Summary:

- Google has exceeded expectations, with its well diversified revenue streams delivering impressive QoQ/ YoY growths and market share expansions, thanks to the embedded generative AI capabilities.

- This is on top of its opportunistic growth from both YouTube Ads and Google Cloud as the next growth driver, with a projected $100B revenue run-rate by end 2024.

- Combined with its growing profitability, rich balance sheet, and robust shareholder returns, GOOG remains a long-term Buy at all dips.

- This is on top of the reasonable valuations compared to its Magnificent Seven peers, double-digit upside potential, and leading position in the generative AI race.

We Are/DigitalVision via Getty Images

We previously covered Alphabet Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL) in February 2024, discussing why we believed that the market had been somewhat short-sighted, with the management already discretely integrating its next-gen AI capabilities into its top-line drivers, with 2024 likely to bring forth excellent results.

Combined with the stock’s depressed valuations and the market’s overreaction, interested investors might dollar cost average accordingly, with it still offering a promising upside potential ahead.

Since then, GOOG has already rallied by +16.5%, well outperforming the wider market at +4.3%. Despite so, we are maintaining our Buy rating here, with the stock still fairly valued while offering an excellent upside potential.

Combined with the promising prospects in its search engine/ generative AI capabilities, robust profitability, and rich balance sheet, we believe that GOOG remains well capitalized to deliver profitable growth and robust shareholder returns ahead.

The GOOG Investment Thesis Remains Excellent, As Bullish Sentiments Return

For now, GOOG has reported a double beat FQ1’24 earnings call on April 25, 2024, with revenues of $80.53B (-6.6% QoQ/ +15.4% YoY) and adj EPS of $1.89 (+15.2% QoQ/ +61.5% YoY).

Much of its top-line tailwinds are attributed to Google Search & other with revenues of $46.15B (-3.8% QoQ/ +14.1% YoY), as the search engine remains the market leader with 90.91% in global share as of April 2024 (-0.47 points MoM/ -1.91 YoY).

It is apparent from these numbers that the team has prioritized growth through “smarter compute allocation” while boosting the performance of its Search Generative Experience [SGE], by offering users with an improved experience and advertisers with better traffic, while optimizing its costs by -80%.

YouTube Ads is also GOOG’s top-line driver, as revenues grow to $8.09B (-12% QoQ/ +20.9% YoY) in the latest quarter, thanks to its growing streaming share at 9.7% as of March 2024 (+0.4 points MoM/ +1.9 YoY).

The combination of robust Generative AI demand and cloud migration has triggered Google Cloud’s excellent growth in revenues to $9.57B (+4.1% QoQ/ +28.4% YoY) as well, along with expanding operating margins of 9.4% (+0.1 points QoQ/ +6.9 YoY).

With Google Cloud reporting stable market share of 11% as of Q1’24 (inline QoQ/ +1 YoY) with growing multi-year remaining performance obligation of $72.5B (-2.1% QoQ/ +17.5% YoY), we believe that GOOG remains well poised to capture increasing computing share ahead.

This is especially since the global cloud market is expected to grow from $495.3B in 2022 to $2.49T in 2032 at an accelerated CAGR of +17.8%, thanks to the new cloud super cycle.

And this is why we concur with GOOG’s statement that “AI innovation across our ads/ cloud ecosystem is core to every aspect of our product portfolio,” further aided by its “clear paths to AI monetization.”

It is apparent that these efforts are already top-line accretive as an AI first company, significantly aided by its well diversified/ multimodal capabilities and the in-house Gemini Ultra’s immense model size with 175TB parameters, compared to OpenAI’s GPT-4 at over 1TB parameters and Microsoft’s (MSFT) new model at 500B.

This is on top of the GOOG management’s conviction of opportunistic growth from both YouTube Ads and Google Cloud as its next growth driver, with a projected $100B revenue run-rate by the end of 2024.

This is up from the FQ1’24 annualized numbers of $70.64B (-3.9% QoQ/ +24.8% YoY), before the addition of YouTube Premium subscriptions (revenue unspecified).

At the same time, GOOG continues to lay off headcounts with 180.89K employees as of March 2024 (-0.8% QoQ/ -5.1% YoY), apparently learning a thing or two from META’s (META) Year Of Efficiency.

As a result of the top-line gains and improved cost efficiencies, it is unsurprising that the former has been reporting expanding operating margins of 31.6% (+4.2 points QoQ/ +6.7 YoY/ +9.4 from FY2019 levels of 22.2%).

At the same time, despite the higher Data Center related capex of $12.01B in FQ1’24 (+9% QoQ/ +91.2% YoY) and $32.25B in FY2023 (+2.4% YoY), GOOG continues to report robust Free Cash Flow generation of $69.11B over the LTM (+11.6% sequentially).

Combined with the impressive net cash position on balance sheet at $94.87B (-2.8% QoQ/ -8.1% YoY/ -18% from FY2019 levels of $115.72B), we can understand why market analysts continue to speculate on potential mega deals that may beef up GOOG’s offerings, one that was recently completed by MSFT with Activision for $69B.

Before any of the HubSpot rumors are verified, we believe that GOOG continues to allocate its robust cash flow to good use, as the management pledged quarterly dividends with the FQ1’24 annualized sum of $0.80 offering investors with a bonus payout.

In addition, readers must note that the management has announced a $70B share repurchase program, with 296M or the equivalent 2.3% of its float already retired over the LTM, and 1.37B/ 9.8% since FY2019, further demonstrating its robust shareholder returns thus far.

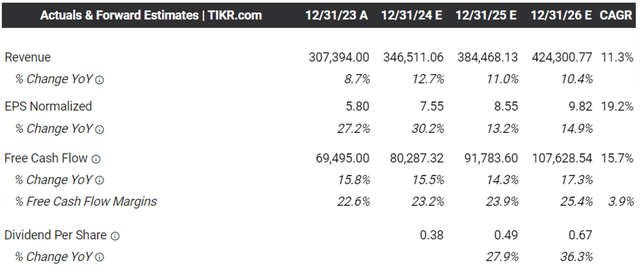

The Consensus Forward Estimates

With its operational costs optimized and higher capex being top/ bottom line accretive, we can also understand why the consensus have moderately raised their forward estimates, with GOOG expected to report an accelerated top/ bottom-line expansion at a CAGR of +11.3%/ +19.2% through FY2026.

This is compared to the previous estimates of +10.6%/ +15%, and nearing the previous growth rate of +19.1%/ +19% between FY2016 and FY2023, respectively.

Most importantly, with GOOG expected to generate robust Free Cash Flow through FY2026, we believe that its balance sheet may continue to grow, along with shareholder returns and opportunistic acquisitions.

So, Is GOOG Stock A Buy, Sell, or Hold?

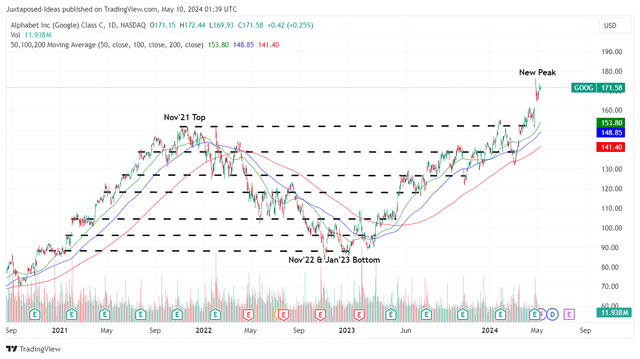

GOOG 3Y Stock Price

For now, GOOG has already regained most of its 2022 losses, while trading above its 50/ 100/ 200 day moving averages and hitting a new peak at the time of writing.

Based on the stock prices of $171.58 at the time of writing and the LTM adj EPS of $6.52, it appears that the stock is trading at a LTM P/E valuation of 26.31x, near to its 5Y P/E mean of 25.79x and upgraded from the previous article’s P/E valuation of 21.18x.

In any case, GOOG remains reasonably valued compared to its Magnificent Seven peers, including META at 23.62x, Apple (AAPL) at 27.77x, MSFT at 34.71x, Amazon (AMZN) at 41.50x, and Tesla (TSLA) at 68.34x.

At the same time, based on the consensus FY2026 adj EPS estimates of $9.82 (expanding at a CAGR of +19.2%, near to its historical growth rate), there remains an excellent upside potential of +47.5% to our long-term price target of $258.30.

As a result of its dual pronged prospective returns through dividend payouts/ share retirement and capital appreciation over the next few years, we are maintaining our Buy rating for GOOG, though without any specific entry point since it depends on individual investors’ dollar cost average and portfolio allocation.

With the stock currently fairly valued while charting new heights at the time of writing, interested readers may consider observing its movement for a little longer before adding. Patient investors may consider adding at its previous trading ranges of between $150s and $160s for an improved margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META, MSFT, TSLA, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.