Summary:

- Palantir Technologies Inc.’s stock has surged ~39% since my September buy recommendation, driven by stellar Q3 2024 earnings and an updated full-year guidance across the board.

- U.S. commercial revenue grew 54% year-over-year, and U.S. government revenue saw its strongest sequential growth in 15 quarters, driven by increased DoD business.

- Palantir’s valuation remains high, but with strong financials, new contracts, and continued momentum, I see further upside potential ahead.

- I herein share my positive sentiment on Palantir and why I see more upside ahead for mid to long-term investors.

fatido/iStock via Getty Images

Investment thesis:

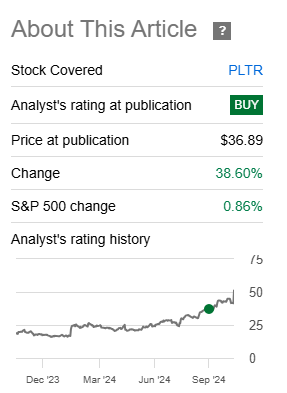

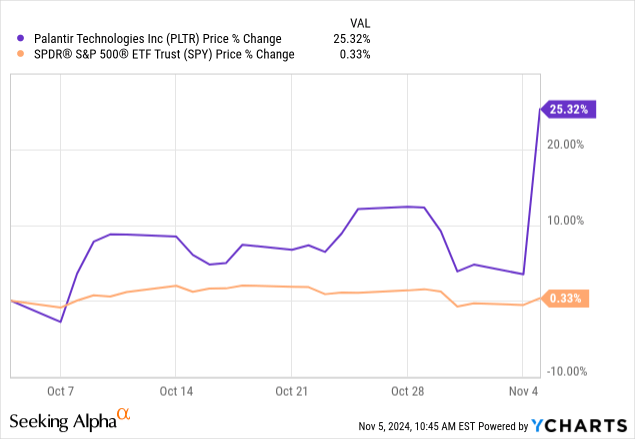

I last wrote on Palantir Technologies Inc. (NYSE:PLTR) in late September and initiated the stock with a Buy rating for mid-to-long-term investors. The stock is up ~39% since then. I saw room for an upside surprise, and the market reiterated my belief on Tuesday after the stock surged over ~20% on stellar Q3 2024 earnings and updated full-year outlook across the board.

The market now recognizes Palantir’s sustainable growth, supported by its expanding Artificial Intelligence Platform (AIP). I specified sustainable because heading into earnings there was a lot of fear about if Palantir could keep up its hyper growth; I addressed this concern pretty heads on in my last article, forecasting “more upside potential to the stock due to the company’s position within AI and the new product cycle after AIP.” I think this sentiment still holds true heading into next quarter.

Seeking Alpha

My investment thesis was two parted:

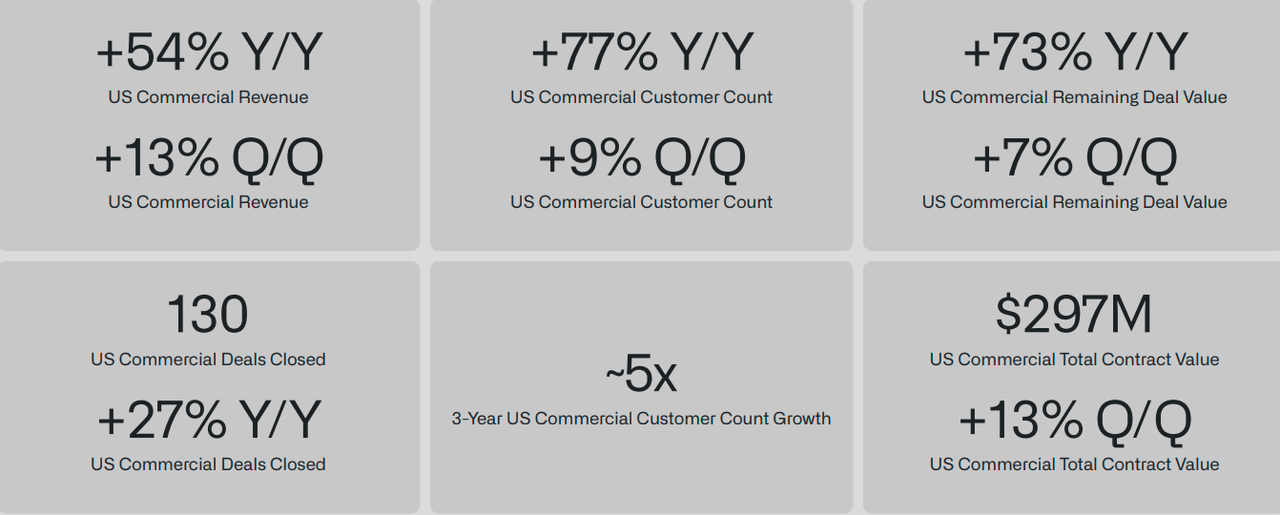

1. I initially foresaw an upside surprise backed by the continued acceleration of the US commercial revenue, expecting the latter to make a bigger chunk of total revenue. And what do you know? U.S. revenue was up 44% year over year and 14% sequentially to $499 million. U.S. commercial revenue was up 54% year over year and 13% sequentially to $179 million, up from last quarter’s $159 million, which was up 55% year over year, above the consensus of 47%. The U.S. commercial business is slowly but surely becoming a more central part of Palantir’s business and has more upside to provide into 2025.

2. I expected the company’s build-out of Warp Speed on AIP to better position it for new customer conversions and expansions in existing customers. While, I’m a fan of Warp Speed, I didn’t get too much new information about the offering on this quarter’s call. This leads me to believe that Warp Speed continues to be more of a longer-term growth catalyst for the business. After this quarter’s call, I am watching for the “ton of new product investments, an enhanced OSDK, more ergonomic compute modules, the multimodal data plane, and much more.”

3. I’m adding another part to my investment thesis on Palantir in light of the earnings, which is the U.S. government revenue. I think U.S. government revenue should accelerate further in the coming quarters as tensions in the Middle East show no clear sign of slowing down. This quarter’s U.S. government business was the strongest sequential growth in 15 quarters, and that was largely driven by the DoD business, which was up 21% year over year.

To put things into perspective, U.S. government revenue was up 40% year over year and 15% sequentially to $320 million. Let’s go back two quarters: In 1Q24, U.S. governmental revenue was up 12% year over year and 8% sequentially to $257 million, and in 2Q24, similarly, the U.S. government revenue was up 24% year over year and 8% sequentially to $278 million. I expect further sequential growth in this segment in the next 2 quarters.

YChart

The stock is up 25% on the one-month chart, outperforming the S&P 500 (SP500), up 0.3%. I continue to believe the stock has more upside ahead on AIP strides and continued growth in the U.S. commercial business. As per my last article, I think we’ll continue to see sustained high growth for commercial revenue in the 4Q24 and FY25 timeframe with a more friendly rate-cut environment.

This quarter proved, once again, that Palantir has solid momentum. For the quarter, the company booked $297 million of U.S. commercial TCV, up 13% sequentially, with the total remaining deal value in the U.S. commercial business up 73% year over year and 7% sequentially. The U.S. commercial customer count was up to 321 customers, which reflects 77% year-over-year growth and 9% sequentially. I expect this upward trend to spill into the next quarter and 2025.

More on earnings:

Management reported revenue at $72.5 million, up 30% year over year and 7% sequentially, and above consensus of $705.1 million, recording the fifth consecutive quarter with revenue growth over 30%. Revenue from Palantir’s top 20 customers was also up 12% year-over-year to $60 million per customer.

“Given how strong our results are, I almost feel like we should just go home,” is what the company’s CEO Alex Karp said on the earnings call after giving the rundown on the results. And while I’m glad they stuck around for the call, I agree with the sentiment. The company’s combined revenue growth and adjusted operating margin were up to 68% during the quarter, up a 4-point increase to the Rule of 40 score sequentially.

The government segment was up 33% year over year and 10% sequentially to $408 million, and international government revenue came in at $89 million, up 13% year over year and down 5% sequentially. This was due to a revenue catch-up in Q2 and a less favorable deal timing. I don’t expect this downward trend to continue into 2025, and I think that even if it does, the U.S. commercial business will come in to offset the weakness there. Net dollar retention was at 118%, up 400 basis points from the previous quarter. This increase was backed by both new customers and expansions with existing customers. As net retention doesn’t account for revenue from new customers acquired in the past 12 months, the intensity in which the U.S. business isn’t yet apparent. I don’t think investors have fully realized the growth potential the company has, and that is why I believe there is more upside ahead as the next quarter impresses again.

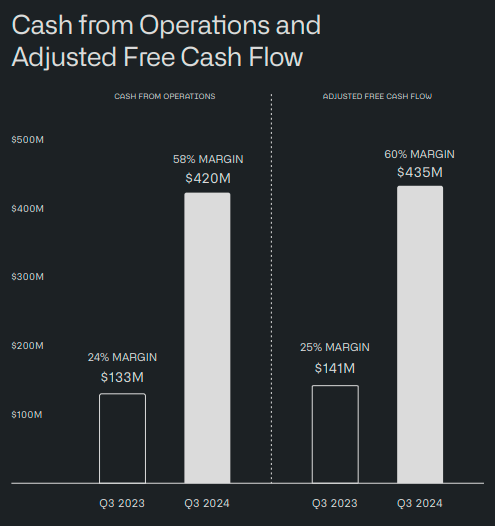

On profitability, the company generated $420 million in cash for operations and $435 million in adjusted cash flow, as seen below from the 3Q24 presentation. This reflects a margin of 58% and 60%, respectively. The company also generated a record adjusted free cash flow at $1 billion, with a margin of 39% on a trialing 12-month basis. The company ended the quarter with $4.6 billion in cash, short-term U.S. treasury securities, and cash equivalents. As part of the share repurchase program, Palantir also repurchased around 1.8 million shares.

Palantir 3Q24 presentation

Valuation:

Palantir has a market cap of $114.5 billion and an enterprise value of $110.2 billion. The stock has been up over 170% in the past 52 weeks, and its beta of 2.70 reflects price volatility higher than the market average. In my last article, Palantir traded at premium multiples, with 28x EV/sales higher than the peer group average of 9.3x. This quarter is no different. The company’s EV/Sales for C2024 is now at 31.7, higher than the peer group average at 9.9, according to data from Refinitiv. Palantir’s metrics remain a point of concern for investors, and that is not news.

This is history repeating itself, in my opinion, and I think Palantir is now better positioned to have another beat next quarter. Analysts’ consensus on the stock remains mixed. According to data from Refinitiv, over 52% of Street analysts are a hold, with ~16 of Street analysts a strong buy, and over 5% a buy. Around 10% of street analysts are a strong sell, and only 3% are a sell. I think the upward trend in PT mean and median show increased optimism on Palantir. The PT median was $24.5 in August, up to $28 in September and October, and is now $31.5. Similarly, the PT mean was $24 in August, up to $25.6 in September and $27.38 in October. It is now at $33.2.

For next quarter, management is projecting revenue in the range of $767 million to $771 million, above the consensus of $744 million, and adjusted income from operations of $298 million- $302 million. As for the full year, Palantir raised its guidance across the board and now expects revenue between $2.805 billion- $2.809 billion, higher than the consensus of $2.76 billion. U.S. commercial revenue is expected to be at $687, with a growth rate of 50%, and adjusted income is expected at $1.054 billion- $1.058 billion. Adjusted free cash flow guidance is expected to exceed $1 billion, and the company is expecting GAAP operating income and net income in each quarter of the year.

What’s next: From Warp Speed to Maven

Palantir signed a new five-year contract to expand the Maven Smart System AI/ML capabilities across the U.S. military service, including the Army, Air Force, Navy, and U.S. Marine Corps etc. According to Vice Admiral Frank Whitworth, the partnership is “tantamount to ensuring that we keep America safe and ready.”

Delivering AI through the Maven Smart System allows customers such as the 18th Airborne to give a workload that required 2,000 staff back during Operation Iraqi Freedom to only require 20 people. This is huge. For customers, as it helps “automate the tail and liberate capital to reinvest in the tooth across government and commercial, we see enterprise autonomy as a key theme in our proof.”

So far, Palantir’s capabilities have allowed it to automate the insurance underwriting process for America’s largest and most well-known insurers, consisting of 78 AI agents. To put things into perspective, said process used to take two weeks to finish, and it now takes as little as three hours. Not only does this save time, but it also saves labor costs exponentially. For the U.S. government, Palantir has automated the foreign disclosure process to take three hours instead of three days. According to management, Maven is a “fight tonight solution at a time when North Korean troops are in Ukraine, Russia is providing satellite intelligence to the Houthis and Iran is launching ballistic missiles at allies.”

Conclusion

Palantir has a vision and a goal, and we’re seeing all that play out quarter after quarter. I expect the coming quarters to follow suit, and even if there’s a hiccup along the way, I think there will be a quick bounce back after, so I’m not too concerned. All in all, Palantir remains a relatively uncontested player in an industry with a growing appetite. I think the stock will continue to reflect exactly that.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.