s no longer the case, and the momentum picture supports a bounce here.

Alphabet has been very weak compared to its peer group, the latter of which has beaten the S&P 500 (SP500) by a staggering 30% this year (so far). Alphabet has underperformed the group, but I think that’s about to change.

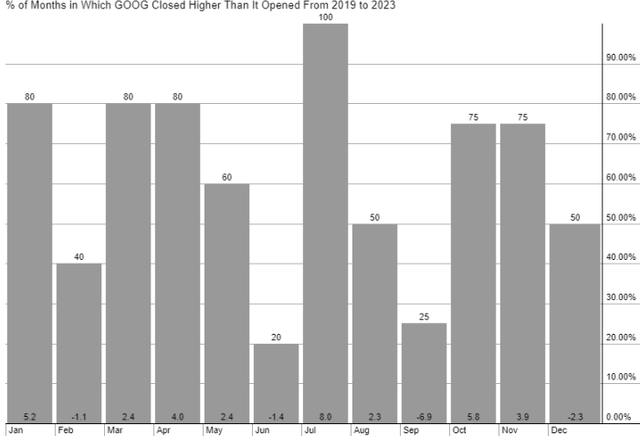

If we look at Alphabet’s seasonality, we can see that for the past few years, July has been positive 100% of the time.

While August is only half that, and September worse, for the immediate term and into the end of the year, seasonality is lining up very nicely with what I see as a high probability of a reversal higher.

Reversion to the mean

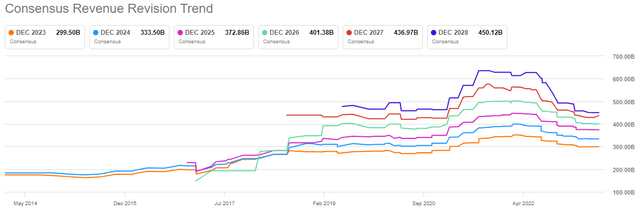

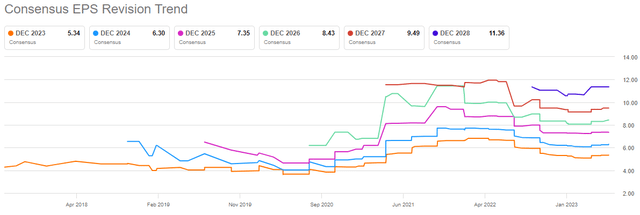

Alphabet, like a lot of tech companies, saw a massive boom in revenue and earnings during the pandemic. That quickly unwound, however, and estimates are back to more reasonable levels. In fact, the long downgrade cycle you see below appears to have ended, which is yet another positive catalyst moving forward.

While revenue revision aren’t exactly flying, they have leveled out and are starting to turn higher. About 62% of recent revisions on the top line have been higher, which is a good start in terms of shifting sentiment. Wedbush was out with a note earlier this week on Alphabet’s ability to capture renewed strength in cloud spending, and if that’s the case, we should see these estimates start to gradually move higher.

Now, I’m not convinced the stock has been struggling on a relative basis because Alphabet’s business is no longer attractive. After all, it is the dominant global player in something just about everyone uses. Rather, the company’s growth rate in both the top and bottom lines has slowed significantly since the pandemic, in a reversion to the mean. The good news is that after the hiccup this year, we should see Alphabet’s top and bottom lines move back higher once more to more normalized levels. We saw revenue and earnings growth move too quickly to the upside during the pandemic, and now too quickly to the downside; now it’s time for the next upswing.

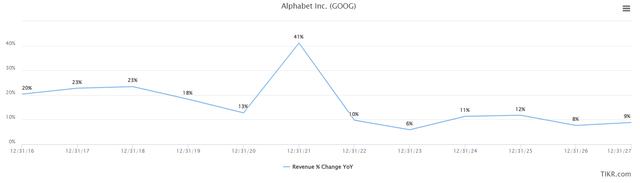

We can see actual revenue growth rates annually and estimates for the next few years, and the bottom is this year at 6%. Estimates are for double-digit growth in 2024 and 2025, which is exactly why I think the stock will be revalued higher once more in the coming months in anticipation of that.

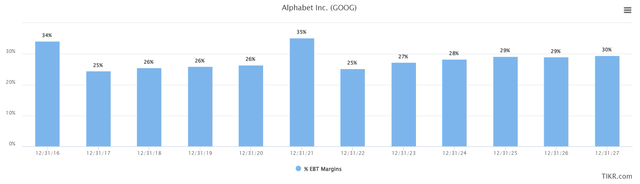

The same is true of operating margins, as we saw a massive boom in profitability on soaring revenue during the pandemic, only to see that reversion last year.

The difference with margins is that the normalization is already underway, and the bottom was last year, not this year. This is an even better story for Alphabet, and it means that if/when revenue growth does take off higher, the gains in profitability will be even larger. The company has been focused in recent months on efficiency, which has meant cutting jobs, mostly, and that stands to generate more margin benefits when revenue trends back up.

That’s why EPS revisions turned higher before revenue did, and if I’m right, there’s more where this came from.

Levels today are still well below the peaks in early 2022, but with revenue growth set to accelerate once again into the end of this year, and margin growth already underway, it is my view that it’s only a matter of time before we get higher EPS estimates.

Risks and other considerations

Of course, owning Alphabet today is not without its risks. Analysts have come out in recent days with valuation calls, AI concerns reducing monetization, and there’s concern over potential ad spending reductions if we get a recession. I personally don’t see any signs a recession is coming, and even if it does, it is likely to be mild unless something changes pretty drastically. Alphabet has done extremely well through past recessions, so if the stock dips on that, that’s yet another reason to buy.

We’ll get to valuation in a minute, but reduced monetization as a result of AI-generated responses (instead of ad inventory) is just a fear at the moment. Could it come true? Sure. But am I going to pass on what looks like a great opportunity in the stock right now because of something that might happen in a few quarters? Nope.

The bottom line is that there’s always something to worry about with Alphabet or any other company you can think of. So, you can sit around and worry and never buy anything, or you can seize the opportunity that’s in front of you.

Final thoughts

The valuation has moved higher in recent months with the share price, as the share price has outpaced gains in EPS revisions. However, as we can see below with the 5-year chart of forward P/E ratios, Alphabet still looks cheap to me.

The median valuation during the past five years has been 25X forward earnings, and we see shares at 21X today. That’s also below where the stock traded pre-pandemic, a condition I believe will be rectified into the latter part of this year as the valuation recognizes higher sales and margin growth coming next year.

If we put all of this together, we have a Google chart that looks poised for reversal, positive seasonality incoming, higher revenue and margin growth estimated for the next couple of years, and a reasonable valuation. I’m putting a strong buy on Alphabet Inc. stock today for these reasons, as I see new highs coming later this year, and potentially quite soon. Use stops, as always, to limit risk, but I think this one has legs for the balance of the year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.