Summary:

- Halliburton’s business continues to tread water, with improvements internationally largely being offset by weakness in North America.

- While Halliburton remains optimistic, some economic data and a reduction in OPEC supply cuts are now pressuring Halliburton’s share price.

- Halliburton’s stock may appear relatively inexpensive, but its margins are unlikely to be maintained at current levels.

lyash01

While Halliburton’s (NYSE:HAL) North America business has been challenged over the past 12 months, this is currently being offset by increased activity internationally. The company’s profits continue to edge higher, but this hasn’t mattered to the share price, which has been fairly range bound over the past two years.

The last time I wrote about Halliburton, I suggested it was vulnerable due to uncertain macro conditions and its dependence on OPEC supporting oil prices. This is proving to be the case, with soft economic data and a planned reduction in OPEC supply cuts now pressuring the share price.

Market Conditions

Despite growing signs of economic weakness over the past 1–2 years, Halliburton remains constructive on energy demand. The company expects crude oil demand to increase by 1.2-2.3 million bpd in 2024, driven by non-OECD countries.

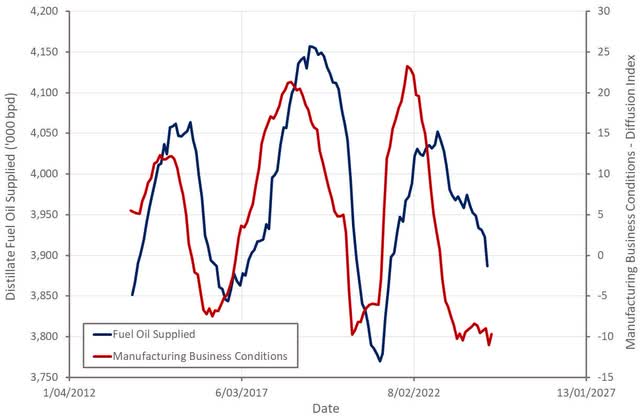

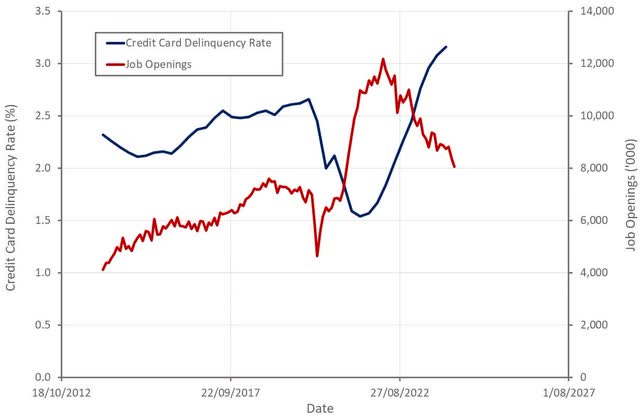

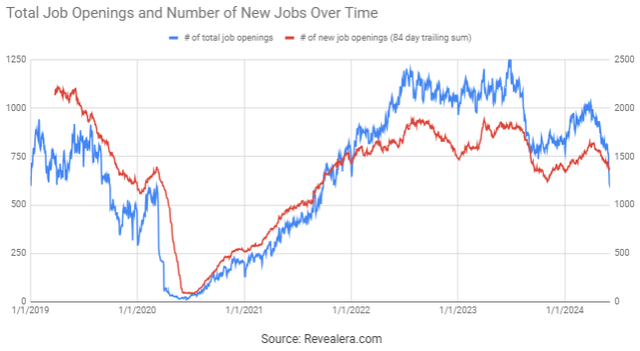

I tend to think that demand will disappoint going forward as economic conditions continue to weaken. The risk of a recession largely appears to have been forgotten, with equity markets moving higher on the back of strong earnings from a handful of companies. A range of economic data suggests that the US economy continues to soften, though, despite enormous fiscal stimulus. For example, manufacturing data remains weak and pressure on consumer spending continues to mount, despite strong employment. The labor market is weakening though and there is a risk it breaks at some point.

Figure 1: Fuel Oil Production and Manufacturing Business Conditions in the US (source: Created by author using data from The Federal Reserve)

Figure 2: US Credit Card Delinquency Rate and Job Openings (source: Created by author using data from The Federal Reserve)

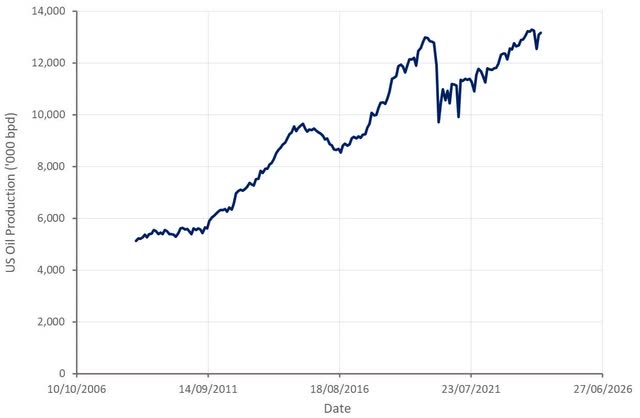

Despite reasonably strong demand growth in recent years, oil supply has been more than able to keep up. The only reason more of a supply glut has not emerged is because of the willingness of OPEC to cut production in order to support prices. This now appears to be coming to an end, though, with voluntary supply cuts totaling 2.2 million bpd being wound down starting in October.

Figure 3: US Oil Production (source: Created by author using data from EIA)

In terms of the services market, Halliburton believes that interest in unconventional reservoirs is rising globally, led by Argentina. Saudi Arabia is also shifting investment from offshore towards unconventionals (Jafurah). Companies like Nabors (NBR) continue to deploy rigs in these regions, pointing towards growth opportunities for Halliburton.

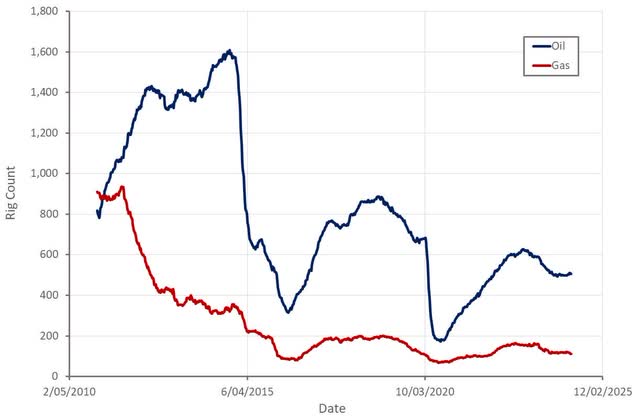

The US frac market should be supported by service company discipline in regard to capacity. This could create a tight market if demand expands, but it won’t save service companies in the event of a downturn. Halliburton also believes that West Africa and the North Sea could be areas of strength in 2025 and beyond.

Figure 4: US Rig Count (source: Created by author using data from Baker Hughes)

Halliburton Business Updates

While I am fairly negative about Halliburton’s near-term prospects, this is due to the nature of oilfield services and the deteriorating demand environment. Halliburton has done a good job in recent years strengthening its business, increasing exposure to areas like offshore, artificial lift and production chemicals. This has been supported by small scale M&A to add specific technical capabilities. Halliburton has also invested in differentiating its core services, like hydraulic fracturing.

This includes the company’s ZEUS platform, which offers electrification, automation and subsurface diagnostics. ZEUS reportedly lowers costs and improves the efficiency of operations. Halliburton’s SmartFleet fracture monitoring system is an automated system for real-time subsurface measurement. Understanding fracture growth is becoming increasingly important as core acreage diminishes and parent-child interferences increases. Halliburton’s automation drives efficiency in simul-fracs and optimizes equipment operation for extended life and increased reliability.

Halliburton has also introduced a new directional drilling system focused on unconventionals in North America. The iCruise CX system is designed for challenging curve and lateral applications. It helps to reduce well time through fast drilling, fast tripping time and quicker casing drill outs. It also helps operators to accurately place wells in the reservoir with its precise steering capabilities.

Despite these efforts, Halliburton remains constrained by the fact it operates in fairly commoditized markets that are relatively capital intensive and offer low growth. Services like ZEUS are an advantage at the moment, but operators will become more cost conscious in the event of a downturn. In addition, electric fleets will become the norm over the next few years as service companies upgrade their fleets.

Financial Analysis

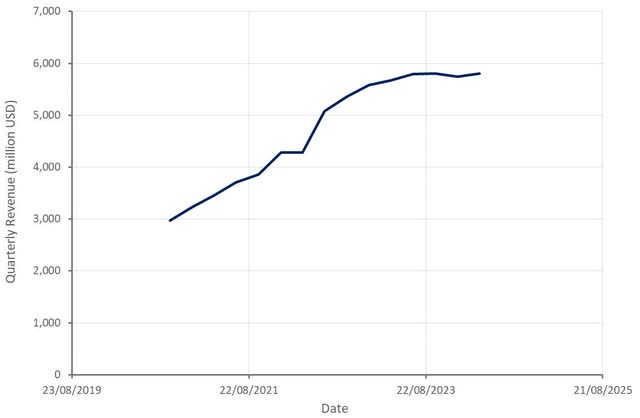

Halliburton generated $5.8 billion revenue in the first quarter, an increase of 2.2% YoY. International revenue was up 12% to $3.3 billion and North America revenue was $2.5 billion, down approximately 8% YoY. Growth was driven by Latin America, which generated $1.1 billion, an increase of 21% YoY. Excluding Latin America, Halliburton’s revenue declined around 1%. While Halliburton’s North America business is struggling, it is somewhat insulated from current conditions by the fact that 40% of its equipment is contracted under long-term contracts.

Completion and Production revenue was $3.4 billion in Q1, down slightly YoY due primarily to a reduction in pressure pumping activity. Halliburton’s Drilling and Evaluation division generated $2.4 billion revenue in the first quarter, an increase of 7% YoY, driven by drilling-related services in the Middle East and North America and general strength in Latin America.

Halliburton expects its international revenue to grow in the low double-digits in 2024. International markets are also expected to remain tight, leading to margin expansion. North America onshore activity has reportedly stabilized, and Halliburton expects steady activity levels in 2024. Halliburton expects LNG to eventually drive a recovery in natural gas activity, but this is not expected in 2024.

Halliburton expects its Completion and Production revenue to increase 2-4% sequentially in the second quarter, and Drilling and Evaluation revenue to grow 1-3% sequentially. This would result in approximately 3% YoY revenue growth, a slight reacceleration after four straight quarters of declines.

Figure 5: Halliburton Revenue (source: Created by author using data from Halliburton)

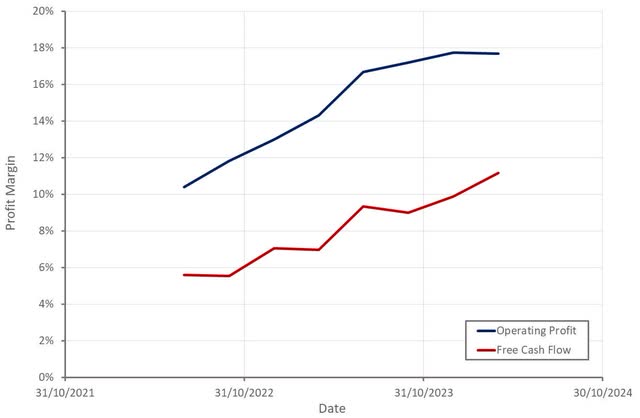

Halliburton generated $987 million operating income in the first quarter, with a 17% operating profit margin. The Completion and Production division’s operating profit margin was 20%, compared to a 16% margin for the Drilling and Evaluation division. Halliburton expects margins for both divisions to edge higher in the second quarter.

Halliburton generated $205 million of free cash flow in the first quarter. Working capital has been a drag on cash flows, but this is becoming less of an issue as growth moderates. Halliburton’s capital investments are increasing, though, which is offsetting some of the working capital improvements. Free cash flow in 2024 is expected to be at least 10% higher than in 2023.

Figure 6: Halliburton Profit Margins (source: Created by author using data from Halliburton)

A recent sharp drop in job openings is suggestive of a further deterioration in demand, which will likely pressure Halliburton’s results in the second half of the year.

Figure 7: Halliburton Job Openings (source: Revealera.com)

Conclusion

While Halliburton appears cheap based on recent earnings, it is actually fairly fully valued when considering the fact its profit margins are probably at unsustainably high levels at the moment. This depends on to what extent service companies are able to demonstrate greater discipline than they have in the past in regard to capacity, and to what extent Halliburton has created real pricing power through service differentiation.

While the company’s earnings are expected to continue increasing, I believe that economic weakness and an expectation of reduced OPEC supply cuts will undermine Halliburton’s profitability as the year progresses. Given the late stage of the current cycle, I believe $20-$25 would represent a more attractive entry point.

Figure 8: Halliburton EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.