Summary:

- While Halliburton’s international business is performing well, weakening economic conditions and a potential end to OPEC+ supply cuts are weighing on the stock.

- Stimulus in China and a rebound in natural gas markets are expected to provide a boost, but I tend to think that any impact on Halliburton’s financials will be limited.

- Halliburton’s valuation is now more reasonable, but there could still be significant downside if the global economy continues to slow.

- In particular, if onshore activity in the U.S. continues to decline, Halliburton’s margins will likely come under pressure.

typhoonski/iStock via Getty Images

Halliburton’s (NYSE:HAL) share price has been under pressure in recent months, with headwinds in the US offsetting strong performance internationally. Investor expectations have also fallen on the back of soft macro conditions and a likely increase in OPEC production.

The last time I wrote about Halliburton I suggested that downside risks were emerging, in particular, weakening economic conditions and a likely end to OPEC+ supply cuts. I continue to think that while Halliburton may appear reasonably valued, its margins are unlikely to be sustained at current levels.

Market Conditions

Oil demand growth continues to be tepid, which I would argue is unsurprising given the ongoing global economic slowdown. It appears to have come as a shock to many expecting an energy super cycle though, including Halliburton. The International Energy Agency is now forecasting 862,000 bbl/day oil demand growth in 2024 and 998,000 bbl/day in 2025. Halliburton previously suggested that crude oil demand would increase by 1.2-2.3 million bpd in 2024, driven by non-OECD countries.

Monetary and fiscal stimulus in China have been supportive of oil and gas demand expectations but there appears to be little substance to the measures announced so far. Forecasters have cut their projections for Chinese oil-demand growth this year due to a sluggish economy and better than expected adoption of electric vehicles.

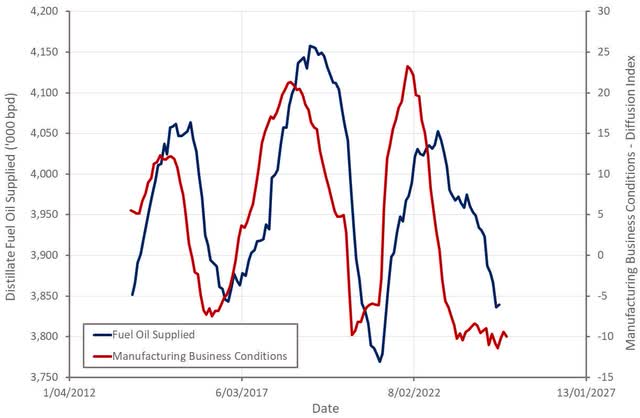

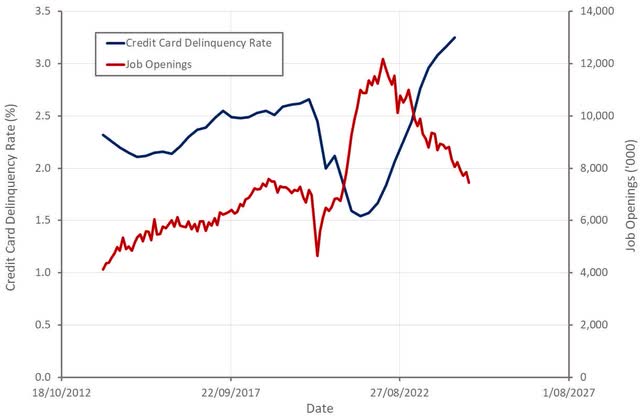

A range of economic data suggests that the US economy continues to soften, despite enormous fiscal stimulus. For example, manufacturing data remains weak and pressure on consumer spending continues to mount, even with strong employment. The labor market is weakening though and there is a risk it breaks at some point.

Figure 1: Distillate Fuel Oil Supplied and Manufacturing Business Conditions (source: Created by author using data from The Federal Reserve and EIA) Figure 2: Job Openings and Credit Card Delinquency Rate (source: Created by author using data from The Federal Reserve)

Weak demand is problematic given that supply growth continues to be solid, a situation that could be worsened if OPEC chooses to abandon support for the market. OPEC+ is reportedly considering increasing oil production in December, with Saudi Arabia set to abandon its unofficial 100 USD/bbl oil price target. Production in Libya is also expected to increase after factions in the country reached an agreement to appoint a new central bank governor.

Oil prices have also faced pressure in recent months due to the failure of tensions between Israel and Iran to escalate to a point where oil and gas production and distribution are impacted.

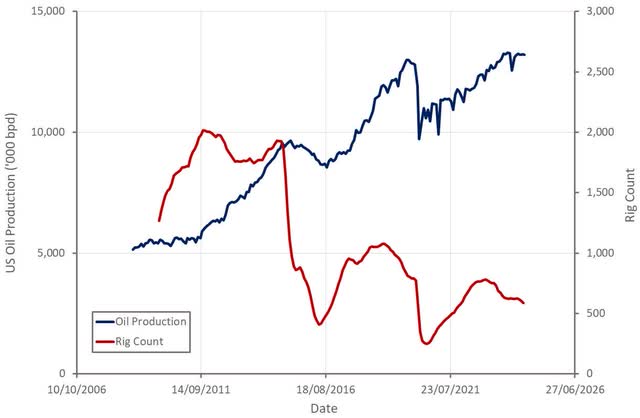

While the oil market remains soft, Halliburton expects activity levels to improve in the US as the integration of recent acquisitions by E&P companies is completed. I’m not sure that activity levels can be materially increased without negatively impacting oil and gas prices though. Service companies are not the only ones showing restraint during the current cycle and I believe that this situation will continue going forward.

Figure 3: US Oil Production and Rig Count (source: Created by author using data from EIA and Baker Hughes)

Halliburton also expects natural gas prices to recover next year, although it is not clear what the catalyst for this will be. There is a growing narrative that after many years of stagnation, electricity demand in the US could return to solid growth (~20% by 2030), driven in large part by AI. AI data centers alone are expected to add about 323 terawatt hours of electricity demand in the US by 2030 (~9% of total demand) and natural gas is expected to supply 60% of the power demand growth from AI and data centers. Estimates put the increase in natural gas demand between 2.7 and 10 bcf/d, compared to current production of approximately 100 bcf/d.

Unconventional plays could be a growth driver internationally, and while this has been an opportunity many years in the making, E&P activity in Argentina and Saudi Arabia could now finally be reaching maturity. Argentina’s Vaca Muerta continues to scale, supported by an increased knowledge base, the development of local supply chains and a more business friendly government. The Vaca Muerta is currently producing around 250 million scf/day of gas and 400,000 bbl/day of oil. With the right infrastructure in place, it is believed that Vaca Muerta could easily produce 2 million bbl/d though.

The Jafurah field in Saudi Arabia is the largest liquid-rich shale gas play in the Middle East and contains an estimated 200 trillion scf of natural gas. Aramco is eventually targeting sufficient production for domestic energy purposes to displace around 500,000 bbl/d of oil consumption. By 2030, Jafurah is also expected to generate over 420 million scf/d of ethane and around 630,000 bbl/d of NGLs. First gas is expected by 2025 and a sustainable sales gas rate of 2 bcf/d is anticipated by 2030. This will entail an enormous investment, with Aramco expected to spend more than 100 billion USD over Jafurah’s life.

Halliburton Business Updates

A weak demand environment in North America is particularly problematic for Halliburton due to its large exposure to the onshore frac market. This is primarily showing up in the form of declining revenue so far, with service company discipline helping to maintain pricing. Halliburton continues to prioritize returns over market share, and as a result, retired several fleets in the second quarter. The company is also somewhat protected by the fact that close to 40% of its fleets are e-fleets under multi-year contracts. The market is transitioning to e-fleets though, which will undermine Halliburton’s advantage in this area over time. In addition, service companies will likely be forced to pursue market share at some point if demand continues to soften.

While Halliburton is largely at the mercy of market conditions, the company continues to increase its exposure to growth areas through a combination of M&A and internal product development. For example, artificial lift is an area of strength at the moment, with Halliburton’s artificial lift product line growing at double the rate of the rest of the business in international markets. Drilling services is another strong point for Halliburton at the moment, with Halliburton’s drilling services revenue in the Middle East growing 30% YoY.

Halliburton has also introduced a new directional drilling system focused on unconventional reservoirs in North America. The iCruise CX system is designed for challenging curve and lateral applications. It helps to reduce well time through fast drilling, fast tripping time and quicker casing drill outs. It also helps operators to accurately place wells in the reservoir with its precise steering capabilities. Adoption in North America has been rapid, with the number of rigs running the system in the Permian Basin increasing by almost 45% since the start of this year.

Halliburton also continues to invest in its stimulation capabilities, in support of its North America onshore pressure pumping business. For example, the Octiv intelligent fracturing platform is a suite of solutions that enable frac automation, digital operations, and remote connectivity. While this can help to reduce cost and improve service quality, it is difficult to see these types of technologies providing a sustainable competitive advantage.

Financial Analysis

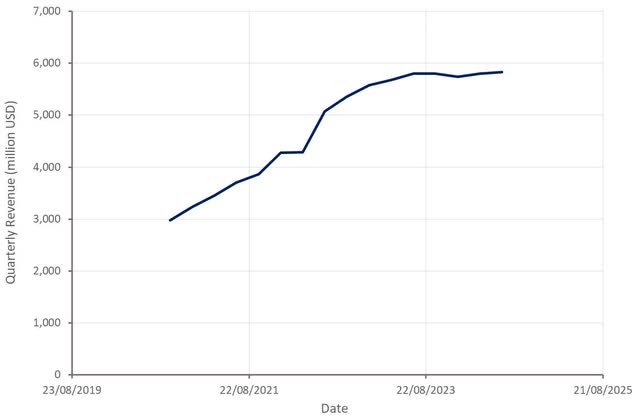

Halliburton generated 5.8 billion USD revenue in the second quarter, which was fairly flat YoY. International revenue increased 8% YoY to 3.4 billion USD, led by Latin America, while North America revenue declined 8% to 2.5 billion USD. The international increase was primarily driven by higher well construction activity and improved wireline activity in Norway, increased completion tool sales and higher stimulation activity in West Africa, higher activity in the Middle East across multiple product lines and higher fluid services in Asia. The decline in North America revenue was driven by reduced pressure pumping services in the US and lower completion tool sales and testing services in the Gulf of Mexico.

Table 1: Halliburton Third Quarter Results by Segment (source: Created by author using data from Halliburton)

In the third quarter, Halliburton expects Completion and Production revenue to decline 1-3% YoY, while Drilling and Evaluation revenue is expected to increase 2-4%. Halliburton’s international business is expected to grow around 10% in 2024, and North America revenue is expected to fall 6-8% YoY in the second half. Halliburton believes that the second half of 2024 will be the low point of activity levels in this cycle, but this seems unlikely given macro weakness and a potential increase in OPEC production.

Figure 4: Halliburton Revenue (source: Created by author using data from Halliburton)

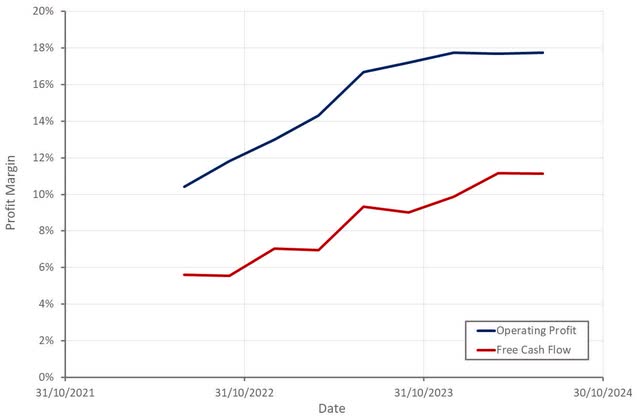

Halliburton’s margins have stabilized in recent quarters with international gains offsetting headwinds in the US. Halliburton generated 1.1 billion USD cash flow from operations in the second quarter and around 800 million USD of free cash flow. CapEx totaled 347 million USD in Q2 and is expected to amount to 6% of revenue for the full year.

Figure 5: Halliburton Margins (source: Created by author using data from Halliburton)

Conclusion

I have been expecting Halliburton’s business to regress for some time now, driven by macro weakness and a normalization of service company margins. While this dynamic has already occurred to some extent, it has been slower and less severe than I anticipated. International markets are currently supporting Halliburton’s business, which could persist if the macro environment remains resilient. There is a risk that increased production from OPEC+ will undermine international activity though.

While there is a persistent belief that natural gas will support a rebound in the US market, I continue to think there is little upside. Natural gas has been a minor contributor to activity levels for over a decade and I don’t see this situation changing.

Halliburton now appears more reasonably valued, but I think a good entry price is probably closer to 20 USD per share. This is because lower activity levels could eventually pressure pricing and margins, leading to a sharp fall in profits and cash flows.

Figure 6: Halliburton EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.