Summary:

- YouTube TV monthly price is being increased.

- This will not impact GOOGL in any profound way.

- More important is to focus on the threat of a recession.

- However, even a recession won’t necessarily harm GOOGL.

PM Images

Quick Background

We just found out that Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) is boosting the price of YouTube TV. It’s coming soon:

Monthly price is being revised from $64.99 previously to $72.99 effective April 18, 2023, according to an email sent to subscribers on Thursday.

And, from Twitter:

An update for our members. As content costs have risen and we continue to invest in our quality of service, we’ll be adjusting our monthly cost, after 3 years, from $64.99/mo to $72.99/mo, in order to bring you the best possible TV service.

It’s an increase of about 12%. It wouldn’t surprise me a bit if this was really an increase to handle the NFL Sunday Ticket. Details are still a bit foggy but they do indicate it could be an add-on to the YouTube TV Base Plan or as some kind of standalone offering via their PrimeTime Channels.

The math with five million subscribers paying $72.99 per month is about $365 million, or about $4.4 billion per year. Given the $283 billion in total revenue for GOOGL, YouTube TV will be driving about 1.55% of all of GOOGL.

Taken as a whole, this means that the price increase mostly covers new content costs and inflation, with little room for any true “extra” profit. In short, this does not move the needle much at all.

Here Are 5 Things That Are More Important

-

Competition in the advertising market: GOOGL’s advertising business, which accounts for the majority of its revenue, is facing increased competition from companies such as Amazon (AMZN) and Facebook (FB). Google will need to continue to innovate and provide value to advertisers to maintain its market position and revenue growth.

-

Regulatory scrutiny: GOOGL is facing regulatory scrutiny in multiple areas, including antitrust, privacy, and content moderation. The outcome of ongoing investigations and potential new regulations could have a significant impact on Google’s business and stock price.

-

Growth of cloud computing: GOOGL’s cloud computing business is growing rapidly and could become an increasingly important part of its revenue. However, the company faces strong competition from established players such as Amazon and Microsoft (MSFT), and it will need to continue to invest in its infrastructure and services to remain competitive.

-

Innovation and new product development: GOOGL’s success has been built on innovation, and the company will need to continue to develop new products and services to drive revenue growth. Key areas of focus could include artificial intelligence, autonomous vehicles, and healthcare technology.

-

Macroeconomic trends: GOOGL, like all companies, is impacted by macroeconomic trends such as interest rates, inflation, and economic growth. Changes in these factors could impact Google’s revenue growth and profitability.

Shifting to What Really Matters

With that out of the way it’s far more important to consider what’s actually pushing GOOGL forward. I’ll keep it simple. You’ve got three legs to the stool.

- Google Services segment

- Google Cloud segment

- Other Bets segment

The Google Services segment is the most important as it generates the majority of Alphabet’s revenue and profits. Within this segment, advertising revenue is particularly important to track, as it is the company’s primary revenue stream.

The Google Cloud segment has significant potential for growth and diversification of Alphabet’s revenue streams, while the Other Bets segment is currently a small part of GOOGL’s overall business and may require more significant investment to achieve profitability.

Let’s zero in a bit more. GOOGL, Facebook, and Amazon are all major players in the online advertising industry, but they have different business models and approaches to advertising. Here are some key similarities:

- All three companies generate significant revenue from advertising, with advertising accounting for a large portion of their overall revenue.

- They all use data and targeting to serve ads to users based on their behavior and interests.

- They all offer self-service advertising platforms that allow advertisers to create and manage ad campaigns.

GOOGL and META are especially dependent on advertising. But, AMZN continues to gain ground. In any event, here are the differences now.

- GOOGL’s advertising business is primarily based on search advertising through its search engine and the Google Ads platform, while META’s business is based on social media advertising through its flagship platform and other social media apps it owns (Instagram, WhatsApp, etc.), and AMZN’s business is based on e-commerce advertising through its marketplace and advertising services.

- GOOGL and META offer display advertising on their platforms, while AMZN is primarily focused on product listings and sponsored search results on its e-commerce platform.

- GOOGL and META use their vast data troves to serve targeted ads to users, while Amazon uses its data on user purchasing behavior and interests to serve ads on its platform and off-platform sites.

Bringing Things Together

If we look forward into 2023 and 2024, most investors are concerned about GOOGL with respect to a recessionary impact on advertising revenue. But, I would also argue that funds could either shift away from GOOGL or into GOOGL, depending on the factors I outline. Here are four ways recessions can impact advertising.

-

Reduced advertising budgets: Advertisers may reduce their advertising budgets or postpone advertising campaigns during a recession to conserve cash and maintain profitability. This can lead to a decline in revenue for advertising platforms and media companies.

-

Shift to performance-based advertising: Advertisers may shift to performance-based advertising models, such as pay-per-click or affiliate marketing, which offer more measurable returns on investment compared to traditional advertising models like brand advertising.

-

Changes in advertising mix: Advertisers may shift their advertising mix to focus on more cost-effective channels, such as digital advertising, and reduce spending on traditional advertising channels like TV and print.

-

Lower advertising rates: During a recession, advertising rates may decline as media companies and advertising platforms compete for a smaller pool of advertising dollars. This can benefit advertisers who can negotiate better rates or get more value for their advertising spend.

If there is no recession, I could see GOOGL being undervalued right now. There is almost certainly a “recession discount” at work right now, given GOOGL’s dependence on advertising. See #1 directly above, which makes it obvious that businesses will spend less if there’s a recession.

Let’s keep going. If there’s a recession, GOOGL could possibly benefit since it is more of a direct marketing tool, where pay-per-click is about performance, not broad strokes, or branding. This is good for GOOGL, for market share, if nothing else. Furthermore, GOOGL could eat up more cash, extracting many pounds of flesh from TV and print. In other words, it could accelerate GOOGL.

I also want to point out that META and AMZN could be similarly impacted, or there might be a divergence. At this point, until we know there will be recession, and how severe it is, it’s a waiting game. What I don’t really see happening is META or AMZN stealing much from GOOGL, if anything at all.

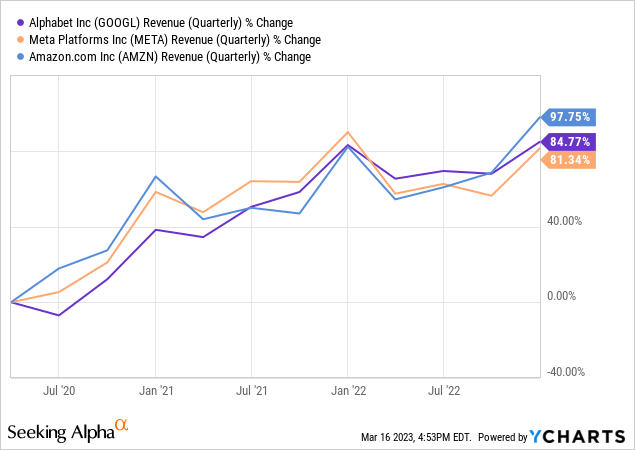

For a quick glance at this, let’s check revenue changes over three years:

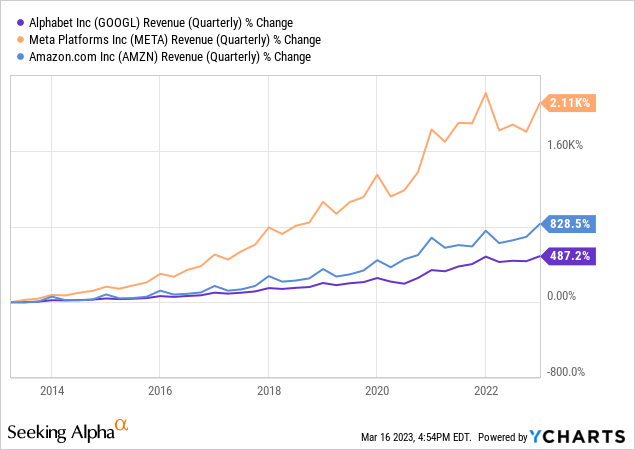

But, we need to zoom out to see revenue growth better:

Unfortunately, we can’t go back much further to see what happens when everything really blows up. We do have 2020 in the mix, but these online behemoths did just fine. You wouldn’t think anything happened at all.

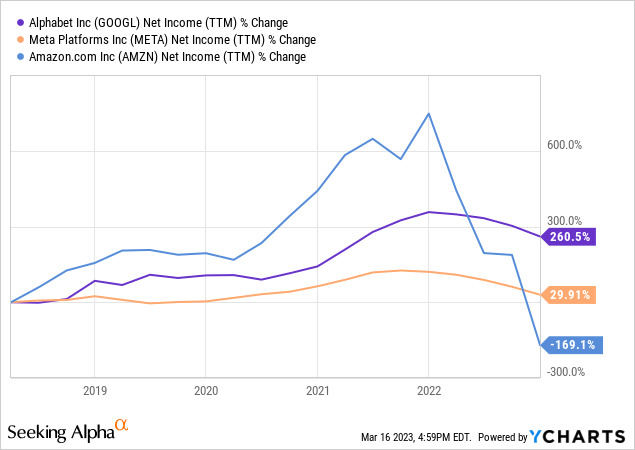

How about net income?

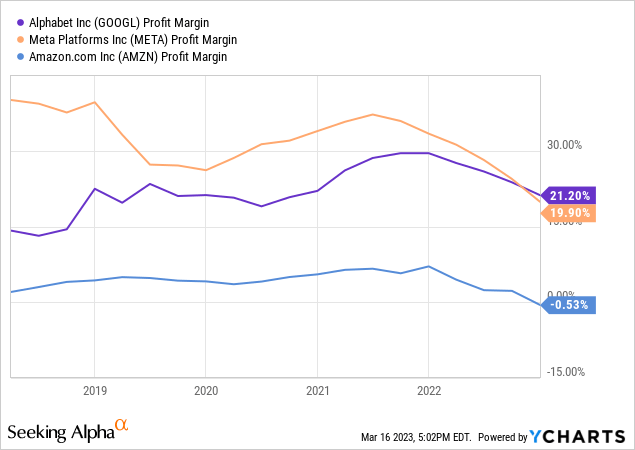

And, how about profit margins?

GOOGL and META are much closer to each other here. And, as many know, AMZN plows billions back into the business directly. That said, I like GOOGL’s profit margin, especially when we take the bigger and longer view, in terms of revenue growth and net income.

So, while we don’t have a great view of the future for GOOGL assuming there is a terrible recession, there is a lot to like about the company. Strategically speaking, and loosely speaking in terms of high level fundamentals, GOOGL has been steady as she goes.

Wrap Up

First, I don’t see the YouTube TV price increase as anything special or unique. The subscription business is growing and the stability it provides is great. But, it’s a small part of the business. The impact is trivial for now.

Second, GOOGL’s closest competitors compete much more on advertising than anything else. A brief analysis indicates that GOOGL and META are closer competitors, of course. Importantly, GOOGL, META and AMZN could be negatively impacted by a recession. However, there is a case to be made that because they are “bigger fish” (or even sharks) they could gobble up the competition directly, or via market share gains. It could be a case of short term pain for long term gain. I don’t see META or AMZN killing GOOGL’s ad business, despite the competitive overlap.

Third, GOOGL has been strong and steady for a long time. Revenue, income and profits have all been powerful for years and years. Initiatives like YouTube TV, and the associated price hikes are important, albeit small. However, it’s really the advertising engine we shall watch closely now, and going forward. In other words, nothing has really changed.

All of this said, there are always threats. There’s no doubt about it. For example, ChatGPT and artificial intelligence could be a serious threat. Or, we might say that GOOGL will finally “turn on” the A.I. properly, and roll it out in a way that changes the game entirely. We shall see. For now, we’ll use GOOGL’s history, the current entrenched competition, and the near future to direct our investing. I consider GOOGL a Buy at $100 or below and a Strong Buy below $90. We will continue to monitor.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.