Summary:

- Many people are switching from cable to streaming services due to cost, with fuboTV offering a sports-first pay TV replacement.

- fuboTV has been expanding into Europe and reported subscriber growth, but faces challenges with profitability, competition, and content contracts.

- The company’s revenue is growing, with a path to profitability in the future, but risks remain due to competition and operational dependencies.

10’000 Hours/DigitalVision via Getty Images

Lots of people are cutting the cord these days. The cost of cable seems prohibitive these days, and while some channels would be missed, there is a huge offering of different streaming services, free and paid, vying for screen time.

Sometimes you’d still want traditional channels for entertainment or sports. That’s where a company like fuboTV (NYSE:FUBO) comes in, styling itself as a sports-first pay TV replacement.

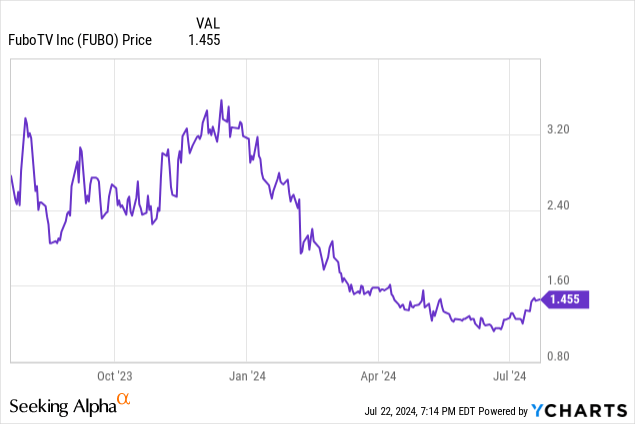

Today, we’ll be looking at fuboTV with its growing subscriber revenue but its history of losing money, and asking whether the growth prospects of the company going forward warrant a look, even given the stock’s relatively depressed price.

Understanding fuboTV

fuboTV is one of several companies that offers a channel package resembling the traditional cable or satellite dish offering for televisions but as a streaming service.

The company caters to sports fans, offering options with services from major sports leagues alongside the traditional channels of entertainment and news services. The revenue comes from both subscribers and advertisers.

In 2021, the company sought to expand further into Europe with the acquisition of Molotov SAS. Costing about $190 million, Molotov is based in France but also has customers in some former French colonies in Africa. The continued integration of Molotov with fuboTV offers some important cost savings, in addition to opening up some new markets.

At the end of 2023, fuboTV had 1.6 million subscribers in North America, up from 1.4 million the prior year. They also reported around 400,000 subscribers in the rest of the world, which includes the French markets and its growth in Spain.

Looking at the Balance Sheet

|

Cash and Equivalents |

$169 million |

|

Total Current Assets |

$308 million |

|

Total Assets |

$1.14 billion |

|

Total Current Liabilities |

$489 million |

|

Total Liabilities |

$907 million |

|

Total Shareholder Equity |

$236 million |

(source: most recent 10-Q from SEC)

The balance sheet of fuboTV has seen a consistently shrinking amount of cash on hand. As losses mount, the goal of the company is to grow into profitability before it burns through the rest of its cash and credit. It’s a race against time, and fuboTV has $169 million in cash to hold itself off for what it hopes will be a profitable future.

Taking current shareholder equity, the price/book value of the stock is hovering right around 1.70. That’s a fairly modest premium to ask for a company with the amount of growth fuboTV has shown, but is reflective of the risks they are taking in a company yet to achieve profitability.

The Risks

The absolute most serious risk of fuboTV is its lack of profitability. That company has not made money, and by estimates is only looking to finally emerge into profitability in 2026. Still, there is more than just the bottom line to be worried about for the company.

The big challenge they’re facing on a day-to-day basis is competition. As a pure cost to content prospect, fuboTV and other streaming services have the traditional TV content providers beat. But if one is looking to enhance their streaming content library, they have almost countless options besides fuboTV to look at for doing so. Netflix and Hulu are the big players, and there is a long, long list of other serious players looking for the attention of end users.

Keeping fuboTV full of important channels means contracts, sometimes long-term contracts, with content providers. Wanting to be the sports-centric channel offering means making potentially costly deals with those providers.

While subscriber revenue is growing substantially, the other side of the revenue coin is advertising revenue. That’s going to require continuing efforts to keep ad inventory up and targeted ads aimed at the proper consumer.

The day-to-day operation of the streaming business also depends on cloud services from Google and Amazon. That’s fine so long as the cloud services run, but if one of those faces significant downtime, the service could suffer.

Growing Revenue

|

2021 |

2022 |

2023 |

2024 (Q1) |

|

|

Subscription |

$564 million |

$906 million |

$1.25 billion |

$374 million |

|

Advertising |

$73 million |

$102 million |

$115 million |

$27 million |

|

Net Loss |

($383 million) |

($562 million) |

($288 million) |

($56 million) |

(source: 10-K from SEC)

While advertising revenue has been on the rise in the last several years, it is the subscription revenue that is soaring, and which in the years to come could allow the company to finally achieve profitability.

The losses are a concern, but they can be seen to be shrinking as the company gets bigger and more mature. There is an avenue to profit here, but it’s going to take time, and limiting losses to their limited resources while they try to reach that point.

Estimates for the next few years see the revenue going from its present level of about $1.37 billion to $1.57 billion next year, $1.76 billion in 2025, and $2.17 billion in 2026. That’s a lot of growth to sustain down the line.

For losses, we have 46¢ per share this year, and 11¢ in 2025. 2026 is expected to be the real turning point, where they are predicted to have a profitability of 16¢ per share.

2Q Earnings Preview

In a couple of weeks, we’ll have a second quarter of earnings released. The estimates there expect a $368 million revenue and an 8¢ loss. Quarterly surprises have been positive lately, but even if we don’t get another positive surprise, we see the trend toward losses shrinking.

Conclusion

fuboTV has a lot of growth to look forward to, and its current premium to book makes it appear that it is not that bad of a deal. If we’re in 2026 looking at a profitable company, $1.40 per share may look like a bargain.

That said, there’s a long way from there to here, which is why I view this as a hold instead of a buy. There is just too big of a risk in the next couple of years as fuboTV tries to manage its growth in a crowded streaming market.

I’ll be keeping an eye on the stock, and I might be tempted to buy it if it tested new lows below what we saw in June. Even as comparatively cheap as a growth stock, there are too many question marks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.