Summary:

- Waymo is rapidly expanding its services and showing its ability to create a winner-takes-all platform in the autonomous industry.

- A recent blog announcement of expansion of Waymo service to Miami sent Uber and Lyft stock down by 10% which shows the impact Waymo is having on competitors.

- Tesla’s lofty ambitions for launching autonomous service in 2025 will likely face massive challenges as the company is significantly behind Waymo in terms of human interventions needed.

- Waymo could end 2025 with over 2 million weekly trips or 100 million annualized trips which should contribute over $3 billion in revenue.

- Waymo could provide Google with strong revenue diversification and new growth potential which should improve the sentiment towards the stock and also improve EPS projections.

Michael Vi/iStock Editorial via Getty Images

Google’s (NASDAQ:GOOG) Waymo is finally showing a strong runway as it expands in new regions and increases its cash pile. Recently, Waymo announced a massive $5.6 billion funding round. It is already having an impact on competitors. We recently saw a significant plunge in the stock of Uber (UBER) and Lyft (LYFT) after Waymo announced that it would expand the service to Miami. The weather conditions in Miami can be quite challenging compared to Los Angeles or Phoenix for driverless cars. Hence, Waymo’s announcement of expanding service in Miami is seen as a sign of good technological maturity and adaptability to different weather conditions. In the previous article, it was mentioned that Google could beat the earnings estimate in key segments.

Waymo’s strategy is becoming more of a winner-takes-all. Tesla (TSLA) is significantly behind Waymo despite the lofty ambitions and announcements of Musk. Tesla’s autopilot requires human intervention every 13 miles according to a recent research report. This is 100 times more than Waymo and it is highly unlikely that Tesla will close the technological gap anytime soon.

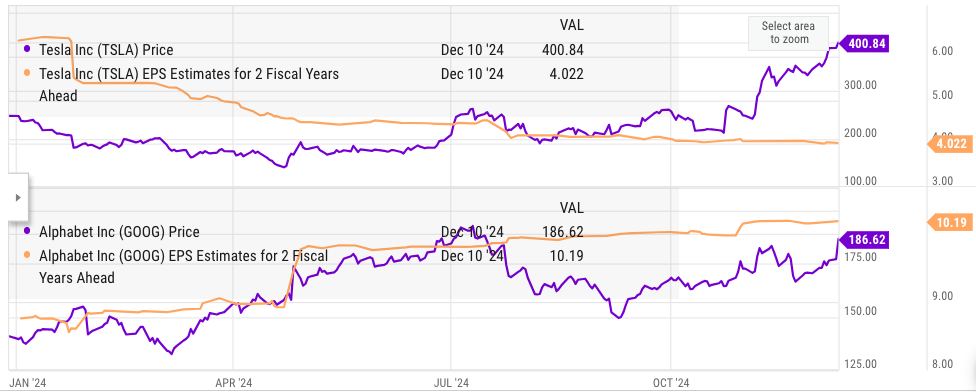

Waymo has announced that it is completing 150,000 weekly trips, up from 100,000 weekly trips in August 2024. After its expansion in 2025, we could see weekly trips reach 2 million level by the end of 2025 or 100 million annualized trips. This should contribute over $3 billion in revenue and also deliver a strong growth sentiment for Google stock. While Tesla stock is trading at 100 times its EPS estimate for 2 fiscal years ahead, Google is trading at only 17 times its EPS estimate for 2 fiscal years ahead.

Waymo’s winner-takes-all strategy

Recently, Waymo published a blog on their website which mentioned that the company will be expanding in Miami soon. A single blog by Waymo was enough to cause a 10% plunge in the stocks of Uber and Lyft. When a company has this massive impact on competitors, we can assume that it will have a winner-takes-all platform. Miami was expected to be a difficult region for Waymo because of challenging rainy conditions. However, Waymo’s expansion to Miami could likely show the maturity of its autonomous technology. We could also see a similar announcement for expansion in other major markets soon.

Waymo has recently raised another staggering $5.6 billion in the latest funding round. This will give the company enough resources to rapidly increase its footprint. Moving beyond the Sun Belt is also important for Waymo as it would show the ability of the service to operate in lucrative markets where weather is a major challenge.

Waymo has also built a gold standard with its autonomous service. The slow and steady approach has prevented any major accidents similar to what we saw in GM’s (GM) Cruise service. Even a single major accident can lead to a big pushback from customers and regulators. Hence, it is important to lower the risk even if it ends up slowing the expansion pace.

Tesla is way behind Waymo

Musk has again made lofty announcements regarding its autonomous service in the recent months. We have been hearing about the possible launch of this service for years but have never seen a product that comes close to launch. One big difference between Tesla’s Autopilot option and a fully autonomous service by Tesla is the legal responsibility. In case of any accidents, while using Autopilot, drivers are still responsible. There have been numerous accidents while using this service, but it does not give Tesla any legal headwinds. On the other hand, for a completely autonomous service, Tesla will likely bear full responsibility for any accidents. This is a massive difference and will require a much higher level of precision from Tesla.

A recent report about possible easing self-driving rules has boosted Tesla stock. However, Tesla will still need to convince customers and local regulators. Even a few major accidents by this service can derail its expansion by years. GM’s Cruise has been asked to pay big fines for previous accidents, and a similar trend could happen with Tesla’s service.

Another important metric to watch is the number of human interventions required. A recent report mentioned that Tesla’s Autopilot required human intervention on average 13 miles. This is a very low number and makes any autonomous service almost impossible.

Tesla will also compete with Waymo, which is already completing 150,000 trips every week. Hence, there will be regular comparisons between the two service which would put greater pressure on Tesla to deliver perfect operation. Musk has announced the launch of the service in 2025, but it seems difficult to believe that any large-scale operations would be possible next year.

Waymo’s revenue and EPS impact

After many years of development, Waymo is finally in a position to make a positive impact on Google’s key numbers. In August 2024, Waymo announced 100,000 weekly trips. In the early December blog, it increased this metric to over 150,000 weekly trips. We could see a similar growth trend in 2025 as the service is expanded to new regions. I believe Waymo could reach 2 million weekly trips or 100 million annualized trips by the end of 2025 unless there is some major accident or regulatory headwind. At $30 for an average ride, this could contribute $3 billion in annualized revenue for Google, or equal to 1% of the company’s revenue base.

Ycharts

Figure: Comparison of Alphabet’s and Tesla’s forward EPS projections. Source: Ycharts

Waymo has several pros and cons compared to other profitable services of Google. Waymo has less competition compared to the advertising or cloud service of Google. This should allow the company to deliver good margins over the long term once it reaches economies of scale. Waymo also has a massive growth runway. We should see the service expand to the trucking industry and last-mile package delivery. On the other hand, the biggest con for this service is the regulatory headwind. Even a single major accident can cause a big pushback for this service and delay expansion.

It is likely that 2025 will be a major year for Waymo. It might not have a big impact on revenue or EPS, but a successful rollout in different regions can change the forward EPS projections of Google significantly.

Seeking Alpha

Figure: Forward EPS projection of Google. Source: Seeking Alpha

Google stock is trading at only 17 times the EPS estimate for the fiscal year ending Dec 2026. On the other hand, Tesla is trading at a staggering 100 times the EPS estimate for the fiscal year ending Dec 2026. The rapid rollout of Waymo and a big lead over Tesla can move some of the premium to Google. We could also see upward EPS revisions depending on the margins and revenue growth reported by Waymo. Investors looking for a good option in the autonomous driving industry could consider Google, which has strong core services and a rapidly growing Waymo business.

Investor Takeaway

Waymo is building a winner-takes-all platform. A recent announcement by Waymo that it will be launching in Miami led to a 10% plunge in the stock of Uber and Lyft. This shows the big impact of Waymo on competitors. The weekly trip count has increased to 150,000 which is a 50% jump from the last announcement in August 2024. At the current expansion, Waymo could reach 2 million weekly trips or 100 million annualized trips by the end of 2025.

Tesla is significantly behind Waymo, and there are few signs that it is ready to roll out a full-fledged robotaxi service. We could see Waymo start contributing to Google’s top-line and bottom-line growth in a few quarters, which can improve the EPS estimates and also lead to an expansion of valuation multiple. Google stock is trading at only 17 times the EPS estimate for the fiscal year ending Dec 2026, making it quite cheap and with a strong autonomous revenue growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.