Summary:

- The release of ChatGPT rocked the tech and investing worlds.

- Microsoft’s investment and Bing initiative bring legitimate competition to Google Search for the first time in a while.

- What does this mean for Google investors? Let’s take a look.

Leon Neal/Getty Images News

Artificial intelligence (AI) technology continues to amaze us, and the pace of development will only accelerate. Companies are matching wits and racing to be first to market. Search advertising is a massive market generating hundreds of billions each year.

Can Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) maintain its industry stranglehold?

My dear, here we must run as fast as we can, just to stay in place.

-Lewis Carroll, Alice in Wonderland.

What Happened?

The explosion in the hype of ChatGPT has been phenomenal. The chatbot was released on November 30th, 2022, and has quickly become the talk of the tech and investment community. Many see it as revolutionary; others have decried the potential for nefarious uses.

Microsoft Corporation’s (MSFT) $10 billion investment lends it extreme credibility and is a direct salvo against Google-parent company Alphabet. Microsoft is pushing Bing in a big way and highlighting Bing’s AI capability.

This is easy picking for Microsoft because it has nothing to lose. Bing is not a difference maker for the company, while Alphabet’s bedrock is Google Search.

Many are already declaring Microsoft the AI king, but this is like declaring the winner of a basketball game after the opening tipoff.

Google has been using and developing AI for years. This may be just the motivator they need.

What are chatbots?

Chatbots are artificial-intelligence-powered applications that interact with us conversationally. If you have ever used the “chat” feature on a website, you are probably familiar with that iteration of them. These are primarily low-level declarative bots that handle limited queries. Want to apply to raise your credit limit on a credit card? The bot can help. They save companies money on customer service and are much more convenient for most consumers (no one likes to sit on hold).

More sophisticated bots include Amazon’s (AMZN) Alexa and Apple’s (AAPL) Siri, which learn tendencies and offer more nuance.

It isn’t brand-new technology. However, ChatGPT is generative. The user can ask it to write songs, compose texts and emails, plan a trip, and even write articles like this one (don’t worry, the day I give up control or let a bot write paragraphs for me, I’ll ride off into the sunset).

There’s much more to it, but this article is about investments, so let’s get to that.

How much does Alphabet rely on Google Search?

In short, Google Search is everything to Alphabet.

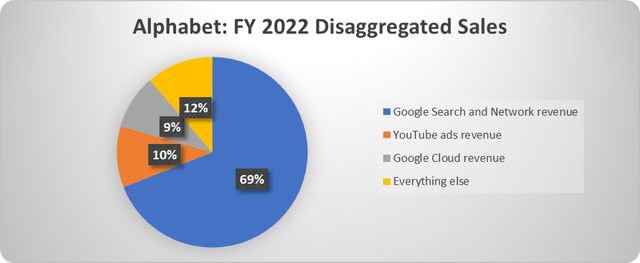

Data source: Alphabet. Chart by author.

Google Search and Google Network make up 69% of the company’s sales and an even more significant portion of operating income since Google Cloud is still a loss maker.

Google Search has grown unfettered by serious competition for many years and is a must for advertisers. Consumers searching for products on Google are ready to buy, as opposed to television or web ads that may reach a large audience of people who are outside the market.

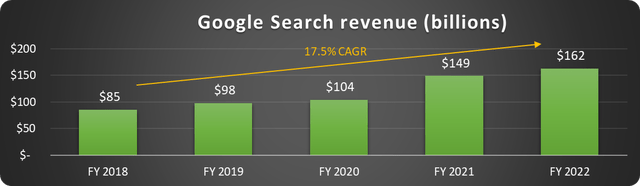

This gives Google tremendous pricing power. Search revenues have nearly doubled since 2018, as shown below.

Data source: Alphabet. Chart by author.

This is why Google must fight back.

Could ChatGPT actually benefit Google?

Google has been developing new AI features for Search for years but has yet to be motivated to push them to market. This could be just the kick in the pants that Google needs.

For example, Google has developed a “multisearch” feature that works in concert with Google Lens. A user could take a picture of a needed car part, for example, and search “where to purchase near me” to find a retailer and the name of the part.

A few days ago, Google demoed its chatbot, dubbed Bard, which has been in the works for years. The market was distressed during the demo that Bard gave an incorrect answer concerning telescopes and pictures of planets outside our solar system.

Like ChatGPT and any other search engine, it depends on underlying data. Frankly, I was shocked (shocked!) to learn there was misinformation on the Internet. I took the opportunity to add a few shares during the 7% decline.

Other initiatives include YouTube Shorts (the company’s answer to TikTok) and YouTube TV, which will soon feature the highly-successful NFL Sunday Ticket.

Let’s remember that ChatGPT is not a finished product. The data it relies on is from 2021 and is not updated in real time. This may not seem significant but think about it. Would an investing article based on 2021 data be relevant?

Similarly, Microsoft Bing’s experiment is just that. The company has tried for years to lure users to its platform and has yet to show the ability to do it. Bing will likely see a slight bump from curious users, and people will revert back to Google Search quickly.

Just as the tough economy is motivating Alphabet’s management to streamline operations, Microsoft may have just poked the bear.

A cautionary note to AI investors.

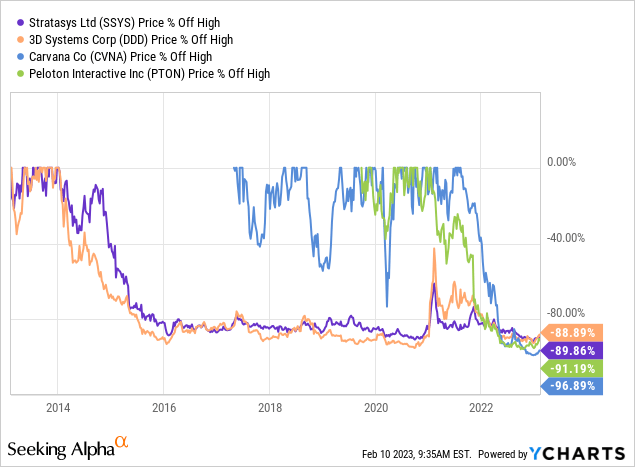

I’ve been around long enough to see many “revolutionary” trends that fizzled and cost unsuspecting investors boatloads of cash. Let’s remember the 3D printing rage that took stock like Stratasys (SSYS) and 3D Systems (DDD) to astronomical levels. Recent examples include pandemic darlings Peloton (PTON) and Carvana (CVNA). Much money has been lost, as shown below.

When investors are piling into cash-burning companies like C3.ai (AI) – caveat emptor (let the buyer beware).

Is Google stock a good investment?

Rumors of my death have been greatly exaggerated.

-Quote widely attributed to Mark Twain.

I’ve been extremely high on Google stock, but I’m willing to change any position based on new information. This new technology is fascinating, but isn’t ready for Prime Time.

Meantime, Google has several initiatives in the works, and now the motivation to get them to market.

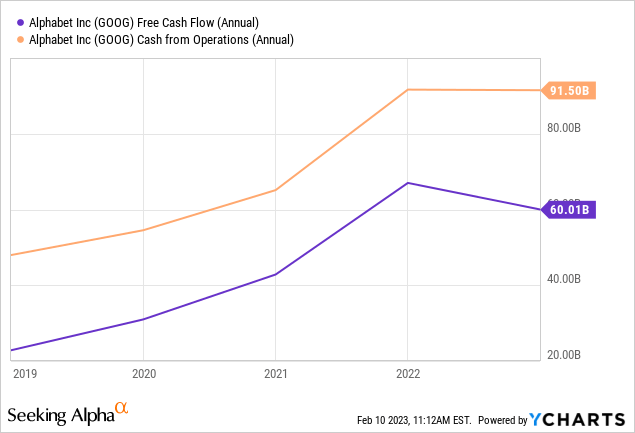

Google stock is being punished by emotional sentiment, which may also help shareholders in the long run. As shown below, Alphabet generates tons of free cash flow – even in a challenging economy.

Alphabet Inc. is taking full advantage of the lower stock price and prolific free cash flow by buying back its stock at a frenetic pace.

Alphabet has repurchased $59 billion worth of its stock in 2022 alone, nearly 5% of the current market cap (on top of $50 billion in 2021). The board of directors recently authorized another $70 billion, so the pace will likely accelerate in 2023.

Google is still the king of search, YouTube is impressive, and Google Cloud growth is terrific. Management finally got the memo to control costs, and now Alphabet Inc. is highly motivated to make innovative initiatives a reality.

Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors’ goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.