Summary:

- Halliburton’s multi-year contract with Petrobras is a significant growth driver, enhancing its Latin American operations amid Petrobras’ aggressive CapEx plans for 2024 and 2025.

- The recent cyberattack on Halliburton, while concerning, is unlikely to materially impact financials or investor sentiment due to its limited disruption.

- Despite challenging North American market conditions, Halliburton’s international segments show strong growth, offsetting regional weaknesses and supporting overall revenue stability.

- Given its beaten-down stock price and attractive valuation, Halliburton is well-positioned to benefit from international growth and potential Fed rate cuts, warranting a cautious “Buy” rating.

Brett_Hondow/iStock Editorial via Getty Images

Halliburton (NYSE:HAL) is a top oil and gas services firm that supports the operations of energy companies across the globe. The company has been around for over 100 years and has a market cap of just over $25 billion. Its status as a large-cap stable player in the oil and gas services makes it a top holding in the S&P Oil and Gas Services ETF (XES) and a 50-year-long member of the S&P 500 index. However, being in the energy industry makes HAL a relatively volatile stock sensitive to changes in activity in the exploration and production industry which is typically sensitive to energy commodity prices. Thus, it’s important to monitor the fluctuations in market conditions and various events that impact HAL’s operations to develop an idea of where this stock could go. Recently, there have been two headlines involving HAL that are important to address in an investment thesis.

Petrobras Contract

In a press release on August 8th, Halliburton announced that had secured a multi-year contract with Petrobras, set to commence in Q2 2025, for providing comprehensive offshore well intervention and plug and abandonment services in Brazil. The contract encompasses a wide range of services, including fluids, completion equipment, wireline, slickline, flowback services, coiled tubing, and project management services. This agreement covers approximately two-thirds of all interventions and plug and abandonment work for Petrobras, indicating its substantial scope. This contract is likely to have a meaningful impact on Halliburton’s operations in Latin America, where the company reported revenue of $1.1 billion in Q2 2024 or 18.8% of its total quarterly revenue. HAL also benefitted from some minor contracts from LNG-giant Equinor in the Brazilian Raia field where it was awarded a portion of contacts totaling $109 million to be split between Halliburton, Schlumberger, and Baker Hughes.

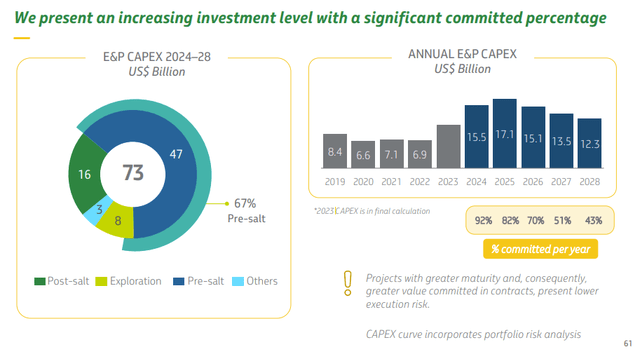

Petrobras reported at the beginning of the year that it would be increasing capital expenditures (CAPEX) significantly over the next five years with that growth being frontloaded in 2024 and 2025. HAL’s contract is set to begin in 2025 when Petrobras CapEx is set to peak at $17.1 billion which is a great sign for HAL’s potential earnings in this project. However, the tough pricing conditions have caused Petrobras to readjust its 2024 CapEx outlook. So far in the first half of 2024, CapEx is up 12.5% YoY alongside a 3.0% YoY increase in total oil and gas production to 2,737 Mboed. In the same earnings release, Petrobras updated its range of CapEx in 2024 to $13.5 to $14.5 billion which is about $1 billion below the projection from investor day at the beginning of the year and a smaller-than-expected increase over total CapEx of $12.67 billion in 2023. Regardless of the adjustments, there is still a clear intention by Petrobras to increase investment in the next few years which means that HAL’s contract is likely worth a substantial amount and puts it in a good position to grow its business in Latin America further through other deals in the region or more work with Petrobras. It is well known that Petrobras and HAL have strong connections. In 2023. Petrobras recognized Halliburton as its best supplier in the category of “Drilling and Completion Services,” and Petrobras has consulted with Halliburton consistently in digitization efforts. Despite all of this, it is important to keep in mind that market conditions matter and can impact the path of a project as we have seen in the 2024 CapEx downgrade.

Halliburton Cyberattack

Not all news is positive, and in late August, HAL was forced to announce the negative news that it had been affected by a cyberattack on August 21st. Initially, details were scarce, with the company reporting limited information on the day of the attack. Reuters reported that a HAL internal source had said the cyberattack “appears to impact business operations at the company’s north Houston campus, as well as some global connectivity networks.” Approximately two weeks later, Halliburton provided more insight into the incident. The company disclosed that the attack caused disruptions and limited access to business applications, and more concerning, hackers had successfully accessed and removed information from Halliburton’s systems. Despite these serious breaches, Halliburton maintained that the attack “is not reasonably likely to have, a material impact on the company’s financial condition or results of operations.” Nevertheless, the company acknowledged potential future costs and highlighted major risks stemming from the incident, including the possibilities of litigation, changes in customer behavior, and increased regulatory scrutiny.

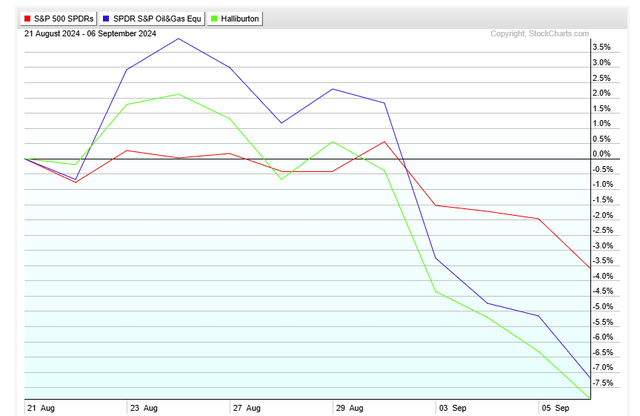

The limited details surrounding the cyberattack make it difficult to assess the impact that it could have on the stock. HAL’s attack is reminiscent of the 2021 Colonial Pipeline attack which saw hackers successfully execute a ransomware attack for a $4.4 million ransom payment. While the Colonial Pipeline attack likely was more disruptive and generated much more discussion about cyberattacks, it is possible a similar attack on HAL could have resulted in some sort of payment to hackers as well. The most likely costs will come from potential and current customers reevaluating their decisions to choose HAL in the competitive oil and gas services space. Looking at the bigger picture, HAL’s management is probably correct that the cyberattack is not going to have a material impact on future operations. These types of attacks happen a lot more frequently these days (unfortunately), and reports of companies falling victim to breaches are not uncommon and are unlikely to be as market-moving as they used to be. Tech companies like CrowdStrike receive much more scrutiny when technical issues are revealed, so HAL will escape unscathed. Since the initial reports of the cyberattack, HAL is down -7.9%, just slightly worse than the -7.2% decline seen in the broader oil & gas services ETF (XES).

Q2 Earnings

Before both of these events, HAL released its Q2 2024 earnings report on July 19th, 2024. Results were tepid as the company reported earnings of $0.80 per share, in line with the earnings consensus estimate, and revenue of $5.83 billion, a -$120 million miss from the sales consensus estimate and up just 0.6% YoY. Operations were heavily affected by sluggishness in its North American operations where revenue fell -8.0% YoY and -2.6% QoQ due to softer oil and gas activity in the region. Offsetting the weakness in North America was a rise in international revenue of 8.1% YoY and 2.9% QoQ with mid to high single-digit year-over-year increases in all international segment revenues: Latin America up 10.4% YoY, Europe/Africa up 8.5% YoY, and Middle East/Asia up 6.2% YoY. Despite stagnating revenues, HAL saw increases in all bottom line measures, operating income, operating cash flows, and net income, and an increase in capital expenditures.

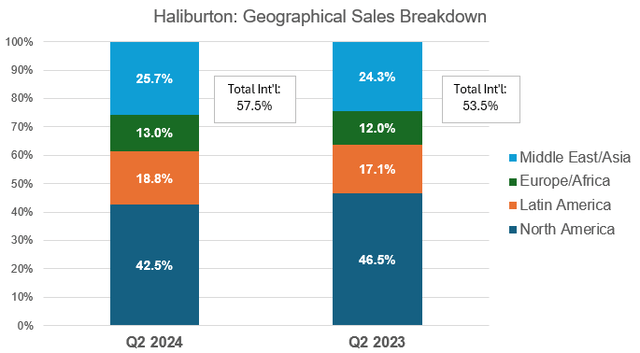

HAL’s success in maintaining earnings growth through tough North American market conditions has come through the growth in its international segments. North American revenues accounted for 42.5% of total revenue which is the highest single segment, but all international segments outweigh it at 57.5%. The Middle East/Asia segment revenues make up the second largest portion of revenue at 25.7% and are followed by Latin America at 18.8% and Europe/Africa at 13.0%. This geographic revenue split was 46.5% in the North America segment and 53.5% in the international segments just a year ago. International contract awards like the Petrobras contract in Brazil are the reason for the expansion of market share in regions outside of the US and say a lot about HAL’s reputation in the industry.

An overview of oil and gas services firms’ Q2 results from Hart Energy noted that this trend of solid international markets offsetting weakness in the US and Canada was industrywide. An Evercore analyst noted that HAL and its three peers, Schlumberger (SLB), Baker Hughes (BHI), and Weatherford (WFRD), “are well-positioned to benefit from the multi-year global upcycle in E&P spending and the increasing demand for energy services and technology.” Analysts covering these firms agreed with this optimism that HAL and its peers could wait out weakness in the US that was expected to last through the end of 2024 by increasing activity in overseas markets. The positive consensus view has twenty-five of the 28 analysts rating HAL as either a “Buy” or a “Strong Buy” even after tepid Q2 earnings and a -2% negative revenue surprise.

Energy Market Conditions

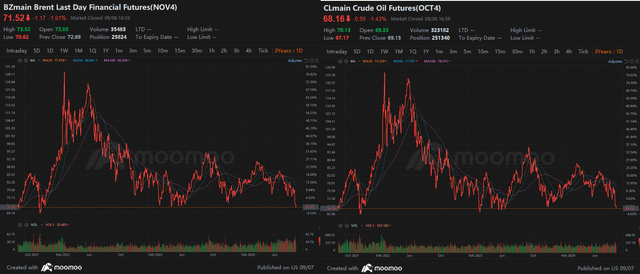

The worst news for HAL is that energy market conditions are currently moving against them, especially when looking at prices. Oil prices had a dreadful week to start the month of September with the Brent spot price falling -7.2% and the WTI spot price falling -7.5%. These moves are the worst weekly moves since late January and put both spot prices at the lowest levels in almost three years. Natural gas spot prices did not have as bad of a week but they have been trading at decade lows since the start of the year except for a brief spike to $3 in Q2. Weak pricing has put a dampener on E&P activity as measured by a few key indicators.

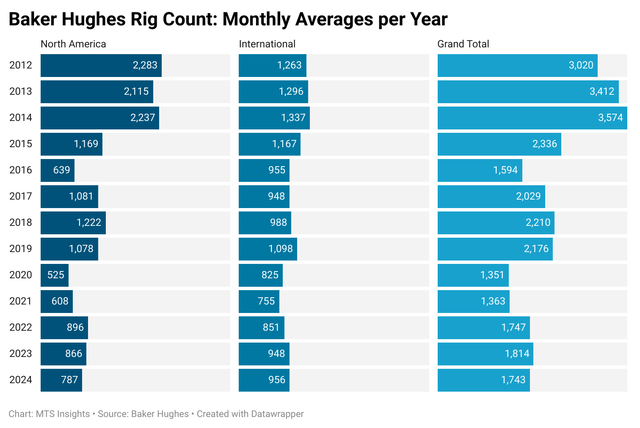

The most popular indicator of E&P activity, the Baker Hughes rig counts, is the strongest evidence of this trend. Monthly data looking at regional rig counts show that total worldwide counts have been negative for the past 13 months are currently down -3.0% YoY, but that doesn’t even tell the full story. In a broader context, we can see that global rig counts are down significantly from pre-pandemic levels. In 2024, the monthly average so far is 1,743 rigs, well below the 2015-2019 average of 2,069. Most of that change is in a slowdown of activity in North America while the International segment was a bit flatter. More recently, the trend has diverged to a greater degree. Monthly International rig count averages in 2023 and 2024 actually grew year-over-year while in North America they dropped. From these numbers, it is evident that operations outside the US are expanding more than in the US in the tough pricing environment, supporting analysts’ views that oil and gas services firms are more likely to grow in those regions.

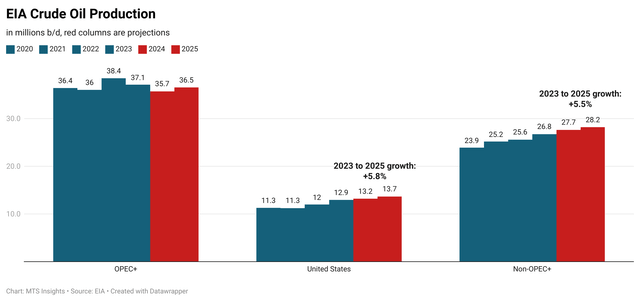

Despite rig counts remaining depressed, oil and gas production is expected to increase in 2024 and 2025 according to the EIA. In the US specifically, production growth of 2.3% in 2024 and 3.5% in 2025 is projected to lead to another record high crude oil production of 13.69 million b/d by 2025 which is an additional 756,000 b/d over 2023 production. Other non-OPEC+ crude oil production is expected to increase as well with growth of 3.3% in 2024 and 2.1% in 2025 or an additional 1.47 million b/d over 2023 production. On top of these increases, it is well known that the OPEC+ output cuts are set to expire by December 2024 which will add even more oil to the market through a gradual increase in OPEC+ production through 2025. The energy markets are pricing in this data now and are the primary forces driving spot prices lower alongside rising recession risks through weaker macro data.

Conclusion

Halliburton is currently navigating a complex energy environment with a mix of upside and downside risks. The two recent events are a net positive for HAL as the positivity of Petrobras contract news offsets the negativity of the cyberattack.

- The Petrobras contract is a significant tailwind to the stock as the size and scope of the contract are likely to be substantial given that Petrobras’ CapEx plans are aggressive in 2024 and 2025. As a side note, Central and South American crude oil and liquid oil fuels production growth (+10.6%) is projected to outpace US crude oil output growth (+5.8%) and non-OPEC+ (ex-US) crude oil output growth (+5.5%) from 2023 to 2025.

- The cyberattack is a bad look for HAL, but with the frequency of these events, it’s unlikely to do any damage to investor sentiment surrounding the stock. Based on the thin details, disruptions were limited and temporary and are unlikely to impact financials. However, it is early, and more information could come out in the next few months that could change this.

Outside of these events, HAL looks like a solid company fundamentally, but unfortunately, it is sensitive to energy market conditions. If production expansion can occur without a major increase in rig counts, then spot prices can be lower than expected in the medium term and present a risk to oil and gas service activity. However, HAL’s diversified customer base allows it to smooth out volatility in regional activity, and it is well-positioned to benefit from international activity growth while North American activity struggles in the second half of 2024. I am issuing a cautious “Buy” rating for this stock because it has been beaten down in the past year (down -30.1%) and trades at a forward P/E ratio of just 9.0x which is below the sector median of 11.2x. In addition to this, large-cap energy firms that have diversified revenue streams like HAL are likely to weather the storm of low energy prices in the short term and reap the benefits of Fed rate cuts on the horizon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.