Summary:

- Alphabet’s Q3-2024 earnings surpassed expectations with revenue at $88.27 billion (up 16% in CC) and adjusted EPS at $2.12 (up 36.8%), driving the stock price higher.

- Google Cloud’s revenue surged 35%, and its operating margin surged as well, highlighting its growing importance to Alphabet’s overall business.

- Despite a year-over-year decline in free cash flow due to deferred tax payments, fines, and increased CapEx, a rebound is expected in the coming quarters.

- AI Overviews are expanding rapidly, now reaching over 1 billion users monthly, enhancing user engagement and monetization through ads, supporting long-term growth potential.

Leon Neal/Getty Images News

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) reported its Q3-2024 results after market close, and the results came in ahead of expectations, sending the share price higher. In my last GOOGL article, I noted how I thought it was undervalued (trading in the low $150s at the time) despite antitrust concerns. I was also impressed with its ability to navigate competition from LLMs, and I highlighted its potential in Google Cloud. I encourage you to read that article as well to get a better idea of how I view Alphabet.

Now, the stock was in the high $170s in after-hours trading, but it’s still reasonably priced, with more long-term gains on the way. In this article, I’ll go over Alphabet’s Q3 strong earnings and explain why I still rate the stock as a Buy for the long term.

Alphabet’s Q3 Earnings Were Solid Overall

In Q3, Alphabet reported revenue of $88.27 billion, a good amount above the $86.22 billion consensus estimate. Similarly, adjusted EPS came in at $2.12, well ahead of the $1.85 estimate. Revenue growth was 15% (16% in constant currency), and EPS growth was a very impressive 36.8% year-over-year.

Impressively, its Google Cloud revenues increased by 35% to $11.35 billion, with its operating income increasing by 632% from $266 million to $1.947 billion. In other words, the operating income margin for this segment grew from 3.16% to 17.15%. Sequentially, the margin grew by about 5.82 percentage points, as it was 11.33% in Q2. Further, the revenue growth rate for the segment accelerated compared to Q2 2024, as Q2’s growth was 28.8%.

What I like is that Google Cloud is increasingly becoming a bigger piece of the pie for Alphabet as it outpaces Google Services revenues, which grew by 13% YoY. In Q2 2024, Google Cloud made up 12.2% of revenues and 4.3% of operating income. In Q3, it was 12.86% of revenues and 6.89% of operating income. With numbers like that, it’s easy to see why Alphabet stock rallied following the report.

While the Cloud segment has a lot of work to do to catch up to Amazon’s (AMZN) AWS operating income margin of 35% and Alphabet’s overall operating margin of 32% for Q3, the trend is looking good.

Free Cash Flow Fell Year-Over-Year, Is That A Problem?

Those who pay attention to free cash flow may have noticed that FCF fell year-over-year. It went from $22.601 billion to $17.637 billion. That’s due to a variety of factors. First, in the Q3 earnings call, Alphabet’s management stated, “We deferred cash tax payments from the 2nd and 3rd quarter to the 4th quarter.”

Apart from that, in Q3, it paid $3 billion in EC shopping fines related to a lawsuit from 2017.

Lastly, its capital expenditures grew notably year-over-year from $8.055 billion to $13.061 billion. Management noted that most of the $13 billion went toward technical infrastructure (~60% of that toward servers and the remainder toward data center and networking equipment). The rest that didn’t go toward technical infrastructure went into facilities, other bets, and other areas.

The company expects about the same level of CapEx in Q4 and an increase in CapEx next year — but not to the same extent that 2024’s CapEx increased.

Its TTM FCF sits at $55.823 billion, which is lower than it was last year. Is the falling FCF a problem? Not necessarily. Estimates will be updated following the earnings release, but as of now, analysts expect a rebound to $76.3 billion in FCF for the full year and $92.1 billion for 2025. Additionally, negative impacts like the fines and tax deferral are only short-term, and increased CapEx can pay off in the long term.

A Positive Update On AI Overviews

In my last GOOGL article, I talked about AI Overviews. I wrote the following:

Alphabet now has AI Overviews, which will keep people on the Google ecosystem. AI Overviews provide AI-generated responses to regular Google Searches using sources across the web. For now, the feature is only available in the U.S., but it will be made international eventually.

Here’s a little update. In the most recent earnings call, Alphabet’s CEO said:

Just this week, AI overview started rolling out to more than 100 new countries and territories.

It will now reach more than 1,000,000,000 users on a monthly basis. We are seeing strong engagement, which is increasing overall search usage and user satisfaction. People are asking longer and more complex questions and exploring a wider range of websites. What’s particularly exciting is that this growth actually increases over time as people learn that Google can answer more of their questions. The integration of ads within AI overviews is also performing well, helping people connect with businesses as they search.

I like the idea of AI Overviews because they are what will stop people from abandoning Google for LLMs, and they can be monetized through ads, which the company is already doing.

GOOGL Stock Is Now Reasonably Valued

Adding up the past four quarters, we get $7.54 in adjusted EPS. With a current after-hours share price of $179.50, that gives us a TTM P/E ratio of 23.8x. Given GOOGL’s growth potential via AI and Google Cloud (mentioned in more detail in my last article), I think this is a reasonable multiple.

It’s actually lower than the SPDR S&P 500 ETF Trust’s (SPY) P/E ratio of about 28x and lower than GOOGL’s five-year average of 26.7x. Thus, I believe GOOGL can maintain this multiple in the medium term and can see gains in line with EPS growth (expected in the mid-teens).

How about its free cash flow multiple? That comes in at 39.93x. And if you remove stock-based compensation ($22.705 billion in the past 12 months) from TTM FCF and use the basic share count of 12.29 billion (in order to not punish dilution twice), you get $2.695 per share in FCF, or a multiple of 66.6x. All of a sudden, Alphabet stock starts to look a lot more expensive. But remember that Alphabet is expected to see a big rebound in FCF, which will swiftly bring this multiple lower.

Anyway, for investors who don’t like looking at multiples, let’s plug some of these numbers into a reverse DCF below and see how much growth is needed to justify Alphabet’s valuation.

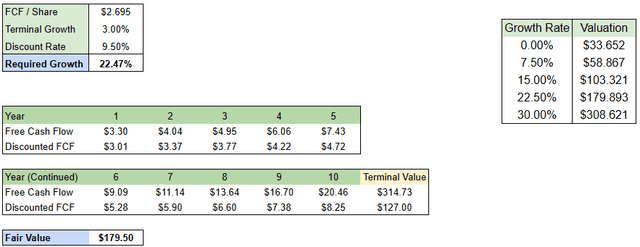

In my reverse DCF, I used the SBC-adjusted FCF per share of $2.695, and I calculated the cost of equity of 9.5% using the CAPM model. I gave it a terminal growth rate slightly higher than long-term inflation/GDP expectations because of the company’s growth potential and its ability to boost per-share metrics via buybacks.

For the stock to be fairly valued, it would have to grow its FCF/share by 22.47% annually for the next 10 years and then just grow by 3% every year after that. It’s not that much to expect when you consider the 2025 FCF estimate of $92.11 billion. If SBC grows to roughly $25 billion by then, the SBC-adjusted FCF would be around $67.11 billion — more than double the current figure of $33.118 billion. Add in the effect of buybacks and the fact that only 3% growth is needed after year 10 (Alphabet is likely to grow by more than 3% 10 years from now, in my opinion), and it’s not that pricey.

GOOGL Stock Reverse DCF (Author)

If you were to do the same reverse DCF and change the FCF per share to not be adjusted for SBC ($4.495 in FCF per share), then the annual required growth rate for 10 years would drop to 15.54%.

Whichever way I look at it, Alphabet’s market cap looks reasonable to me.

The Bottom Line On GOOGL Stock

Even though GOOGL stock is notably higher than my last Buy rating in the $150s, I think it’s reasonably valued and that it can perform well in the long term. However, it will still likely be prudent to wait for a dip before acquiring a large number of shares.

The long-term potential is great. As Google Cloud becomes a larger portion of the pie, it can help accelerate Alphabet’s overall revenue growth. A 35% year-over-year revenue increase in Google Cloud is nothing to sneeze at, and the segment’s margins are trending in the right direction but can still increase greatly before getting near AWS’s margins.

Further, AI Overviews are progressing well and will now reach more than 1 billion users monthly.

Alphabet is expected to spend more on CapEx next year, but it looks like this CapEx is being put to good use, as the financials are trending nicely. Despite the higher expected CapEx spending, FCF is still expected to rebound in the next few quarters, which will make the valuation look better from that perspective.

In the final analysis, GOOGL stock looks reasonably valued and is a long-term Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, GOOG:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.